How to Create a Financial Roadmap That Leads to Wealth

Mia Anderson

Photo: How to Create a Financial Roadmap That Leads to Wealth

In the intricate world of personal finance, creating a robust financial roadmap is akin to embarking on a journey towards financial freedom. This article aims to be your compass, guiding you through the process of designing a financial plan that not only secures your present but also paves the way for a prosperous future. The journey to wealth accumulation is not a sprint but a strategic marathon, and with the right financial planning, anyone can achieve their financial aspirations.

Understanding the Basics of Financial Planning

What is Financial Planning?

Financial planning is essentially a process of organizing your finances to achieve personal financial goals. It involves assessing your current financial situation, identifying your short and long-term goals, and creating a comprehensive strategy to manage your money effectively. It's like having a personalized map that guides you from your current financial position to your desired destination.

Why is it Important?

In today's complex financial landscape, planning is not just a luxury but a necessity. It empowers individuals to take control of their financial future, ensuring they make informed decisions about their money. Whether it's saving for retirement, buying a home, or investing for growth, a well-crafted financial plan provides direction and discipline.

The Benefits of a Financial Roadmap

A financial roadmap offers numerous advantages. Firstly, it provides clarity and focus, helping you prioritize your financial goals. It also encourages disciplined savings and investment, allowing your money to work harder. Moreover, it can reduce financial stress and anxiety, as you have a clear plan to tackle life's financial challenges.

Creating Your Financial Roadmap

Step 1: Assess Your Current Financial Situation

Before charting a course, you must know your starting point. Begin by evaluating your current financial health. This includes calculating your net worth (assets minus liabilities), analyzing your income and expenses, and reviewing your current savings and investments. Understanding your financial baseline is crucial for setting realistic goals.

Step 2: Define Your Financial Goals

What do you want to achieve financially? This could range from short-term goals like saving for a vacation to long-term objectives like retirement planning. Define your goals clearly, making them specific and measurable. For instance, instead of saying "I want to save money," set a goal like "I want to save $20,000 for a down payment on a house in the next two years."

Step 3: Develop a Budget

A budget is a cornerstone of financial planning. It helps you understand and control your spending, ensuring your money is allocated efficiently. Start by listing your monthly income and fixed expenses (rent, utilities, etc.). Then, allocate funds for variable expenses (groceries, entertainment) and savings or investments. Remember, a budget should be flexible and adaptable to your lifestyle.

Step 4: Manage and Reduce Debt

Debt can be a significant obstacle to wealth accumulation. Evaluate your current debt, including credit cards, loans, and mortgages. Develop a strategy to manage and reduce this debt. Consider strategies like debt consolidation or focusing on paying off high-interest debt first. The less debt you carry, the more financial freedom you'll have.

Step 5: Build an Emergency Fund

Life is full of unexpected events, and having an emergency fund is crucial for financial resilience. Aim to save enough to cover three to six months' worth of living expenses. This fund will provide a safety net during financial emergencies, preventing you from derailing your long-term financial plans.

Step 6: Plan for Major Life Events

Financial planning is not just about the present; it's about preparing for the future. Consider upcoming life events such as marriage, having children, or purchasing a home. Each of these milestones has significant financial implications. For instance, starting a family might require adjustments to your insurance coverage and savings strategies.

Step 7: Invest for the Long Term

Investing is a powerful tool for wealth creation. Explore various investment options such as stocks, bonds, mutual funds, or real estate. Diversify your portfolio to manage risk effectively. Remember, investing is a long-term game, and short-term market fluctuations should not deter you. Consult a financial advisor to create an investment strategy aligned with your risk tolerance and goals.

Step 8: Regularly Review and Adjust Your Plan

Financial planning is an ongoing process. Regularly review your financial roadmap to ensure it remains relevant and effective. Life changes, and so should your financial plan. Whether it's a salary increase, a new family member, or a change in economic conditions, update your plan to reflect these shifts.

Overcoming Common Challenges

Lack of Discipline

Sticking to a financial plan requires discipline. It's easy to get sidetracked by immediate desires or unexpected expenses. To stay on track, consider setting up automatic savings plans and creating a budget that allows for some flexibility. Regularly remind yourself of your long-term goals to maintain motivation.

Market Volatility

The financial markets can be unpredictable, and seeing your investments fluctuate can be unsettling. Remember, long-term investing is a strategy that focuses on time in the market, not timing the market. Stay informed but avoid making impulsive decisions based on short-term market movements.

Life's Uncertainties

From job losses to unexpected health issues, life can throw curveballs. A comprehensive financial plan should include strategies to manage these risks. Adequate insurance coverage and a well-funded emergency fund are essential components to navigate life's uncertainties.

Real-Life Example: The Power of Financial Planning

Consider the story of Sarah, a young professional who started her financial journey in her mid-20s. She began by setting clear goals: buying a home, starting a family, and ensuring a comfortable retirement. Sarah created a detailed budget, allocated funds for savings and investments, and consistently contributed to her retirement accounts.

When the housing market cooled, Sarah seized the opportunity, using her savings for a down payment on a home. She continued to invest in her retirement, benefiting from the power of compound interest. As her family grew, Sarah adjusted her insurance policies and savings plans to accommodate her new financial responsibilities.

Today, Sarah is in her 40s, well on her way to achieving her financial goals. Her early planning and discipline have paid off, providing her with financial security and peace of mind.

Conclusion

Financial planning is a journey of empowerment and security. It's about taking control of your financial destiny and making your money work for you. By creating a comprehensive financial roadmap, you can navigate the complexities of personal finance, overcome challenges, and build wealth over time.

Remember, the journey to financial success is unique for everyone. Tailor your financial plan to your goals, lifestyle, and risk tolerance. Seek professional advice when needed, and stay committed to your plan. With the right strategy and discipline, you can unlock the doors to financial freedom and a prosperous future.

Start your financial planning journey today, and let this article be your guiding light towards a wealthier tomorrow.

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

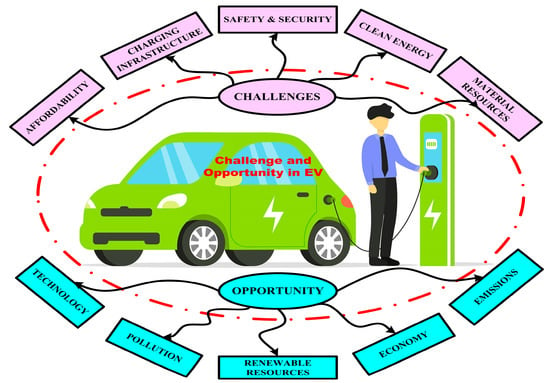

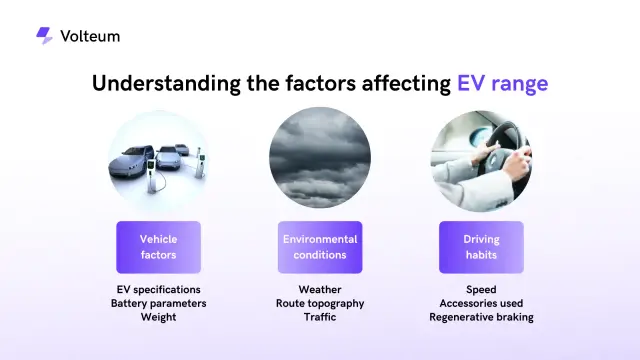

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick