Unlock Financial Freedom: Top Personal Finance Software You Need to Know

Mia Anderson

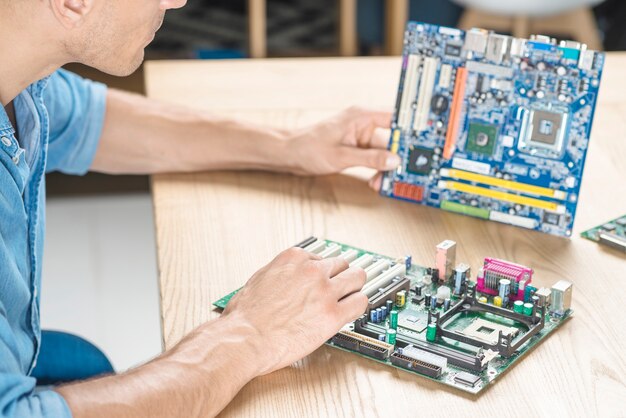

Photo: Unlock Financial Freedom: Top Personal Finance Software You Need to Know

In an increasingly digital world, managing personal finances has become more streamlined and accessible, thanks to the advent of personal finance software. These tools are designed to help individuals and families track their spending, manage their budgets, and plan for the future. But with so many options available, how do you choose the right software to unlock your financial freedom? This article explores the best personal finance software, offering insights into their features, benefits, and how they can be used to achieve your financial goals.

Why Personal Finance Software is Essential

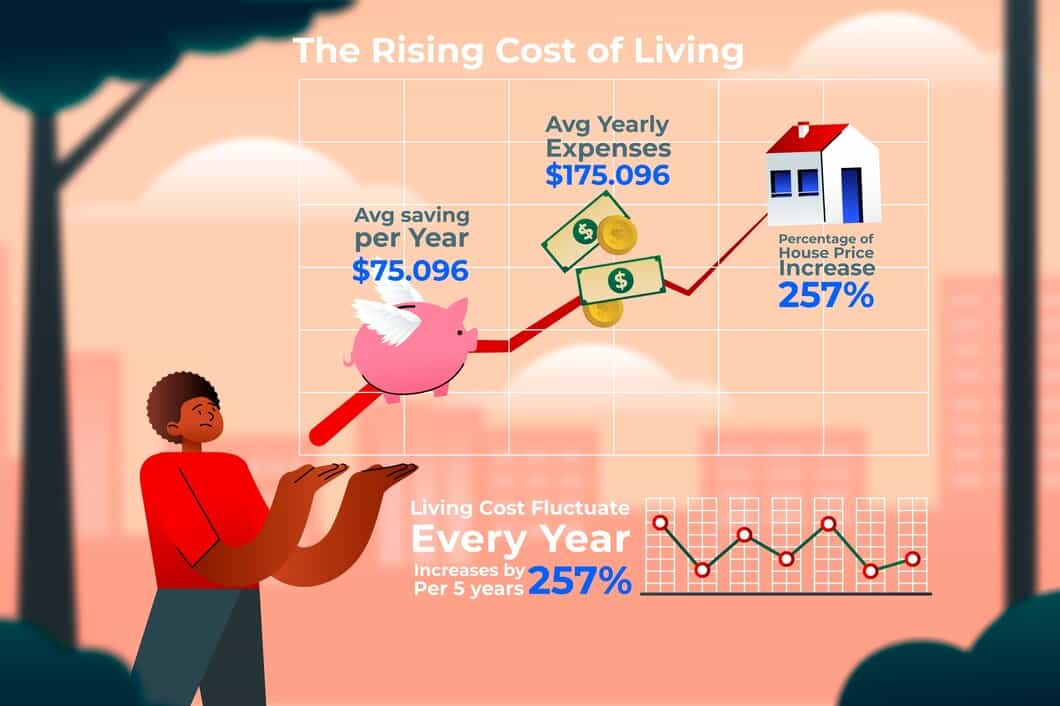

Understanding the Importance of Financial Management

Managing finances can be a daunting task. From tracking daily expenses to planning for long-term goals like retirement, the complexities involved often lead to stress and poor financial decisions. This is where personal finance software comes into play. These tools are not just about keeping tabs on your spending; they are about providing you with a comprehensive view of your financial health.

In the past, managing finances meant keeping track of receipts, balancing checkbooks, and manually entering data into spreadsheets. Today, personal finance software has simplified this process, automating many of these tasks and providing real-time insights. Whether you're looking to build a budget, save for a major purchase, or invest in the stock market, the right software can be a game-changer.

Top Personal Finance Software Options

1. Quicken: A Legacy of Financial Management

Quicken is one of the oldest and most well-known personal finance software options available. It offers a range of features that cater to different financial needs, from budgeting and expense tracking to investment management and retirement planning. Quicken's long-standing reputation for reliability and comprehensive tools makes it a favorite among users who require a robust solution.

Why Choose Quicken?

- Comprehensive budgeting tools

- Investment tracking capabilities

- Customizable reports

- Access to financial planning tools

Quicken is ideal for individuals who want a detailed view of their finances and prefer a desktop-based solution. However, its complexity may be overwhelming for beginners.

2. Mint: Simplify Your Budgeting

Mint is a free personal finance software known for its user-friendly interface and powerful budgeting tools. It automatically syncs with your bank accounts, credit cards, and other financial institutions, categorizing transactions and providing a clear overview of your spending habits.

What Makes Mint Stand Out?

- Free to use

- Automatic transaction categorization

- Customizable budget goals

- Alerts and reminders for bills

Mint is perfect for users who are new to budgeting and want an easy-to-use platform that does the heavy lifting for them.

3. YNAB (You Need A Budget): Taking Control of Your Money

YNAB is a budgeting tool that operates on a unique philosophy: give every dollar a job. This software is designed to help you become more intentional with your money, focusing on proactive financial management.

YNAB's Key Features:

- Zero-based budgeting

- Goal tracking

- Financial education resources

- Real-time expense tracking

YNAB is ideal for individuals who are serious about getting out of debt and achieving long-term financial goals. Its hands-on approach encourages users to engage more deeply with their finances.

4. Personal Capital: The Best for Investment Management

Personal Capital is more than just a budgeting tool; it's a comprehensive financial management platform that offers powerful investment tracking features. With Personal Capital, you can manage your finances while keeping a close eye on your investment portfolio.

Why Personal Capital is Worth Considering:

- Detailed investment tracking

- Retirement planning tools

- Net worth calculation

- Fee analyzer for investment accounts

Personal Capital is best suited for individuals who have a diverse investment portfolio and want a tool that integrates both budgeting and investment management.

5. PocketGuard: Stay Within Your Limits

PocketGuard is a simple, straightforward budgeting app that helps you avoid overspending. By linking to your financial accounts, PocketGuard shows you how much money you have left to spend after accounting for bills, goals, and necessities.

PocketGuard's Best Features:

- Simplified budget management

- Easy-to-understand interface

- Real-time updates on available funds

- Customizable spending limits

PocketGuard is perfect for those who need a clear, concise overview of their finances without getting bogged down in details.

The Benefits of Using Personal Finance Software

Streamlining Your Budgeting Process

One of the most significant advantages of using personal finance software is the ability to streamline your budgeting process. These tools automatically categorize your expenses, allowing you to see where your money is going and where you can cut back. By providing a clear picture of your spending habits, these tools help you make informed decisions about your budget.

Achieving Financial Goals

Personal finance software is not just about tracking your spending; it's about achieving your financial goals. Whether you're saving for a vacation, a down payment on a house, or retirement, these tools allow you to set specific goals and track your progress. They offer reminders, insights, and tips to help you stay on track.

Reducing Financial Stress

Managing finances can be stressful, especially if you're not sure where your money is going. Personal finance software takes the guesswork out of financial management, providing you with real-time insights and reducing the stress associated with money management.

Enhancing Financial Literacy

Many personal finance software options come with educational resources that help users improve their financial literacy. From articles and tutorials to webinars and financial coaching, these resources provide valuable information that can help you make smarter financial decisions.

Choosing the Right Personal Finance Software

Factors to Consider

When choosing personal finance software, there are several factors to consider:

- Ease of Use: Look for software that is user-friendly and matches your level of financial literacy.

- Features: Consider the features that are most important to you, such as budgeting tools, investment tracking, or bill reminders.

- Cost: Some personal finance software is free, while others require a subscription. Consider your budget and the value you're getting from the software.

- Compatibility: Ensure the software is compatible with your devices and financial institutions.

- Security: Personal finance software will have access to your financial data, so it's crucial to choose a platform with robust security measures.

Making the Final Decision

Ultimately, the best personal finance software is the one that meets your specific needs and helps you achieve your financial goals. Take advantage of free trials and explore different options before making your final decision.

Conclusion

Personal finance software is an invaluable tool for anyone looking to take control of their finances. By offering a range of features from budgeting and expense tracking to investment management and financial planning, these tools can help you unlock your financial freedom. Whether you're just starting on your financial journey or looking to optimize your current strategy, the right personal finance software can make all the difference.

By choosing a tool that aligns with your goals and needs, you'll be well on your way to achieving financial stability and freedom. Remember, the key to financial success is not just about how much you earn, but how well you manage and grow your wealth.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllDiscover the hottest entertainment news and updates! Stay ahead with the latest trends and exclusive stories. Click now for breaking news.

Mia Anderson

Discover the latest exclusive movie releases that everyone’s talking about. Don’t miss out click to stay ahead of the curve!

Mia Anderson

Discover the latest tips for creating a top fan website in 2024. Learn key strategies and boost your site’s success click to read the complete guide now!

Mia Anderson

Discover the latest tips for creating a top-notch home theater in 2024. Learn expert advice on setup, gear, and design. Start your home theater journey today!

Mia Anderson

Automotive

View AllForecast the EV market of 2030. Learn about expected growth rates, market penetration, and the rise of EV ownership globally.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreLearn the key factors influencing EV adoption, from cost and range to charging infrastructure and environmental concerns.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 28, 2024

Harnessing Machine Learning Algorithms to Transform Your Insights

Discover the top machine learning algorithms driving innovation today. Learn how they can enhance your data analysis. Click to explore and revolutionize your insights!

August 29, 2024

Discover How Digital Transformation Services Can Revolutionize Your Business

Discover how digital transformation services can revolutionize your business. Explore top solutions to drive growth and efficiency. Read more now!

December 20, 2024

Don’t Buy That Smartphone Until You Read This 2024 Comparison

Make an informed smartphone purchase! Our 2024 comparison guide helps you find the perfect match. Click to learn more.

Tips & Trick