How to Pay Off Debt Fast: Proven Strategies That Work

Mia Anderson

Photo: How to Pay Off Debt Fast: Proven Strategies That Work

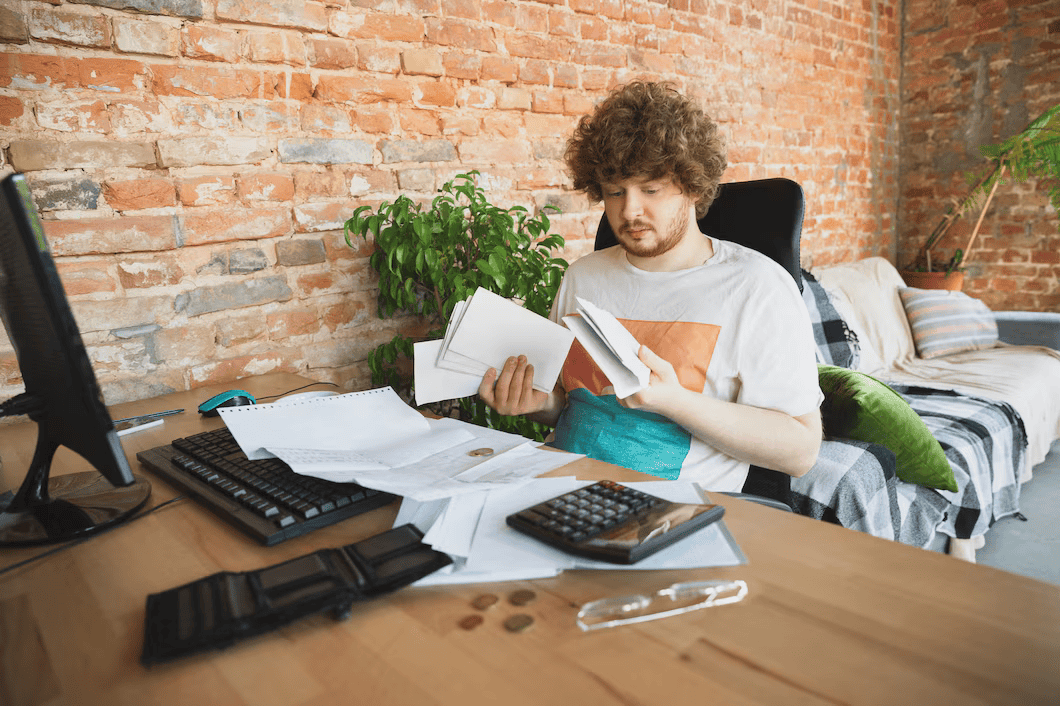

Are you feeling overwhelmed by debt and seeking a way to regain control of your financial future? You're not alone. In today's fast-paced world, managing debt is a common challenge, but with the right strategies, you can pave the way to financial freedom. This article will guide you through proven methods to pay off debt quickly and efficiently, empowering you to take charge of your finances in 2024 and beyond.

Understanding Debt Repayment Strategies

When it comes to debt payoff, there's no one-size-fits-all approach. Different strategies work for different people, depending on their financial situation and personal preferences. Let's explore some of the most effective debt repayment strategies and how they can help you become debt-free.

The Debt Snowball Method

Imagine a snowball rolling down a hill, gathering momentum and size as it goes. This is the essence of the debt snowball method. Here's how it works:

- Identify your debts: Make a list of all your debts, including credit cards, loans, and any other outstanding balances.

- Prioritize by amount: Arrange your debts from the smallest to the largest balance, regardless of interest rates.

- Focus on the smallest debt: Allocate as much of your budget as possible to pay off the smallest debt while making minimum payments on the others.

- Snowball your payments: Once the smallest debt is paid off, take the amount you were paying towards it and apply it to the next smallest debt, creating a 'snowball' effect.

The beauty of this method lies in its psychological impact. By focusing on quick wins with smaller debts, you gain a sense of accomplishment and motivation to tackle larger debts. This strategy is ideal for those who need a boost of confidence and motivation to stay on track.

The Debt Avalanche Method

In contrast to the snowball method, the debt avalanche approach prioritizes interest rates over balance amounts. Here's a breakdown:

- List your debts: Create a comprehensive list of all your debts, just like in the snowball method.

