How to Save Money on Taxes with These Simple Strategies

Mia Anderson

Photo: How to Save Money on Taxes with These Simple Strategies

Tax season can be a stressful time for many, but it also presents an opportunity to maximize your financial gains through strategic planning. Are you ready to discover simple yet effective ways to reduce your tax burden and keep more of your hard-earned money? In this comprehensive guide, we'll delve into the world of tax savings, offering practical strategies that can make a significant difference in your financial well-being. Get ready to take control of your finances and embrace a brighter financial future!

The Importance of Tax Planning

Tax planning is an essential aspect of financial management that often goes overlooked. Many individuals approach tax season with a sense of dread, hoping to simply get through it without any surprises. However, proactive tax planning can be a game-changer, allowing you to take advantage of various deductions, credits, and strategies to minimize your tax liability. By understanding the power of tax savings, you can transform your financial outlook and achieve your long-term goals.

Unlocking Tax Savings: A Step-by-Step Guide

1. Understand Your Tax Bracket

The first step towards effective tax savings is understanding your tax bracket. Tax brackets determine the rate at which your income is taxed, and they vary depending on your filing status and income level. By knowing your tax bracket, you can make informed decisions about your finances and employ strategies to potentially lower your taxable income.

For example, let's consider Sarah, a single professional with an annual income of $75,000. Sarah falls into the 22% tax bracket for the 2024 tax year. By being aware of her tax bracket, Sarah can explore ways to reduce her taxable income, such as contributing to a retirement account or taking advantage of tax deductions.

2. Maximize Retirement Contributions

One of the most powerful tax-saving strategies is contributing to tax-advantaged retirement accounts. These accounts not only help you secure your financial future but also offer significant tax benefits. Let's explore two popular retirement savings options:

a. Traditional IRA (Individual Retirement Account)

With a Traditional IRA, you can contribute pre-tax dollars, which lowers your taxable income for the current year. For example, if Sarah contributes $5,000 to her Traditional IRA, her taxable income for the year would be reduced to $70,000, potentially moving her into a lower tax bracket. Over time, the funds in a Traditional IRA grow tax-deferred, meaning you only pay taxes when you make withdrawals during retirement.

b. Employer-Sponsored Plans (e.g., 401(k), 403(b))

Many employers offer retirement plans such as 401(k) or 403(b) accounts, which allow employees to contribute a portion of their pre-tax income. These contributions are often deducted directly from your paycheck, making it an effortless way to save for retirement while reducing your taxable income. For instance, if Sarah's employer offers a 401(k) plan and she contributes $10,000 annually, her taxable income would be further reduced, resulting in substantial tax savings.

3. Take Advantage of Tax Deductions

Tax deductions are a powerful tool to lower your taxable income and, consequently, your tax liability. Let's explore some common deductions that can make a significant impact:

- Standard Deduction vs. Itemized Deductions: The standard deduction is a fixed amount that taxpayers can subtract from their taxable income. For the 2024 tax year, the standard deduction for single filers is $13,850. However, if your eligible expenses exceed the standard deduction, you may benefit from itemizing deductions. Common itemized deductions include mortgage interest, state and local taxes, charitable contributions, and medical expenses.

- Charitable Contributions: Giving back to the community through charitable donations not only makes a positive impact but can also provide tax benefits. Keep track of your donations, whether they are monetary or non-cash contributions, as they can be deducted from your taxable income.

- Self-Employment Deductions: If you're self-employed or have a side hustle, there are various deductions available to you. These may include home office expenses, business-related travel, and the cost of supplies and equipment. Properly documenting and claiming these deductions can significantly reduce your tax burden.

4. Explore Tax Credits

Tax credits are an even more valuable tool for reducing your tax liability as they provide a dollar-for-dollar reduction in the taxes you owe. Unlike deductions, which lower your taxable income, credits directly decrease the amount of tax you pay. Here are some tax credits to consider:

- Child Tax Credit: If you have children under the age of 17, you may be eligible for the Child Tax Credit. For 2024, the credit amount is up to $2,000 per qualifying child. This credit can significantly reduce your tax bill or even result in a refund.

- Education Credits: Paying for higher education expenses? You might qualify for education credits such as the American Opportunity Tax Credit or the Lifetime Learning Credit. These credits can help offset the cost of tuition, fees, and other educational expenses.

- Energy Efficiency Credits: Making energy-efficient improvements to your home? You may be eligible for tax credits for installing energy-saving appliances, insulation, or renewable energy systems.

5. Optimize Your Withholdings

Reviewing and adjusting your tax withholdings is a simple yet effective way to manage your tax situation. If you consistently receive large tax refunds, it may indicate that you're having too much tax withheld from your paycheck. Consider adjusting your W-4 form to claim additional allowances, resulting in a higher net pay each pay period. Conversely, if you owe a significant amount of taxes each year, you may need to increase your withholdings to avoid penalties.

Real-Life Tax Savings Example

Let's bring these strategies to life with a real-life example. Meet John, a married professional with two children. John and his wife, both earning a combined annual income of $120,000, have been feeling the tax pinch for years. Here's how they can implement tax-saving strategies:

- Retirement Contributions: John and his wife decide to contribute $10,000 each to their employer-sponsored 401(k) plans. This reduces their taxable income to $100,000, potentially lowering their tax bracket.

- Itemized Deductions: They own a home and have significant mortgage interest and property tax expenses. By itemizing their deductions, they can further reduce their taxable income.

- Child Tax Credits: With two children, they claim the Child Tax Credit, which provides a substantial reduction in their tax liability.

- Education Credits: Their eldest child is attending college, and they qualify for the American Opportunity Tax Credit, further reducing their tax bill.

By implementing these strategies, John and his wife can significantly lower their tax liability, potentially saving thousands of dollars each year. This allows them to allocate more funds towards their financial goals and build a more secure future.

Conclusion

Tax savings is not just a privilege for the financially savvy; it's an accessible strategy for anyone willing to take control of their finances. By understanding your tax bracket, maximizing retirement contributions, leveraging deductions and credits, and optimizing your withholdings, you can significantly reduce your tax liability. Remember, tax planning is an ongoing process, and staying informed about the latest tax laws and strategies is crucial. Start implementing these simple yet powerful steps today, and watch your financial future flourish!

Remember, tax laws and regulations can change, so it's essential to stay updated and consult a tax professional for personalized advice. With the right strategies and a proactive approach, you can unlock substantial tax savings and achieve your financial goals. Happy tax savings!

Marketing

View All

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Discover how the Metaverse is revolutionizing entertainment in 2024. Read about the latest trends and innovations shaping the future of digital experiences.

Mia Anderson

Find out which movie streaming platforms are the best in 2024. Get insights, compare options, and choose your ideal service. Click to learn more!

Mia Anderson

Discover the amazing history of animated films and how they came to rule the world. Discover how animation has captured the attention of viewers all across the world, from the first attempts to the greatest works of today!

Mia Anderson

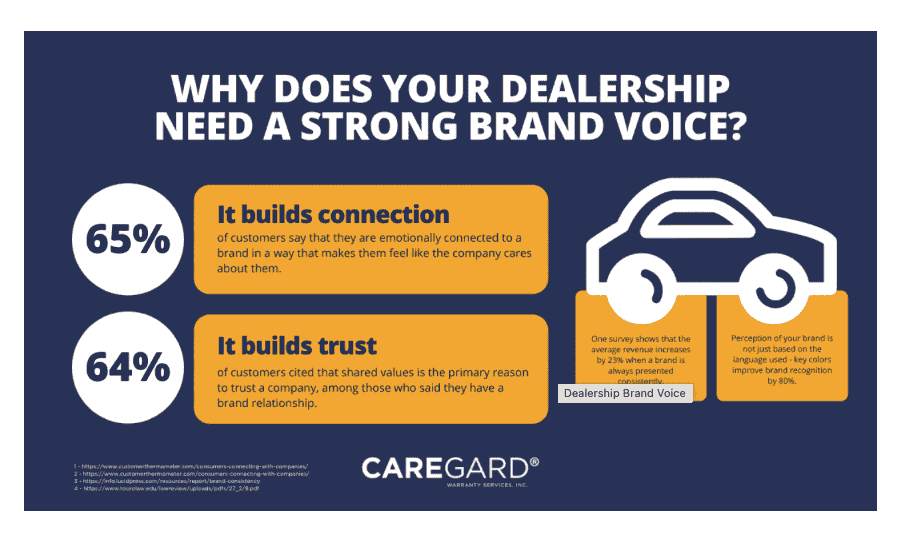

Automotive

View AllDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

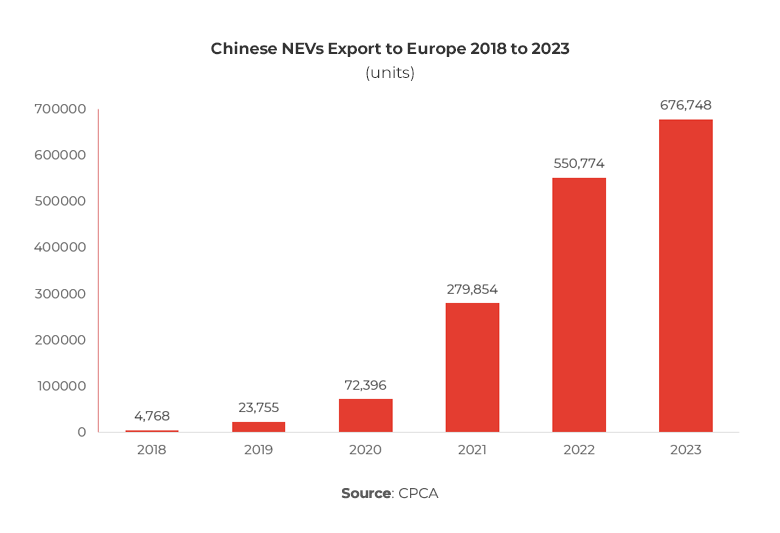

Read MoreLearn how import and export tariffs affect EV prices globally and what that means for buyers and manufacturers.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MorePolular🔥

View All

1

2

4

6

7

8

9

10

Technology

View All

August 9, 2024

The Best Video Game Graphics in 2024

Find out which video games from 2024 provide the most amazing graphics and captivating gameplay. These games will wow you with their beautiful settings and minute features!

August 27, 2024

How Expert IT Consulting Services Can Transform Your Business

Discover top IT consulting services to drive business growth. Explore expert solutions tailored to your needs and boost your tech efficiency. Click to learn more!

December 13, 2024

Should You Upgrade to a Smart Home? 6 Reasons to Start Today

Upgrade your home with smart tech! Learn 6 compelling reasons to embrace the future. Click to explore and transform your living space.

Tips & Trick