5 Common Financial Myths You Need to Stop Believing

Mia Anderson

Photo: 5 Common Financial Myths You Need to Stop Believing

Personal finance is a complex and ever-evolving journey, filled with decisions that can shape your financial future. As you strive to make informed choices, it's crucial to separate fact from fiction. In the vast landscape of financial advice, myths and misconceptions can easily cloud your judgment, leading you astray from the path to financial freedom. This article aims to shed light on five common financial myths that you should stop believing, empowering you to make more informed and confident decisions about your money.

Myth 1: Retirement Planning is Only for the Old

Reality Check: Retirement planning is not exclusive to the elderly. It's a lifelong journey that should begin as early as possible.

One of the most pervasive financial myths is the notion that retirement planning is solely for those approaching their golden years. This misconception often leads younger individuals to postpone their financial planning, believing they have ample time to spare. However, the reality is that starting early is one of the most powerful tools in your financial arsenal.

Consider this scenario: Sarah, a 25-year-old recent graduate, decides to start saving for retirement. She contributes a modest amount each month to her retirement account. Fast forward 40 years, and Sarah's consistent contributions, coupled with the power of compound interest, have grown into a substantial nest egg. This early start has allowed her to retire comfortably, enjoying the fruits of her financial foresight.

Starting early provides a longer time horizon for your investments to grow, allowing you to benefit from the magic of compounding. It also offers a safety net against unforeseen financial setbacks and provides the flexibility to adjust your savings strategy as your life circumstances change.

Myth 2: Debt is Always Bad

Busting the Myth: Not all debt is created equal, and some forms can be a strategic tool for building wealth.

Debt often carries a negative connotation, and it's easy to fall into the trap of believing that all debt is detrimental. However, this financial myth overlooks the strategic use of debt as a tool for wealth creation.

Imagine a young entrepreneur, John, who takes out a business loan to launch his startup. This debt allows him to invest in equipment, hire talent, and establish a solid foundation for his company. As the business grows, John's debt becomes a stepping stone to success, enabling him to expand and generate substantial profits.

Not all debt is bad debt. Strategic borrowing, such as taking out a mortgage to buy a home or a student loan to invest in education, can be a wise financial move. The key is to understand the difference between good debt and bad debt. Good debt is an investment that has the potential to increase your net worth over time, while bad debt is typically used to finance depreciating assets or short-term consumption.

Myth 3: You Need a High Income to Invest

Debunking the Misconception: Investing is accessible to individuals from all income brackets.

Many people believe that investing is only for the wealthy, but this is far from the truth. The idea that you need a high income to invest is a financial myth that can deter individuals with modest earnings from exploring the world of investing.

Let's take the example of Emily, a teacher with a modest salary. She decides to start investing in the stock market by allocating a small portion of her monthly income. Over time, her investments grow, and she learns to diversify her portfolio, gradually building her wealth.

The beauty of investing is that it's a scalable activity. You can start small and gradually increase your contributions as your financial situation allows. Many investment platforms and apps cater to beginner investors, offering low-cost options and educational resources. By starting early and adopting a long-term perspective, individuals with varying income levels can participate in the market and work towards their financial goals.

Myth 4: Financial Planning is Too Complex for the Average Person

Reality: Financial planning is a learnable skill, and you don't need to be an expert to take control of your finances.

Financial planning can seem daunting, with its jargon and complex strategies. This complexity often leads people to believe that it's beyond their capabilities, creating a barrier to financial literacy. However, this financial myth can be dispelled with the right mindset and resources.

Take the story of Michael, a self-proclaimed "finance novice." He decided to take charge of his finances and began by educating himself through online courses and financial blogs. He started with the basics, learning about budgeting, saving, and investing. Gradually, he gained confidence and began implementing simple financial strategies in his daily life.

Financial planning is a skill that can be acquired through education and practice. Numerous resources, including books, online courses, and financial advisors, are available to guide you on your journey. By taking small steps and seeking reliable information, anyone can become more financially literate and make informed decisions.

Myth 5: The Stock Market is a Gamble

Setting the Record Straight: While the stock market carries risks, it is not a game of chance.

The stock market is often associated with risk and uncertainty, leading some to view it as a gamble. This financial myth can deter risk-averse individuals from exploring the potential benefits of investing in stocks.

Imagine a conservative investor, Lisa, who is hesitant to invest in the stock market due to its perceived volatility. However, after thorough research and consultation with a financial advisor, she discovers that a well-diversified portfolio can mitigate risks and provide long-term growth.

Investing in the stock market is not akin to gambling. It is an investment strategy that, when approached with research and a long-term perspective, can offer substantial returns. Diversification, a fundamental principle of investing, involves spreading your investments across various assets to minimize risk. By understanding market trends, conducting thorough research, and seeking professional advice, individuals can make informed investment decisions and manage their risk exposure.

Conclusion: Empowering Your Financial Journey

In the realm of personal finance, myths and misconceptions can be stumbling blocks on the path to financial success. By debunking these five common financial myths, we've uncovered valuable insights that can empower you to make more informed decisions.

Retirement planning is a lifelong endeavor, and starting early is a strategic advantage. Debt can be a strategic tool when used wisely. Investing is accessible to all income levels, and financial planning is a learnable skill. Lastly, the stock market, while risky, is not a gamble when approached with knowledge and a long-term vision.

As you navigate your financial journey, remember that financial literacy is a powerful tool. By questioning common beliefs and seeking reliable information, you can make choices that align with your goals and circumstances. Stay informed, stay curious, and take control of your financial future.

Marketing

View All

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

Explore the latest trends in fan fiction for 2024. Learn what fan fiction is, its impact on media, and why it’s a thriving creative outlet. Read now!

Mia Anderson

Discover the latest tips for creating a top-notch home theater in 2024. Learn expert advice on setup, gear, and design. Start your home theater journey today!

Mia Anderson

Automotive

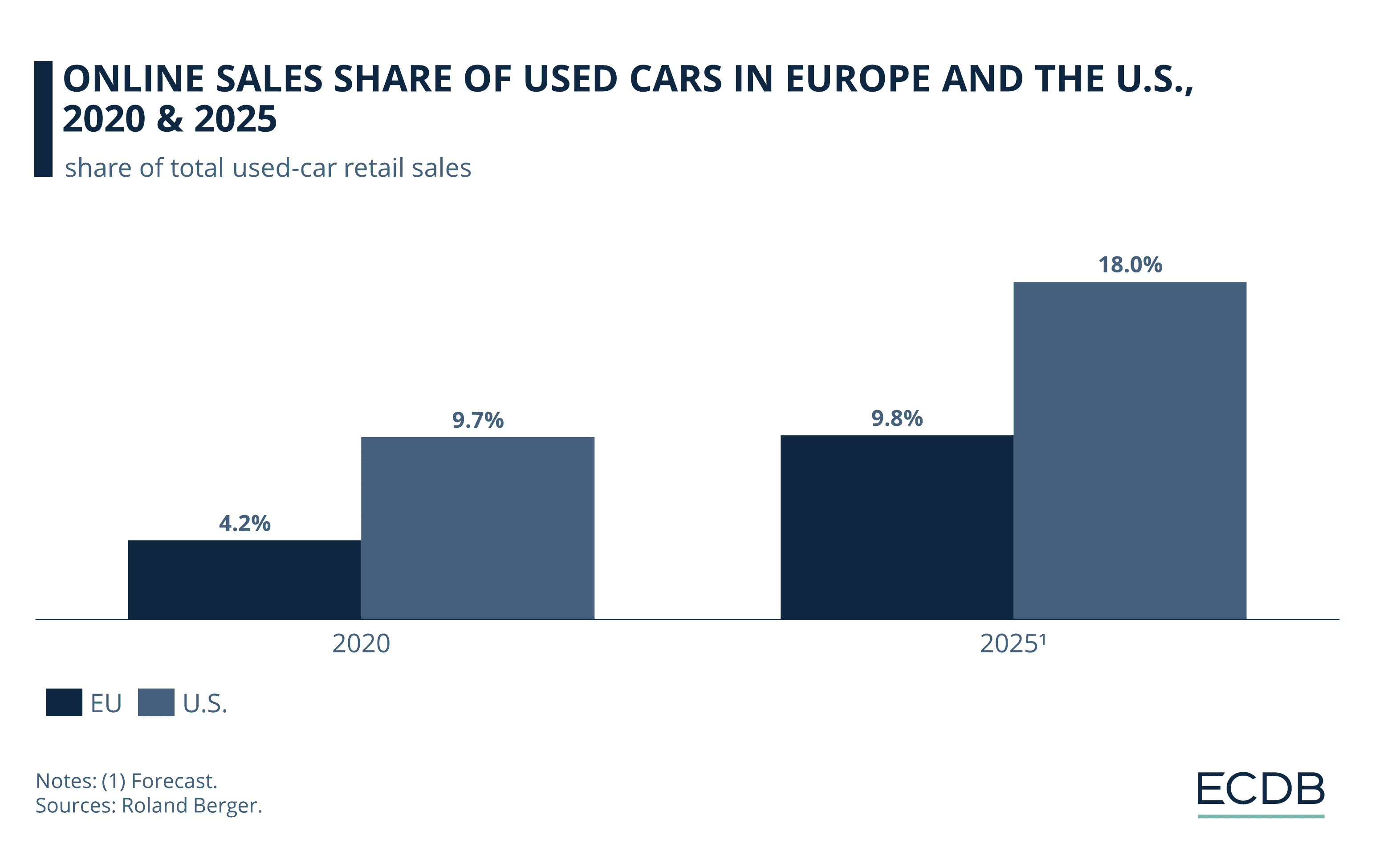

View AllExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreUncover how vehicle-to-grid (V2G) technology is reshaping the energy ecosystem by integrating EVs into power grids.

Read MoreDiscover how government policies are accelerating EV adoption. Explore tax incentives, regulations, and global policy success stories.

Read MorePolular🔥

View All

1

2

3

4

6

7

8

9

10

Technology

View All

August 10, 2024

The Top Productivity Apps to Boost Your Efficiency in 2024

Boost your productivity to the most with the top 2024 applications! Learn how to better focus, manage projects, and arrange chores using these tools. Increase your productivity with these best practices.

December 18, 2024

Upgrade Your Streaming Experience: The Best 4K TVs to Buy in 2024

Elevate your streaming with the top 4K TVs of 2024! Click to discover the ultimate viewing experience and choose the right one.

January 21, 2025

Future Trends in Data Science: What’s Next?

Explore future trends in data science, from quantum computing to neuromorphic AI. Stay ahead of the curve with emerging technologies!

Tips & Trick