How to Automate Your Savings in 3 Simple Steps

Mia Anderson

Photo: How to Automate Your Savings in 3 Simple Steps

Automating your savings is a powerful strategy to build wealth and achieve financial security without the constant effort of manual transfers and calculations. It's an effective way to reach your financial goals, whether it's saving for a dream vacation, a down payment on a house, or a comfortable retirement. In this article, we'll explore a step-by-step process to automate your savings, making it effortless and efficient. Say goodbye to the stress of manual saving and hello to a streamlined financial journey.

The Power of Automated Savings

Saving money is a fundamental aspect of personal finance, but it can often feel like an uphill battle. Traditional methods of saving, such as manual transfers from your checking account to savings or setting aside cash, can be time-consuming and prone to human error. This is where automation comes to the rescue, making the process seamless and effortless.

By automating your savings, you're harnessing the power of technology to work for you. It's like having a personal financial assistant who ensures your money is being allocated efficiently without any extra effort on your part. This approach can significantly improve your financial discipline and help you reach your goals faster.

Step 1: Set Clear Financial Goals

The first step to automating your savings is to define your financial objectives. Start by asking yourself: What do I want to save for? Is it a short-term goal, like an upcoming wedding or a new car, or a long-term dream, such as buying a house or retiring early?

Setting clear goals is crucial because it provides direction and motivation. For example, let's say you want to save for a dream vacation to Hawaii. This goal is specific and exciting, giving you a clear target to work towards. You can calculate the estimated cost of the trip, including flights, accommodation, and activities, to determine the total amount you need to save.

Breaking Down Your Goals

Once you have a clear goal, break it down into smaller, achievable milestones. For the Hawaii trip, you might set monthly savings targets. For instance, if the trip will cost $5,000 and you want to go in 12 months, you'd aim to save $416.67 per month. Breaking down the goal makes it more manageable and allows you to track your progress effectively.

Moreover, consider creating a visual representation of your goals. A savings thermometer or a simple spreadsheet can help you visualize your progress and stay motivated. Each time you reach a milestone, you'll feel a sense of accomplishment, encouraging you to continue.

Step 2: Choose the Right Savings Tools

Now that you have your goals in place, it's time to select the best tools to automate your savings. There are various options available, each with its own benefits:

High-Interest Savings Accounts

Online banks often offer high-interest savings accounts, providing a great way to grow your money while keeping it accessible. These accounts typically offer higher interest rates than traditional brick-and-mortar banks, allowing your savings to compound over time. Look for accounts with no monthly fees and easy access to your funds.

For example, let's say you open a high-interest savings account with an annual percentage yield (APY) of 2%. If you deposit $1,000, after one year, you'll have earned $20 in interest, and your balance will be $1,020. This might not seem like much, but compound interest can significantly boost your savings over the long term.

Certificate of Deposits (CDs)

If you have a long-term savings goal and can afford to lock in your funds for a fixed period, consider Certificates of Deposits (CDs). CDs offer higher interest rates than regular savings accounts, but you must commit to keeping your money in the account for a set term, typically ranging from 3 months to 5 years.

For instance, if you open a 2-year CD with a 3% APY and deposit $5,000, you'll earn $300 in interest over the term, provided you don't withdraw the funds early. CDs are excellent for long-term goals, but ensure you understand the terms and penalties for early withdrawal.

Automated Investment Accounts

For those with a longer investment horizon and a higher risk tolerance, automated investment accounts can be a great choice. These platforms use algorithms to invest your money based on your risk profile and goals. They often offer features like automatic rebalancing and tax-loss harvesting to optimize your investments.

Imagine you set up an automated investment account with a monthly contribution of $200. The platform invests your money in a diversified portfolio of stocks and bonds. Over time, your investments grow, and you benefit from the power of compounding returns. This approach is ideal for long-term goals like retirement or building a substantial nest egg.

Step 3: Set Up Automatic Transfers

With your goals and savings tools in place, it's time to make the magic happen by setting up automatic transfers. This step ensures that your savings are consistent and effortless.

Determine Your Savings Amount

Decide on the amount you want to save regularly. This could be a fixed amount or a percentage of your income. For example, you might choose to save 10% of your monthly salary. If your income varies, consider saving a percentage instead of a fixed sum to maintain consistency.

Schedule Regular Transfers

Most banks and financial institutions offer the option to schedule recurring transfers. Set up automatic transfers from your checking account to your chosen savings or investment accounts. You can choose the frequency, such as weekly, bi-weekly, or monthly, depending on your preferences and income schedule.

For instance, if you get paid bi-weekly, you could set up a transfer for the day after your paycheck arrives. This way, you save a portion of your income before you even see it, making it easier to stick to your savings plan.

Make Use of Round-Up Apps

Consider using innovative apps that round up your purchases to the nearest dollar and save or invest the spare change. These apps connect to your bank account and automatically transfer the rounded-up amounts to a savings or investment account.

Imagine you buy a coffee for $3.75. The app will round up the purchase to $4 and save or invest the extra $0.25. While it may seem small, these micro-savings can add up quickly. Over time, you'll be surprised by how much you've saved without even noticing.

The Benefits of Automated Savings

Automating your savings offers numerous advantages that can significantly impact your financial well-being:

- Consistency: Automatic transfers ensure you save regularly, making it a habit. This consistency is key to achieving your financial goals.

- Effortless Saving: Once set up, you can forget about manual transfers and calculations. Your savings grow without constant reminders or effort.

- Discipline: Automation helps you stick to your savings plan, even during challenging times. It's a powerful way to build financial discipline.

- Time-Saving: No more manual transfers or trips to the bank. Automated savings free up your time for other important tasks or leisure activities.

- Financial Security: By consistently saving, you build a safety net for unexpected expenses and future goals, reducing financial stress.

Overcoming Common Challenges

While automating your savings is a straightforward process, there may be challenges along the way. Here's how to tackle them:

Fluctuating Income

If your income varies, consider saving a percentage of each paycheck rather than a fixed amount. This ensures that you save consistently, even during leaner months. You can also adjust your savings rate as your income changes.

Unexpected Expenses

Life is unpredictable, and emergencies can happen. To prepare for these, build an emergency fund as part of your automated savings plan. Aim to save enough to cover 3-6 months' worth of living expenses. This fund will provide a safety net for unexpected costs.

Temptation to Spend

It's natural to be tempted to spend your hard-earned money. To resist this, keep your savings goals visible and remind yourself of the benefits of saving. Consider setting up separate savings accounts for different goals, making it easier to stay focused.

Real-Life Success Stories

Automated savings have transformed the financial lives of countless individuals. Here's an inspiring story to illustrate the power of this strategy:

Sarah's Journey to Financial Freedom

Sarah, a 30-year-old marketing professional, had always struggled with saving. She wanted to buy a house but found it challenging to set aside money consistently. After learning about automated savings, she decided to give it a try.

Sarah opened a high-interest savings account and set up automatic transfers of 15% of her monthly salary. She also used a round-up app to save her spare change. Within a year, she had saved enough for a down payment on her dream home.

Sarah's story is a testament to the effectiveness of automated savings. By making it a seamless part of her financial routine, she achieved a significant milestone without sacrificing her lifestyle.

Conclusion

Automating your savings is a powerful tool to take control of your financial future. By setting clear goals, choosing the right savings tools, and setting up automatic transfers, you can effortlessly build wealth and achieve your dreams. Remember, consistency and discipline are key to success.

Start small if you need to, but start today. The beauty of automation is that it allows you to save without feeling the pinch. Before you know it, you'll be well on your way to financial freedom, enjoying the fruits of your automated savings strategy.

So, what are you waiting for? Take the first step towards financial security and automate your savings now!

Marketing

View All

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover how superhero movies are influencing today's culture and society. Explore trends, insights, and cultural impact. Click to read more!

Mia Anderson

Discover the top Marvel movies of 2024 that are generating buzz! Unveil must-watch films, explore reviews, and find out why these hits are worth your time.

Mia Anderson

Discover the top superhero movie trends of 2024! Get exclusive insights and predictions that will shape the year’s biggest blockbusters. Click to learn more!

Mia Anderson

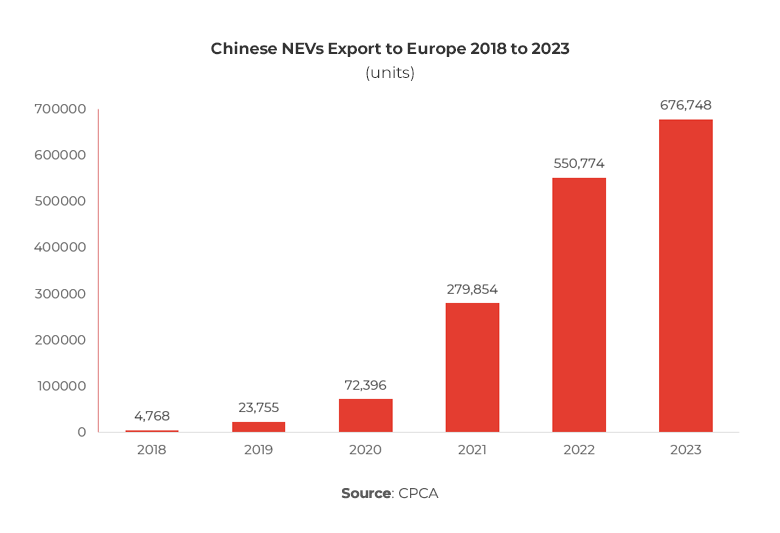

Automotive

View AllLearn about the growing trend of electric two-wheelers and three-wheelers. Why are these vehicles gaining popularity?

Read MoreLearn how import and export tariffs affect EV prices globally and what that means for buyers and manufacturers.

Read MoreLearn how smart city initiatives are seamlessly integrating EV infrastructure to enhance mobility and sustainability.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 9, 2024

The Evolution of Mobile Apps: A Revolutionary Journey

Learn about the amazing development of mobile applications and how they have affected our lives. See how apps took over the globe and molded our future, from the App Store's early days to the newest developments.

August 31, 2024

Boost Your Workflow Efficiency with Robotics Process Automation

Discover how Robotics Process Automation (RPA) can streamline your processes and boost efficiency. Read our expert guide for actionable insights and tips!

September 12, 2024

Top IoT Applications Revolutionizing Industry Today

Discover how top IoT applications are transforming industries. Explore key benefits and advancements in our in-depth analysis. Click to learn more.

Tips & Trick