Is Refinancing Worth It? When to Make the Move on Your Loans

Mia Anderson

Photo: Is Refinancing Worth It? When to Make the Move on Your Loans

In the world of personal finance, refinancing is a strategy that often raises questions and curiosity. Many borrowers wonder if refinancing their loans is worth the effort and potential costs involved. In this article, we'll dive into the concept of refinancing, exploring when it becomes a financially sound decision and how it can benefit you in the long run. So, is refinancing worth it? Let's find out!

Understanding Refinancing: A Quick Overview

Refinancing is the process of replacing an existing loan with a new one, typically with more favorable terms. This can include lower interest rates, reduced monthly payments, or even changing the loan type altogether. Borrowers often consider refinancing for various reasons, such as taking advantage of better market conditions or adjusting the loan to fit their current financial situation.

For instance, imagine a homeowner who purchased their house with a 30-year fixed-rate mortgage at a higher interest rate. With time, interest rates drop significantly, and this homeowner decides to refinance their mortgage. By doing so, they can secure a lower interest rate, potentially saving thousands of dollars over the life of the loan.

When to Consider Refinancing Your Loans

Refinancing is not a one-size-fits-all solution, and there are specific scenarios where it makes the most sense. Here are some situations when refinancing can be a smart financial move:

1. Lower Interest Rates:

One of the most common reasons to refinance is to take advantage of lower interest rates. When market rates drop significantly, refinancing can lead to substantial savings. For example, if you have a high-interest credit card debt and transfer the balance to a new card with a 0% introductory APR, you can save a considerable amount by paying off the debt during the promotional period.

2. Adjusting Loan Terms:

Sometimes, borrowers may want to change the terms of their loan. For instance, a homeowner might opt to refinance their 30-year mortgage into a 15-year one, enabling them to pay off their home faster and save on interest. This strategy works best when there is enough financial flexibility to handle the higher monthly payments.

3. Shifting from Variable to Fixed Rates:

If you have a loan with a variable interest rate, refinancing to a fixed-rate loan can provide stability and protection against rising rates. This is especially beneficial in an environment where interest rates are expected to increase over time.

4. Debt Consolidation:

Refinancing can also be a powerful tool for debt management. By consolidating multiple debts into a single loan with a lower interest rate, you can simplify your finances and potentially reduce your monthly payments. This strategy is often used for credit card debt, where high-interest rates can make repayment challenging.

Real-Life Example: The Benefits of Refinancing

Let's consider the story of Sarah, a recent college graduate with a mountain of student loan debt. Sarah had multiple federal and private loans with varying interest rates, making repayment a complex and expensive affair. After landing a stable job, she decided to explore refinancing options.

By refinancing her student loans, Sarah was able to consolidate all her loans into one, significantly lowering her monthly payments and reducing the overall interest rate. This not only made her debt more manageable but also allowed her to focus on building her savings and investing for the future.

Weighing the Pros and Cons

While refinancing can offer numerous advantages, it's essential to consider the potential drawbacks as well:

Pros:

- Lower interest rates can lead to significant savings.

- Refinancing can provide financial flexibility and better cash flow.

- It can simplify debt management by consolidating multiple loans.

- In some cases, refinancing can help improve your credit score.

Cons:

- Refinancing often involves closing costs and fees, which can offset potential savings.

- It may require a good credit score and a stable financial history to qualify for the best rates.

- Refinancing a long-term loan to a shorter term can increase monthly payments.

Making the Decision to Refinance

Deciding whether to refinance your loans is a personal decision that depends on your unique financial situation and goals. Here are some questions to ask yourself before taking the plunge:

- Have interest rates dropped significantly since you initially took out the loan?

- Can you afford the closing costs and fees associated with refinancing?

- Will refinancing improve your overall financial situation in the long term?

- Are you planning to stay in your current home or keep the asset for the long term?

If you answer yes to most of these questions and believe that refinancing will provide tangible benefits, it might be a worthwhile decision.

Conclusion: Weighing the Benefits and Timing it Right

Refinancing can be a powerful financial tool, offering the potential to save money, simplify debt management, and provide financial flexibility. However, it's essential to understand that refinancing is not a universal solution. The decision should be made after careful consideration of your financial goals, market conditions, and the potential costs involved.

By timing your refinancing move right and ensuring it aligns with your long-term financial strategy, you can unlock the benefits of this financial strategy. Remember, it's about making informed choices that set you up for financial success in the long run.

So, is refinancing worth it? The answer lies in your unique financial circumstances and the potential advantages it can bring to your financial journey.

Marketing

View All

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

Entertainment

View AllExplore the essence of indie films in 2024. Learn how they stand out from mainstream cinema. Read now to dive into the world of indie filmmaking!

Mia Anderson

Discover the essential steps to becoming a video game tester in 2024. Learn the skills, qualifications, and tips needed to start your gaming career today.

Mia Anderson

Discover how digital distribution is transforming film marketing and reach. Learn the key strategies for leveraging this trend to maximize your film's success!

Mia Anderson

Discover how narrative design transforms video games into immersive experiences. Learn industry secrets and start creating unforgettable stories today!

Mia Anderson

Automotive

View AllDiscover the best tips to sell your car fast and hassle-free. Maximize your car's value today!

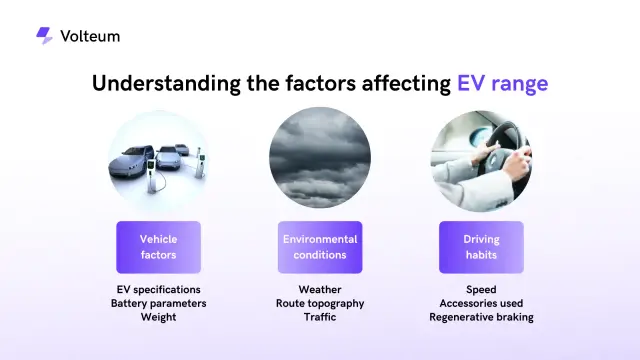

Read MoreLearn how the evolution of EV charging networks will ensure they meet the growing demand. Are we ready for 2030 and beyond?

Read MoreLearn how owning an EV is reshaping daily life, from commuting habits to charging practices. Discover the lifestyle shift.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

December 11, 2024

Top 5 AI-Powered Tech Gadgets You Should Buy This Year

Embrace the power of AI! Discover 5 must-have gadgets that will simplify your life. Click to learn more and shop the future of tech.

December 10, 2024

How to Buy the Right Laptop for College – A Complete Buyer’s Guide

Find the perfect laptop for college with our comprehensive guide! Click to learn about key features and make an informed purchase.

August 12, 2024

The Ultimate Guide to Enterprise Resource Planning Solutions: Supercharge Your Business!

Unleash your business's full potential with Enterprise Resource Planning (ERP) solutions. Learn how ERP can revolutionize your operations with improved inventory management, data-driven insights, and more! Click to discover the 8 best ERP software to transform your business.

Tips & Trick