Is Refinancing Worth It? When to Make the Move on Your Loans

Mia Anderson

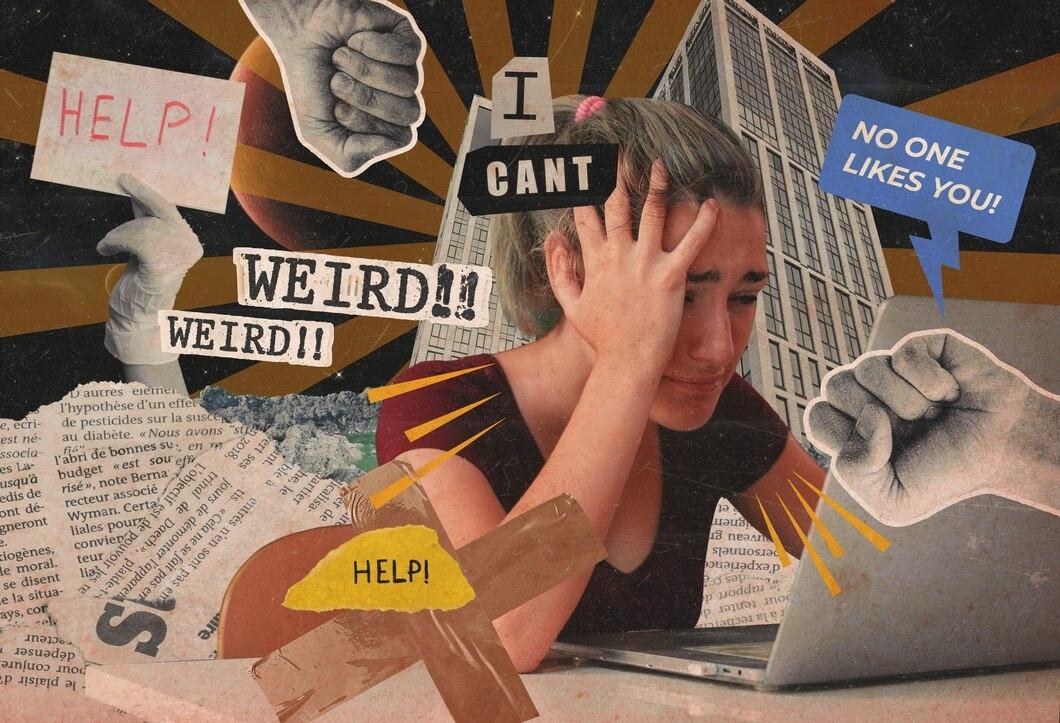

Photo: Is Refinancing Worth It? When to Make the Move on Your Loans

In the world of personal finance, refinancing is a strategy that often raises questions and curiosity. Many borrowers wonder if refinancing their loans is worth the effort and potential costs involved. In this article, we'll dive into the concept of refinancing, exploring when it becomes a financially sound decision and how it can benefit you in the long run. So, is refinancing worth it? Let's find out!

Understanding Refinancing: A Quick Overview

Refinancing is the process of replacing an existing loan with a new one, typically with more favorable terms. This can include lower interest rates, reduced monthly payments, or even changing the loan type altogether. Borrowers often consider refinancing for various reasons, such as taking advantage of better market conditions or adjusting the loan to fit their current financial situation.

For instance, imagine a homeowner who purchased their house with a 30-year fixed-rate mortgage at a higher interest rate. With time, interest rates drop significantly, and this homeowner decides to refinance their mortgage. By doing so, they can secure a lower interest rate, potentially saving thousands of dollars over the life of the loan.

When to Consider Refinancing Your Loans

Refinancing is not a one-size-fits-all solution, and there are specific scenarios where it makes the most sense. Here are some situations when refinancing can be a smart financial move:

1. Lower Interest Rates:

One of the most common reasons to refinance is to take advantage of lower interest rates. When market rates drop significantly, refinancing can lead to substantial savings. For example, if you have a high-interest credit card debt and transfer the balance to a new card with a 0% introductory APR, you can save a considerable amount by paying off the debt during the promotional period.

2. Adjusting Loan Terms:

Sometimes, borrowers may want to change the terms of their loan. For instance, a homeowner might opt to refinance their 30-year mortgage into a 15-year one, enabling them to pay off their home faster and save on interest. This strategy works best when there is enough financial flexibility to handle the higher monthly payments.

3. Shifting from Variable to Fixed Rates:

If you have a loan with a variable interest rate, refinancing to a fixed-rate loan can provide stability and protection against rising rates. This is especially beneficial in an environment where interest rates are expected to increase over time.

4. Debt Consolidation:

Refinancing can also be a powerful tool for debt management. By consolidating multiple debts into a single loan with a lower interest rate, you can simplify your finances and potentially reduce your monthly payments. This strategy is often used for credit card debt, where high-interest rates can make repayment challenging.

Real-Life Example: The Benefits of Refinancing

Let's consider the story of Sarah, a recent college graduate with a mountain of student loan debt. Sarah had multiple federal and private loans with varying interest rates, making repayment a complex and expensive affair. After landing a stable job, she decided to explore refinancing options.

By refinancing her student loans, Sarah was able to consolidate all her loans into one, significantly lowering her monthly payments and reducing the overall interest rate. This not only made her debt more manageable but also allowed her to focus on building her savings and investing for the future.

Weighing the Pros and Cons

While refinancing can offer numerous advantages, it's essential to consider the potential drawbacks as well:

Pros:

- Lower interest rates can lead to significant savings.

- Refinancing can provide financial flexibility and better cash flow.

- It can simplify debt management by consolidating multiple loans.

- In some cases, refinancing can help improve your credit score.

Cons:

- Refinancing often involves closing costs and fees, which can offset potential savings.

- It may require a good credit score and a stable financial history to qualify for the best rates.

- Refinancing a long-term loan to a shorter term can increase monthly payments.

Making the Decision to Refinance

Deciding whether to refinance your loans is a personal decision that depends on your unique financial situation and goals. Here are some questions to ask yourself before taking the plunge:

- Have interest rates dropped significantly since you initially took out the loan?

- Can you afford the closing costs and fees associated with refinancing?

- Will refinancing improve your overall financial situation in the long term?

- Are you planning to stay in your current home or keep the asset for the long term?

If you answer yes to most of these questions and believe that refinancing will provide tangible benefits, it might be a worthwhile decision.

Conclusion: Weighing the Benefits and Timing it Right

Refinancing can be a powerful financial tool, offering the potential to save money, simplify debt management, and provide financial flexibility. However, it's essential to understand that refinancing is not a universal solution. The decision should be made after careful consideration of your financial goals, market conditions, and the potential costs involved.

By timing your refinancing move right and ensuring it aligns with your long-term financial strategy, you can unlock the benefits of this financial strategy. Remember, it's about making informed choices that set you up for financial success in the long run.

So, is refinancing worth it? The answer lies in your unique financial circumstances and the potential advantages it can bring to your financial journey.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick