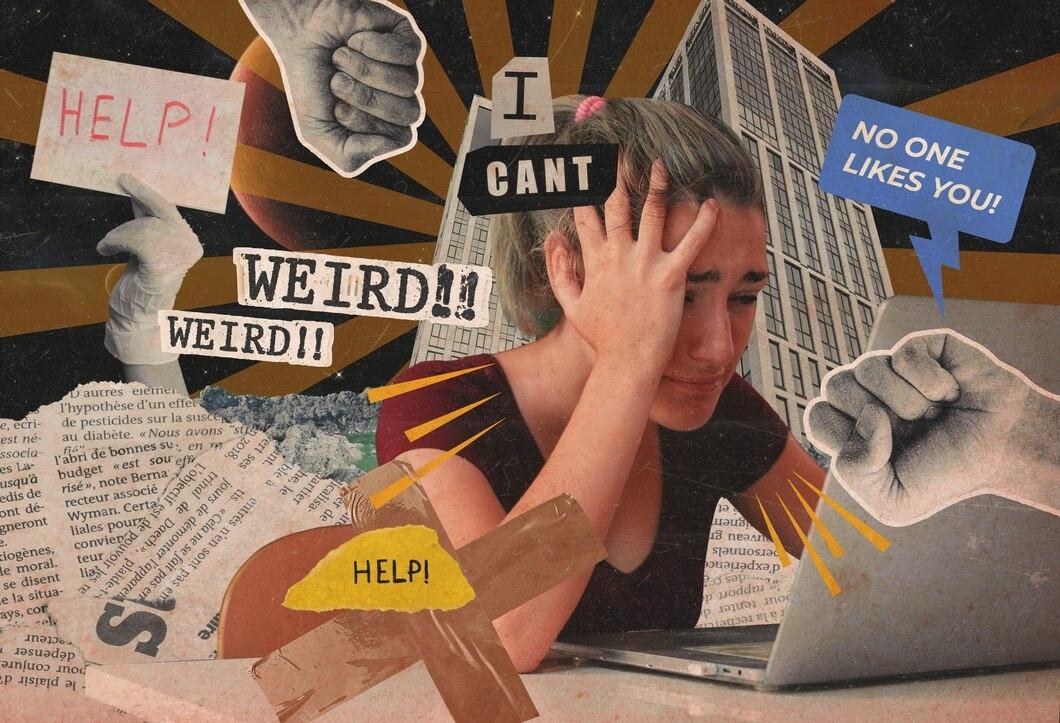

Financial Red Flags: How to Spot a Bad Deal Before It’s Too Late

Mia Anderson

Photo: Financial Red Flags: How to Spot a Bad Deal Before It’s Too Late

making smart decisions with your money is crucial, but it's not always easy to spot a potential disaster waiting to happen. Whether you're a seasoned investor or just starting to navigate the financial world, recognizing financial red flags can save you from costly mistakes and potential financial ruin. Let's delve into the art of identifying bad deals and empower you to make informed choices with your hard-earned money.

Understanding Financial Red Flags

Financial red flags are warning signs indicating a potential financial pitfall or a deal that might not be as lucrative as it seems. These red flags can be subtle, but they often hint at underlying issues that could lead to significant losses if ignored. Being vigilant and aware of these signs is the first step towards protecting your financial interests.

Common Red Flags to Watch Out For

Lack of Transparency

A company or investment opportunity that lacks transparency should raise immediate concerns. If the financial entity is reluctant to provide detailed information about their operations, financial history, or future projections, it's a major red flag. Legitimate businesses typically have nothing to hide and are open about their financial health.

For instance, imagine investing in a startup that refuses to disclose its financial statements or provide a clear business plan. This lack of transparency could indicate financial instability or even fraudulent activity. Always seek comprehensive information before committing your money.

Overly Complex or Vague Terms

When presented with a financial deal, pay close attention to the terms and conditions. If the language is overly complex, filled with legal jargon, or intentionally vague, it might be a tactic to confuse investors. Such complexity can hide unfavorable clauses or risks that could impact your investment negatively.

Consider a scenario where you're offered a high-yield investment product with a lengthy contract filled with convoluted terms. If you struggle to understand the agreement, it's a sign to proceed with caution. Always ensure you comprehend the terms and conditions before signing on the dotted line.

Unrealistic Returns

If an investment promises returns that seem too good to be true, they probably are. Excessively high returns often indicate a high-risk venture or, worse, a scam. Sustainable and legitimate investments typically offer more modest, consistent returns over time.

For example, if someone offers you a guaranteed 50% return on your investment in just a few months, it's a red flag waving wildly. Remember, if it sounds too good to be true, it probably is.

Pressure Tactics

Be cautious of financial advisors or salespeople who use high-pressure tactics to rush you into making a decision. Legitimate professionals understand the importance of careful consideration and will provide you with ample time to evaluate the opportunity.

Imagine a scenario where a broker calls you repeatedly, urging you to invest in a hot new stock before the market closes. This pressure is a classic red flag, indicating they might be more interested in their commission than your financial well-being.

Real-Life Example: The Bernie Madoff Scandal

One of the most notorious financial frauds in history, the Bernie Madoff scandal, serves as a stark reminder of the importance of recognizing red flags. Madoff, a former NASDAQ chairman, ran a Ponzi scheme that cost investors billions of dollars.

Madoff's scheme lured investors with promises of consistently high returns, regardless of market conditions. This unrealistic performance should have been a significant red flag. Additionally, his lack of transparency about his investment strategy and refusal to allow independent audits were warning signs that were unfortunately ignored by many.

Protecting Yourself: Due Diligence and Research

To safeguard your financial interests, due diligence and thorough research are essential. Here's a simple step-by-step process to help you evaluate financial opportunities:

- Research the Company or Investment: Conduct an in-depth analysis of the company or investment. Look for their track record, financial health, and reputation in the industry.

- Understand the Risks: Every investment carries risks. Identify and understand the potential risks associated with the opportunity. Are these risks within your comfort zone, or do they seem excessive?

- Seek Independent Advice: Consult with a trusted financial advisor or accountant who can provide an unbiased opinion. They can help you identify red flags and assess the viability of the investment.

- Check Regulatory Compliance: Ensure the investment or company is registered with relevant regulatory bodies. Unregistered entities might be operating outside the law.

- Trust Your Instincts: If something feels off, trust your instincts. If you're uncomfortable with the deal, it's better to walk away.

Conclusion

Spotting financial red flags is a critical skill for anyone looking to navigate the complex world of finance. By being vigilant, conducting thorough research, and trusting your instincts, you can avoid falling victim to bad deals. Remember, legitimate opportunities are transparent, offer realistic returns, and provide ample time for consideration. Stay informed, ask questions, and always protect your financial future.

Staying alert and informed is the best defense against financial pitfalls. Keep an eye out for the red flags discussed, and you'll be well-equipped to make sound financial decisions.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick