6 Must-Know Strategies for Freelancers to Manage Finances Efficiently

Mia Anderson

Photo: 6 Must-Know Strategies for Freelancers to Manage Finances Efficiently

Freelancing offers unparalleled freedom and flexibility in your career, but it also comes with unique challenges, especially when it comes to managing finances. As your own boss, you're responsible for keeping your financial house in order, ensuring a steady income, and planning for the future. In this article, we'll explore six indispensable strategies to help freelancers navigate the financial landscape effectively and set themselves up for long-term success.

1. Separate Business and Personal Finances

One of the most crucial steps for freelancers is to establish a clear separation between business and personal finances. This might seem like a simple concept, but it's often overlooked, leading to financial chaos.

Creating dedicated business bank accounts and credit cards is the foundation of this strategy. By doing so, you can easily track your business income, expenses, and overall financial performance. This separation simplifies tax preparation, as you won't need to sift through personal transactions to identify business-related ones.

For instance, imagine a freelance graphic designer who initially used their personal credit card for all expenses. As their business grew, they found it increasingly challenging to differentiate between personal purchases and those related to client projects. By opening a business credit card, they could effortlessly track project-related expenses, making tax season less stressful and more accurate.

2. Create a Realistic Budget

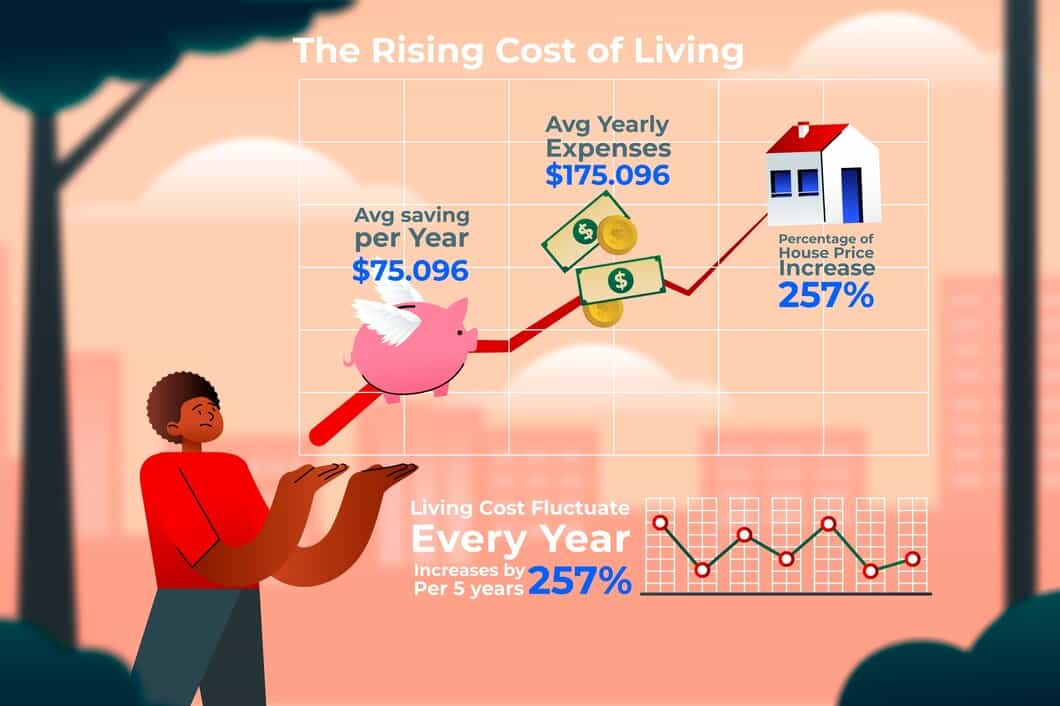

Budgeting is a cornerstone of financial management, and freelancers should embrace it wholeheartedly. Start by calculating your monthly income, considering the variability of freelance earnings. Next, list all your expenses, categorizing them into essential (e.g., rent, utilities) and discretionary (e.g., entertainment, travel) spending.

A well-structured budget provides a clear picture of your financial health and helps you make informed decisions. It allows you to allocate funds for savings, investments, and emergency funds while ensuring that your expenses align with your income.

Let's consider a freelance writer who creates a budget and discovers that their monthly income varies significantly. By setting aside a fixed amount for savings and creating a buffer for slower months, they can navigate the ups and downs of freelancing with greater financial stability.

3. Invoice Promptly and Efficiently

Timely invoicing is vital for maintaining a healthy cash flow. As a freelancer, you should establish a consistent invoicing process and adhere to it rigorously. Create professional invoices that include all necessary details, such as project scope, hourly rates, and payment terms.

Consider using invoicing software or templates to streamline the process and ensure accuracy. Prompt invoicing not only helps you get paid faster but also demonstrates your professionalism to clients.

A freelance web developer, for instance, might utilize invoicing software that sends automatic payment reminders to clients, reducing the time spent on follow-ups and expediting the payment process.

4. Save for Taxes and Emergencies

Freelancers are responsible for their tax obligations, which can be a significant financial burden if not managed properly. It's essential to set aside a portion of your income for taxes regularly. Calculate your estimated quarterly tax payments and ensure you have the funds to cover them.

Additionally, building an emergency fund is crucial for financial resilience. Life's uncertainties can impact your work, and having a financial cushion can provide peace of mind. Aim to save enough to cover at least three to six months' worth of living expenses.

A freelance photographer, for example, could allocate a percentage of each payment received into a dedicated tax savings account. This proactive approach ensures they have the funds to meet tax obligations and avoids the stress of scrambling for money when tax season arrives.

5. Invest in Your Financial Education

The world of finance can be complex, and staying informed is essential for making sound financial decisions. Invest time in learning about personal finance, taxation for freelancers, and investment strategies.

Explore online resources, attend webinars, or consider consulting a financial advisor who specializes in self-employment. Understanding financial concepts will empower you to make informed choices about savings, investments, and retirement planning.

For instance, a freelance marketer might educate themselves on the benefits of a solo 401(k) retirement plan, allowing them to maximize tax-advantaged savings and plan for their financial future effectively.

6. Stay Organized and Track Expenses

Maintaining meticulous records is essential for freelancers. Keep track of all income and expenses, including receipts and invoices. This practice not only simplifies tax preparation but also provides valuable insights into your financial trends.

Utilize accounting software or spreadsheet tools to categorize and analyze your financial data. Regularly review your financial statements to identify areas where you can cut costs or negotiate better deals with vendors.

A freelance consultant, for instance, could use a simple spreadsheet to record expenses, making it easier to identify recurring costs that could be reduced or eliminated, ultimately improving their bottom line.

Conclusion

Managing finances as a freelancer requires discipline, organization, and a proactive mindset. By implementing these six strategies, you can take control of your financial journey. From separating business and personal finances to staying financially educated, these steps will help you build a solid financial foundation and ensure long-term success in your freelance career.

Remember, financial management is an ongoing process, and adapting these strategies to your unique circumstances will contribute to a more secure and prosperous future. Embrace the challenge, and you'll reap the rewards of financial freedom as a freelancer.

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllDiscover the hottest entertainment news and updates! Stay ahead with the latest trends and exclusive stories. Click now for breaking news.

Mia Anderson

Discover the latest exclusive movie releases that everyone’s talking about. Don’t miss out click to stay ahead of the curve!

Mia Anderson

Discover the latest tips for creating a top fan website in 2024. Learn key strategies and boost your site’s success click to read the complete guide now!

Mia Anderson

Discover the latest tips for creating a top-notch home theater in 2024. Learn expert advice on setup, gear, and design. Start your home theater journey today!

Mia Anderson

Automotive

View AllForecast the EV market of 2030. Learn about expected growth rates, market penetration, and the rise of EV ownership globally.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreLearn the key factors influencing EV adoption, from cost and range to charging infrastructure and environmental concerns.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 28, 2024

Harnessing Machine Learning Algorithms to Transform Your Insights

Discover the top machine learning algorithms driving innovation today. Learn how they can enhance your data analysis. Click to explore and revolutionize your insights!

August 29, 2024

Discover How Digital Transformation Services Can Revolutionize Your Business

Discover how digital transformation services can revolutionize your business. Explore top solutions to drive growth and efficiency. Read more now!

December 20, 2024

Don’t Buy That Smartphone Until You Read This 2024 Comparison

Make an informed smartphone purchase! Our 2024 comparison guide helps you find the perfect match. Click to learn more.

Tips & Trick