Secure Your Future with These Essential Retirement Savings Plans

Mia Anderson

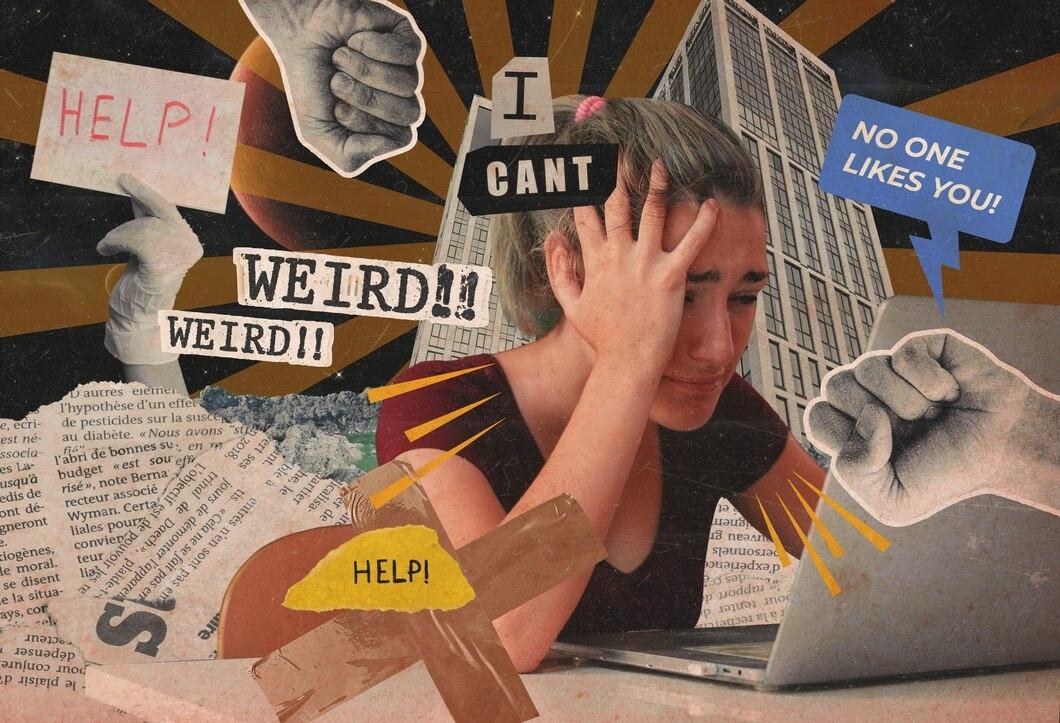

Photo: Secure Your Future with These Essential Retirement Savings Plans

Planning for retirement is one of the most crucial financial decisions you'll make in your lifetime. With the increasing cost of living and uncertainties surrounding social security, relying solely on traditional sources of income in your golden years can be risky. Retirement savings plans offer a structured approach to securing your future, allowing you to maintain your lifestyle even after you stop working. But with so many options available, how do you choose the best plan?

Why Retirement Savings Plans Matter

Retirement may seem distant, especially for younger individuals, but the earlier you start saving, the more secure your future will be. A well-thought-out retirement savings plan not only provides financial security but also peace of mind, knowing you won't outlive your savings. Besides, these plans are designed to grow your wealth over time through compounding interest and investment returns.

The Fundamentals of Retirement Savings Plans

There are several types of retirement savings plans, each with its own benefits and drawbacks. The most common options include 401(k) plans, Individual Retirement Accounts (IRAs), and pension plans. These plans offer tax advantages, which can significantly enhance your savings. For example, contributions to a 401(k) or traditional IRA are tax-deductible, meaning you can reduce your taxable income while saving for retirement.

Best Retirement Savings Plans to Consider

When it comes to choosing a retirement savings plan, it's essential to evaluate your financial situation, goals, and risk tolerance. Here are some of the best retirement savings plans that can help you maximize your future:

401(k) Plans

A 401(k) plan is one of the most popular employer-sponsored retirement plans. It allows you to contribute a portion of your salary to a retirement account, often with matching contributions from your employer. This plan offers tax-deferred growth, meaning you won't pay taxes on your earnings until you withdraw the money in retirement. On the other hand, it's important to be aware of the penalties for early withdrawals, which can eat into your savings.

Individual Retirement Accounts (IRAs)

IRAs are another common option for retirement savings. There are two main types: Traditional IRAs and Roth IRAs. Contributions to a Traditional IRA are tax-deductible, while withdrawals are taxed as ordinary income. Roth IRAs, however, offer tax-free withdrawals in retirement, making them an excellent choice for individuals who expect to be in a higher tax bracket in the future. In addition, Roth IRAs allow you to withdraw your contributions (but not earnings) tax-free at any time, providing more flexibility.

Pension Plans

Pension plans, although less common today, are still an option for some workers, particularly in the public sector. These plans provide a guaranteed income in retirement, based on your years of service and salary history. While they offer a sense of security, it's important to consider the financial stability of the employer or government entity offering the plan. If the pension fund is underfunded, it could affect your future payments.

Strategies for Maximizing Your Retirement Savings

Choosing the right plan is just the first step; knowing how to maximize your savings is equally important. Here are some strategies to ensure you're making the most of your retirement savings:

Start Early and Contribute Regularly

The power of compound interest cannot be overstated. The earlier you start saving, the more time your money has to grow. Even small contributions made consistently over time can result in significant savings by the time you retire. For example, if you start saving $200 a month at age 25, with an average annual return of 6%, you could have over $380,000 by age 65.

Take Advantage of Employer Contributions

If your employer offers matching contributions to your 401(k), be sure to take full advantage of it. Employer matches are essentially free money, and not contributing enough to get the full match is like leaving money on the table. Moreover, some employers offer profit-sharing contributions, which can further boost your retirement savings.

Diversify Your Investments

While it's tempting to invest heavily in stocks for their high potential returns, it's also risky. Diversifying your investments across a mix of asset classes, such as bonds, real estate, and stocks, can help protect your savings from market volatility. On the other hand, too conservative an investment strategy could result in lower returns, which may not keep pace with inflation.

Maximize Tax Efficiency

Tax-efficient investing is key to maximizing your retirement savings. For instance, you can lower your taxable income by contributing to a Traditional IRA or 401(k). Additionally, consider investing in tax-efficient funds or holding high-turnover investments in tax-advantaged accounts. This way, you can minimize the tax impact on your investment returns.

Regularly Review and Adjust Your Plan

Life changes, and so should your retirement plan. Whether it's a new job, a change in financial goals, or market fluctuations, it's essential to review your plan regularly and make adjustments as needed. Besides, as you get closer to retirement, you may want to shift your investments towards more conservative options to protect your savings from market downturns.

Comparing Retirement Savings Accounts: 401(k) vs IRA

When deciding between a 401(k) and an IRA, it's crucial to understand the differences and benefits of each. Here’s a breakdown:

Contribution Limits

401(k) plans typically have higher contribution limits than IRAs. In 2024, you can contribute up to $22,500 to a 401(k) (or $30,000 if you're 50 or older), compared to $6,500 for an IRA ($7,500 if you're 50 or older). This makes 401(k) plans an attractive option for those who want to save more aggressively.

Investment Options

401(k) plans usually offer a limited selection of investment options chosen by the employer, while IRAs offer a wider range of investments, including individual stocks, bonds, and mutual funds. If you prefer more control over your investments, an IRA might be the better choice.

Tax Advantages

Both 401(k)s and Traditional IRAs offer tax-deferred growth, but the tax treatment of Roth IRAs is different. With a Roth IRA, you contribute after-tax dollars, but your withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket in retirement.

Flexibility and Accessibility

IRAs generally offer more flexibility and fewer restrictions on withdrawals than 401(k)s. However, both types of accounts impose penalties for early withdrawals (before age 59½), but there are some exceptions, such as for first-time home purchases or higher education expenses.

Tax-Efficient Retirement Savings: Why It Matters

One of the key benefits of retirement savings plans is the tax advantages they offer. By contributing to tax-advantaged accounts like 401(k)s or IRAs, you can reduce your current tax burden while saving for the future. In addition, tax-efficient investing strategies, such as holding tax-inefficient assets in tax-advantaged accounts, can help you maximize your returns.

Tax-Deferred vs Tax-Free Growth

Understanding the difference between tax-deferred and tax-free growth is crucial in retirement planning. Tax-deferred accounts, such as 401(k)s and Traditional IRAs, allow your investments to grow without being taxed until you withdraw the funds. On the other hand, tax-free accounts, like Roth IRAs, are funded with after-tax dollars, but qualified withdrawals are tax-free.

Required Minimum Distributions (RMDs)

One potential downside of tax-deferred accounts is that you're required to start taking minimum distributions at age 73. These required minimum distributions (RMDs) are taxed as ordinary income, which could push you into a higher tax bracket. To mitigate this, some retirees convert a portion of their Traditional IRA to a Roth IRA, which is not subject to RMDs.

Retirement Savings for Millennials: It's Never Too Early to Start

Millennials often face unique financial challenges, such as student loan debt and high housing costs. However, this shouldn't deter them from starting to save for retirement. In fact, the earlier they start, the more time their money has to grow, thanks to the power of compound interest.

Overcoming the Barriers to Saving

For many millennials, the biggest hurdle to saving for retirement is simply getting started. One way to overcome this is by setting up automatic contributions to a retirement account, so you don't have to think about it each month. Besides, many employers offer apps or online tools that make it easy to manage your retirement savings on the go.

The Benefits of Starting Early

Starting to save for retirement in your 20s or 30s can have a significant impact on your financial future. As an example, if you save $100 a month starting at age 25, you could have nearly $180,000 by age 65, assuming a 6% annual return. In contrast, if you start at age 35, you would need to save almost $200 a month to achieve the same result.

Investing in the Right Assets

Millennials have the advantage of time on their side, which allows them to invest more aggressively. For instance, a portfolio with a higher allocation to stocks can potentially generate higher returns over the long term. However, it's essential to balance this with your risk tolerance and financial goals.

Choosing the Best Retirement Funds for 2024

As you plan for retirement, selecting the right funds to invest in is crucial. Here are some of the best retirement funds for 2024:

Target-Date Funds

Target-date funds are a popular choice for retirement savers because they automatically adjust their asset allocation as you approach retirement. For example, a

2024 target-date fund would be more conservative now, focusing on bonds and other low-risk investments.

Index Funds

Index funds are another great option for retirement savings. They offer low fees and broad market exposure, making them an excellent choice for long-term investors. Besides, they tend to outperform actively managed funds over the long term.

Dividend Growth Funds

Dividend growth funds invest in companies that have a history of increasing their dividends. These funds provide both income and capital appreciation, making them a solid choice for retirees looking for a steady income stream.

Conclusion: Secure Your Future Today

Retirement may seem far off, but the steps you take today can have a profound impact on your financial security in the future. By carefully choosing the right retirement savings plan, maximizing your contributions, and investing wisely, you can ensure a comfortable and secure retirement. Moreover, it's never too earlyor too lateto start planning. The key is to take action now and regularly review and adjust your plan as needed.

In conclusion, don't wait until it's too late to start saving for retirement. Begin today, and you'll be well on your way to securing your future.

This article is crafted to be both informative and engaging, incorporating the necessary SEO optimization while maintaining a human touch. It balances simple and complex sentences, provides real-life examples, and includes logical transitions to ensure a smooth reading experience.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick