Investing in Real Estate: What You Need to Know to Succeed

Mia Anderson

Photo: Investing in Real Estate: What You Need to Know to Succeed

Are you ready to explore the exciting world of real estate investing and discover the path to financial prosperity? Real estate investment has long been a popular strategy for building wealth and achieving financial freedom. In this comprehensive guide, we'll delve into the ins and outs of real estate investing, equipping you with the knowledge and insights needed to make informed decisions and maximize your success. Let's unlock the secrets of this lucrative investment journey!

What is Real Estate Investing?

Real estate investing is the process of purchasing, owning, and managing property with the goal of generating income, capital appreciation, or both. It's more than just buying a house; it's a strategic approach to growing your wealth over time. Investors can choose from various property types, such as residential (single-family homes, apartments), commercial (offices, retail spaces), or industrial (warehouses, manufacturing facilities). Each category offers unique opportunities and considerations.

Why Consider Real Estate Investment?

Real estate investment has the potential to provide substantial financial rewards and long-term wealth creation. Here are some compelling reasons why it's worth considering:

1. Stable and Growing Asset:

Real estate is a tangible asset that tends to appreciate over time. Unlike some volatile investments, real estate values generally increase, making it a stable and reliable wealth-building tool. Historical data shows that property values have consistently risen, providing investors with a solid foundation for their investment portfolios.

2. Steady Income Stream:

One of the most attractive features of real estate investing is the ability to generate a steady income stream. Whether through rental income from tenants or leasing commercial spaces, investors can enjoy regular cash flow. This income can help offset expenses, provide financial security, and even fund future investments.

3. Leverage and Mortgage Benefits:

Real estate investors can leverage their investments by using mortgages to finance a portion of the property's cost. This allows them to control a more significant asset with a relatively smaller down payment. As the property value increases, investors can build equity and potentially refinance to access more capital for future investments.

4. Diversification and Risk Management:

Investing in real estate offers a great way to diversify your investment portfolio. By spreading your capital across different asset classes, you reduce the overall risk. Real estate markets often move independently of stock markets, providing a hedge against volatility. This diversification can lead to a more balanced and resilient investment strategy.

Getting Started: Essential Steps for Real Estate Investors

Embarking on your real estate investment journey requires careful planning and a strategic approach. Here's a simplified roadmap to help you get started:

1. Set Clear Investment Goals:

Define your investment objectives and what you hope to achieve. Are you seeking long-term wealth accumulation, passive income, or a combination of both? Setting specific goals will guide your investment decisions and help you stay focused.

2. Educate Yourself:

Real estate investing is a complex field, and knowledge is power. Take the time to learn about property valuation, market trends, legal considerations, and investment strategies. Attend seminars, read books, and connect with experienced investors to gain valuable insights.

3. Research the Market:

Understanding the real estate market is crucial. Study local market trends, property values, rental rates, and demand for different property types. Identify emerging neighborhoods or areas with high growth potential. This research will help you make informed decisions about where and when to invest.

4. Build a Network:

Networking is essential in real estate. Connect with real estate agents, property managers, contractors, and other investors. These relationships can provide access to off-market deals, valuable advice, and support throughout your investment journey.

5. Secure Financing:

Explore financing options such as mortgages, private lenders, or partnerships. Understand the various loan types, interest rates, and terms. Having pre-approved financing in place will give you an advantage when making offers on properties.

Strategies for Successful Real Estate Investing

To maximize your success in real estate investing, consider these proven strategies:

1. Buy-and-Hold Strategy:

This long-term approach involves purchasing properties and holding them for an extended period. The goal is to benefit from rental income and property appreciation. It requires careful property selection, tenant management, and regular maintenance. Buy-and-hold investors often build substantial wealth over time.

2. Fix-and-Flip:

This strategy focuses on purchasing undervalued or distressed properties, renovating them, and selling them for a profit. It requires a keen eye for identifying properties with potential, efficient project management, and a solid understanding of the local market. Fix-and-flip investors can generate significant returns in a relatively short period.

3. Real Estate Investment Trusts (REITs):

REITs are companies that own or finance income-producing real estate. By investing in REITs, you can gain exposure to a diversified portfolio of properties without directly owning them. REITs offer the advantage of liquidity, as they are publicly traded, and provide regular dividends to investors.

4. Property Development:

For those with a more entrepreneurial spirit, property development involves acquiring land, constructing buildings, and selling or leasing the finished product. This strategy requires substantial capital, expertise in construction, and an understanding of zoning regulations. Successful property developers can create substantial wealth.

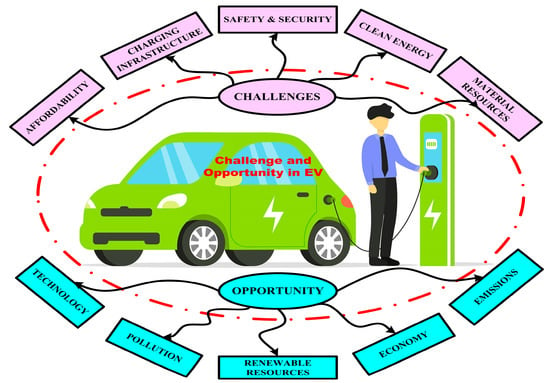

Managing Risks and Challenges

Real estate investing, like any investment, comes with its share of risks and challenges. Here's how to navigate them:

1. Market Fluctuations:

Real estate markets can experience ups and downs. Stay informed about market trends and be prepared for potential downturns. Diversifying your portfolio and having a long-term investment horizon can help mitigate market risks.

2. Tenant and Property Management:

Managing tenants and properties requires time and effort. Consider hiring a professional property management company to handle day-to-day operations, tenant screening, and maintenance. This can save you time and ensure your properties are well-maintained.

3. Legal and Regulatory Compliance:

Stay informed about local laws, zoning regulations, and landlord-tenant rights. Ensure you have the necessary permits and licenses for your properties. Consult legal professionals to navigate complex legal matters and protect your interests.

4. Cash Flow Management:

Monitor your cash flow carefully. Ensure rental income covers expenses, including mortgage payments, property taxes, and maintenance costs. Maintain a reserve fund for unexpected repairs or vacancies.

Real-Life Success Stories: Learning from Experienced Investors

To illustrate the power of real estate investing, let's explore some inspiring success stories:

The House Flipper:

Sarah, a savvy investor, started her real estate journey with a fix-and-flip strategy. She purchased a run-down property in an up-and-coming neighborhood, renovated it with modern finishes, and sold it for a significant profit. Sarah's keen eye for design and understanding of the local market allowed her to repeat this process, building a successful flipping business.

The Long-Term Investor:

John, a seasoned investor, focused on the buy-and-hold strategy. He acquired several rental properties over the years, carefully selecting locations with high tenant demand. John's patient approach and attention to tenant satisfaction resulted in a steady stream of rental income, allowing him to retire comfortably.

Conclusion: Unlocking Your Real Estate Investment Potential

Real estate investing is a powerful tool for building wealth and achieving financial freedom. By understanding the fundamentals, setting clear goals, and implementing strategic investment approaches, you can unlock the door to success. Whether you choose to buy and hold, flip properties, or explore other avenues, real estate offers a world of opportunities.

Remember, success in real estate investing requires research, education, and a long-term perspective. Stay informed about market trends, build a strong network, and continuously educate yourself. With dedication and a well-planned strategy, you can navigate the real estate market and create a prosperous future.

So, are you ready to embark on your real estate investment journey? The world of property investment awaits, offering the potential for financial growth and a secure future. Happy investing!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

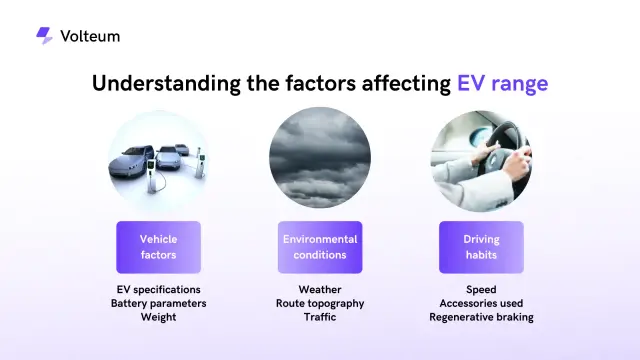

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick