Why You’re Losing Money: Top 7 Financial Mistakes to Avoid

Mia Anderson

Photo: Why You’re Losing Money: Top 7 Financial Mistakes to Avoid

Are you ready to take control of your financial destiny and avoid the traps that lead to money woes? In this article, we'll explore the top financial mistakes that might be holding you back from achieving your monetary goals. By understanding and steering clear of these common pitfalls, you can pave the way for a more secure and prosperous financial future. Let's dive in!

Common Financial Mistakes to Avoid

1. The New Year, New Spending Trap

The excitement of a new year often brings a wave of enthusiasm for fresh starts and new beginnings. However, this mindset can lead to a common financial pitfall: the "New Year, New Spending" trap. Many people fall into the temptation of justifying unnecessary purchases or overspending at the start of the year, believing it's a chance to reinvent themselves or their lives.

For instance, you might feel compelled to buy the latest tech gadget or embark on an expensive vacation, thinking it's a way to celebrate the new year. But this impulsive spending can quickly derail your financial plans. The key to avoiding this mistake is to maintain a disciplined approach to your finances throughout the year. Remember, financial responsibility is a year-round commitment, not just a resolution for January 1st.

2. Waiting to Save

One of the most common financial errors people make is delaying their savings efforts until the end of the month. This habit can be detrimental to your financial health. Imagine you've spent the entire month paying bills, covering expenses, and indulging in a few treats, only to realize there's little left to save.

A smarter strategy, as suggested by financial experts, is to set up automatic transfers to your savings account right after you receive your paycheck. This way, you prioritize saving before other expenses eat into your income. By paying yourself first, you ensure that your savings grow consistently, providing a solid foundation for your financial goals.

3. Chasing Headlines, Ignoring Your Plan

In the fast-paced world of finance, it's easy to get caught up in the hype or hysteria surrounding certain investments or market trends. Financial educator Yanely Espinal highlights the tendency to chase headlines as a significant financial mistake. When we fixate on short-term fluctuations or sensational news, we risk making emotional decisions that can veer us off course from our long-term financial objectives.

For example, imagine reading a headline about a tech startup's skyrocketing stock price. It's tempting to jump on the bandwagon and invest impulsively, but this could lead to poor investment choices. Instead, stick to your well-thought-out financial plan, regularly review it, and make adjustments as needed. This disciplined approach will help you navigate market noise and make informed decisions.

4. Lack of Diversification

Diversification is a cornerstone of wise investing, yet many individuals make the financial error of putting all their eggs in one basket. Relying solely on a single investment or asset class can expose you to significant risk. If that one investment performs poorly, your entire financial portfolio could take a hit.

A well-diversified portfolio typically includes a mix of stocks, bonds, and other assets, spreading the risk across different sectors and industries. This way, if one area experiences a downturn, your overall portfolio is less likely to suffer drastically. Diversification is a powerful tool to protect your wealth and ensure your financial security.

5. Ignoring Tax Planning

Taxes are an inevitable part of life, and failing to plan for them can result in unnecessary financial strain. Efficient tax planning is a crucial aspect of smart money management, yet it's often overlooked. By seeking professional advice, you can optimize your tax liabilities and potentially save a substantial amount of money.

For instance, understanding tax-efficient investment strategies or taking advantage of tax deductions can significantly reduce your tax burden. Don't let tax season catch you off guard; be proactive in seeking guidance to make the most of your hard-earned money.

6. Neglecting Regular Financial Reviews

Life is full of changes, and your financial plan should evolve with it. One of the financial mistakes people often make is neglecting to review and adjust their financial strategies regularly. As your circumstances, goals, or market conditions change, your financial plan should adapt accordingly.

Regularly scheduled financial check-ins allow you to assess your progress, reevaluate your risk tolerance, and make necessary adjustments. Whether it's an annual review or more frequent assessments, staying on top of your finances ensures that your money is working hard for you, no matter what life throws your way.

7. Cosigning Loans

Cosigning a loan for a friend or family member might seem like a kind gesture, but it can turn into a financial nightmare. Financial educator Yanely Espinal warns against this common pitfall. When you cosign a loan, you become equally responsible for the debt. If the primary borrower fails to make payments, your credit score and financial stability could be at risk.

It's essential to understand the potential consequences before cosigning. Consider the reliability of the borrower and the impact on your own financial health. While it may be a difficult conversation, discussing alternatives or offering financial education could be a more sustainable way to help your loved ones.

Conclusion

Navigating the world of personal finance is a journey filled with opportunities and potential pitfalls. By recognizing and avoiding these common financial mistakes, you empower yourself to make informed decisions and build a solid financial foundation. Remember, financial success is not just about making money but also about managing it wisely.

Stay tuned for more insightful articles on personal finance, where we'll delve into practical strategies to grow your wealth, manage debt, and achieve your financial aspirations. Your financial journey is unique, and with the right knowledge and mindset, you can unlock a prosperous future.

Marketing

View All

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the best online gaming platforms that offer unparalleled gameplay. Click now to find your perfect match and elevate your gaming experience.

Mia Anderson

Discover the latest online movie distribution trends driving success in 2024. Stay ahead with expert insights click now to revolutionize your strategy!

Mia Anderson

Unlock the secrets of modern screenwriting with our expert tips and techniques. Start crafting compelling scripts today click to learn how!

Mia Anderson

Discover how digital distribution is transforming film marketing and reach. Learn the key strategies for leveraging this trend to maximize your film's success!

Mia Anderson

Automotive

View AllNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

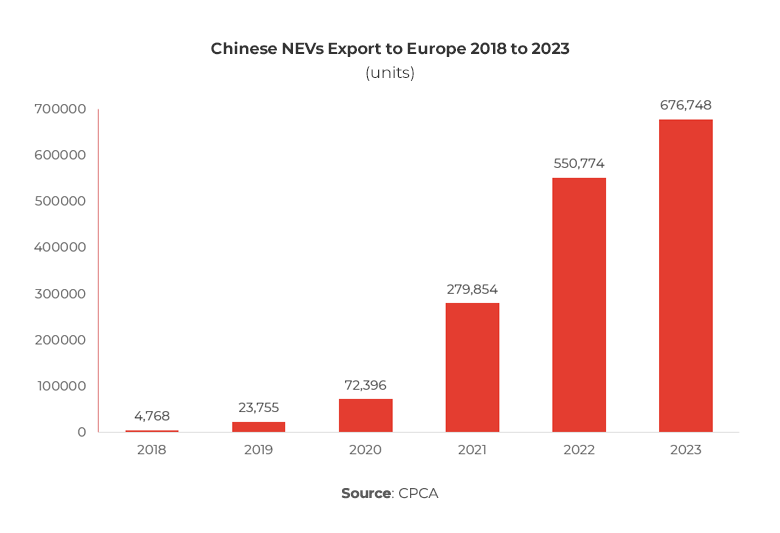

Read MoreLearn how import and export tariffs affect EV prices globally and what that means for buyers and manufacturers.

Read MoreDiscover the rapid growth of EV adoption worldwide. Learn key stats, trends, and how it’s shaping the future of mobility.

Read MorePolular🔥

View All

2

3

4

5

6

7

8

9

10

Technology

View All

January 21, 2025

CI/CD for Machine Learning: A Complete Guide

Master continuous integration and deployment (CI/CD) for machine learning models. Learn how to streamline your MLOps pipeline!

December 6, 2024

How to Choose the Right Smartwatch for Your Fitness Goals in 2024

Find the perfect smartwatch to track your fitness journey! Our guide helps you select the ideal companion. Click to learn more and get motivated.

December 21, 2024

The Best Budget Tech for 2024 – How to Get Quality Without Breaking the Bank

Discover high-quality tech without the high price tag! Click to explore the best budget gadgets and save big in 2024.

Tips & Trick