How to Get Cash Back on Home Loan Refinancing

Mia Anderson

Photo: How to Get Cash Back on Home Loan Refinancing

Understanding Home Loan Refinancing

Home loan refinancing refers to the process of replacing an existing mortgage with a new one, typically to obtain better terms or rates. This financial strategy allows homeowners to either secure a lower interest rate, reduce monthly payments, or extract equity from their property. By refinancing their home loans, individuals can potentially lower their overall borrowing costs and improve their financial stability.

The primary reasons homeowners might consider refinancing include enhancing affordability through lower interest rates, adjusting the loan term for various financial goals, and tapping into accumulated home equity, which can be beneficial for major expenses such as home improvements, education, or debt consolidation. Lower interest rates can significantly decrease monthly payments, allowing homeowners to allocate funds to other priorities. Additionally, refinancing to a shorter loan term can help accelerate mortgage repayment, resulting in substantial interest savings over time.

Home equity is another crucial element in the refinancing decision. Homeowners can choose to refinance for a higher amount than their existing loan, accessing cash back that can be utilized for various purposes. This can be particularly appealing for homeowners looking to fund significant projects or consolidate debts at a more favorable interest rate. It is essential to assess the costs involved in refinancing, as fees and potential penalties associated with the original mortgage can influence overall savings.

In essence, refinancing is not merely about renegotiating a loan but rather a strategic financial decision that can lead to cash back and improved financial flexibility. Understanding the intricacies of home loan refinancing will empower homeowners to make informed decisions that align with their financial objectives.

The Cash Back Concept Explained

The cash back concept in home loan refinancing is an appealing option for many homeowners looking to ease their financial burdens. Essentially, cash back refers to a monetary benefit that borrowers receive at the closing of their refinancing transaction. When homeowners refinance their existing mortgage, they may qualify for a cash back incentive, which can be used for various purposes including home improvements, paying off debt, or covering unexpected expenses. This option is particularly enticing as it provides immediate liquidity to the homeowner.

<pone $100,000="" $200,000="" $300,000,="" 80%="" a="" accrued="" allow="" amount="" and="" appraised="" at="" back="" balance="" borrowers="" but="" cash="" conditions="" conditions.It is critical to differentiate cash back offers from typical refinancing options. While standard refinancing may provide lower interest rates or changing loan terms, cash back transactions involve borrowing against the home's equity for immediate cash. Additionally, cash back refinancing typically incurs higher interest rates and closing costs, as lenders assume more risk. Thus, while cash back refinancing may offer a useful financial tool, it is essential for homeowners to carefully assess their financial goals and the long-term implications of such a decision. For example, a homeowner opting for a cash back refinance to fund a renovation could significantly enhance their property's value, whereas another using it to consolidate debts may find relief from high-interest payments.

Benefits of Cash Back Refinancing

Cash back refinancing presents a unique opportunity for homeowners seeking financial relief and flexibility. By allowing property owners to tap into their home's equity, this type of refinancing can provide immediate funds for various needs. This section discusses the principal advantages of cash back refinancing and how it stands out compared to traditional mortgage refinancing options.

One of the most significant benefits of cash back refinancing is the ability to consolidate debt. Homeowners can use the cash received to pay off high-interest debts, such as credit card balances or personal loans. By doing so, individuals can potentially lower their overall monthly payments and reduce their financial stress. In addition to debt consolidation, cash back refinancing allows for important home improvements, enabling property enhancement that can subsequently increase the home's value.

Here are some key advantages of cash back refinancing:

- Immediate Access to Funds: Homeowners can receive cash to address urgent financial requirements or desired upgrades, offering quick access compared to waiting for savings.

- Potential for Lower Interest Rates: Depending on the market, cash back refinancing may provide lower interest rates than current debts, leading to savings over time.

- Flexible Allocation of Funds: The cash received can be used, according to the homeowner's priorities, allowing flexibility in managing finances.

- Streamlined Process: Cash back refinancing often involves less complicated processes than obtaining separate personal loans or lines of credit.

- Enhanced Financial Control: By reducing or eliminating existing debts, homeowners can improve their overall financial situation and feel more in control.

In essence, cash back refinancing offers a multitude of benefits that can greatly enhance a homeowner's financial stability and flexibility. By understanding these advantages, individuals can make informed decisions regarding their refinancing options, ultimately leading to greater financial well-being.

Eligibility Criteria for Cash Back on Refinancing

When considering cash back on refinancing your home loan, it is crucial to understand the eligibility criteria that lenders typically evaluate. The first factor influencing your eligibility is your credit score. Generally, lenders prefer borrowers with a score of 620 or higher. A robust credit score demonstrates financial responsibility and can significantly enhance your chances of securing favorable refinancing terms, including cash back options.

Another essential aspect is the equity in your home. Equity refers to the difference between your home's current market value and the outstanding balance of your mortgage. To qualify for cash back, it is typically required that you have at least 20% equity built within your property. This allows you to access the cash while still maintaining a manageable debt-to-income ratio. If your equity is lower than this threshold, you may be limited in the amount of cash you can receive.

Additionally, lenders will require income verification to assess your ability to repay the refinanced loan. This includes providing recent pay stubs, tax returns, and possibly additional documentation depending on your employment status. Consistent and verifiable income is crucial for meeting the lenders’ criteria.

Finally, it's important to note that specific lender guidelines may vary. Different financial institutions may have unique criteria regarding the refinancing process, cash back offerings, and associated fees. Consequently, it is advisable to conduct thorough research and consult with multiple lenders to determine their specific eligibility requirements.

By understanding these key factors credit score, home equity, income verification, and lender-specific conditions you can better position yourself to achieve approval for cash back on refinancing your home loan.

Steps to Secure Cash Back on Your Refinance

Homeowners considering refinance options may find cash back opportunities beneficial for fulfilling immediate financial needs or enhancing investment potential. The process of securing cash back on a home loan refinance typically involves several critical steps. Understanding these steps can help streamline the overall experience and enhance the likelihood of successful refinancing.

The first step involves preparing necessary documentation. Homeowners should gather relevant financial records such as recent pay stubs, tax returns, bank statements, and details concerning existing debts. This information will be crucial for potential lenders to evaluate the homeowner's financial health. Having these documents organized beforehand can facilitate the application process and reduce potential delays.

Next, it is imperative to compare multiple lenders to identify the best refinancing options. Homeowners should research various lenders' offerings, focusing on interest rates, loan terms, and featured cash back incentives. Additionally, utilizing online calculators can aid in estimating potential cash back amounts. It is advisable to take note of each lender's closing costs, as these can influence the overall financial outcome of the refinance deal.

Once suitable lenders have been identified, submitting applications is the next logical step. Each application will require a comprehensive review of the submitted documentation. Homeowners should maintain clear communication with lenders during this phase to address any additional queries or documentation requests promptly.

Finally, it is essential to understand the closing costs associated with the home loan refinancing. These costs can vary widely among lenders, and they may include appraisal fees, title insurance, and loan origination fees. A transparent understanding of these fees will enable homeowners to gauge whether cash back received will outweigh the incurred costs during the refinancing process.

By diligently following these steps, homeowners can effectively secure cash back on their home loan refinancing endeavors.

Common Pitfalls to Avoid

When homeowners embark on the journey of refinancing their home loans with the goal of securing cash back, they can often encounter various pitfalls that can ultimately hinder their financial objectives. Awareness of these common mistakes can enhance decision-making during refinancing. Here are key areas to be cautious of:

1. Not Shopping Around for Rates: One of the most frequent missteps is failing to research different lenders. Homeowners often settle for the first offer without comparing rates and terms. By not shopping around, they may miss out on better interest rates or favorable terms that could significantly impact their cash back potential.

2. Misunderstanding Loan Terms: Refinancing can come with several complex terms and conditions. Homeowners sometimes overlook details like amortization periods or prepayment penalties. A lack of understanding of these terms can lead to unfavorable results, such as higher overall payments than anticipated.

3. Failing to Account for Fees: Many homeowners focus solely on the cash back amount when refinancing, neglecting to consider the associated fees. These could include closing costs, appraisal fees, and lender fees. If these costs exceed the cash back received, it may lead to an overall negative financial impact.

4. Ignoring Credit Score Impact: Refinancing can have a temporary effect on a homeowner's credit score. Some may overlook the importance of maintaining or improving their credit score before refinancing, which can directly influence the rates available to them.

5. Not Evaluating Long-term Implications: Focusing solely on immediate cash back can distract homeowners from considering the long-term implications of refinancing, such as extending the loan term and the potential for increased interest payments over time.

A thorough awareness and navigation of these pitfalls can empower homeowners to make more informed decisions when seeking cash back during the refinancing process.

Real-Life Examples of Successful Cash Back Refinancing

Consider the case of Sarah, a homeowner in her early 40s who decided to refinance her home in order to consolidate debt. Sarah had accumulated significant credit card debt and personal loans, leading to high monthly payments and financial strain. After researching her options, she opted for a cash back refinancing solution, allowing her to tap into her home equity while reducing her interest rates. With a streamlined process, Sarah managed to secure a cash back amount that covered her high-interest debts. Following the refinancing, her monthly expenses decreased substantially, enabling her to plan better for her future.

Another illustrative example involves the Johnson family, who faced unexpected medical expenses, placing their financial stability at risk. Recognizing that their home had appreciated in value since purchase, they explored refinancing options that could provide quick cash. They approached a lender for cash back refinancing and were delighted to discover they could release enough equity to cover their expenses without increasing their monthly payments significantly. The process took approximately six weeks, and the results were transformative. Not only did they manage the medical bills, but they also set aside a portion for future savings. Through this refinancing, they alleviated a heavy burden and felt a renewed sense of hope.

Lastly, let us look at Tom, a retiree who wanted to finance his dream vacation. Despite living on a fixed income, Tom decided to refinance his mortgage. He found a lender who offered a compelling cash back option that provided him with a lump sum payout. This cash back refinancing not only funded his travel plans but also allowed him to make some much-needed home improvements. Tom's experience was largely positive, although he faced a few challenges during the application process, particularly with documentation. However, with persistence and the right support, he ultimately achieved his goal and enjoyed a well-deserved vacation.

FAQs About Cash Back Home Loan Refinancing

Home loan refinancing can be a complex process, and many borrowers have questions about how cash back works within this context. Here are some frequently asked questions that address common concerns.

1. When is the best time to consider refinancing for cash back?

The optimal time for refinancing is typically when mortgage interest rates decrease significantly below your current rate or when your home's value increases. Refinancing to access cash back can be advantageous if you need funds for home improvements, debt consolidation, or other major expenses. However, it is essential to ensure that the refinancing costs do not outweigh the benefits of accessing cash back.

2. How is cash back calculated during refinancing?

Cash back from a refinancing deal typically comes from the equity you have accumulated in your home. When you refinance, you may choose to take out a loan amount higher than your existing mortgage balance. The difference is given back to you as cash. For instance, if your home is valued at $300,000 and your current mortgage balance is $200,000, you could refinance for a new loan of $250,000. This would allow you to take $50,000 in cash back, minus any closing costs associated with the new loan.

3. How does refinancing for cash back impact my mortgage terms?

Refinancing for cash back usually involves adjusting your existing mortgage terms, which can include extending the loan duration or changing the interest rate. While this may provide immediate funds, it may also lead to increased overall interest payments. Borrowers should carefully review the loan terms and consider potential long-term financial implications.

Understanding these aspects can significantly enhance your refinance experience, enabling you to make informed decisions tailored to your financial needs.

Conclusion: Making Informed Financial Decisions

Throughout this article, we have explored the concept of cash back refinancing and its potential advantages for homeowners. Cash back refinancing allows homeowners to access cash through their home equity while simultaneously securing a new mortgage that may offer better terms. This option can be particularly beneficial for those looking to consolidate debt, fund home improvements, or cover unexpected expenses. Understanding the mechanics of how cash back refinancing works is crucial for homeowners considering this financial strategy.

We emphasized the importance of assessing one’s financial situation before proceeding with refinancing. Homeowners should evaluate the current market rates, their credit scores, and overall debt levels. Additionally, it is vital to conduct a thorough analysis of the costs associated with refinancing, including closing costs and fees that may offset the benefits of cash obtained. These insights will empower homeowners to make well-informed financial decisions that align with their long-term goals.

Throughout our discussions, we highlighted the necessity of researching various lenders and comparing offers to find the best refinancing options. Not all refinancing deals are created equal, and terms can vary significantly from one financial institution to another. By dedicating time to explore different lenders and their cash back refinancing products, homeowners can secure favorable terms that will ultimately benefit their financial landscape.

As you consider the cash back refinancing option, we encourage you to reflect on your unique financial circumstances and goals. Engaging with professionals or seeking advice from peers can provide valuable perspectives. We invite you to share your experiences or seek further information in the comments section below. Your journey toward financial empowerment begins with informed choices and a proactive approach to understanding the complexities of home loan refinancing.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

Entertainment

View AllExplore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the best streaming services of 2024 with our in-depth reviews. Find out which platforms offer the best value and why you should choose them. Read now!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

View AllUnlock the secrets to getting top dollar for your car! Prep, price, and promote effectively.

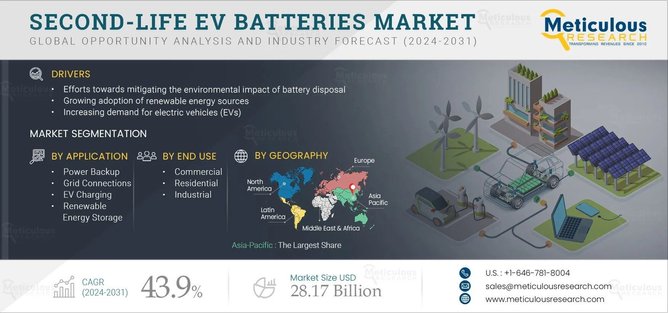

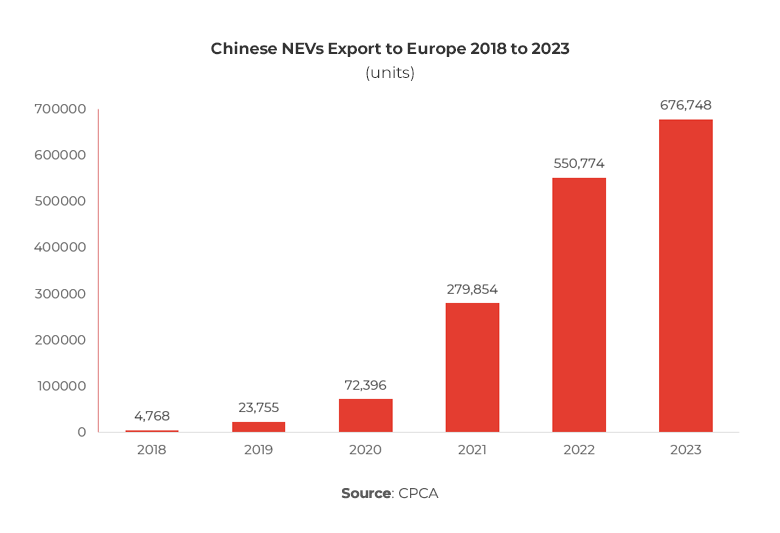

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MoreCompare trends in luxury and budget EV offerings. Find out which one suits your needs and budget in 2024.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

9

10

Technology

View All

September 15, 2024

Discover the Best Project Management Software of 2024

Discover the best project management software of 2024! Uncover top picks, latest trends, and expert reviews. Click now to streamline your projects!

December 10, 2024

Best Tech Gadgets for Remote Workers in 2024 – Don’t Miss These!

Boost your productivity with the top tech gadgets for remote work! Click to discover must-have tools to enhance your work-from-home setup.

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick