Retirement Planning 101: Steps to Secure Your Financial Future

Mia Anderson

Photo: Retirement Planning 101: Steps to Secure Your Financial Future

Are you ready to embark on a journey towards a financially secure retirement? Retirement planning is an essential yet often overlooked aspect of personal finance. Many people dream of a comfortable retirement, but without proper planning, it might remain just that - a dream. In this comprehensive guide, we'll walk you through the fundamentals of retirement planning, offering practical steps to ensure your golden years are filled with financial security and peace of mind. Let's dive in and explore how you can take control of your future today!

The Importance of Retirement Planning

Retirement planning is not just about saving money; it's about designing the retirement lifestyle you desire. It empowers you to make informed decisions about your future, ensuring you can maintain your desired standard of living when you decide to leave the workforce. Here's why it's crucial:

Financial Security

The primary goal of retirement planning is to guarantee financial stability during retirement. By starting early and implementing a well-thought-out strategy, you can build a substantial retirement fund. This fund will provide a steady income stream, allowing you to cover essential expenses and indulge in the activities you love.

Peace of Mind

A solid retirement plan alleviates the stress and anxiety associated with financial uncertainty. Knowing you have a secure financial future enables you to focus on the present and enjoy your working years without constant worry.

Freedom to Choose

Effective retirement planning gives you the freedom to choose when and how you retire. Whether you dream of traveling the world, starting a hobby business, or simply relaxing at home, a well-prepared retirement plan can make these dreams a reality.

Step-by-Step Guide to Retirement Planning

Now, let's break down the process of retirement planning into manageable steps, making it easy for you to get started on your journey.

1. Define Your Retirement Goals

The first step is to envision your ideal retirement lifestyle. What does retirement mean to you? Do you want to travel extensively, downsize to a cozy cottage, or volunteer in your community? Understanding your goals will help you determine the financial resources needed to achieve them.

For instance, let's consider the story of Sarah, a 35-years-old marketing professional. She dreams of retiring early, at 55, and spending her time traveling the world. By defining her goal, Sarah can calculate the savings required to sustain her desired lifestyle for the long-term.

2. Calculate Your Retirement Needs

Estimating your retirement expenses is crucial to understanding how much you need to save. Start by considering your current monthly expenses and categorize them into essential and discretionary spending.

- Essential Expenses: These are the costs necessary for your basic living, such as housing, utilities, groceries, and healthcare.

- Discretionary Expenses: These are the fun and leisure costs, such as travel, dining out, and entertainment.

For example, if your current monthly essential expenses are $2500 and discretionary expenses are $1000, you can estimate your annual retirement needs. Remember to account for inflation and potential changes in expenses during retirement.

3. Determine Your Retirement Age

The age at which you plan to retire significantly impacts your retirement planning. Retiring early means you'll need to save more aggressively, while delaying retirement can provide more time for your savings to grow.

Consider the story of John, who wants to retire at 65. He calculates that he'll need $1.5 million in savings to sustain his desired retirement lifestyle. By starting early and investing wisely, John can reach his goal without sacrificing his current lifestyle.

4. Assess Your Current Financial Situation

Take a thorough look at your current financial standing, including your income, savings, investments, and debts. This step is crucial in understanding your starting point and identifying areas for improvement.

- Income: Calculate your annual income from all sources, including salary, investments, and any side hustles.

- Savings: Evaluate your existing savings, such as emergency funds, retirement accounts, and other investments.

- Debts: List all your debts, including mortgages, car loans, and credit card balances, along with their interest rates and repayment terms.

5. Create a Retirement Savings Plan

Now it's time to develop a strategy to bridge the gap between your current financial situation and your retirement goals. Here are some key components of a robust retirement savings plan:

a. Budgeting and Saving

Create a realistic budget that allocates a portion of your income towards retirement savings. Consider using the 50/30/20 rule, where 50% of your income covers essentials, 30% is for discretionary spending, and 20% goes into savings.

b. Retirement Accounts

Take advantage of tax-advantaged retirement accounts like 401(k)s, IRAs, or similar options. These accounts offer tax benefits and can significantly boost your savings over time.

c. Investment Strategies

Explore investment options to grow your savings. Diversify your portfolio with a mix of stocks, bonds, mutual funds, and other assets to balance risk and return. Consider consulting a financial advisor to tailor an investment strategy to your risk tolerance and goals.

6. Regularly Review and Adjust Your Plan

Retirement planning is not a one-time task; it's an ongoing process. Life events, economic changes, and personal circumstances can impact your financial situation. Therefore, it's essential to review and adjust your plan regularly.

- Annual Check-Ins: Set a yearly reminder to review your retirement plan. Assess your progress, re-evaluate your goals, and make adjustments as needed.

- Major Life Events: Revisit your plan whenever significant life changes occur, such as marriage, divorce, the birth of a child, or a job change. These events can impact your financial situation and retirement goals.

- Market Fluctuations: Keep an eye on economic trends and market performance. Adjust your investment strategy as necessary to capitalize on growth opportunities or protect your savings during downturns.

Overcoming Common Retirement Planning Challenges

Retirement planning is not without its challenges, but being aware of potential obstacles can help you navigate them successfully. Here are some common challenges and strategies to overcome them:

1. Starting Late

If you're reading this and thinking it's too late to start planning, think again! While starting early is ideal, it's never too late to begin. You can still take control of your retirement by creating a more aggressive savings plan and exploring catch-up contributions to retirement accounts.

2. Market Volatility

Market fluctuations can be intimidating, but remember that long-term investing is a marathon, not a sprint. Focus on a well-diversified portfolio and avoid making impulsive decisions based on short-term market movements.

3. Inflation

Inflation can erode the purchasing power of your savings over time. To combat this, consider investing in assets with the potential for growth, such as stocks and real estate. Regularly review and adjust your retirement plan to account for inflation's impact.

4. Healthcare Costs

Healthcare expenses can be a significant concern in retirement. Consider purchasing long-term care insurance or exploring Medicare options to help manage these costs. Additionally, staying informed about healthcare trends and policies can help you make informed decisions.

Conclusion

Retirement planning is a journey that requires dedication and a long-term perspective. By following the steps outlined in this guide, you can take control of your financial future and secure the retirement lifestyle you desire. Remember, it's never too early or too late to start planning.

Start by defining your retirement goals and understanding your financial situation. Create a realistic savings plan, take advantage of retirement accounts, and explore investment opportunities. Regularly review and adjust your plan to stay on track. With determination and a well-thought-out strategy, you can look forward to a retirement filled with financial security, freedom, and the fulfillment of your dreams.

So, take the first step today, and let your retirement planning journey begin!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

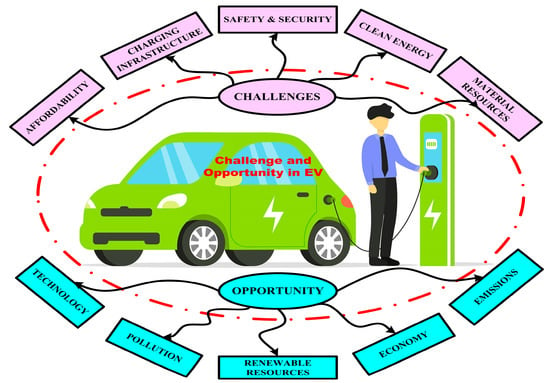

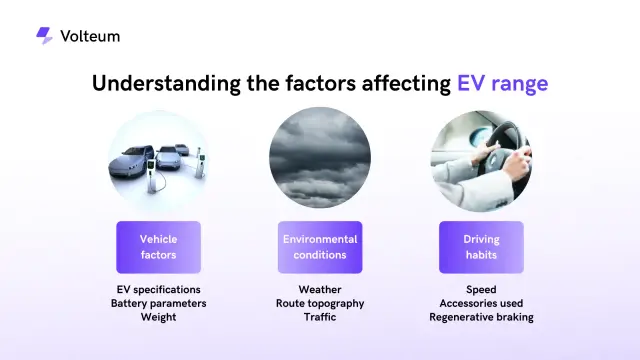

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick