The Ultimate Guide to Asset Planning: Strategies for Building Wealth

Mia Anderson

Photo: The Ultimate Guide to Asset Planning: Strategies for Building Wealth

Are you seeking ways to build your wealth and secure your financial future? You've come to the right place. This ultimate guide will take you on a journey through the world of asset planning, offering strategies and insights to help you make the most of your investments and achieve your long-term financial goals. From understanding the basics of asset allocation to exploring advanced wealth accumulation techniques, we'll equip you with the knowledge and confidence to become your own financial navigator. So, get ready to dive into the exciting world of financial planning and discover the path to a richer future.

Understanding the Basics of Asset Planning

Asset planning, in its simplest form, is the process of strategically managing your investments to meet your financial objectives. It involves carefully selecting and overseeing a portfolio of assets, such as stocks, bonds, real estate, and more, to grow your wealth over time. Effective asset planning is a delicate balance of risk and reward, requiring an understanding of your financial goals, risk tolerance, and time horizon.

The Importance of a Well-Thought-Out Plan

A well-crafted asset plan serves as your financial roadmap, helping you navigate the often complex world of investing. It ensures your decisions are aligned with your long-term goals and risk appetite, whether you're planning for retirement, saving for a child's education, or simply aiming to build a comfortable nest egg. By allocating your resources efficiently and adopting suitable strategies, you can maximize your investment returns while minimizing potential risks.

Common Misconceptions About Asset Planning

Before delving deeper, let's dispel some common myths about asset planning:

- "Asset planning is only for the wealthy": This is a fallacy. Regardless of your income or net worth, effective asset planning is accessible and beneficial to everyone. It's about making the most of what you have and ensuring your financial security.

- "It's all about stocks and shares": While equities are a common component of investment portfolios, asset planning encompasses a diverse range of investment options, including bonds, mutual funds, real estate, and more. A well-diversified portfolio is often a key to success.

- "It's too complicated for the average person": Yes, asset planning involves a learning curve, but it is not inaccessible. With the right guidance and resources, anyone can become a savvy investor. This guide aims to demystify the process and empower you to take control of your financial future.

Defining Your Financial Goals and Risk Tolerance

At the heart of effective asset planning is a clear understanding of your financial goals and risk tolerance. Defining these parameters will shape your investment strategy and help you stay focused and motivated throughout your financial journey.

Setting Clear and Achievable Financial Goals

When setting financial goals, it's crucial to be specific and realistic. Ask yourself: What are you hoping to achieve through asset planning? Common goals include retirement planning, saving for significant purchases like a home or education, or simply building long-term wealth. Each goal will have its own timeline and investment strategy. For example, retirement planning may involve a mix of equities and fixed-income investments, whereas shorter-term goals might focus on more conservative, stable options.

Assessing Your Risk Tolerance

Risk tolerance is an individual's emotional and financial capacity to withstand fluctuations in the value of their investments. It's essential to assess your risk tolerance honestly, as it will influence the types of assets you choose and the potential volatility you can expect. Generally, younger investors with a longer time horizon can afford to take on more risk, often favoring growth-oriented investments. In contrast, those closer to retirement or with more conservative goals may opt for less volatile options.

Exploring Asset Planning Strategies

Now that we've laid the foundational knowledge let's explore some specific asset planning strategies. These approaches will help you build a robust investment portfolio and make informed decisions about allocating your resources.

Diversification: Don't Put All Your Eggs in One Basket

Diversification is a cornerstone of successful asset planning. It involves spreading your investments across various asset classes, sectors, and industries to reduce risk. By diversifying, you lower the impact of any single investment on your overall portfolio, smoothing out potential losses and gains. For example, if you invest solely in tech stocks and the industry experiences a downturn, your portfolio could take a significant hit. However, by also investing in bonds, real estate, or other sectors, you mitigate this risk.

Active vs. Passive Management: Choosing Your Investment Style

Active management involves a more hands-on approach, where you or a portfolio manager actively buy and sell investments to outperform the market. This strategy often entails higher fees but can potentially lead to greater returns. Passive management, on the other hand, favors a more passive approach, typically involving index funds or exchange-traded funds (ETFs) that track a specific market index. This strategy generally has lower fees and is more suited to long-term investors who want a simpler approach.

Rebalancing: Maintaining Your Preferred Risk Profile

Over time, your asset allocation can drift from your initial plan due to varying investment performances. Rebalancing is the process of periodically adjusting your portfolio to return it to your desired risk profile. For example, if equities have performed well, they may now make up a larger portion of your portfolio than intended. By selling some stocks and buying more bonds, you can restore the balance and maintain your preferred level of risk.

Wealth Accumulation Techniques

Beyond the basic strategies, there are more advanced techniques to consider as you progress in your asset planning journey. These techniques can help accelerate your wealth accumulation and optimize your portfolio.

Tax-Efficient Investing

Taxes can significantly impact your investment returns, so adopting tax-efficient strategies is crucial. This involves understanding the tax implications of different investment types and timing your purchases and sales to minimize tax burdens. For example, holding investments for the long term (over a year) may qualify for lower capital gains tax rates when you eventually sell. Additionally, tax-advantaged retirement accounts, such as 401(k)s or Individual Retirement Accounts (IRAs), can provide significant tax benefits.

Utilizing Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount regularly, regardless of the market price. By doing so, you buy more shares when prices are low and fewer when prices are high, averaging out your purchase price over time. This method helps take the emotion out of investing, ensures discipline, and can lead to solid returns over the long term. For example, consistently investing $500 monthly in a mutual fund, regardless of its share price, will accumulate more shares when prices are low and fewer when they are high.

The Power of Compound Interest

Compound interest is often referred to as "magic" when it comes to wealth accumulation. It involves earning interest not only on your initial investment but also on the interest accumulated over time. The longer your investment horizon, the more significant the impact of compound interest. For instance, consider an investment of $10,000 earning an annual interest rate of 7%. After 20 years, your investment would grow to approximately $40,454, with over $23,000 coming from compound interest.

Retirement Planning Tips

Retirement planning is a significant aspect of asset planning, ensuring you have sufficient funds to maintain your desired standard of living during your golden years. Here are some strategies to consider:

Start Early and Maximize Retirement Accounts

The power of compound interest is especially evident when it comes to retirement planning. The earlier you start saving, the more time your investments have to grow. Take advantage of tax-advantaged retirement accounts, such as 401(k)s, IRAs, or pension plans, to benefit from tax breaks and employer-matching contributions. Even if you're starting later in life, don't let that deter you – the key is to begin as soon as possible.

Consider Annuities for Guaranteed Income

Annuities are financial products that provide a guaranteed income stream during retirement. In exchange for an initial lump sum or series of payments, an insurance company will make regular payments to you for a specified period or even for life. Annuities can provide peace of mind and stability, ensuring a consistent income regardless of market fluctuations.

Plan for Healthcare Costs

Healthcare expenses are often a significant consideration in retirement planning. It's crucial to factor in these costs and explore options for covering them. Medicare is a common choice, but you may also want to consider supplemental insurance or long-term care insurance to address potential health needs as you age.

Conclusion

Effective asset planning is a journey that requires knowledge, discipline, and a long-term perspective. By understanding your financial goals and risk tolerance, adopting diverse investment strategies, and utilizing wealth accumulation techniques, you can build a secure financial future for yourself and your loved ones. Remember, the power of compound interest and the benefits of starting early cannot be overstated.

Now that you've reached the end of this guide, you should feel empowered to take control of your financial destiny. So, go ahead and dive into the world of asset planning, knowing that you have the tools and strategies to make informed decisions and build the wealthy future you deserve.

Happy investing, and may your financial dreams come true!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

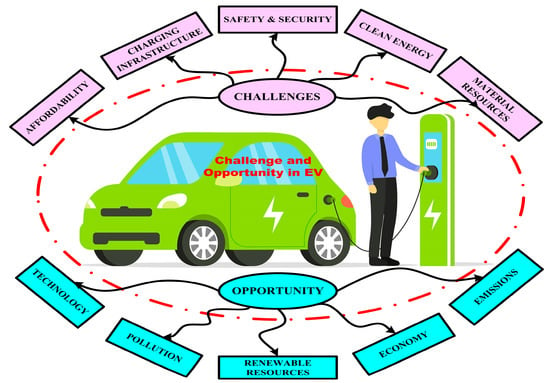

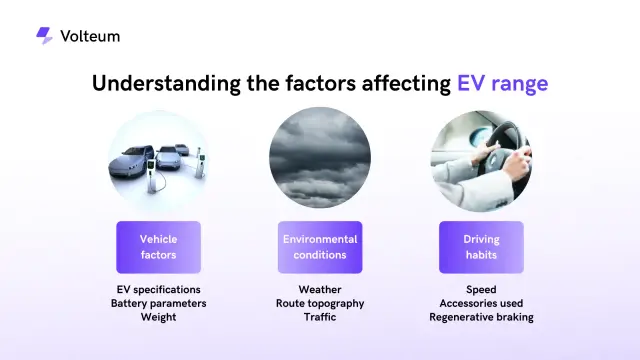

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick