Discover Financial Freedom with Debt Consolidation Loans

Mia Anderson

Photo: Discover Financial Freedom with Debt Consolidation Loans

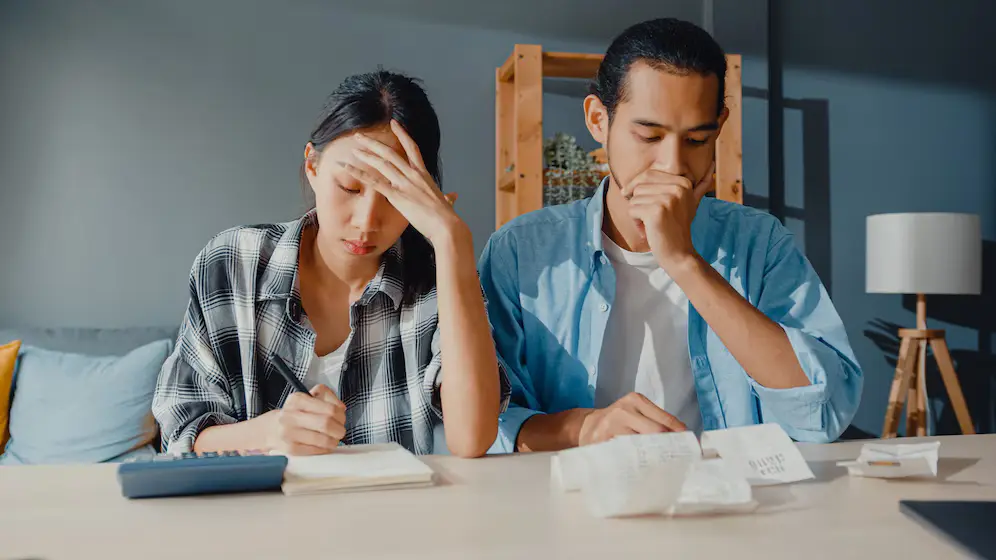

In today's financial landscape, managing debt can be a challenging endeavor. Many individuals find themselves overwhelmed by multiple debts, each with its own interest rate and repayment schedule. Fortunately, debt consolidation loans offer a promising solution. These loans can streamline your finances and potentially save you money. This article delves into how debt consolidation loans work, their benefits, and how to choose the best options for your situation.

Understanding Debt Consolidation Loans

Debt consolidation loans are financial tools designed to combine multiple debts into a single loan with one monthly payment. This process can simplify your finances and potentially reduce your overall interest rates. By consolidating debt, you can manage your payments more effectively and often at a lower cost.

How Debt Consolidation Loans Work

When you take out a debt consolidation loan, you borrow a sum of money to pay off several existing debts. This leaves you with just one loan to repay. The new loan typically has a fixed interest rate, which can be lower than the rates of your previous debts. As a result, you may save money on interest over time and enjoy the convenience of a single payment.

Types of Debt Consolidation Loans

- Personal Loans: Unsecured personal loans are a common choice for debt consolidation. These loans do not require collateral and often come with competitive interest rates. They are suitable for individuals with good credit histories who need to consolidate various types of debt.

- Balance Transfer Credit Cards: These credit cards offer low or 0% introductory interest rates for balance transfers. They can be an effective way to consolidate high-interest credit card debt. However, it is crucial to pay off the balance before the introductory period ends to avoid higher interest rates.

- Home Equity Loans: Homeowners might consider using a home equity loan or line of credit (HELOC) to consolidate debt. These loans use your home as collateral, potentially offering lower interest rates. However, this option carries the risk of losing your home if you fail to make payments.

Benefits of Debt Consolidation Loans

Simplified Finances

One of the primary benefits of debt consolidation is the simplification of your finances. Instead of juggling multiple payments, due dates, and creditors, you only need to focus on a single payment. This can reduce stress and help you stay organized.

Potential Cost Savings

Consolidation loans can reduce your overall interest costs, especially if you secure a lower interest rate than your existing debts. For example, if you consolidate high-interest credit card debt into a loan with a lower rate, you could save a significant amount of money over the life of the loan.

Improved Credit Score

By consolidating your debts and making consistent payments, you can improve your credit score. A lower credit utilization ratio and fewer missed payments can positively impact your credit history.

Personalized Solutions

Debt consolidation loans offer various options tailored to different financial situations. Whether you need a personal loan, a balance transfer card, or a home equity loan, there are solutions designed to fit your needs.

Choosing the Best Debt Consolidation Loan

Assess Your Financial Situation

Before selecting a debt consolidation loan, evaluate your financial situation. Determine the total amount of debt you need to consolidate and assess your credit score. This information will help you choose the most appropriate loan type and terms.

Compare Interest Rates

Interest rates vary among different lenders and loan types. It is essential to compare rates to ensure you are getting the best deal. Look for loans with lower rates than your current debts to maximize your savings.

Consider Fees and Terms

Examine the fees associated with each loan option, such as origination fees or balance transfer fees. Additionally, review the loan terms, including the repayment period and any prepayment penalties. Choose a loan with favorable terms that align with your financial goals.

Explore Lenders and Providers

Research various lenders and debt consolidation loan providers. Reputable lenders often offer transparent terms and competitive rates. As a personal example, Jane, a recent borrower, found that her local credit union provided a lower rate compared to national banks. Exploring different options can lead to significant savings.

Effective Debt Consolidation Strategies

Create a Budget

Establishing a budget is a crucial step in managing your finances after consolidating debt. Track your income and expenses to ensure you can comfortably make your monthly payments. A well-planned budget can prevent future debt accumulation.

Set Financial Goals

Setting clear financial goals helps you stay motivated and focused on your debt repayment plan. Whether you aim to pay off your loan early or save a certain amount each month, having specific goals can guide your financial decisions.

Monitor Your Credit

Regularly monitor your credit report to track your progress and ensure accuracy. Address any errors promptly and keep an eye on your credit score to gauge the impact of your consolidation efforts.

Real-Life Example

Consider the case of Mark, who was struggling with multiple credit card debts and high-interest rates. By consolidating his debts with a personal loan, he reduced his overall interest rate from 18% to 8%. This move not only lowered his monthly payments but also helped him pay off his debt faster. Mark's experience demonstrates the potential benefits of debt consolidation and the importance of choosing the right loan.

Conclusion

Debt consolidation loans can offer a smart path to financial freedom by simplifying your payments and potentially reducing your overall costs. By understanding how these loans work, evaluating your options, and implementing effective strategies, you can take control of your financial future. Remember to carefully compare loan options and seek solutions that best fit your needs. With the right approach, you can achieve greater financial stability and enjoy the peace of mind that comes with managing your debt effectively.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

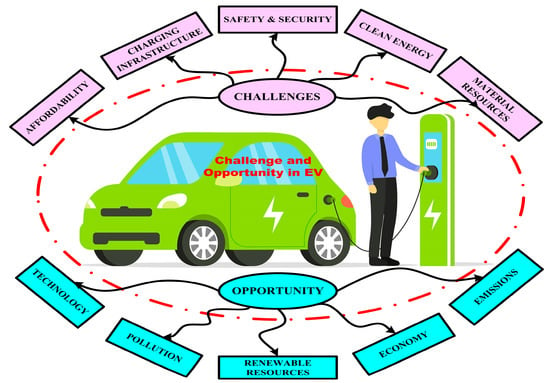

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 12, 2024

Top HR Software for Small Businesses

Streamline your small business with the best HR software solutions. Discover the top picks for HR management tools to revolutionize your business and boost productivity.

January 21, 2025

CI/CD for Machine Learning: A Complete Guide

Master continuous integration and deployment (CI/CD) for machine learning models. Learn how to streamline your MLOps pipeline!

August 28, 2024

Harnessing Machine Learning Algorithms to Transform Your Insights

Discover the top machine learning algorithms driving innovation today. Learn how they can enhance your data analysis. Click to explore and revolutionize your insights!

Tips & Trick