How to Master Personal Finance Without Breaking a Sweat

Mia Anderson

Photo: How to Master Personal Finance Without Breaking a Sweat

Personal finance management is a vital skill that can empower individuals to take control of their financial lives and secure a brighter future. However, for many, the world of personal finance can seem daunting and complex. In this comprehensive guide, we'll explore practical strategies and insights to help you master personal finance without feeling overwhelmed. By the end, you'll be equipped with the knowledge and tools to make informed financial decisions and achieve your monetary goals.

Understanding the Basics of Personal Finance Education

What is Personal Finance Management?

Personal finance management is the process of managing your money, investments, and financial decisions to achieve your short-term and long-term goals. It involves understanding your income, expenses, savings, and investments, and making strategic choices to ensure financial stability and growth.

Why is Financial Literacy Important?

Financial literacy is the foundation of personal finance management. It equips you with the knowledge and skills to make informed decisions about your money. Being financially literate means understanding concepts like budgeting, saving, investing, credit, and debt management. This knowledge is essential for navigating the financial challenges and opportunities that life presents.

Setting the Stage: Assessing Your Financial Situation

Know Your Financial Goals

The first step towards mastering personal finance is to define your financial goals. Are you saving for a down payment on a house, planning for retirement, or aiming to pay off student loans? Understanding your goals will help you create a tailored plan. For instance, if you're a recent graduate, your focus might be on managing student debt and building an emergency fund.

Evaluate Your Current Financial Health

Before making any significant financial decisions, it's crucial to assess your current financial situation. This involves calculating your net worth, which is the difference between your assets (what you own) and liabilities (what you owe). It also includes analyzing your income and expenses to identify areas where you can cut costs or increase savings. For example, tracking your monthly spending can reveal unnecessary expenses that could be redirected towards savings or debt repayment.

Essential Personal Finance Management Strategies

Budgeting: The Cornerstone of Financial Control

Creating a budget is a fundamental practice in personal finance management. A budget helps you allocate your income to various expenses and savings goals. Start by listing your monthly income and fixed expenses like rent, utilities, and loan payments. Then, allocate funds for variable expenses such as groceries, entertainment, and transportation. Ensure you set aside a portion of your income for savings and investments. For instance, you could follow the 50/30/20 rule, where 50% of your income covers necessities, 30% goes to wants, and 20% is directed towards savings and debt repayment.

Saving and Investing: Growing Your Wealth

Saving and investing are key components of building long-term wealth. Start by establishing an emergency fund to cover unexpected expenses, typically equivalent to three to six months' worth of living expenses. Once you have a solid safety net, consider investing in various assets like stocks, bonds, mutual funds, or real estate. Diversifying your investments can help manage risk and maximize returns. For instance, investing in a mix of stocks and bonds can provide both growth potential and stability.

Managing Debt: A Balancing Act

Debt is a common aspect of personal finance, and managing it effectively is crucial. Prioritize high-interest debt, such as credit card balances, as these can quickly accumulate and become unmanageable. Consider strategies like debt consolidation or balance transfers to reduce interest rates and simplify repayment. For student loans, explore income-driven repayment plans or loan forgiveness programs that can ease the financial burden.

Overcoming Common Financial Challenges

Navigating Taxes and Tax Benefits

Taxes play a significant role in personal finance, and understanding tax codes can be challenging. As a student or recent graduate, it's essential to know the tax benefits related to education. For instance, you may be eligible for tax deductions or credits for tuition fees, student loan interest, or education-related expenses. Stay informed about tax laws and deadlines to ensure you're maximizing your tax benefits and avoiding penalties.

Building Credit and Managing Credit Cards

Building a strong credit history is vital for accessing loans, mortgages, and other financial products at favorable rates. Start by understanding your credit score and the factors that influence it. Use credit cards responsibly by paying off balances in full each month to avoid interest charges. Consider setting up automatic payments to ensure you never miss a due date. For students, a secured credit card or becoming an authorized user on a parent's account can help establish credit history.

Staying on Track: Long-Term Financial Planning

Retirement Planning: Preparing for the Future

It's never too early to start planning for retirement. Explore retirement savings options like 401(k)s, IRAs, or similar plans, especially if your employer offers matching contributions. These accounts provide tax advantages and help your savings grow over time. Consider consulting a financial advisor to determine the best retirement strategy for your situation.

Insurance and Risk Management

Protecting yourself and your assets is a critical aspect of personal finance. Evaluate your insurance needs, including health, life, disability, and property insurance. Ensure you have adequate coverage to safeguard against unexpected events. Regularly review and update your insurance policies as your life circumstances change.

Final Thoughts

Mastering personal finance management is a journey that requires dedication and continuous learning. By setting clear financial goals, understanding the basics, and implementing practical strategies, you can take control of your financial future. Remember, financial literacy is a powerful tool that can help you make informed decisions and navigate the complexities of the financial world. Stay informed, seek professional advice when needed, and adapt your financial plan as your life evolves.

Resources and Further Reading

For those seeking additional guidance, numerous resources are available to enhance your personal finance education. Online platforms, financial blogs, and government websites offer valuable information on various financial topics. Consider attending financial literacy events or workshops to gain practical insights and connect with experts. Remember, the more you know about personal finance, the better equipped you'll be to make sound financial decisions and achieve your goals.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

Entertainment

View AllDiscover the best video editing software for 2024. Our expert picks will help you choose the perfect tool for your needs. Click to find out more.

Mia Anderson

Discover how narrative design transforms video games into immersive experiences. Learn industry secrets and start creating unforgettable stories today!

Mia Anderson

Discover the top podcasting trends of 2024 and stay ahead in the industry. Learn how to leverage new insights click now to future-proof your podcast!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

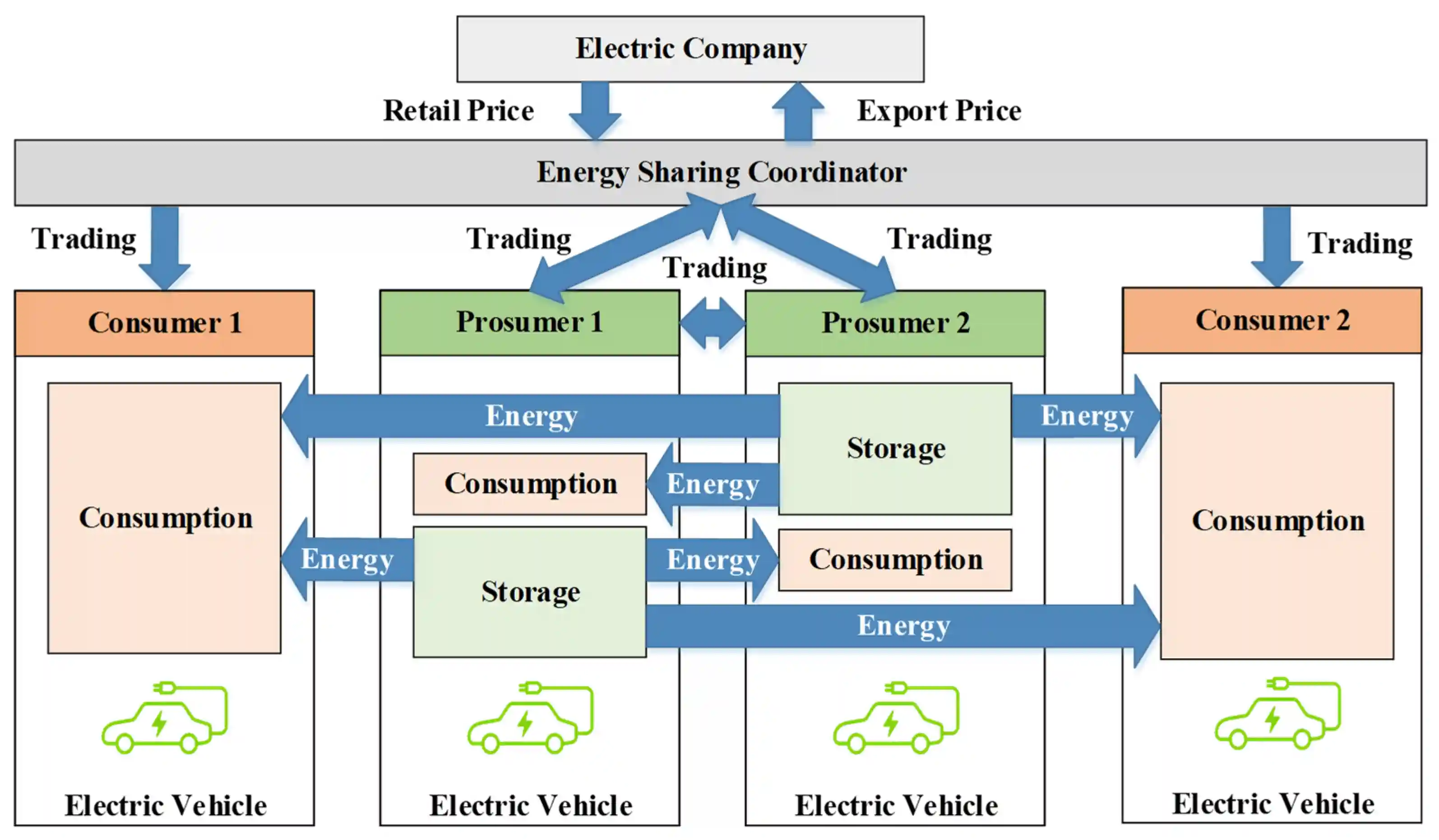

View AllLearn how smart city initiatives are seamlessly integrating EV infrastructure to enhance mobility and sustainability.

Read MoreExplore how different age groups are embracing EVs. Learn what drives adoption among millennials, Gen Z, and baby boomers.

Read MoreExplore the role of EVs in peer-to-peer energy sharing. Could EVs become key players in the decentralized energy market?

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 27, 2024

How Expert IT Consulting Services Can Transform Your Business

Discover top IT consulting services to drive business growth. Explore expert solutions tailored to your needs and boost your tech efficiency. Click to learn more!

December 20, 2024

What’s the Best Camera for Vlogging? Top Picks for 2024

Elevate your vlogging game with the best cameras of 2024! Click to explore and find your perfect content creation companion.

September 15, 2024

Tips for Securing Your IoT Devices in 2024

Discover the latest strategies for securing IoT devices in 2024. Learn practical tips to protect your smart tech and enhance your digital safety.

Tips & Trick