Smart Ways to Invest in the Stock Market Without Losing Sleep

Mia Anderson

Photo: Smart Ways to Invest in the Stock Market Without Losing Sleep

Investing in the stock market can be an exciting yet nerve-wracking journey, especially for beginners. The idea of growing your wealth and securing your financial future is enticing, but the fear of losing money can keep many investors up at night. However, with the right approach and strategies, you can invest in the stock market without losing sleep. This article will explore smart ways to navigate the stock market, manage financial risks, and build a solid investment portfolio. Say goodbye to sleepless nights and hello to confident investing!

Understanding the Stock Market Basics

Before diving into the world of investing, it's crucial to grasp the fundamentals of the stock market. Here's a simple breakdown:

What is the Stock Market?

The stock market is a platform where shares of publicly traded companies are bought and sold. It serves as a meeting point for investors looking to buy ownership stakes in companies and companies seeking to raise capital by selling shares.

How Does it Work?

Investors purchase stocks, becoming partial owners of the company. The value of these stocks fluctuates based on various factors, including company performance, market trends, and economic conditions. Investors aim to buy stocks at lower prices and sell them when the prices rise, generating profits.

Types of Investments

The stock market offers a variety of investment options, including:

- Stocks: Individual shares of a company, providing ownership and potential dividends.

- Bonds: Debt investments where investors loan money to companies or governments in exchange for interest payments.

- Mutual Funds: Professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges, offering diversification and flexibility.

Smart Investment Strategies for Peaceful Nights

Now, let's explore some smart strategies to invest in the stock market without losing sleep:

1. Define Your Investment Goals

Start by setting clear investment goals. Are you investing for the long term, aiming for retirement, or saving for a specific goal like buying a house? Defining your objectives will guide your investment decisions and help you choose the right strategies. For instance, long-term investors can focus on buying and holding quality stocks, while short-term investors might consider more active trading approaches.

2. Diversify Your Portfolio

Diversification is a powerful risk management tool. Instead of putting all your eggs in one basket, spread your investments across different asset classes, industries, and geographic regions. This way, if one investment performs poorly, others may compensate, reducing the overall risk. Consider investing in a mix of stocks, bonds, and ETFs to create a well-diversified portfolio.

Real-Life Example: Imagine you have invested all your money in the technology sector. If the tech industry experiences a downturn, your entire portfolio could suffer. However, if you had also invested in healthcare, consumer goods, and government bonds, the impact of the tech sector's decline would be less severe.

3) Adopt a Long-Term Perspective

Successful investing often requires a long-term mindset. Short-term market fluctuations can be unsettling, but history has shown that stock markets generally trend upwards over time. Avoid the temptation to make impulsive decisions based on daily market movements. Focus on the long-term growth potential of your investments.

An Investor's Story: John, a seasoned investor, shared his experience: "When I started investing, I was constantly checking stock prices, and every dip made me anxious. But I learned to trust my long-term strategy. I focused on buying solid companies and held onto them for years. Despite short-term volatility, my portfolio has consistently grown, and I now sleep soundly at night."

4. Manage Risk with Research and Analysis

Thorough research and analysis are essential to making informed investment decisions. Understand the companies you invest in, study their financial health, and assess their growth potential. Look for companies with strong fundamentals, a competitive edge, and a history of consistent performance. Avoid investing based on rumors or short-term market trends.

Research Tips:

- Review companies' annual reports and financial statements.

- Analyze industry trends and market dynamics.

- Consider using online tools and platforms that provide stock analysis and market insights.

- Stay updated on economic news and events that may impact your investments.

5. Consider Automated Investment Platforms

For those who prefer a more hands-off approach, automated investment platforms can be a great option. These platforms use algorithms to manage your investment portfolio, automatically rebalancing and optimizing your investments based on your risk tolerance and goals. This strategy can be particularly appealing to busy individuals or those new to investing.

Benefits of Automated Investing:

- Removes emotional decision-making, reducing impulsive actions.

- Provides a disciplined and consistent investment approach.

- Offers a low-cost way to diversify your portfolio.

6. Start Small and Learn as You Go

Investing doesn't require a large initial sum. You can start small and gradually build your portfolio. Many online brokerage platforms offer fractional shares, allowing you to invest in portions of stocks, making it more accessible and affordable. As you invest, learn from your experiences and refine your strategy.

Beginner's Tip: "I started investing with a small amount each month. I chose a few companies I believed in and invested consistently. Over time, I learned about different investment strategies and expanded my portfolio. Starting small gave me the confidence to grow my investments without feeling overwhelmed."

Managing Financial Risk

Financial risk management is crucial to ensuring a good night's sleep as an investor. Here's how to approach it:

1. Understand Your Risk Tolerance

Every investor has a different level of risk they are comfortable with. Assess your risk tolerance by considering factors like your financial goals, investment time horizon, and emotional comfort. Are you comfortable with potential short-term losses for higher long-term gains, or do you prefer a more conservative approach? Understanding your risk tolerance will help you choose suitable investment strategies.

2. Set Stop-Loss Orders

A stop-loss order is a powerful tool to limit potential losses. It is an instruction to sell a stock if it reaches a certain price, protecting you from significant declines. For example, if you buy a stock at $50, you can set a stop-loss order at $45. If the stock price drops to $45, your shares will be sold, preventing further losses. This strategy can help you sleep easier, knowing you have a safety net in place.

3. Regularly Review and Rebalance

Regularly reviewing your portfolio is essential to ensure it aligns with your goals and risk tolerance. As markets change, the balance of your investments may shift. Rebalancing involves adjusting your portfolio to maintain your desired asset allocation. For instance, if stocks have performed exceptionally well, you may want to sell some and reinvest in other asset classes to maintain diversification.

Conclusion: Investing with Confidence

Investing in the stock market doesn't have to be a source of anxiety. By adopting smart strategies, such as setting clear goals, diversifying your portfolio, conducting thorough research, and managing risk, you can navigate the market with confidence. Remember, investing is a long-term journey, and short-term fluctuations are part of the process.

Start small, learn as you go, and consider seeking advice from financial professionals if needed. With the right approach, you can build a solid investment portfolio and achieve your financial goals without losing sleep. Happy investing!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

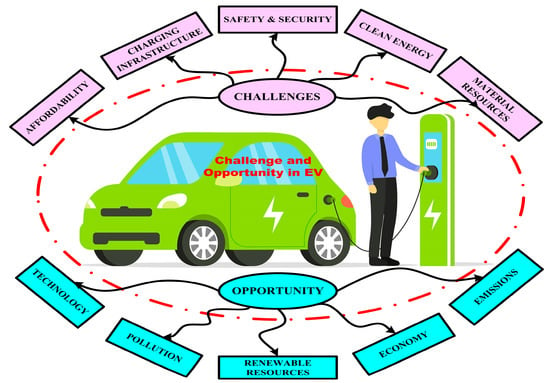

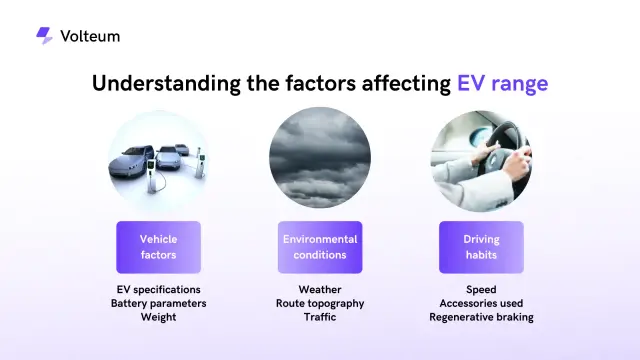

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick