Financial Planning for Millennials: Secrets to Success

Mia Anderson

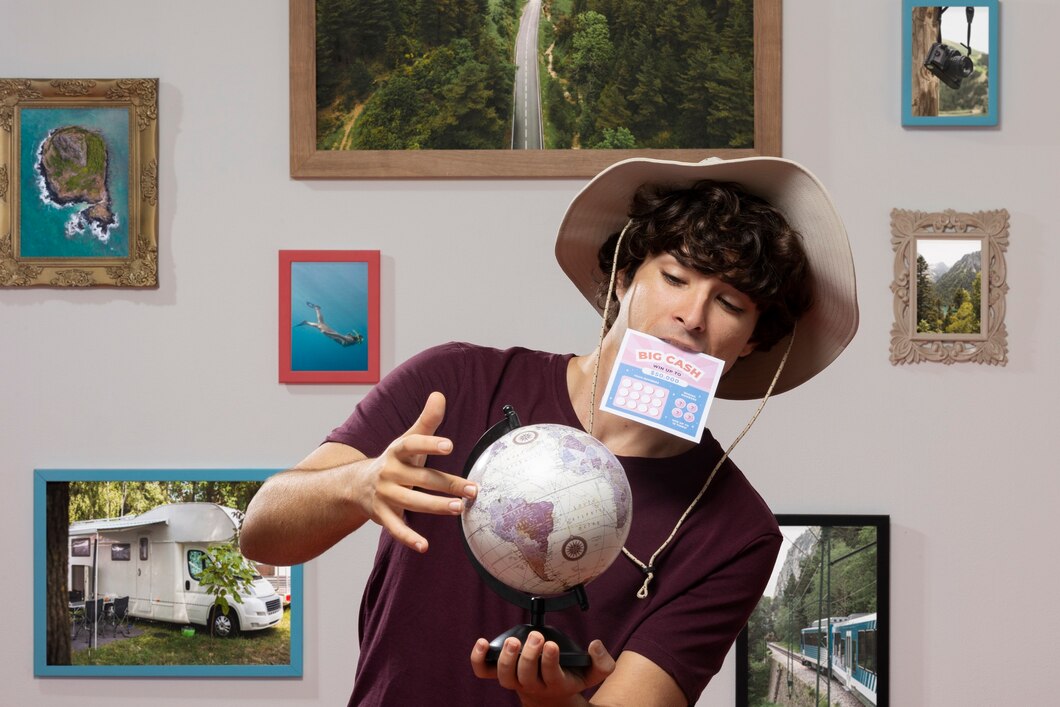

Photo: Financial Planning for Millennials: Secrets to Success

In today's complex financial landscape, millennials are navigating a unique set of challenges and opportunities. From managing student loans to planning for retirement, the journey towards financial stability can be daunting. This article aims to empower millennials by unveiling the secrets to successful financial planning, offering a comprehensive guide to securing their financial future. Get ready to explore practical strategies, debunk common misconceptions, and discover the path to financial freedom tailored to the millennial mindset.

Understanding the Millennial Perspective

Millennials, often dubbed the 'experience-seeking' generation, approach financial matters with a distinct perspective. They value experiences, prioritize ethical investments, and embrace technology in their financial decision-making. This generation is tech-savvy, utilizing digital tools for budgeting, investing, and tracking their financial progress. Understanding these traits is crucial when tailoring financial planning advice to millennials.

The Tech-Savvy Advantage

Millennials' affinity for technology can be a powerful tool in financial management. Digital platforms offer easy access to financial information, allowing them to research investment options, compare financial products, and make informed decisions. Online resources, such as financial blogs, podcasts, and educational websites, provide valuable insights and help demystify complex financial concepts. By leveraging technology, millennials can stay informed and take control of their financial destiny.

Building a Solid Financial Foundation

1. Set Clear and Realistic Goals

The cornerstone of successful financial planning is setting clear and achievable goals. Whether it's paying off student loans, saving for a down payment on a house, or building an emergency fund, defining your objectives is essential. Break down larger goals into smaller, manageable milestones. For instance, if your goal is to save $20,000 for a house down payment in two years, set monthly savings targets and track your progress. This approach provides a sense of direction and motivation, making financial planning a rewarding journey.

2. Create a Budget and Stick to It

Budgeting is a fundamental skill for financial success. Start by tracking your income and expenses for a month to understand your spending habits. Allocate your income to cover essentials, such as rent, utilities, and groceries, and then prioritize savings and debt repayment. Consider using budgeting apps or spreadsheets to categorize and monitor your spending. Adjust your budget as needed, but strive for consistency. A well-structured budget empowers you to make informed financial choices and avoid unnecessary expenses.

3. Tackle Debt Strategically

Millennials often face the challenge of managing student loans and other debts. Create a debt repayment strategy by listing all your debts, their interest rates, and minimum payments. Focus on paying off high-interest debts first, as they accumulate more interest over time. Consider debt consolidation or refinancing options to reduce interest rates and simplify repayment. Remember, eliminating debt is a crucial step towards financial freedom, allowing you to redirect your money towards savings and investments.

Investing for the Future

1. Start Investing Early

Time is a powerful ally in the world of investing. Millennials have the advantage of time on their side, and starting early can significantly impact their financial future. Even small, regular investments can grow exponentially over time due to the power of compound interest. Consider opening a retirement account, such as a 401(k) or IRA, and contribute regularly. Take advantage of employer-matched contributions if available, as this is essentially 'free money' towards your retirement savings.

2. Diversify Your Portfolio

Diversification is a key principle in investing. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This strategy reduces risk because if one investment performs poorly, others may compensate. Millennials can explore various investment options, including exchange-traded funds (ETFs), which are a popular choice among financial planners due to their diversification benefits and ease of management. Consult financial advisors or utilize online resources to learn about different investment vehicles and build a well-diversified portfolio.

3. Embrace Ethical Investing

Millennials' preference for ethical investments aligns with a growing trend in the financial industry. Sustainable and socially responsible investing (SRI) focuses on companies and funds that meet specific environmental, social, and governance (ESG) criteria. By investing in SRI funds, millennials can support businesses that align with their values while potentially achieving competitive returns. This approach allows millennials to make a positive impact on society and the environment while growing their wealth.

Navigating Financial Pitfalls

1. Avoid Common Money Mistakes

Millennials should be cautious of common financial pitfalls. One mistake is overspending on non-essential items or experiences, which can derail savings goals. Another pitfall is neglecting to review and adjust financial plans regularly. Life circumstances change, and so should your financial strategy. Regularly assess your investments, savings, and insurance coverage to ensure they align with your evolving needs and goals.

2. Manage Lifestyle Inflation

As income increases, it's easy to fall into the trap of lifestyle inflation, where spending rises in parallel with earnings. This can hinder savings and investment goals. Instead, consider increasing your savings rate as your income grows. For example, if you receive a raise, allocate a portion of it towards savings or investments rather than increasing your spending. This approach ensures that you maintain a healthy financial balance and make progress towards your long-term objectives.

3. Seek Professional Guidance

Financial planning can be complex, and seeking professional advice is a wise decision. Certified financial planners can provide personalized guidance based on your unique circumstances. They can help you navigate tax strategies, estate planning, and risk management. While millennials may be tech-savvy, a professional's expertise can offer valuable insights and help avoid costly mistakes. Consider meeting with a financial advisor to discuss your goals and develop a comprehensive financial plan.

Conclusion

Financial planning is a journey, and for millennials, it's an opportunity to shape a secure and fulfilling future. By setting clear goals, managing debt, and embracing investing, millennials can take control of their financial destiny. The key is to start early, stay informed, and adapt to changing circumstances. Remember, financial freedom is not just about the destination but also about the journey. Embrace the process, learn from your experiences, and celebrate your financial milestones. With a well-structured plan and a proactive approach, millennials can unlock the secrets to financial success and enjoy a life of prosperity and security.

Frequently Asked Questions (FAQs)

- Q: How can millennials get started with financial planning?

A: Begin by assessing your current financial situation, including income, expenses, and debts. Set clear goals and create a budget. Consider using budgeting apps or seeking guidance from financial advisors to develop a personalized plan. - Q: What are some common challenges millennials face in financial planning?

A: Millennials often struggle with managing student loan debt, saving for major life events, and navigating the complexities of investing. Additionally, the temptation to overspend and the need to balance short-term desires with long-term financial goals can be challenging. - Q: How can millennials stay motivated with their financial plans?

A: Break down your financial goals into smaller, achievable milestones and celebrate each success. Visualize the long-term benefits of financial planning, such as owning a home or achieving financial independence. Surround yourself with like-minded peers who share similar financial goals, as this can provide support and accountability. - Q: Is it necessary to hire a financial advisor?

A: While not mandatory, consulting a financial advisor can offer valuable insights and personalized guidance. They can help you navigate complex financial decisions, optimize your investment strategy, and ensure your plan aligns with your goals. However, millennials can also educate themselves through online resources and financial literacy courses to make informed decisions.

Final Thoughts

Financial planning is a powerful tool for millennials to secure their future and achieve their dreams. By following the principles outlined in this guide, millennials can take control of their finances, make informed decisions, and build a solid foundation for long-term wealth. Remember, financial success is a journey, and every step taken today brings you closer to a brighter financial future.

Marketing

View All

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

Entertainment

View AllDiscover expert tips to elevate your binge-watching sessions in 2024. Stay entertained and healthy with these essential tricks. Click now for the ultimate guide!

Mia Anderson

Discover the latest viral marketing strategies that can catapult your brand to success in 2024. Learn proven tips to create buzz and engage your audience. Start now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Automotive

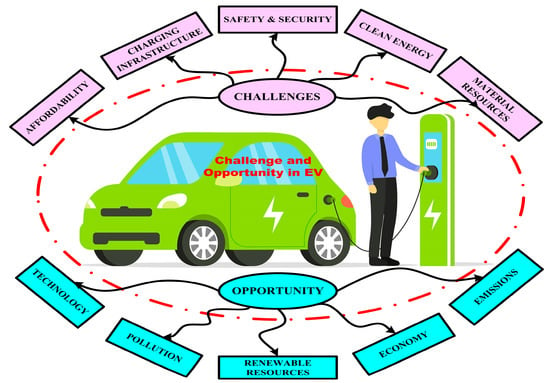

View AllExplore the growing trend of integrating renewable energy with EV charging stations. Learn how clean energy is fueling EVs.

Read MoreExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MorePolular🔥

View All

1

3

4

5

6

7

8

10

Technology

View All

August 9, 2024

The Ultimate Guide to Choosing the Right Deep Learning Framework

Find out the main distinctions between PyTorch and TensorFlow, two popular deep learning frameworks. Discover their advantages, disadvantages, and practical uses to help you choose wisely for your upcoming AI project!

August 26, 2024

Transform Your Business with Essential AI Software Tools You Need to Know

Discover the best Artificial Intelligence software to boost your business efficiency and innovation. Click to explore top AI tools and transform your operations.

December 10, 2024

Should You Buy a Smart Fridge? Here’s Why It Might Be Worth the Investment

Discover the benefits of a smart fridge! Learn how it can revolutionize your kitchen. Click to explore and decide if it's worth the investment.

Tips & Trick