10 Surprising Ways to Boost Your Financial Stability in 2024

Mia Anderson

Photo: 10 Surprising Ways to Boost Your Financial Stability in 2024

In the ever-evolving landscape of personal finance, achieving stability is a quest many embark upon. As we step into 2024, it's time to explore unconventional yet effective strategies to bolster your financial resilience. This article delves into a collection of surprising methods, backed by insights from recent financial trends, to help you navigate the path to financial stability with confidence.

Understanding the Financial Stability Landscape

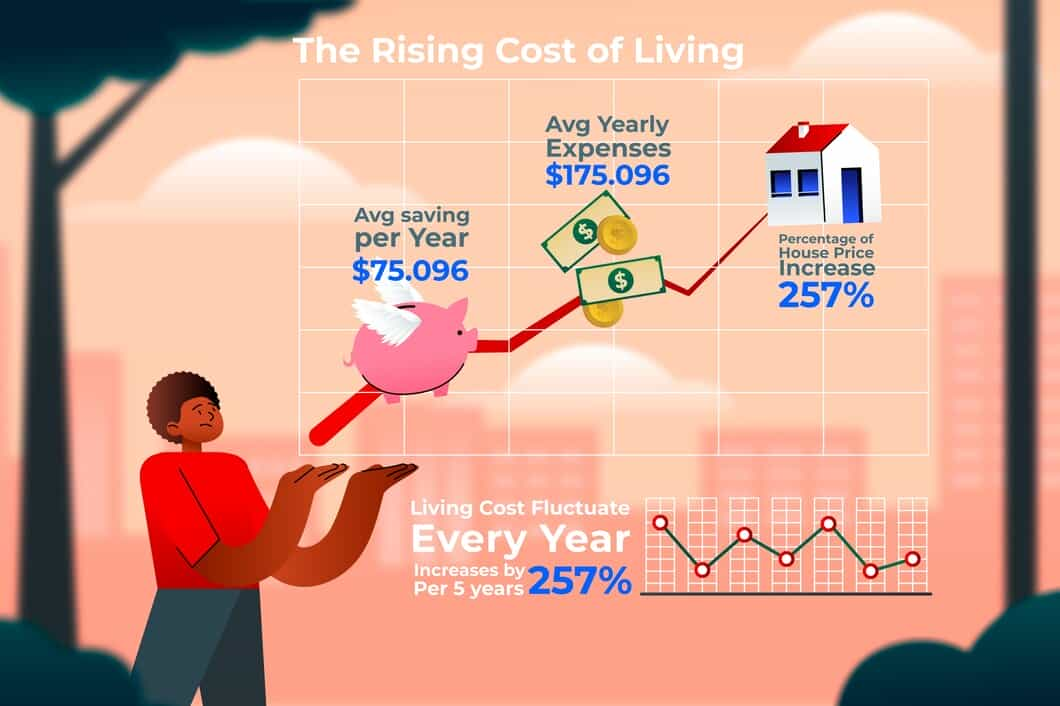

Financial stability, a cornerstone of personal finance, is not merely about accumulating wealth but also about building resilience against economic uncertainties. In recent years, the global financial system has witnessed shifts, with markets adjusting to monetary policy changes and addressing risks associated with market concentration. These developments highlight the importance of proactive money management and strategic financial planning.

Key Trends in Financial Stability:

- Medium-Term Growth Prospects: Economic activity is projected to gain momentum in the coming years, driven by robust labor markets and recovering household incomes.

- Geopolitical Risks: While recession risks have decreased, geopolitical tensions pose emerging challenges, emphasizing the need for adaptive financial strategies.

- Monetary Policy Shift: The era of negative interest rates is transitioning, potentially offering long-term benefits for financial system stability.

- Asset Price Vulnerability: Benign risk pricing makes asset prices susceptible to shocks, underscoring the importance of diversified investment approaches.

10 Surprising Strategies for Financial Stability in 2024

1. Embrace the Power of Automation

In today's digital age, automation is your ally in the quest for financial stability. Consider setting up automated savings plans, where a predetermined amount is transferred from your checking account to savings or investment accounts regularly. This strategy, often referred to as "paying yourself first," ensures consistent savings and removes the temptation to spend impulsively. For instance, if you allocate 10% of your monthly income to a high-yield savings account, you'll accumulate a substantial emergency fund over time, providing a safety net for unexpected expenses.

2. Diversify Your Income Streams

Relying solely on a single source of income can be a financial risk. Diversifying your income streams is a powerful way to enhance stability. Explore side hustles, freelance work, or passive income opportunities. For instance, if you have a passion for photography, consider selling your photos online or offering your services for events. This not only boosts your overall income but also provides a safety net if your primary source of income faces challenges.

3. Master the Art of Negotiation

Negotiation is a valuable skill that can significantly impact your financial well-being. Whether it's negotiating a higher salary, better benefits, or lower interest rates on loans, effective negotiation can lead to substantial financial gains. For example, successfully negotiating a 10% salary increase can translate to thousands of dollars in additional income annually. Practice your negotiation skills, and don't be afraid to ask for what you deserve.

4. Embrace Frugal Living (But Not at the Expense of Enjoyment)

Frugality is often associated with financial stability, but it doesn't mean sacrificing all life's pleasures. Embrace a mindful approach to spending, focusing on experiences and values that bring genuine happiness. For instance, instead of frequent restaurant dining, host potluck dinners with friends, creating memorable experiences while saving money. The key is to find a balance between saving and enjoying life, ensuring that financial stability doesn't come at the cost of personal fulfillment.

5. Invest in Education and Skills

Investing in yourself is one of the most rewarding financial moves you can make. Continuous learning and skill development can lead to career advancement, higher earning potential, and increased financial security. Consider online courses, certifications, or workshops to enhance your professional skills. For instance, acquiring digital marketing skills can open doors to freelance opportunities, allowing you to diversify your income and build financial stability.

6. Build a Supportive Financial Community

Financial stability is not a solo journey. Surround yourself with like-minded individuals who share your financial goals. Join or create a financial accountability group where members support each other in achieving financial milestones. These communities provide a wealth of knowledge, motivation, and accountability. For example, a group member's success story about paying off debt can inspire and guide others facing similar challenges.

7. Make Your Money Work Harder

Maximizing the potential of your money is crucial for financial stability. Explore investment opportunities beyond traditional savings accounts. Consider investing in stocks, bonds, or real estate, but ensure you understand the risks involved. Diversifying your investment portfolio can help mitigate risks and potentially generate higher returns over time. For instance, investing in a well-diversified index fund can provide a solid foundation for long-term wealth accumulation.

8. Embrace Financial Technology (FinTech) Innovations

The rise of FinTech has revolutionized personal finance. Utilize financial apps and tools to streamline your money management. These technologies offer budgeting assistance, automated savings, and investment guidance. For instance, budgeting apps can help you track expenses, identify areas for savings, and set achievable financial goals. Embracing FinTech can make managing your finances more efficient and effective.

9. Prioritize Debt Management

Debt can be a significant obstacle to financial stability. Develop a strategic plan to manage and reduce debt. Focus on high-interest debt first, as it accumulates faster. Consider debt consolidation or refinancing options to lower interest rates and make repayment more manageable. For example, transferring credit card balances to a low-interest loan can save you money and help you become debt-free faster.

10. Regularly Review and Adjust Your Financial Plan

Financial stability is an ongoing process that requires regular evaluation. Set aside time to review your financial goals, assess your progress, and make adjustments as needed. Life circumstances and economic conditions can change, so staying adaptable is crucial. For instance, if you receive a promotion and salary increase, revisit your savings and investment strategies to maximize the additional income.

Conclusion: Empowering Your Financial Journey

Achieving financial stability is a journey that requires a combination of strategic planning, adaptability, and a proactive mindset. By embracing these surprising strategies, you can navigate the financial landscape of 2024 with confidence and resilience. Remember, financial stability is not just about numbers; it's about building a secure foundation for your future and achieving your personal goals.

As you embark on this financial journey, stay informed, be open to new ideas, and seek opportunities to enhance your financial literacy. The path to financial stability is unique for each individual, and these strategies provide a roadmap to help you tailor your approach to your specific needs and circumstances.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

Entertainment

View AllDiscover how superhero movies are influencing today's culture and society. Explore trends, insights, and cultural impact. Click to read more!

Mia Anderson

Discover the intriguing realm of celebrity culture and how it affects society. Learn about the possible effects of our infatuation and how celebrities turn their notoriety into brands. An must read for everybody curious about the contemporary celebrity phenomena.

Mia Anderson

Unlock the secrets of social media marketing for artists in 2024. Learn strategies to grow your online presence and monetize your art. Start your journey today!

Mia Anderson

Having trouble deciding between Netflix and Disney+? Consider the advantages and disadvantages of each streaming service to help you choose the best one for your needs.

Mia Anderson

Automotive

View AllUncover why Dealer Daily is revolutionizing the auto industry. Gain a competitive edge with these powerful strategies.

Read MoreForecast the EV market of 2030. Learn about expected growth rates, market penetration, and the rise of EV ownership globally.

Read MoreFind out about the latest tax incentives and rebates available for EV buyers in 2024. Save money on your next purchase!

Read MorePolular🔥

View All

1

2

4

5

7

8

9

10

Technology

View All

December 13, 2024

Should You Upgrade to a Smart Home? 6 Reasons to Start Today

Upgrade your home with smart tech! Learn 6 compelling reasons to embrace the future. Click to explore and transform your living space.

September 15, 2024

Tips for Securing Your IoT Devices in 2024

Discover the latest strategies for securing IoT devices in 2024. Learn practical tips to protect your smart tech and enhance your digital safety.

December 18, 2024

Upgrade Your Streaming Experience: The Best 4K TVs to Buy in 2024

Elevate your streaming with the top 4K TVs of 2024! Click to discover the ultimate viewing experience and choose the right one.

Tips & Trick