Home Equity Loans Explained: A Step-By-Step Guide to Unlocking Cash

Mia Anderson

Photo: Home Equity Loans Explained: A Step-By-Step Guide to Unlocking Cash

Have you ever considered tapping into the hidden potential of your home's value? Home equity loans offer an intriguing opportunity for homeowners to access cash by leveraging the equity they've built in their homes. In this comprehensive guide, we'll take a step-by-step journey through the world of home equity loans, demystifying the process and helping you understand how you can unlock the cash you need.

Understanding Home Equity

Before we dive into the loan process, let's start with the basics. Home equity is the portion of your home that you truly own, free and clear of any mortgage or loan obligations. It's the difference between the current market value of your home and the remaining balance on your mortgage. For example, if your home is valued at $300,000 and you have a mortgage of $200,000, your home equity is $100,000.

Home equity is like a savings account that grows over time as you pay down your mortgage and as your home's value increases. It's a valuable asset that can be used as collateral for loans, providing homeowners with a financial resource when they need it.

Step 1: Evaluating Your Equity

The first step in the home equity loan process is to assess how much equity you have available. This can be done through a professional appraisal or by researching recent sales of similar homes in your area. Understanding your home's current market value is essential to determine the amount of equity you can access.

For instance, let's say Sarah and John bought their home for $250,000 five years ago. After making regular mortgage payments and with the housing market on the rise, they estimate their home's current value to be around $320,000. With a remaining mortgage of $180,000, their home equity is approximately $140,000. This substantial equity can be a powerful financial tool.

Step 2: Choosing the Right Loan Type

Home equity loans come in various forms, each with its own advantages and considerations. The two most common types are:

- Home Equity Loan (HEL): This is a fixed-rate loan where you receive a lump sum of cash upfront. It's sometimes referred to as a second mortgage as it's a separate loan in addition to your primary mortgage. HELs typically have fixed interest rates and a set repayment period, making budgeting and planning easier.

- Home Equity Line of Credit (HELOC): A HELOC is a revolving line of credit that allows you to borrow money as needed, up to a certain limit. It functions like a credit card, where you can borrow, repay, and borrow again during the draw period. HELOCs often have variable interest rates, which can fluctuate over time.

The choice between a HEL and HELOC depends on your financial goals and preferences. HELs are ideal for one-time expenses with a fixed cost, while HELOCs offer flexibility for ongoing projects or expenses.

Step 3: Applying for the Loan

Once you've decided on the loan type, it's time to apply. The application process is similar to a traditional mortgage application and typically involves the following steps:

- Loan Application: You'll need to fill out a loan application form, providing details about your income, assets, and debts. Be prepared to disclose information about your employment, bank accounts, and other financial obligations.

- Appraisal: Lenders often require a professional appraisal to determine the current market value of your home. This ensures that the loan amount is in line with the actual value of your property.

- Documentation: Gather all necessary documents, such as tax returns, pay stubs, and bank statements. These documents help lenders assess your financial health and ability to repay the loan.

- Credit Check: Lenders will review your credit history and score to evaluate your creditworthiness. A good credit score can lead to more favorable loan terms and interest rates.

Step 4: Understanding Loan Terms and Costs

After your application is approved, it's crucial to understand the loan terms and associated costs. Home equity loans often come with closing costs, which may include appraisal fees, origination fees, and other charges. These costs can vary depending on the lender and the loan amount.

Additionally, pay close attention to the interest rate and repayment terms. Home equity loans typically have lower interest rates compared to credit cards or personal loans, but it's essential to ensure the payments fit within your budget.

Real-Life Scenario:

Let's revisit Sarah and John. They decide to go with a Home Equity Loan to fund their home renovation project. After a successful application process, they secure a loan of $50,000 with a fixed interest rate of 5% and a 15-year repayment term. With this loan, they can finally transform their outdated kitchen into a modern, functional space.

Conclusion:

Home equity loans provide homeowners with a financial tool to unlock the value of their homes. By following these steps, you can navigate the process with confidence, ensuring you make informed decisions. Whether it's for home improvements, debt consolidation, or other financial goals, home equity loans offer a way to leverage your home's value and achieve your dreams.

Remember, it's crucial to assess your financial situation, understand the loan terms, and seek professional advice if needed. With careful planning and a clear understanding of home equity loans, you can make the most of this valuable financial resource.

Marketing

View All

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the best streaming services for 2024 and find your next favorite show. Read now for expert recommendations and start streaming today!

Mia Anderson

Discover the future of OTT platforms in 2024. Learn how they're reshaping media consumption globally. Click here to stay ahead in the streaming revolution!

Mia Anderson

Discover the ultimate 2024 guide to becoming a successful influencer. Learn strategies, tips, and trends. Start your influencer journey now click to begin!

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

Automotive

View AllLearn about the top platforms for selling your car efficiently. Compare options and make the best choice!

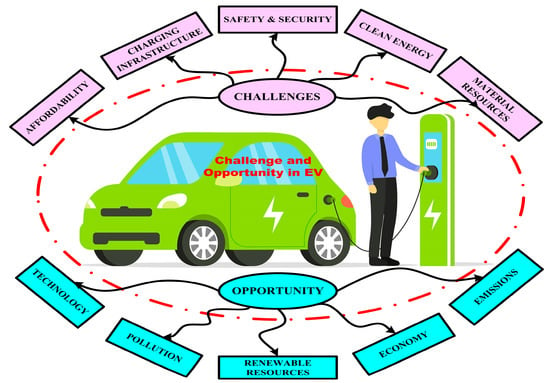

Read MoreLearn how rising fuel prices are making EVs a more attractive option. See why EV adoption is soaring in 2024.

Read MoreExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MorePolular🔥

View All

1

2

4

5

6

7

8

9

10

News

View AllAugust 7, 2024

2024 Presidential Candidates: The Ultimate Guide to the Upcoming US Election

Read MoreTechnology

View All

December 15, 2024

Best Home Tech Deals You Can’t Miss in 2024 – Shop Now Before They’re Gone

Don't miss out on incredible home tech deals! Click to explore limited-time offers and upgrade your home tech setup.

December 6, 2024

How to Choose the Right Smartwatch for Your Fitness Goals in 2024

Find the perfect smartwatch to track your fitness journey! Our guide helps you select the ideal companion. Click to learn more and get motivated.

August 9, 2024

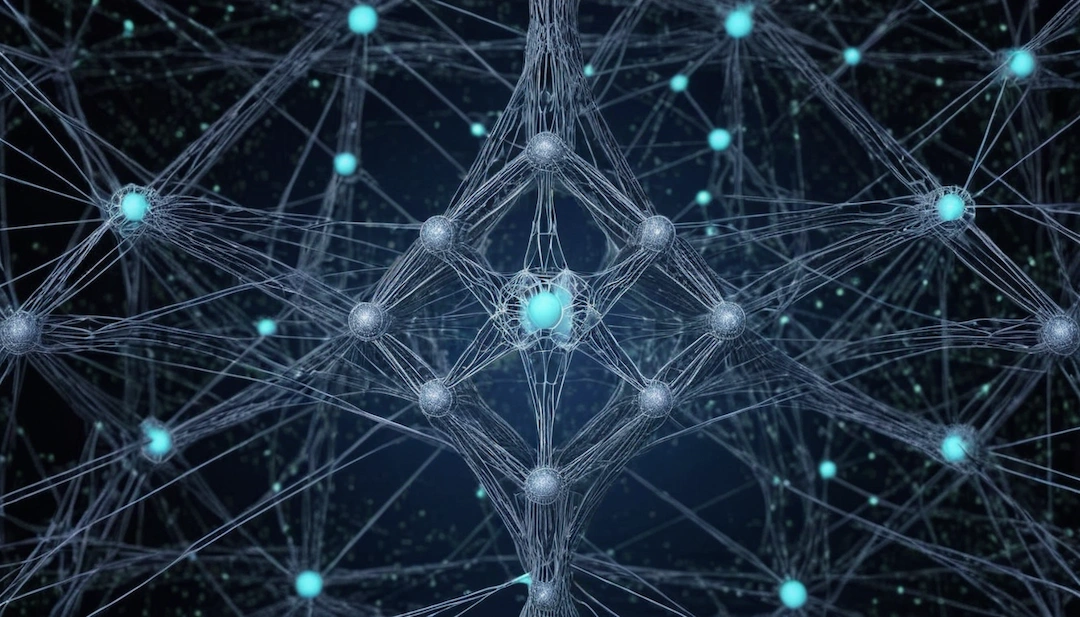

Unveiling the Power of Neural Network Architecture: A Beginner's Guide

Discover the countless possibilities of Neural Network Architecture—a fascinating field! Discover uses of this technology in your daily life and business as you learn how it simulates the functioning of the human brain.

Tips & Trick