How to Build an Emergency Fund: A Complete Guide

Mia Anderson

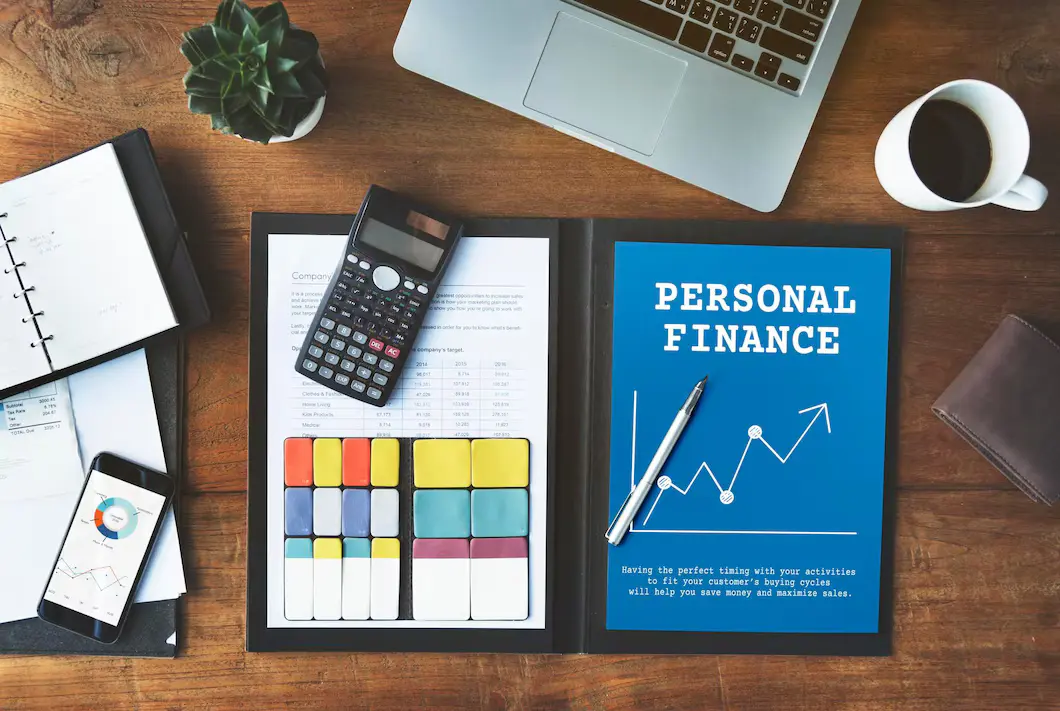

Photo: How to Build an Emergency Fund: A Complete Guide

In today's unpredictable world, having a financial safety net is crucial. An emergency fund is your personal financial lifeboat, offering stability and peace of mind during unexpected life events. This comprehensive guide will navigate you through the process of building an emergency fund, providing practical tips and insights to ensure you're prepared for whatever life throws your way.

Understanding the Emergency Fund Concept

An emergency fund is a dedicated pool of money set aside to cover unforeseen expenses or financial setbacks. It's your financial cushion, designed to help you weather the storms of life without going into debt or facing financial hardship.

The Importance of Emergency Savings:

Imagine losing your job unexpectedly or facing a sudden medical emergency. Without an emergency fund, you might find yourself struggling to pay bills or even covering basic necessities. This is where emergency savings come into play, providing a buffer to maintain financial stability during challenging times.

Financial planners often recommend having enough savings to cover three to six months' worth of living expenses. This may seem like a daunting amount, but it's a realistic goal that can be achieved with the right strategies.

How Much is Enough? Determining Your Emergency Fund Goal

The ideal amount for an emergency fund varies from person to person. It depends on various factors, including your income, expenses, and personal circumstances.

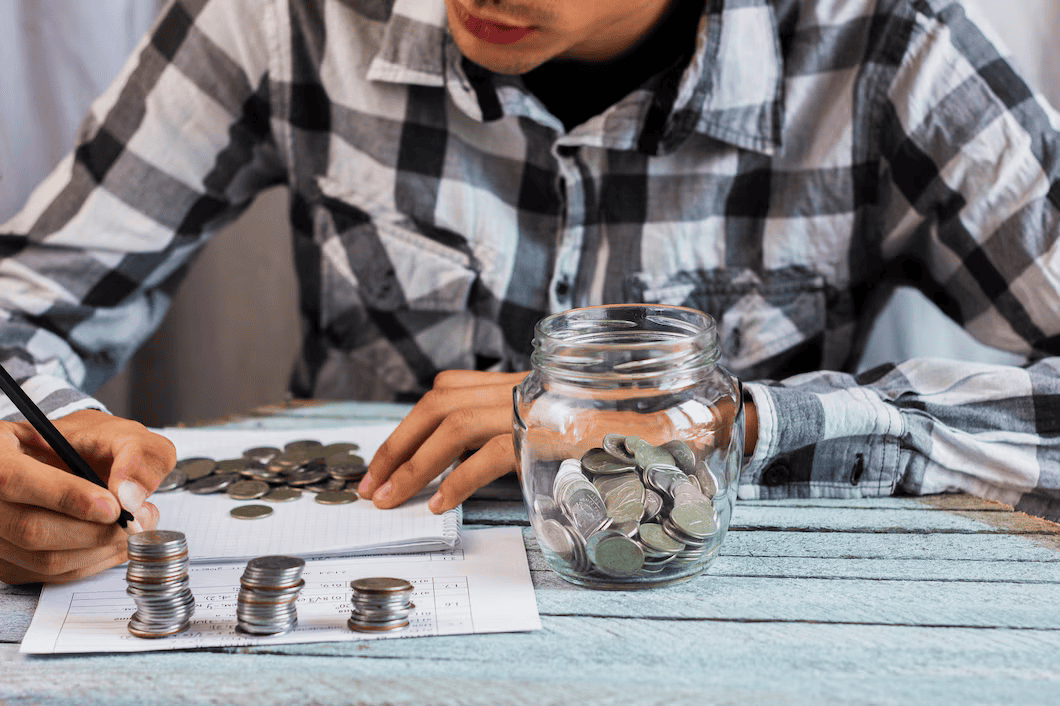

Assessing Your Financial Situation

Start by evaluating your current financial standing. Calculate your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, and any debt obligations. This will give you a clear picture of your essential costs.

For instance, let's consider the case of Sarah, a single professional living in a metropolitan area. Her monthly expenses include $1,500 for rent, $300 for utilities, $500 for groceries, and $200 for transportation. Additionally, she has a student loan payment of $400 per month.

Setting a Realistic Goal

Now, Sarah needs to determine how many months' worth of expenses she wants to save. As a general rule, aim for at least three months, but be realistic about your situation.

- Three Months' Expenses: In Sarah's case, three months' worth of expenses would be approximately $7,500. This is a good starting point for her emergency fund.

- Six Months' Expenses: If Sarah wants to be even more prepared, she could aim for six months' worth of expenses, totaling $15,000. This might be a more suitable goal for those with higher expenses or less job security.

- Tailoring to Your Needs: Remember, these are general guidelines. You might need more or less, depending on your circumstances. For instance, freelancers or self-employed individuals may want to save more due to variable income.

Expert Insights

Financial experts suggest that a typical U.S. household should aim for at least $33,000 in emergency savings. This figure can be intimidating, but it's a goal worth striving for, ensuring comprehensive financial security.

Strategies to Build Your Emergency Fund

Now that you have a goal in mind, let's explore effective strategies to reach it.

Make Saving a Habit

Building an emergency fund is a marathon, not a sprint. Focus on developing a consistent saving habit rather than fixating on the total amount.

- Automate Your Savings: Set up automatic transfers from your paycheck or checking account to your savings account. This way, you save effortlessly without even noticing the money is gone. Many employers offer this option, and banks also provide automated transfer services.

- Start Small: You don't need a large sum to begin. Even saving $50 or $100 per paycheck can add up over time. The key is consistency.

- Find a Strategy that Works for You: Experiment with different saving methods. Some people prefer saving a fixed amount each month, while others might save a percentage of their income. Find what suits your financial behavior and stick to it.

Cut Back and Save More

To accelerate your emergency fund growth, consider cutting back on non-essential expenses and redirecting those funds towards savings.

- Identify Discretionary Spending: Review your spending habits and identify areas where you can cut back. This could include dining out less, reducing subscription services, or opting for more affordable entertainment options.

- Set Savings Challenges: Challenge yourself to save a certain amount each month by reducing unnecessary expenses. For example, try the '52-week money challenge,' where you save $1 the first week, $2 the second week, and so on.

- Involve Your Family: If you have a partner or family, involve them in the process. Discuss ways to reduce household expenses and contribute to the emergency fund together.

Boost Your Income

Increasing your income can significantly impact your savings rate. Here's how:

- Side Hustles: Consider taking on a side job or freelance work to supplement your income. This could be anything from driving for a ride-sharing service to selling handmade crafts online.

- Negotiate Salary or Raises: If you feel your current income doesn't reflect your skills and contributions, negotiate a raise with your employer. It can be a powerful way to boost your savings potential.

- Utilize Your Skills: Offer your skills to others as a service. For instance, if you're great at graphic design, offer to create logos or marketing materials for local businesses.

Staying Motivated and Patient

Building an emergency fund is a long-term commitment that requires patience and discipline.

Track Your Progress

Keep yourself motivated by tracking your savings progress. Use a spreadsheet or a budgeting app to monitor your emergency fund growth. Visualizing your savings can provide a sense of accomplishment and encourage you to stay on track.

Celebrate Milestones

Set milestones and celebrate when you reach them. For example, treat yourself to a small reward when you hit the three-month savings mark. Celebrating achievements will make the process more enjoyable and help you stay motivated.

Stay Focused on the Goal

There may be times when you feel discouraged or tempted to dip into your savings. Remind yourself of the purpose of your emergency fund and the financial security it provides. Stay focused on the long-term benefits.

Conclusion: A Secure Financial Future

Building an emergency fund is an essential step towards achieving personal finance security. It's a journey that requires dedication and commitment, but the benefits are invaluable.

Remember, the key is to start small, be consistent, and adapt your strategies as needed. By following the tips outlined in this guide, you'll be well on your way to establishing a robust emergency fund, ensuring you're prepared for life's unexpected twists and turns.

So, take control of your financial future, one step at a time, and watch your emergency fund grow into a powerful financial safety net.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the top movies to watch in 2024. Explore our curated list of must-see films and stay updated on the year's hottest cinematic releases.

Mia Anderson

Discover how influencers' place in the media is changing. Discover how influencers are revolutionizing the marketing landscape and why it is impossible to ignore their impact on consumers. Find out the keys to their worth and success!

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the best premium TV shows streaming right now. Get exclusive recommendations and top picks to enhance your viewing experience. Click to explore!

Mia Anderson

Automotive

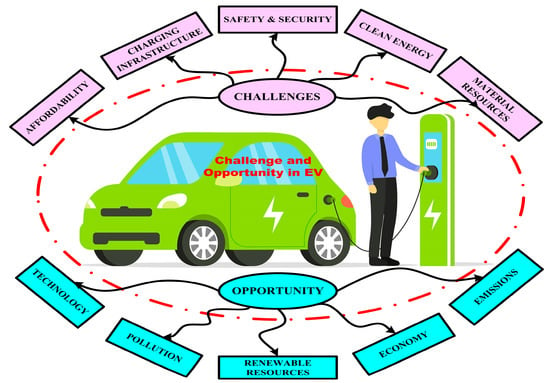

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreCompare the total cost of ownership (TCO) between EVs and internal combustion engine vehicles. Which is more affordable?

Read MoreDiscover how AI applications are transforming EV technology, from autonomous driving to predictive maintenance.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

September 17, 2024

Top Software Development Life Cycle Trends to Watch in 2024

Explore the latest 2024 trends in the Software Development Life Cycle. Learn how AI, MLOps, and cloud innovations are shaping the future. Read now for insights!

August 12, 2024

Small Business, Big Leap: Call Center Software that Scales with You

Elevate your small business with call center software. Discover the top 5 platforms with advanced features like AI bots and omnichannel support to transform your customer experience.

Tips & Trick