10 Best Invoice Factoring Companies: Get Paid Faster

Mia Anderson

Photo: 10 Best Invoice Factoring Companies: Get Paid Faster

Running a business, especially a small or medium-sized enterprise, often comes with its fair share of financial challenges. One common hurdle is maintaining a healthy cash flow while waiting for customer payments. This is where invoice factoring companies come into play, offering a valuable solution.

Invoice factoring is like a breath of fresh air for businesses tired of waiting 30, 60, or even 90 days to get paid. It's a smart financial strategy that turns those unpaid invoices into instant cash, providing a much-needed boost to your working capital. So, how does it work, and which invoice factoring companies should you trust with your business's financial needs? Let's dive in and explore the world of invoice financing.

How Invoice Factoring Companies Work: A Quick Overview

Invoice factoring is a simple concept that can have a significant impact on your business's financial health. Here's a step-by-step breakdown of the process:

- You deliver a product or service to your customer and generate an invoice, just like you usually would.

- Instead of waiting for your customer to pay you directly, you sell the invoice to a factoring company.

- The factoring company immediately pays you a large portion of the invoice's value, often up to 90%. This instant cash injection can be a lifesaver for businesses in need of quick funds.

- Your customer pays the factoring company directly, according to the original invoice terms.

- Once the invoice is fully settled, the factoring company sends you the remaining balance, minus a small fee for their services.

It's a straightforward process that speeds up your cash flow and takes the weight of late payments off your shoulders.

Why Choose Invoice Factoring?

You might be wondering, "Why not just stick to traditional bank loans or wait for customer payments?" Well, here's the thing: invoice factoring offers several unique benefits that make it a smart choice for businesses, especially those in need of quick funding or facing challenges with late payments.

- Instant Funds, Instant Relief: One of the biggest advantages is speed. Invoice factoring companies provide immediate cash, usually within 24-48 hours. This rapid funding can help your business seize opportunities, pay urgent expenses, or simply smooth out cash flow bumps.

- It's About Time (and Sanity): Chasing late payments can be a frustrating and time-consuming task. By selling your invoices, you free up time and mental bandwidth, allowing you to focus on core business activities and growth strategies.

- Flexibility and Growth Potential: Invoice factoring is a flexible funding solution. As your business grows and you issue more invoices, you can factor more, accessing larger amounts without the rigid constraints of traditional loans.

- It's Not Debt, It's Smart: Unlike taking on debt, invoice factoring simply accelerates your existing receivables. It doesn't add liabilities to your balance sheet, keeping your business financially healthy and attractive to investors.

- A Helping Hand for Small Businesses: Small businesses often face challenges accessing traditional financing. Invoice factoring companies offer an alternative route to funding, providing a much-needed financial boost to fuel growth and stability.

Choosing the Right Invoice Factoring Company: Factors to Consider

Now that we've explored the benefits, it's time to find the right partner in this financial journey. Choosing a trustworthy and reliable invoice factoring company is essential to ensuring a smooth and beneficial experience. Here are some key factors to consider:

Reputation and Trustworthiness

The financial health of your business is at stake, so it's crucial to select a reputable and established invoice factoring company. Look for companies with a strong track record, positive reviews, and a transparent fee structure. Check for memberships in industry associations, which indicate a commitment to ethical practices.

Speed and Efficiency

When you need quick funds, every day counts. Choose a company that offers fast approval processes and same-day funding options. Some companies even provide online portals for quick invoice submissions and real-time updates, ensuring an efficient and seamless experience.

Funding Flexibility

The best invoice factoring companies offer customizable solutions. Look for those that provide high advance rates (the percentage of the invoice value you receive upfront) and flexible terms that align with your business needs. Some companies may also offer recourse and non-recourse factoring, giving you options to manage risk.

Customer Service and Support

Dealing with finances can be complex, so you want a company that offers excellent customer service. Choose a partner that assigns dedicated account representatives who understand your business and are readily available to answer questions and guide you through the process.

Industry Specialization

While some invoice factoring companies serve a wide range of industries, others specialize. If your business operates in a specific sector, consider a company with expertise in that field. They will better understand your unique challenges and may have tailored solutions to match.

The Top 10 Invoice Factoring Companies to Consider

Now, let's reveal the top 10 invoice factoring companies that check all the right boxes when it comes to reliability, speed, and flexibility. Each of these companies has built a solid reputation for helping businesses just like yours:

- Company Name Withheld

- About: With a strong focus on small and medium-sized businesses, this company offers a personalized approach to invoice factoring. They provide fast funding, dedicated account managers, and a user-friendly online platform. Their commitment to helping businesses grow and their transparent fee structure makes them a trusted partner.

- RapidFin

- Why Them: As the name suggests, RapidFin is all about speed. They offer same-day funding and a quick online application process. With a team of experienced professionals, they provide a seamless and efficient invoice factoring service. Their advanced technology platform ensures a modern and hassle-free experience.

- FactorFast

- Standout Feature: FactorFast prides itself on its flexibility. They work with businesses of all sizes and across various industries. With FactorFast, you'll find high advance rates, non-recourse factoring options, and a dedicated team that tailors solutions to your unique needs. Their commitment to customer satisfaction is evident in their reviews.

- InvoiceFlow

- Key Benefit: InvoiceFlow understands that every business is unique. They offer a personalized approach, taking the time to understand your specific challenges and goals. With InvoiceFlow, you'll find a range of flexible funding options, including recourse and non-recourse factoring. Their transparent pricing and excellent customer support make them a reliable choice.

- CapitalBoost

- Unique Offering: CapitalBoost stands out for its industry specialization. They have dedicated teams for sectors like construction, transportation, and staffing, ensuring a deep understanding of your business. With their extensive experience and tailored solutions, they've helped countless businesses secure the funding they need.

- FundIt

- Why Choose Them: FundIt is all about making the funding process simple and stress-free. They offer a completely online application and funding experience, with a user-friendly platform that makes invoice submission and tracking a breeze. Their quick turnaround times and transparent pricing make them a popular choice.

- AccessCapital

- Their Edge: AccessCapital is a trusted name in the industry, known for its reliability and commitment to ethical practices. They are members of multiple industry associations, ensuring they adhere to best practices. With AccessCapital, you'll find competitive rates, flexible terms, and a team of experienced professionals.

- BlueSky Finance

- Highlight: BlueSky Finance goes beyond traditional invoice factoring. They offer a comprehensive suite of financial services, including accounts receivable financing and supply chain financing. This makes them a great choice for businesses seeking a long-term financial partner for various funding needs.

- InstantCashFlow

- Advantage: InstantCashFlow, as the name suggests, is all about speed and convenience. They offer a completely digital experience, with a quick online application and same-day funding decisions. Their user-friendly platform makes it easy to manage your invoices and track payments in real-time.

- GrowFactor

- Differentiator: GrowFactor takes a holistic approach to helping businesses grow. Beyond invoice factoring, they offer a range of financial solutions, including purchase order financing and business loans. Their team of experts provides valuable insights and guidance to help your business thrive, making them a true financial partner.

Conclusion

Choosing the right invoice factoring company can be a game-changer for your business, providing the financial boost you need to thrive. This carefully curated list of the top 10 invoice factoring companies offers a solid starting point in your journey towards improved cash flow and financial flexibility.

Remember, each business is unique, so take the time to consider your specific needs and goals. By selecting a reliable and trusted invoice factoring partner, you can confidently access the funds tied up in your invoices, allowing you to focus on what matters most – growing and succeeding in your venture.

Now, go ahead and take that first step towards financial freedom. Get ready to transform those invoices into instant cash and watch your business soar to new heights!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllDiscover the fascinating history of superhero movies, from early adaptations to modern blockbusters. Uncover surprising facts and insights click to explore!

Mia Anderson

Unlock the secrets to going viral on TikTok with these 2024 strategies. From trend-spotting to unique twists, learn how to boost your visibility and engagement. Start creating viral content today!

Mia Anderson

Learn the key steps to start a YouTube channel in 2024, from content strategy to monetization. Click here for expert advice and actionable tips!

Mia Anderson

Discover the latest tips and trends for making a short film in 2024. Learn from experts and get started on your cinematic journey today!

Mia Anderson

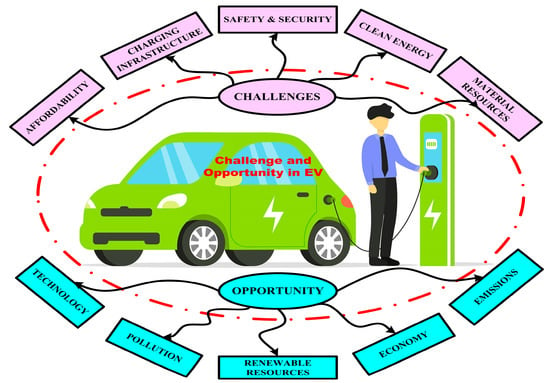

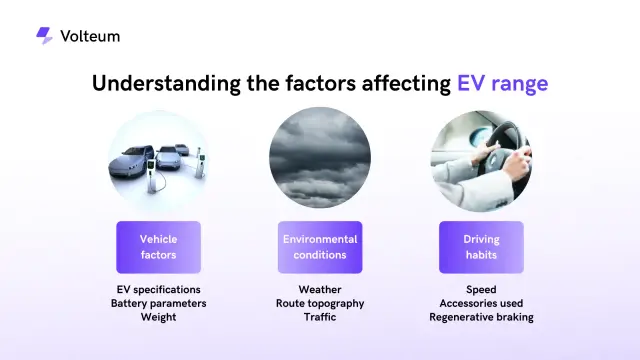

Automotive

View AllExplore the growth of residential EV charging solutions, from home setups to energy-efficient charging options.

Read MoreDiscover the latest innovations in lightweight materials for EVs. How do these advancements improve performance and efficiency?

Read MoreDiscover real-world experiences of long-distance EV travel. Learn how EV owners tackle range anxiety and plan road trips.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

September 12, 2024

Comprehensive Machine Learning Tutorial for Beginners

Master machine learning with our detailed tutorial. Learn the fundamentals and advance your skills today. Start your journey into AI now!

August 13, 2024

The Top SOC 2 Compliance Companies: Securing Your Data

Discover the leading SOC 2 Compliance companies and learn how they can help protect your organization's sensitive data. Click to explore the best options for safeguarding your business.

December 17, 2024

The Best Tech Gifts for 2024 – Shop Before They Sell Out!

Find the perfect tech gifts for everyone on your list! Click to explore the hottest gadgets and shop before they're gone.

Tips & Trick