Why Diversifying Your Investments Is Key to Long-Term Wealth

Mia Anderson

Photo: Why Diversifying Your Investments Is Key to Long-Term Wealth

In the ever-evolving world of finance, one principle stands tall as a beacon for investors seeking long-term prosperity: investment diversification. As we step into 2024, it's time to explore why spreading your financial wings across various assets is not just a strategy but a cornerstone of successful wealth management. This article will take you on a journey through the significance of diversification, its impact on portfolio risk management, and the insights that make it an essential tool for every investor.

Understanding the Basics: What is Investment Diversification?

Before we delve into the intricacies, let's establish a foundation. Investment diversification is the art of allocating your financial resources across different asset classes, industries, and geographical regions. It's like building a sturdy house you wouldn't rely solely on one type of material. Instead, you'd use bricks, wood, concrete, and steel to create a robust structure. Similarly, diversifying investments reduces the risk of significant losses by not putting all your eggs in one basket.

The Historical Perspective: Diversification's Track Record

A quick glance at historical data reveals a compelling story. According to a 2024 Diversification Landscape report by Morningstar, the basic 60/40 portfolio, a classic diversification strategy, has outperformed the stocks-only benchmark 87% of the time since 1976. This finding underscores the resilience and reliability of diversification, especially in the long run.

However, it's worth noting that diversification's performance hasn't been immune to market conditions. The report highlights that in 2023's bullish market environment, portfolio diversification didn't provide the expected boost in returns. This observation prompts an intriguing question: Is diversification's power diminishing?

Analyzing the Current Landscape: Diversification in 2024

Embracing a Simpler Approach

In the first half of 2024, a trend emerged that favored a more straightforward approach to diversification. The Morningstar report suggests that investors might not need to venture too far beyond the basic mix of larger-cap stocks and high-quality bonds to achieve diversification. This finding challenges the notion that complexity always leads to better results.

Diversifying Your Diversifiers

An intriguing perspective from CAIA's "Portfolio for the Future" column emphasizes the importance of diversifying your diversifiers. This concept highlights the need to vary the strategies used to diversify investments. For instance, short positions in the Japanese yen, which performed well in 2024, showcase the benefits of incorporating different investment approaches.

The Benefits of Diversification: A Closer Look

Risk Reduction

At its core, diversification is a risk management strategy. By spreading investments across various assets, you reduce the impact of any single investment's poor performance. Imagine investing all your money in a single tech stock. If that company encounters a scandal or market shift, your entire portfolio could suffer. Diversification acts as a safety net, ensuring that one bad apple doesn't spoil the entire bunch.

Long-Term Growth

Diversification is a marathon, not a sprint. While it may not always yield the highest short-term returns, it consistently delivers over the long haul. The historical data mentioned earlier is a testament to this. By maintaining a diversified portfolio, investors can weather market storms and capitalize on opportunities across different sectors and regions.

Navigating Market Uncertainties

Markets are unpredictable, and economic conditions can change rapidly. Diversification provides a buffer against these uncertainties. For example, if the technology sector experiences a downturn, a well-diversified portfolio with investments in healthcare, real estate, and international markets can help offset potential losses.

Practical Tips for Effective Diversification

Start with Asset Classes

Begin by understanding the various asset classes: stocks, bonds, real estate, commodities, and more. Each class has unique characteristics and risk profiles. Diversifying across these classes is a fundamental step towards a balanced portfolio.

Consider Industry Sectors

Within each asset class, explore different industry sectors. For instance, in the stock market, you can invest in technology, healthcare, energy, and consumer goods. This approach ensures that your portfolio is not overly reliant on a single industry's performance.

Think Globally

Geographical diversification is often overlooked but crucial. International markets offer unique opportunities and can provide stability during domestic economic downturns. Consider investing in emerging markets or developed economies outside your home country.

Regularly Review and Rebalance

Diversification is not a set-it-and-forget-it strategy. Regularly review your portfolio to ensure it aligns with your goals and market conditions. Rebalancing involves adjusting your asset allocation to maintain the desired level of diversification.

Conclusion: Diversification as a Journey

Investment diversification is not a one-size-fits-all strategy, and its effectiveness can vary over time. The insights from 2024 suggest that a simpler approach might be more practical, and diversifying your diversifiers adds an extra layer of resilience. While historical data supports the long-term benefits of diversification, investors should remain adaptable and open to evolving strategies.

As you embark on your investment journey, remember that diversification is a powerful tool to navigate the financial landscape. It empowers you to manage risk, seize opportunities, and build a robust financial future. Stay informed, stay diversified, and watch your wealth grow.

Marketing

View All

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

Explore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the latest tips for creating a top-notch home theater in 2024. Learn expert advice on setup, gear, and design. Start your home theater journey today!

Mia Anderson

Automotive

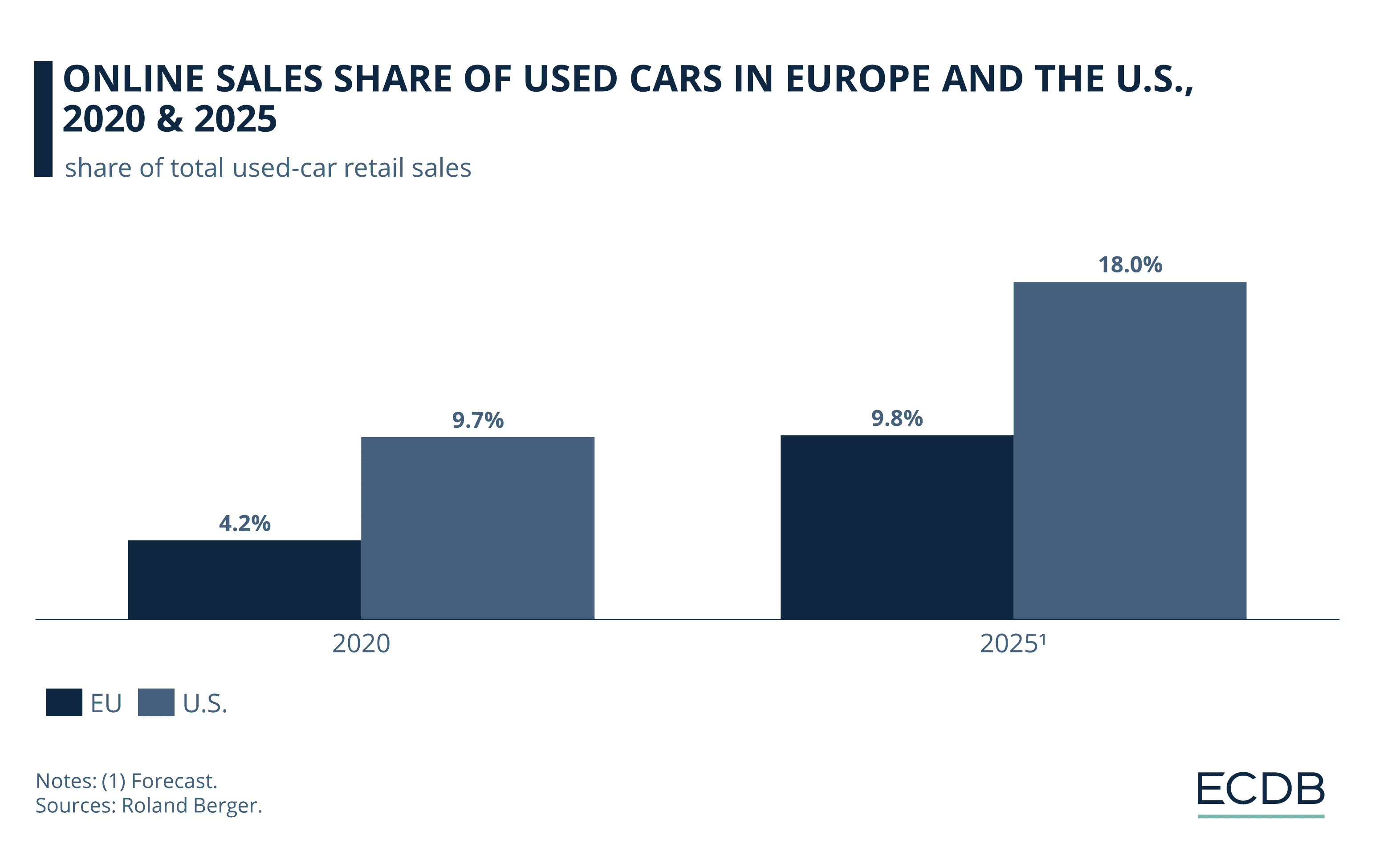

View AllExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreUncover how vehicle-to-grid (V2G) technology is reshaping the energy ecosystem by integrating EVs into power grids.

Read MoreDiscover how government policies are accelerating EV adoption. Explore tax incentives, regulations, and global policy success stories.

Read MorePolular🔥

View All

1

2

3

4

6

7

8

9

10

Technology

View All

August 10, 2024

The Top Productivity Apps to Boost Your Efficiency in 2024

Boost your productivity to the most with the top 2024 applications! Learn how to better focus, manage projects, and arrange chores using these tools. Increase your productivity with these best practices.

December 18, 2024

Upgrade Your Streaming Experience: The Best 4K TVs to Buy in 2024

Elevate your streaming with the top 4K TVs of 2024! Click to discover the ultimate viewing experience and choose the right one.

January 21, 2025

Future Trends in Data Science: What’s Next?

Explore future trends in data science, from quantum computing to neuromorphic AI. Stay ahead of the curve with emerging technologies!

Tips & Trick