- Sort by interest rates: Organize your debts from the highest to the lowest interest rate.

- Tackle the highest-interest debt: Allocate as much as you can to pay off the debt with the highest interest rate while maintaining minimum payments on others.

- Rinse and repeat: Once a debt is cleared, roll the payment amount into the next highest-interest debt.

This strategy is mathematically efficient as it minimizes the overall interest paid. However, it may require more patience as you might not see immediate progress on individual debts. The debt avalanche method is best suited for those who are motivated by long-term savings and are comfortable with a more gradual payoff process.

Utilizing Debt Management Tools

In the digital age, numerous online tools and mobile apps have emerged to assist with debt payoff. These innovative solutions can streamline your debt management journey and provide valuable insights.

Debt Payoff Apps

- Round-up Apps: Apps like Chip and Changed enable you to round up your purchases to the nearest dollar when using debit or credit cards. The spare change is then automatically sent as extra payments towards your debt. This method allows you to gradually chip away at your debt without feeling the pinch.

- Debt Organization Apps: Tools such as Undebt.it and Unbury.me help you create a customized debt payoff plan. These apps allow you to input or link your debt accounts, providing a clear overview of your financial situation. They often suggest strategies like the snowball or avalanche method and may even automate payments for you.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single, new loan with a lower interest rate. This strategy can simplify your repayment process and potentially reduce the overall cost of your debt. By shortening the repayment period, you can become debt-free faster and save on interest. However, it's essential to carefully consider the terms and conditions of any consolidation loan to ensure it aligns with your financial goals.

Boosting Your Income for Faster Debt Payoff

While managing expenses is crucial, increasing your income can significantly accelerate your debt repayment journey. Here are some practical ways to boost your earnings:

- Part-time Jobs: Consider taking on a part-time job, especially if your current schedule allows for it. This could be a side hustle like driving for ride-sharing services, freelancing in your area of expertise, or even dog walking.

- Selling Unused Items: Declutter your home and sell gently used or unwanted items online or through local marketplaces. This not only generates extra cash but also promotes a minimalist lifestyle.

- Negotiate a Raise: If you're employed, research salary trends in your industry and prepare a case for a salary increase. A successful negotiation can provide a substantial boost to your debt repayment fund.

Staying Motivated and Adapting Your Strategy

Paying off debt is a marathon, not a sprint. It's essential to stay motivated and adapt your strategy as needed. Here are some tips:

- Set Realistic Goals: Break down your debt payoff journey into manageable milestones. Celebrate each achievement, no matter how small, to maintain momentum.

- Visualize Your Progress: Use charts, graphs, or apps that visually represent your debt reduction. Seeing your progress can be a powerful motivator.

- Seek Support: Share your financial goals with trusted friends or family members. Their encouragement and accountability can help you stay on track.

- Regularly Review and Adjust: Your financial situation may change over time. Periodically evaluate your debt management plan and make adjustments to ensure it remains effective and aligned with your goals.

Conclusion: A Path to Financial Freedom

Embarking on a debt payoff journey is a courageous step towards financial freedom. By understanding and implementing the right debt repayment strategies, you can take control of your finances and achieve remarkable results. Whether you choose the snowball or avalanche method, utilize debt management apps, or explore debt consolidation, the key is to find a strategy that suits your unique circumstances and preferences.

Remember, the road to becoming debt-free may have its challenges, but with determination and a well-thought-out plan, you can overcome them. Stay focused, adapt as needed, and celebrate your progress along the way. Financial freedom is within your reach, and the rewards of a debt-free life are well worth the effort.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

Automotive

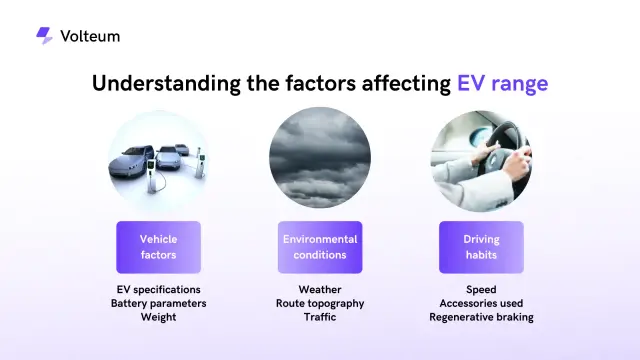

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick