5 Financial Tools Every Startup Founder Needs to Know About

Mia Anderson

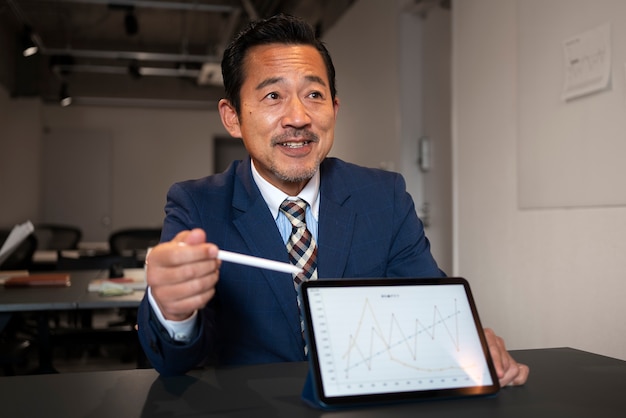

Photo: 5 Financial Tools Every Startup Founder Needs to Know About

Startup founders often find themselves wearing multiple hats, from being the visionary leader to handling day-to-day operations. But one aspect that demands particular attention is financial management, which can make or break a young business. In the vast landscape of financial tools and software, it can be overwhelming for founders to choose the right ones. This article aims to simplify the process by highlighting five crucial financial tools that every startup founder should have in their toolkit, ensuring efficient financial management and contributing to the overall success of their venture.

Unlocking Financial Management: The Must-Have Tools for Startup Founders

Starting a business is an exhilarating journey, but it's crucial to have the right financial resources to navigate the challenges ahead. Here are five financial tools that will become your trusted allies in the startup world:

1. Accounting Software: The Foundation of Financial Management

Every startup needs a robust accounting system to track income, expenses, and overall financial health. Modern accounting software has revolutionized the way businesses manage their finances. Quickbooks, Xero, and FreshBooks are popular choices among startups due to their user-friendly interfaces and comprehensive features. These tools simplify complex accounting tasks, making it easier for founders to manage invoices, expenses, and financial reports without an extensive accounting background.

For instance, let's consider Sarah, a startup founder who was initially overwhelmed by the financial side of her business. With Quickbooks, she was able to quickly generate profit and loss statements, helping her make informed decisions about cost-cutting measures during a challenging economic period. The software's automation features also saved her valuable time, allowing her to focus more on strategic planning.

2. Expense Management Platforms: Streamlining Business Spending

Keeping track of expenses is vital for maintaining financial discipline. Expense management platforms like Expensify and Receipt Bank offer efficient ways to monitor and manage business spending. These tools allow founders and their teams to capture and organize receipts, creating a seamless expense reporting process. By integrating these platforms with accounting software, startups can ensure that every dollar spent is accounted for, reducing the risk of errors and fraud.

Imagine a startup team returning from a business trip with a stack of receipts. With Expensify, they can quickly snap photos of the receipts, automatically extract the data, and categorize expenses, making the reimbursement process effortless and transparent.

3. Financial Planning and Analysis (FP&A) Software: Strategizing for the Future

Financial planning is a critical aspect of ensuring the long-term success of a startup. FP&A software enables founders to create financial models, forecasts, and scenarios to make informed decisions. Tools like Adaptive Insights and Anaplan provide powerful capabilities for budgeting, forecasting, and scenario planning. With these tools, founders can assess the financial impact of strategic decisions and adapt to changing market conditions.

For example, a startup planning to launch a new product line can use FP&A software to model various scenarios, such as different pricing strategies or sales projections, helping them determine the most viable path forward. This level of financial insight is invaluable for making strategic choices that drive growth.

4. Invoicing and Payment Solutions: Ensuring Timely Cash Flow

Cash flow management is crucial for startups, and efficient invoicing plays a significant role. Invoicing and payment solutions like Stripe, PayPal, and Square offer seamless ways to send invoices and receive payments. These platforms provide customizable templates, automated payment reminders, and secure payment processing, ensuring that startups get paid promptly and maintain a healthy cash flow.

Consider a freelance graphic designer who uses Square to invoice clients. The platform's ease of use and quick payment processing have significantly improved the designer's cash flow, allowing them to reinvest in their business and expand their services.

5. Business Intelligence (BI) Tools: Unlocking Data-Driven Decisions

Data is a powerful asset for startups, and business intelligence tools help founders make sense of it all. BI tools like Tableau, Power BI, and Google Data Studio enable founders to visualize and analyze financial data, providing valuable insights for decision-making. These tools can connect to various data sources, including accounting software and spreadsheets, to create interactive dashboards and reports.

By using BI tools, founders can identify trends, track key performance indicators (KPIs), and make data-driven decisions. For instance, a startup might use Tableau to analyze customer behavior, identifying the most profitable customer segments and tailoring marketing strategies accordingly.

The Power of Financial Tools in Startup Success

In the world of startups, financial management is a critical skill for founders to master. These five financial tools offer a comprehensive suite of capabilities, from accounting and expense management to financial planning and data analysis. By leveraging these tools, startup founders can:

- Streamline financial processes, saving time and reducing errors.

- Make informed decisions based on accurate and up-to-date financial data.

- Improve cash flow management, ensuring the business has the necessary resources to grow.

- Identify trends and opportunities through data analysis, gaining a competitive edge.

- Maintain transparency and accountability in financial operations.

For instance, a tech startup using these tools might quickly identify a surge in customer acquisition costs and adjust their marketing strategy accordingly, optimizing their budget allocation and driving more efficient growth.

Conclusion: Empowering Founders with Financial Confidence

Financial management is a critical skill for startup founders, and the right tools can make all the difference. By embracing these five financial tools, founders can navigate the complexities of finance with confidence. From efficient accounting to data-driven decision-making, these tools provide the foundation for a financially healthy and successful startup.

Remember, each tool serves a unique purpose, and combining them creates a powerful financial management ecosystem. As a founder, staying on top of your finances is essential for steering your startup towards success. Embrace these tools, adapt them to your business needs, and watch your financial management skills flourish.

The journey of a startup is filled with challenges and opportunities, and with the right financial tools, you'll be well-equipped to make informed decisions and build a thriving business.

Marketing

View All

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover proven strategies for monetizing your blog in 2024. Learn how to boost revenue effectively. Read now for actionable insights and start earning today!

Mia Anderson

Discover top tips on streaming your favorite films legally & safely with our guide - click now, don't miss out!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Automotive

View AllExplore cutting-edge innovations shaping EV charging infrastructure and making electric vehicles more accessible globally.

Read MoreExplore resale value trends for electric vehicles and what buyers can expect when selling their EV in the future.

Read MoreLearn how electric vehicles (EVs) help reduce greenhouse gas emissions and combat climate change. Discover the environmental benefits!

Read MorePolular🔥

View All

1

2

3

4

5

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

December 7, 2024

Top 10 Smartphones with the Best Battery Life in 2024

Say goodbye to battery anxiety! Discover the top 10 smartphones with exceptional battery life. Click to explore and stay charged all day.

December 12, 2024

The Ultimate Tech Deals You Need to Grab Before They Disappear in 2024

Don't miss out on the hottest tech deals of 2024! Click to discover limited-time offers and save big on gadgets.

December 16, 2024

How to Upgrade Your PC for Under $500 – Best Components for 2024

Upgrade your PC on a budget! Discover the best components for 2024 to enhance performance. Click to learn more and build your dream PC.

Tips & Trick