The Hidden Benefits of Credit Cards You Probably Aren’t Using

Mia Anderson

Photo: The Hidden Benefits of Credit Cards You Probably Aren’t Using

credit cards have become an integral part of our financial toolkit, offering convenience and purchasing power. While many of us are familiar with the basic benefits of credit cards, such as earning rewards and building credit history, there are some hidden perks that often go unnoticed. These benefits can significantly enhance your financial well-being and provide a safety net in various situations. Let's delve into the lesser-known advantages of credit cards and explore how they can work in your favor.

Building a Financial Safety Net

One of the most underrated benefits of credit cards is the financial security they provide. In times of emergencies or unexpected expenses, having a credit card can be a lifesaver. Imagine your car breaking down unexpectedly, leaving you with a hefty repair bill. Instead of dipping into your savings or taking out a loan, a credit card can come to the rescue. By utilizing your credit limit, you can cover the cost and pay it off over time, allowing you to manage the expense without straining your immediate finances.

For instance, Sarah, a cautious spender, always had a fear of unexpected financial burdens. However, when her laptop suddenly crashed, she was grateful to have a credit card. She was able to purchase a new laptop immediately and pay for it in installments without disrupting her monthly budget. This real-life example highlights how credit cards can provide a much-needed financial cushion.

Travel Perks and Protection

Credit cards often come with a range of travel benefits that can make your journeys more enjoyable and worry-free. From airport lounge access to travel insurance, these perks can significantly enhance your travel experience. For instance, many credit cards offer rental car insurance, which can save you money and provide peace of mind when renting a vehicle. Additionally, some cards provide trip cancellation and interruption insurance, ensuring that you're covered if your travel plans go awry.

Consider the story of John, an avid traveler, who always uses his credit card for travel bookings. During a recent trip, his flight was canceled due to bad weather, leaving him stranded. Thanks to his credit card's travel insurance, he was able to claim compensation for the inconvenience and book an alternative flight without any financial loss. This scenario demonstrates how credit cards can offer valuable protection and support during travel-related emergencies.

Extended Warranties and Purchase Protection

Another hidden gem of credit cards is the extended warranty and purchase protection they often provide. When you make a purchase using your credit card, you may be eligible for an extended warranty on the item, which can be particularly useful for expensive electronics or appliances. This extended warranty can save you money on repairs or replacements, providing an added layer of protection for your purchases.

For example, Emily, an avid tech enthusiast, purchased a new smartphone with her credit card. A few months later, the phone developed a manufacturing defect. Fortunately, her credit card's extended warranty covered the repair costs, saving her from an expensive out-of-pocket expense. This real-life scenario showcases how credit cards can offer valuable purchase protection, ensuring your hard-earned money is well-protected.

Fraud Protection and Security

Credit cards also offer robust fraud protection and security features, making them a safer payment option than cash or debit cards. Most credit card companies have advanced security systems in place to detect and prevent fraudulent activities. In the event of unauthorized transactions, credit card companies typically offer zero liability protection, meaning you won't be held responsible for any fraudulent charges.

A personal experience shared by Michael, a frequent online shopper, highlights the importance of this benefit. He noticed some suspicious transactions on his credit card statement and immediately contacted his card issuer. The company promptly investigated the issue, reversed the fraudulent charges, and issued him a new card. This incident showcases how credit cards can provide peace of mind and security, ensuring your financial well-being.

Building Credit and Financial Management

Using credit cards responsibly can be an excellent way to build or improve your credit score. By making timely payments and maintaining a low credit utilization ratio, you demonstrate financial responsibility to credit bureaus. This, in turn, can lead to better loan terms, lower interest rates, and increased credit limits in the future.

Moreover, credit cards can serve as a valuable tool for financial management. By tracking your expenses and analyzing your monthly statements, you can gain a better understanding of your spending habits. This awareness can help you create a budget, identify areas for improvement, and make informed financial decisions.

Conclusion

Credit cards offer more than just convenience and rewards. The hidden benefits, such as financial safety nets, travel perks, extended warranties, fraud protection, and credit-building opportunities, make them an invaluable financial tool. By understanding and utilizing these advantages, you can maximize the potential of your credit cards and enhance your overall financial well-being.

Remember, while credit cards can provide numerous benefits, it's essential to use them responsibly and stay within your means. By doing so, you can enjoy the perks while avoiding the pitfalls of excessive debt and interest charges. Embrace the power of credit cards, and unlock the hidden advantages that can make a significant difference in your financial journey.

Marketing

View All

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the best streaming services for 2024 and find your next favorite show. Read now for expert recommendations and start streaming today!

Mia Anderson

Discover the future of OTT platforms in 2024. Learn how they're reshaping media consumption globally. Click here to stay ahead in the streaming revolution!

Mia Anderson

Discover the ultimate 2024 guide to becoming a successful influencer. Learn strategies, tips, and trends. Start your influencer journey now click to begin!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

Automotive

View AllLearn about the top platforms for selling your car efficiently. Compare options and make the best choice!

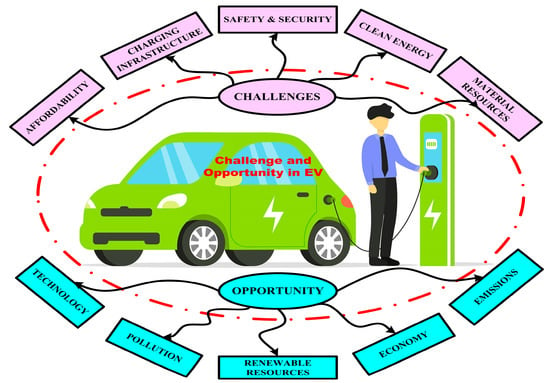

Read MoreLearn how rising fuel prices are making EVs a more attractive option. See why EV adoption is soaring in 2024.

Read MoreExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MorePolular🔥

View All

1

2

4

5

6

7

8

9

10

News

View AllAugust 7, 2024

2024 Presidential Candidates: The Ultimate Guide to the Upcoming US Election

Read MoreTechnology

View All

December 15, 2024

Best Home Tech Deals You Can’t Miss in 2024 – Shop Now Before They’re Gone

Don't miss out on incredible home tech deals! Click to explore limited-time offers and upgrade your home tech setup.

December 6, 2024

How to Choose the Right Smartwatch for Your Fitness Goals in 2024

Find the perfect smartwatch to track your fitness journey! Our guide helps you select the ideal companion. Click to learn more and get motivated.

August 9, 2024

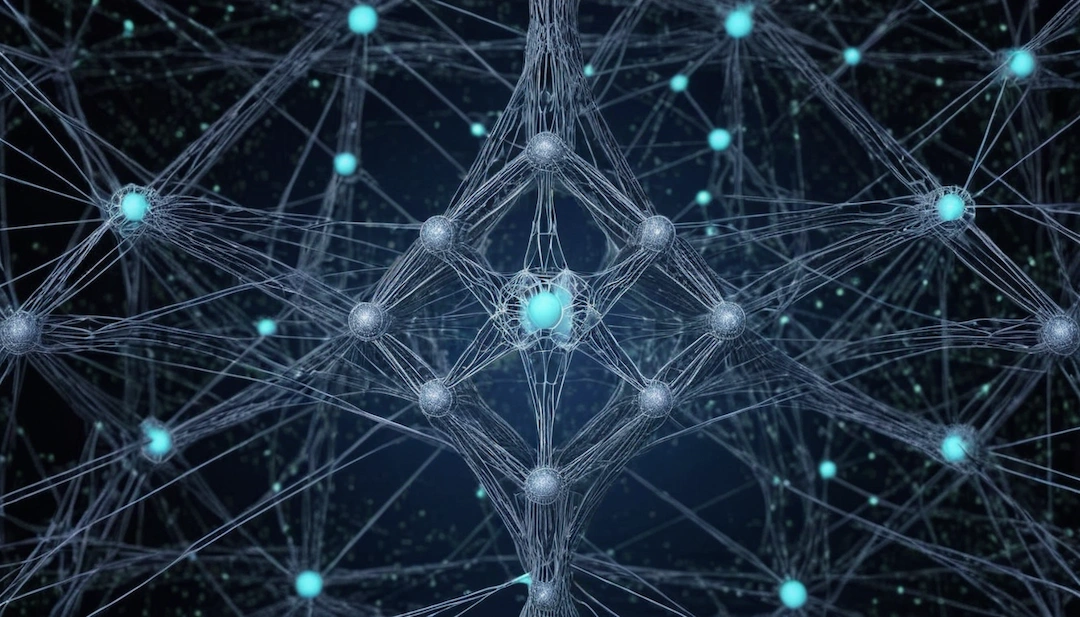

Unveiling the Power of Neural Network Architecture: A Beginner's Guide

Discover the countless possibilities of Neural Network Architecture—a fascinating field! Discover uses of this technology in your daily life and business as you learn how it simulates the functioning of the human brain.

Tips & Trick