Essential Wealth Management Tips to Grow Your Fortune Safely

Mia Anderson

Photo: Essential Wealth Management Tips to Grow Your Fortune Safely

In today’s complex financial landscape, effective wealth management is crucial for anyone looking to build and preserve their wealth. Whether you’re a high-net-worth individual, a business owner, or simply someone aiming for financial security, implementing the right strategies can significantly impact your financial future. This article explores essential wealth management advice, focusing on practical tips and strategies to grow your fortune safely.

Understanding Wealth Management

Wealth management is more than just financial planning; it encompasses a broad range of strategies designed to protect and grow your assets. It involves a comprehensive approach, addressing everything from investment advice to estate planning. By employing effective wealth management strategies, you can ensure your financial well-being and achieve long-term success.

Wealth Management Strategies

Diversification: A Key to Stability

One of the cornerstone principles of wealth management is diversification. Spreading your investments across various asset classes—such as stocks, bonds, real estate, and commodities—helps mitigate risk. For example, a diversified portfolio can cushion against market volatility, ensuring that a downturn in one sector does not disproportionately affect your overall wealth.

Risk Management and Asset Allocation

Risk management is essential for preserving wealth. Effective asset allocation involves dividing your investments among different asset classes based on your risk tolerance, investment goals, and time horizon. For instance, younger investors might allocate more towards equities for higher growth potential, while those nearing retirement may prefer bonds for stability.

Financial Planning for High-Net-Worth Individuals

High-net-worth individuals face unique financial challenges and opportunities. Personalized financial planning is crucial to addressing these needs effectively. This may include managing large portfolios, navigating complex tax regulations, and planning for significant life events.

Personalized Investment Strategies

For high-net-worth individuals, tailored investment strategies are essential. This might involve alternative investments, such as private equity or hedge funds, which can offer higher returns but come with increased risk. Working with a financial advisor to design a strategy that aligns with your specific goals and risk tolerance is key to optimizing your portfolio.

Tax-Efficient Wealth Management

Tax efficiency is critical in preserving wealth. Implementing strategies such as tax-loss harvesting, utilizing tax-deferred accounts, and making use of tax-advantaged investments can help minimize your tax liability. For example, investing in municipal bonds may offer tax-free income, which can be advantageous for those in higher tax brackets.

Investment Advice for Wealth Growth

Investing wisely is fundamental to growing your wealth. Here are some strategies to consider:

Long-Term Investing

Investing with a long-term perspective allows you to ride out market fluctuations and benefit from compounding returns. Historical data shows that long-term investments, such as a diversified stock portfolio, often outperform short-term trading strategies.

Regular Portfolio Review

Regularly reviewing and adjusting your investment portfolio ensures it remains aligned with your financial goals and risk tolerance. For instance, rebalancing your portfolio periodically can help maintain your desired asset allocation and address any imbalances that may arise.

Wealth Preservation Techniques

Preserving your wealth involves protecting it from various risks, including market downturns, inflation, and unforeseen life events.

Estate Planning for Wealth Protection

Estate planning is crucial for ensuring your wealth is distributed according to your wishes. This involves creating wills, trusts, and powers of attorney to manage your assets and provide for your heirs. For example, setting up a trust can help reduce estate taxes and avoid probate, ensuring a smooth transition of your wealth.

Insurance and Risk Management

Insurance plays a vital role in wealth preservation by protecting against potential losses. Life insurance, disability insurance, and property insurance are some of the types that can safeguard your assets and income. Adequate insurance coverage helps mitigate financial risks and ensures that your wealth is protected against unexpected events.

Retirement Planning for the Wealthy

Planning for retirement involves more than just saving; it requires strategic planning to ensure that your wealth lasts throughout your retirement years.

Creating a Retirement Income Strategy

Developing a retirement income strategy involves calculating how much you’ll need to maintain your desired lifestyle and determining the best way to generate that income. This may include a combination of Social Security benefits, pension plans, retirement accounts, and investment income.

Managing Retirement Withdrawals

Strategically managing withdrawals from your retirement accounts can help maximize your income and minimize taxes. For example, drawing from taxable accounts first and allowing tax-deferred accounts to grow can be a tax-efficient strategy.

Wealth Management Tips for Business Owners

Business owners often face additional complexities in managing their wealth. Here are some tips tailored to their unique situation:

Separating Personal and Business Finances

Maintaining separate personal and business finances is crucial for effective wealth management. This separation helps in accurately assessing your personal financial situation and ensures that your business liabilities do not impact your personal wealth.

Planning for Business Succession

Business succession planning involves preparing for the future transfer of your business. This includes identifying potential successors, creating a succession plan, and ensuring that your business remains viable and continues to grow after your departure.

Private Wealth Management Services

Private wealth management services offer personalized financial advice and management tailored to individual needs. These services often include comprehensive financial planning, investment management, and estate planning. Working with a private wealth manager can provide valuable insights and strategies to help you achieve your financial goals.

Benefits of Working with a Private Wealth Manager

Private wealth managers provide a high level of expertise and personalized service. They can help you navigate complex financial situations, optimize your investment portfolio, and develop a comprehensive wealth management plan tailored to your unique needs.

High-Net-Worth Investment Opportunities

Exploring investment opportunities designed for high-net-worth individuals can enhance your wealth growth. These opportunities often include:

Alternative Investments

Alternative investments, such as venture capital, private equity, and real estate, can offer high returns and diversification benefits. However, they may also come with higher risks and lower liquidity compared to traditional investments.

Customized Investment Solutions

Customized investment solutions are designed to meet the specific needs and goals of high-net-worth individuals. These may include bespoke portfolio management, tax-efficient strategies, and access to exclusive investment opportunities.

Conclusion

Effective wealth management is essential for growing and preserving your fortune. By employing strategic wealth management advice, including diversification, risk management, and personalized financial planning, you can enhance your financial stability and achieve long-term success. Whether you’re a high-net-worth individual, a business owner, or someone planning for retirement, implementing these strategies will help secure your financial future.

By staying informed and working with financial professionals, you can navigate the complexities of wealth management and make informed decisions that align with your goals. Start implementing these tips today to take control of your financial destiny and grow your wealth safely.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

Entertainment

View AllExplore the ultimate guide to 2024 film festivals. Discover top events, trends, and tips for filmmakers and attendees. Click to learn more now!

Mia Anderson

Discover the latest viral marketing strategies that can catapult your brand to success in 2024. Learn proven tips to create buzz and engage your audience. Start now!

Mia Anderson

Discover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to an unforgettable movie trivia night with our ultimate guide. Get tips, trivia questions, and game ideas to boost your event's fun!

Mia Anderson

Automotive

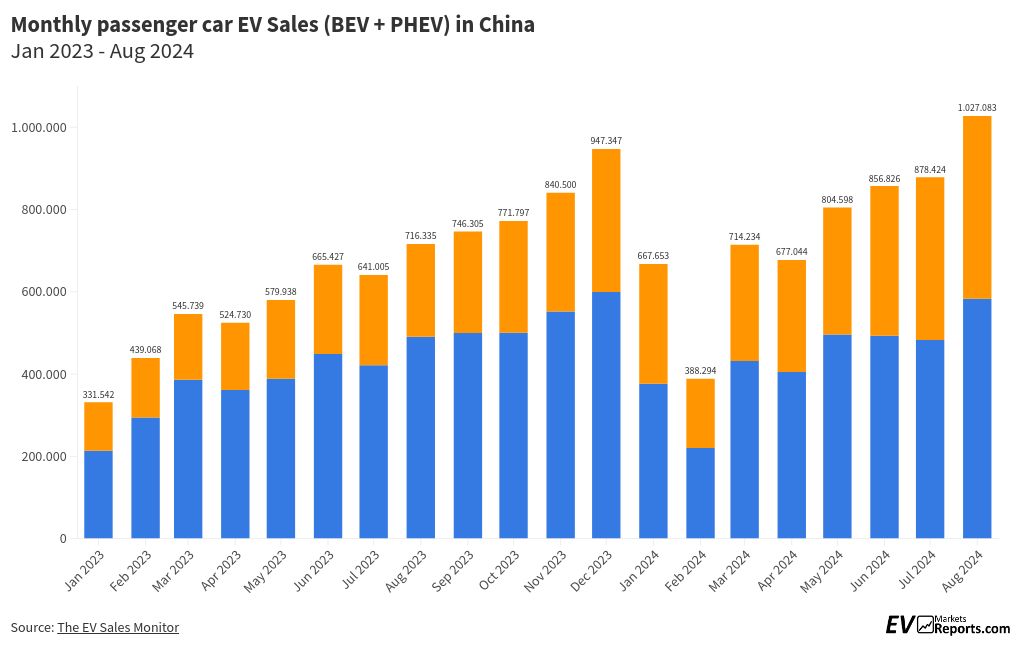

View AllDiscover the latest trends in electric vehicle adoption in China. What factors are driving this rapid growth?

Read MoreExplore what drives consumer interest in EVs. Discover key insights into attitudes, barriers, and 2024’s hottest EV trends.

Read MoreNew to the dealership world? This Dealer Daily guide offers essential tips to kickstart your career. Take control of success!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 18, 2024

Exploring Future AI: Key Trends and Innovations for 2024

Discover the latest trends and breakthroughs in AI for 2024. Explore future innovations and their impact on technology. Read now to stay ahead!

December 12, 2024

The 7 Best Budget Laptops for Students in 2024

Find the perfect laptop for students without breaking the bank! Click to explore affordable options and choose the best fit.

August 10, 2024

The Future Unveiled: Exploring the Top AR Apps of 2024

Check out our selection of the top augmented reality applications for 2024! We've selected the best applications that highlight the fascinating potential of augmented reality, ranging from gaming to astronomy.

Tips & Trick