The Ultimate Guide to Getting a Business Loan

Mia Anderson

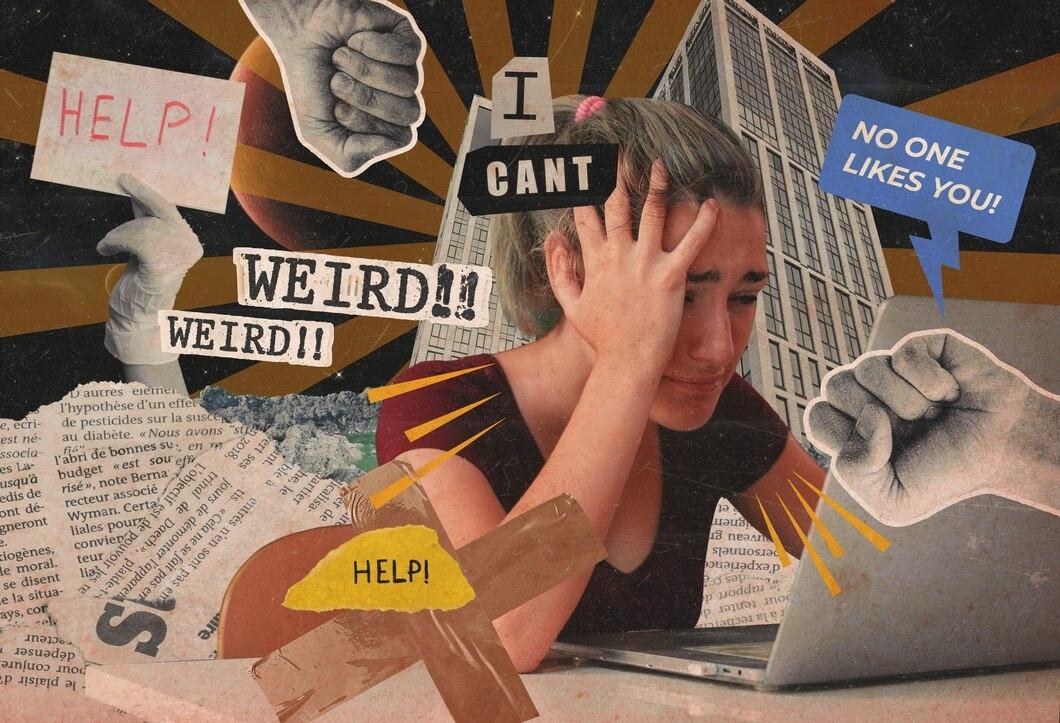

Photo: The Ultimate Guide to Getting a Business Loan

Starting and expanding a business often requires external funding, and navigating the world of business loans can be a daunting task for entrepreneurs. This ultimate guide will lift the veil on the lending process, offering valuable insights and practical tips to help you secure the funding your business needs. From understanding loan options to maximizing your loan potential, we will explore the secrets to obtaining a business loan and unlocking capital for your venture's growth.

Understanding the Need for Business Loans

Access to capital is crucial for any business, be it a small startup or an established enterprise. Business loans provide the financial fuel necessary to ignite and sustain growth. Whether it's investing in new equipment, expanding your team, or launching a marketing campaign, a business loan can be a powerful tool to turn your vision into reality.

Unlocking the Secrets of Successful Borrowing

The lending landscape can be complex and intimidating, especially for first-time borrowers. However, with the right knowledge and preparation, you can navigate this landscape with confidence. Here are some secrets to improve your chances of securing a business loan:

- Know Your Options: Different types of loans cater to various business needs. Familiarize yourself with the range of options, including SBA loans (offered by the Small Business Administration), private label loans, and alternative lenders like specialized finance companies or groups of private investors. Each option has its own advantages and requirements, so understanding these nuances is essential.

- Prepare Comprehensive Documentation: Lenders will scrutinize your business and personal finances before approving a loan. Stay organized and keep detailed records, including tax returns for at least the last three years. This demonstrates transparency and helps lenders assess your creditworthiness.

- Demonstrate Strength and Consistency: Lenders want to see your strength as a borrower. Address any apparent weaknesses in your application and present a coherent story. Consistency and a well-thought-out plan will boost your chances of loan approval.

- Consider Alternative Lenders: Don't limit yourself to traditional banks. Alternative lenders, such as specialized finance companies or groups of private investors, can offer more flexible terms and a simpler application process. They are often eager for your business and may provide faster access to capital.

Maximizing Your Loan Potential

Simply obtaining a business loan is not enough. To truly benefit your business, you need to maximize the potential of the loan. Here are some strategies to achieve this:

- Use Funds Strategically: Clearly define your business goals and allocate loan funds accordingly. Whether it's investing in new technology, expanding your physical presence, or boosting your marketing efforts, ensure that every dollar borrowed contributes directly to your growth strategy.

- Repayment Planning: Develop a realistic repayment plan that considers your cash flow projections. Timely repayment not only maintains a healthy credit score but also builds a positive relationship with your lender, increasing the likelihood of future loans.

- Explore Government Programs: Depending on your industry and location, government programs can provide additional support. These programs often offer favorable terms and may be tailored to specific business needs, such as those in disadvantaged areas.

- Consider Online Lenders: For quick access to capital, online lenders can be a viable option, especially if you don't qualify for traditional loans. However, be mindful of the potential for higher interest rates and ensure you understand the repayment terms.

A Step-by-Step Guide to Securing a Business Loan

Now that we've explored the secrets and strategies, let's walk through the practical steps to obtaining a business loan:

1. Assess Your Business Needs: Clearly understand why you need the loan and how you plan to use the funds. This will help you determine the appropriate loan type and amount.

2. Prepare Your Documentation: Gather and organize all the necessary financial records, including tax returns, profit and loss statements, and business plans. Lenders may also request personal financial information, especially if your business is new or doesn't have an extensive credit history.

3. Research Lenders: Compare different lenders and loan products to find the best fit for your business. Consider factors such as interest rates, repayment terms, and the application process. Don't forget to explore alternative lenders and government programs, as mentioned earlier.

4. Complete the Application: Work closely with your chosen lender to complete the application process. Be transparent and provide all the required information. A strong application demonstrates your credibility and improves your chances of loan approval.

5. Negotiate and Finalize Terms: Once your application is approved, carefully review the loan terms and conditions. Don't be afraid to negotiate, especially if you have a strong credit history or collateral to offer. Ensure you fully understand the repayment schedule, interest rates, and any associated fees or penalties.

6. Utilize Funds and Repay as Planned: When you receive the loan, use the funds precisely as intended and outlined in your application. Stick to your repayment plan, making payments on time to maintain a positive credit history and build a solid foundation for future borrowing.

Common Pitfalls to Avoid

As you navigate the business loan process, be mindful of potential pitfalls that could hinder your success:

- Inadequate Preparation: Failing to prepare comprehensive documentation or a coherent business plan can weaken your application. Lenders may perceive this as a lack of organization or commitment, reducing your chances of loan approval.

- Overlooking Alternative Options: Some businesses may shy away from alternative lenders, assuming traditional banks are the only option. By exploring alternative lenders and government programs, you may discover more favorable terms and faster access to capital.

- Neglecting Repayment Planning: Timely repayment is critical to maintaining a healthy credit score and relationship with your lender. Neglecting to plan for repayment can lead to financial strain and damage your chances of securing future loans.

- Misusing Funds: Using loan funds for unrelated or unnecessary expenses can hinder your business's growth and damage your reputation with lenders. Always stick to your intended use of funds to demonstrate responsible borrowing.

Real-World Success Stories

Hearing the experiences of other businesses can provide valuable insights and inspiration. Here's an anecdote illustrating the successful navigation of the business loan process:

"As a small business owner, I needed funds to upgrade our e-commerce platform and enhance our online presence. With a passion for technology and a vision, I approached lenders with confidence. I had prepared comprehensive documentation and was able to secure an SBA loan. This loan transformed our online store, increasing sales by 35% in just six months. We're now planning our next expansion, and I'm grateful for the power of that loan, which helped us reach new heights." – Tech-Savvy Entrepreneur, E-commerce Industry

Final Thoughts

Obtaining a business loan is a significant step towards fueling your business's growth and achieving your entrepreneurial dreams. By understanding the lending process, preparing thoroughly, and maximizing your loan potential, you can unlock the capital necessary to thrive. Remember, knowledge is power, and with this ultimate guide, you now have the insights to navigate the world of business loans successfully.

So, take that first step, explore your options, and embark on the journey to securing the funding your business deserves. With the right approach and a well-crafted plan, you'll be well on your way to turning your vision into a thriving reality.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick