Top Tax Planning Strategies to Save Big in 2024

Mia Anderson

Photo: Top Tax Planning Strategies to Save Big in 2024

As we approach 2024, effective tax planning becomes crucial for individuals and businesses alike. With the evolving tax laws and economic conditions, understanding and applying smart tax strategies can lead to significant savings. In this article, we will explore the top tax planning strategies to help you maximize your deductions and reduce your tax liability effectively.

The Importance of Tax Planning

Tax planning is not just about filling out forms or meeting deadlines. It's a strategic approach to managing your finances with the goal of minimizing your tax burden. Effective tax planning can lead to substantial savings and prevent unexpected tax bills. Moreover, by planning ahead, you can take advantage of tax-saving opportunities that might otherwise be missed.

Effective Tax Planning

Effective tax planning involves a thorough understanding of your financial situation and the tax implications of various actions. For instance, planning your investments wisely and timing them correctly can help in optimizing your tax outcomes. It's about making informed decisions that align with your financial goals and tax-saving opportunities.

Example: Retirement Contributions

One practical example of effective tax planning is contributing to retirement accounts such as IRAs or 401(k)s. Contributions to these accounts are often tax-deductible, which can reduce your taxable income for the year. By maximizing your contributions, you not only save for your future but also enjoy immediate tax benefits.

Tax Savings Strategies for 2024

With 2024 around the corner, it's essential to stay updated on the latest tax-saving strategies. Changes in tax laws and economic conditions can affect your tax planning approach. Here are some key strategies to consider:

Maximize Tax Deductions

One of the simplest ways to save on taxes is by maximizing your deductions. This includes both standard and itemized deductions. For example, if you own a home, mortgage interest and property taxes may be deductible. Similarly, charitable contributions can also provide significant tax benefits.

Example: Charitable Donations

Consider increasing your charitable donations before the end of the year. Donations to qualified organizations are deductible, which can reduce your taxable income. Keep track of all donations and ensure you obtain proper documentation to claim these deductions.

Tax Planning Tips for Individuals

For individuals, tax planning involves more than just maximizing deductions. It's also about understanding how various financial decisions impact your tax situation. Here are some tips to help individuals navigate their tax planning:

- Review Your Withholding: Ensure that the amount of tax withheld from your paycheck aligns with your expected tax liability. Adjust your withholding if necessary to avoid surprises at tax time.

- Consider Tax-Efficient Investments: Investing in tax-efficient funds or accounts can help minimize the tax impact on your investment returns.

- Plan for Major Life Events: Major life events such as buying a home, having a child, or starting a new job can have significant tax implications. Plan accordingly to optimize your tax outcomes.

Smart Tax Strategies for Small Businesses

Small businesses have unique tax planning needs. Here are some smart tax strategies specifically designed for small business owners:

Example: Business Expenses

Keep detailed records of all business expenses, as many of these can be deducted from your taxable income. This includes costs related to office supplies, travel, and professional services. By accurately tracking and documenting these expenses, you can reduce your taxable income and maximize your deductions.

- Utilize Tax Credits: Take advantage of available tax credits, such as those for hiring employees from certain groups or investing in renewable energy.

- Invest in Retirement Plans: Establishing retirement plans for yourself and your employees can provide tax benefits and help secure your financial future.

2024 Tax Optimization Techniques

As tax laws evolve, staying informed about new optimization techniques is vital. For 2024, consider the following techniques to enhance your tax planning:

Advanced Tax Planning Methods

Advanced tax planning involves more complex strategies that can provide significant tax benefits. These may include:

- Income Splitting: This technique involves distributing income among family members or entities to take advantage of lower tax brackets.

- Tax-Loss Harvesting: Offset gains by selling investments that have lost value. This strategy can help reduce your overall taxable income.

Tax Efficiency Strategies

Improving tax efficiency involves optimizing how you manage and invest your money to minimize taxes. Strategies may include:

- Tax-Deferred Investments: Invest in accounts that defer taxes until withdrawals are made, such as traditional IRAs or 401(k)s.

- Tax-Exempt Investments: Consider investments that are exempt from federal taxes, such as municipal bonds.

Reduce Tax Liability

Reducing your tax liability is the ultimate goal of effective tax planning. Implementing the strategies discussed can help achieve this goal. Regularly review and adjust your tax plan as needed to ensure it remains effective and aligned with your financial goals.

Example: Estate Planning

Estate planning can also play a role in reducing tax liability. By setting up trusts or making strategic gifts, you can minimize estate taxes and ensure that your assets are distributed according to your wishes.

Conclusion

In summary, implementing top tax planning strategies for 2024 can lead to substantial savings and more efficient management of your finances. By maximizing deductions, utilizing smart strategies, and staying informed about new techniques, you can effectively reduce your tax liability and achieve your financial goals. As always, consider consulting with a tax professional to tailor these strategies to your specific situation.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

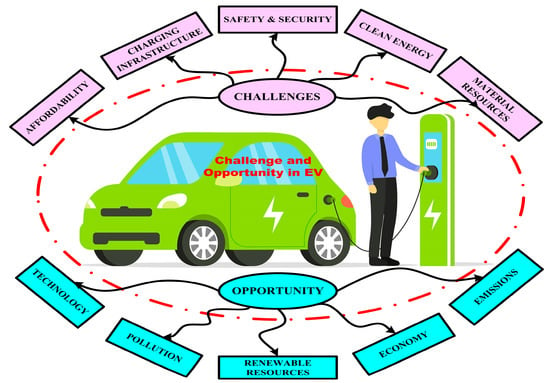

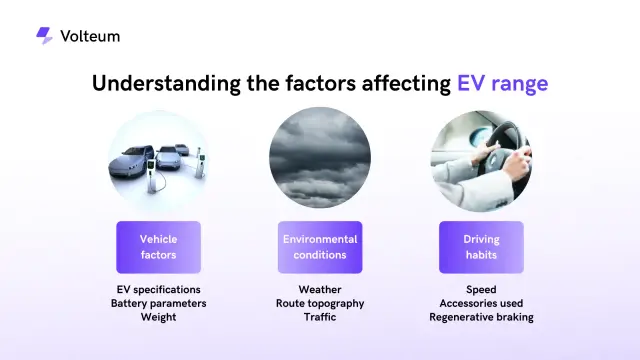

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick