The Hidden Benefits of Credit Cards You Probably Aren’t Using

Mia Anderson

Photo: The Hidden Benefits of Credit Cards You Probably Aren’t Using

credit cards have become an integral part of our financial toolkit, offering convenience and purchasing power. While many of us are familiar with the basic benefits of credit cards, such as earning rewards and building credit history, there are some hidden perks that often go unnoticed. These benefits can significantly enhance your financial well-being and provide a safety net in various situations. Let's delve into the lesser-known advantages of credit cards and explore how they can work in your favor.

Building a Financial Safety Net

One of the most underrated benefits of credit cards is the financial security they provide. In times of emergencies or unexpected expenses, having a credit card can be a lifesaver. Imagine your car breaking down unexpectedly, leaving you with a hefty repair bill. Instead of dipping into your savings or taking out a loan, a credit card can come to the rescue. By utilizing your credit limit, you can cover the cost and pay it off over time, allowing you to manage the expense without straining your immediate finances.

For instance, Sarah, a cautious spender, always had a fear of unexpected financial burdens. However, when her laptop suddenly crashed, she was grateful to have a credit card. She was able to purchase a new laptop immediately and pay for it in installments without disrupting her monthly budget. This real-life example highlights how credit cards can provide a much-needed financial cushion.

Travel Perks and Protection

Credit cards often come with a range of travel benefits that can make your journeys more enjoyable and worry-free. From airport lounge access to travel insurance, these perks can significantly enhance your travel experience. For instance, many credit cards offer rental car insurance, which can save you money and provide peace of mind when renting a vehicle. Additionally, some cards provide trip cancellation and interruption insurance, ensuring that you're covered if your travel plans go awry.

Consider the story of John, an avid traveler, who always uses his credit card for travel bookings. During a recent trip, his flight was canceled due to bad weather, leaving him stranded. Thanks to his credit card's travel insurance, he was able to claim compensation for the inconvenience and book an alternative flight without any financial loss. This scenario demonstrates how credit cards can offer valuable protection and support during travel-related emergencies.

Extended Warranties and Purchase Protection

Another hidden gem of credit cards is the extended warranty and purchase protection they often provide. When you make a purchase using your credit card, you may be eligible for an extended warranty on the item, which can be particularly useful for expensive electronics or appliances. This extended warranty can save you money on repairs or replacements, providing an added layer of protection for your purchases.

For example, Emily, an avid tech enthusiast, purchased a new smartphone with her credit card. A few months later, the phone developed a manufacturing defect. Fortunately, her credit card's extended warranty covered the repair costs, saving her from an expensive out-of-pocket expense. This real-life scenario showcases how credit cards can offer valuable purchase protection, ensuring your hard-earned money is well-protected.

Fraud Protection and Security

Credit cards also offer robust fraud protection and security features, making them a safer payment option than cash or debit cards. Most credit card companies have advanced security systems in place to detect and prevent fraudulent activities. In the event of unauthorized transactions, credit card companies typically offer zero liability protection, meaning you won't be held responsible for any fraudulent charges.

A personal experience shared by Michael, a frequent online shopper, highlights the importance of this benefit. He noticed some suspicious transactions on his credit card statement and immediately contacted his card issuer. The company promptly investigated the issue, reversed the fraudulent charges, and issued him a new card. This incident showcases how credit cards can provide peace of mind and security, ensuring your financial well-being.

Building Credit and Financial Management

Using credit cards responsibly can be an excellent way to build or improve your credit score. By making timely payments and maintaining a low credit utilization ratio, you demonstrate financial responsibility to credit bureaus. This, in turn, can lead to better loan terms, lower interest rates, and increased credit limits in the future.

Moreover, credit cards can serve as a valuable tool for financial management. By tracking your expenses and analyzing your monthly statements, you can gain a better understanding of your spending habits. This awareness can help you create a budget, identify areas for improvement, and make informed financial decisions.

Conclusion

Credit cards offer more than just convenience and rewards. The hidden benefits, such as financial safety nets, travel perks, extended warranties, fraud protection, and credit-building opportunities, make them an invaluable financial tool. By understanding and utilizing these advantages, you can maximize the potential of your credit cards and enhance your overall financial well-being.

Remember, while credit cards can provide numerous benefits, it's essential to use them responsibly and stay within your means. By doing so, you can enjoy the perks while avoiding the pitfalls of excessive debt and interest charges. Embrace the power of credit cards, and unlock the hidden advantages that can make a significant difference in your financial journey.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

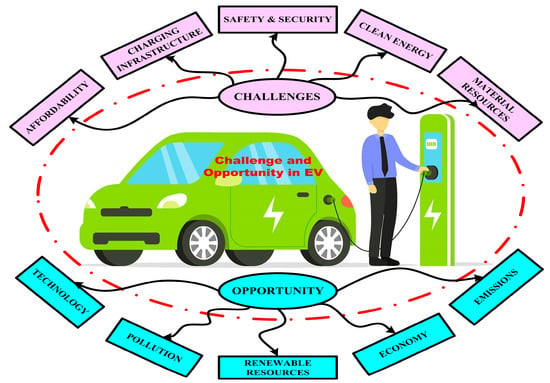

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick