The Stock Market's Wild Ride: A Year in Review

Mia Anderson

Photo: The Stock Market's Wild Ride: A Year in Review

The stock market is often compared to a rollercoaster, and 2023 proved to be an exhilarating ride with plenty of twists and turns. As we reflect on the year that was, we'll take a journey through the highs and lows, the surprises and the trends, and the lessons learned from a year that kept investors on the edge of their seats. This review aims to provide an insightful and informative perspective on the stock market's performance, offering a comprehensive analysis for both seasoned investors and those new to the world of finance.

Market Performance: A Tale of Resilience

A Rocky Start

The year began with a sense of trepidation as the market grappled with the aftermath of the previous year's challenges. Global economic uncertainties, lingering pandemic concerns, and geopolitical tensions set the stage for a cautious start. The first quarter saw a noticeable dip in stock prices, with investors adopting a wait-and-see approach. This period was characterized by increased volatility, with some sectors taking a harder hit than others.

The Summer Rebound

As the year progressed, a remarkable turnaround began to unfold. The second quarter brought a surge of optimism as economic indicators started to show signs of recovery. Investors, sensing a shift in market sentiment, seized the opportunity, leading to a significant market rally. Sectors like technology and healthcare led the charge, with many companies reporting better-than-expected earnings. This period was a testament to the market's ability to adapt and recover, offering a glimmer of hope to those who had endured the initial turbulence.

Navigating Uncertainty

The latter half of the year presented a different challenge. While the market had regained its footing, various factors kept investors on their toes. Rising interest rates, inflation concerns, and shifting global policies created an environment of uncertainty. The market's resilience was tested, with some investors opting for a more cautious approach, while others saw these challenges as opportunities for strategic investments.

Key Trends and Surprises

Tech Sector's Comeback

One of the most notable trends of 2023 was the resurgence of the technology sector. After a period of underperformance, tech stocks made a remarkable comeback, with many industry leaders outperforming the broader market. This recovery was fueled by innovation, with companies focusing on cutting-edge technologies and digital transformation, which resonated well with investors.

ESG Investing Gains Traction

Environmental, Social, and Governance (ESG) investing emerged as a prominent theme this year. With growing awareness of sustainability and ethical practices, investors increasingly sought out companies with strong ESG credentials. This trend not only impacted stock prices but also influenced corporate strategies, as companies began to prioritize ESG factors to attract a wider investor base.

M&A Activity and Market Consolidation

The year witnessed a flurry of mergers and acquisitions, as companies sought to strengthen their positions in a competitive landscape. This trend not only reshaped industries but also created opportunities for investors. However, it also raised questions about the potential impact on market competition and the long-term implications for investors.

Lessons Learned

Diversification is Key

The market's volatility throughout the year reinforced the importance of diversification. Investors who maintained a well-diversified portfolio were better equipped to weather the storms and capitalize on the market's ups and downs. This strategy, a cornerstone of long-term investing, proved its value once again.

Market Timing is a Challenge

Attempting to time the market proved to be a tricky endeavor. The year's fluctuations demonstrated that predicting short-term market movements is a complex task. Many investors who tried to time the market found themselves caught in a game of chance, often missing out on potential gains. This highlights the value of a long-term investment strategy and the importance of staying invested through market cycles.

Stay Informed, But Keep Perspective

The year's events underscored the need for investors to stay informed and adaptable. Keeping up with market news and understanding the underlying factors driving price movements is crucial. However, it's equally important to maintain a long-term perspective and avoid knee-jerk reactions to short-term fluctuations.

Conclusion: Looking Ahead

As we bid farewell to a year of market adventures, it's evident that the stock market remains a dynamic and unpredictable force. The lessons learned in 2023 will undoubtedly shape investment strategies for the future. Investors who embrace a balanced approach, combining a long-term vision with adaptability, are likely to navigate the market's twists and turns more effectively.

The year 2023 has shown us that the stock market is a complex ecosystem, influenced by a myriad of factors. While it can be a thrilling ride, it also demands a thoughtful and informed approach. As we move forward, let this year's experiences guide us towards making more prudent investment decisions, ensuring we are prepared for whatever the market may bring.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

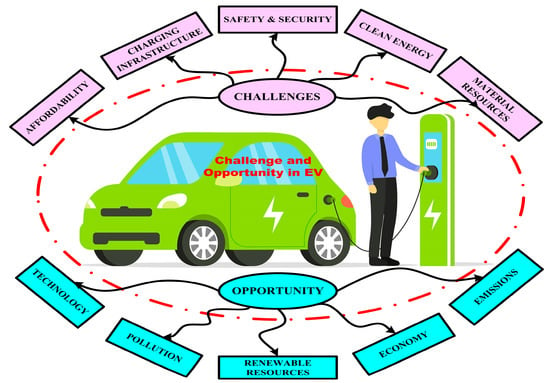

Automotive

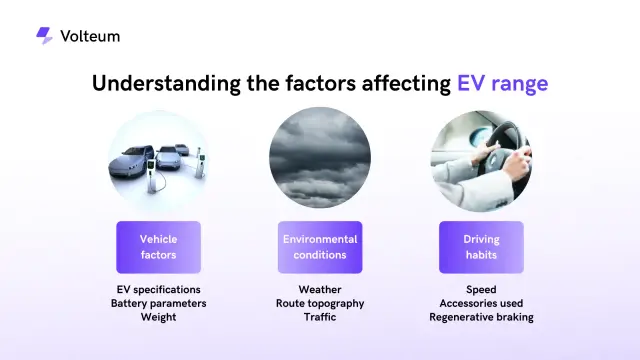

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

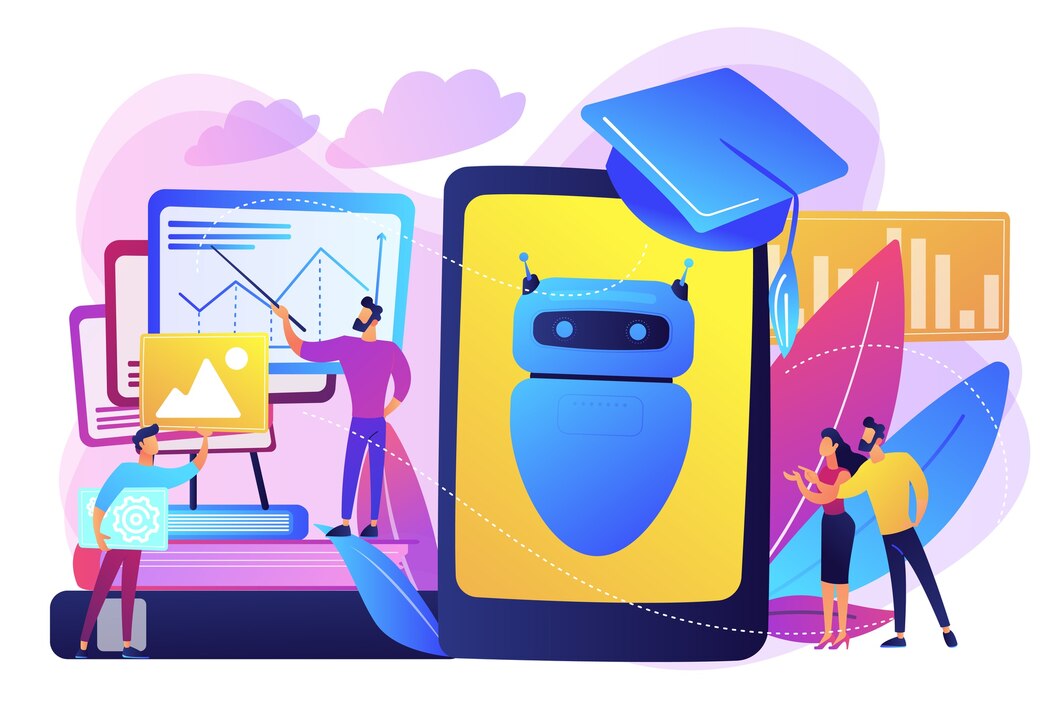

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick