Unlocking Cash Flow for Staffing Agencies: The Power of Invoice Factoring

Mia Anderson

Photo: Unlocking Cash Flow for Staffing Agencies: The Power of Invoice Factoring

Staffing agencies play a critical role in connecting talented individuals with businesses in need of their skills. However, one of the biggest challenges these agencies face is maintaining a healthy cash flow, especially when clients have lengthy payment terms. This is where invoice factoring comes into play, offering a powerful solution to unlock much-needed funds and stabilize operations.

In this comprehensive guide, we will explore the world of invoice factoring for staffing companies, shedding light on how it works, its immense benefits, and why it has become an increasingly popular financing option. By the end, you will understand how this innovative approach can transform your agency's financial health and overall growth trajectory.

What is Invoice Factoring for Staffing Companies?

Invoice factoring is a form of short-term financing that provides staffing agencies with rapid access to working capital. It is specifically designed to address the challenges faced by staffing companies that rely heavily on timely client invoice payments to meet their weekly or bi-weekly payroll obligations.

Here's a simple analogy to understand the concept: imagine your staffing agency as a garden, and invoice factoring as a watering can. When you water the plants in your garden, they thrive and grow, just as your agency flourishes when invoices are paid on time. But what happens when those invoices are delayed? That's where the watering can, or invoice factoring, comes to the rescue, providing the much-needed liquidity to keep your garden vibrant and healthy.

In the context of staffing agencies, invoice factoring involves selling your agency's outstanding invoices to a specialized factoring company. This company then provides an advance on the value of those invoices, typically within 24-48 hours, allowing you to meet immediate financial obligations, such as payroll.

How Does Invoice Factoring Work?

The process of invoice factoring is straightforward and efficient. Here's a step-by-step breakdown to illustrate how it works:

Step 1: You Submit Invoices

When you partner with a factoring company, you submit the invoices your staffing agency has issued to its clients. These invoices represent the money owed to your agency for the services provided, such as placing temporary or permanent staff in various roles.

Step 2: Advance Payment

Upon receiving your invoices, the factoring company will typically advance you a significant percentage (usually around 90-95%) of the total invoice value. This advance is deposited into your account promptly, often within a day or two. This immediate access to funds ensures that you can meet payroll demands and other financial commitments without delay.

Step 3: The Factoring Company Collects Payment

Once the advance has been made, the responsibility for collecting payment on those invoices shifts to the factoring company. They will follow up with your clients to ensure timely payment, just as your agency would have done otherwise. This step frees up your time and resources, allowing you to focus on core business activities.

Step 4: Remaining Funds Released

After the factoring company has received full payment from your clients, they will release the remaining percentage of the invoice value to you, minus a small fee for their services. This fee is typically a small percentage of the total invoice amount and varies depending on the factoring company and the terms of your agreement.

Why is Invoice Factoring Beneficial for Staffing Agencies?

Invoice factoring offers a multitude of advantages for staffing agencies, especially those that struggle with inconsistent cash flow due to delayed client payments. Here are some key benefits:

Improved Cash Flow

The most significant advantage of invoice factoring is its ability to enhance your agency's cash flow. By providing immediate access to funds, you no longer have to worry about covering payroll or other expenses while awaiting client payments. This stability allows you to run your business with confidence and pursue growth opportunities.

Quick Setup and Streamlined Process

Many funding companies for staffing agencies have cumbersome, manual processes that slow down funding. However, invoice factoring companies utilize technology to streamline and speed up the entire process. This means you can set up invoice factoring quickly and start enjoying the benefits without unnecessary delays.

Flexibility and Growth Potential

Invoice factoring provides the flexibility to scale your funding alongside your business. As your staffing agency grows and takes on more clients, you can factor more invoices to access higher levels of funding. This flexibility ensures that you always have the necessary capital to support your operations and expansion plans.

Reduced Administrative Burden

When you engage in invoice factoring, the responsibility for collecting payments shifts to the factoring company. This significantly reduces the administrative burden on your agency, freeing up time and resources that can be redirected towards more strategic activities, such as business development and client relationship management.

Access to Expertise

Factoring companies bring a wealth of expertise in accounts receivable management and debt collection. They employ skilled professionals who understand the intricacies of invoice collection and can navigate potential challenges effectively. This means you benefit from their specialized knowledge and experience in ensuring timely payments.

Real-World Example: A Snapshot

To illustrate how invoice factoring can work in practice, let's consider a hypothetical example of a staffing agency called "Talent Scouters."

Talent Scouters provides temporary administrative and customer service staff to various companies. Their clients typically pay invoices within 30 days, but Talent Scouters must meet payroll obligations every two weeks. To bridge this gap, they decide to partner with a factoring company, "Fast Funding Solutions."

Here's how the process unfolds:

- Talent Scouters sends invoices totaling $200,000 to Fast Funding Solutions.

- Fast Funding Solutions applies a 2% discount and purchases the invoices for $196,000.

- They advance Talent Scouters 95% of the purchase amount, wiring $186,200 into their account within 48 hours.

- Talent Scouters uses these funds to cover their upcoming payroll, ensuring their temporary staff receive their wages on time.

- The remaining $9,800 is held in a reserve account by Fast Funding Solutions until the clients pay their invoices.

In this scenario, invoice factoring ensures that Talent Scouters can meet their payroll commitments without worrying about late client payments. It provides a quick and efficient solution to a common challenge faced by staffing agencies, demonstrating the power of invoice factoring in action.

Best Practices for Engaging with Factoring Companies

When considering invoice factoring for your staffing agency, it's important to approach this financial partnership with care and attention to detail. Here are some best practices to keep in mind:

Research and Compare Factoring Companies

Take the time to research and compare multiple factoring companies. Look for companies with a strong reputation in the industry, competitive rates, and a track record of successful partnerships with staffing agencies. Review their terms, fees, and the level of customer support they offer.

Understand the Fees and Discounts

Invoice factoring companies typically charge a percentage of the total invoice value as their fee. This is often referred to as a "discount." Make sure you understand this fee structure and any other associated costs to ensure there are no surprises. Compare the discount rates offered by different companies to find the most competitive option.

Ensure a Good Fit for Your Agency

Not all factoring companies are created equal. Some may specialize in certain industries or have specific requirements that might not align with your agency's needs. Look for a company that understands the unique challenges and dynamics of the staffing industry and can offer tailored solutions.

Review the Contract Carefully

Before entering into a factoring agreement, carefully review the contract. Pay close attention to the terms and conditions, including the fees, payment timelines, and any restrictions or obligations. It's always a good idea to have a legal professional review the contract to ensure your agency's interests are protected.

Maintain Transparent Communication

Open and transparent communication is key to a successful partnership with a factoring company. Be clear about your agency's financial situation, the nature of your clients, and any potential challenges you foresee. This will help the factoring company understand your needs and tailor their services accordingly.

Conclusion

Invoice factoring is a powerful tool for staffing agencies to unlock their financial potential and stabilize their operations. By leveraging this innovative financing solution, agencies can transform their cash flow, meet obligations, and pursue growth strategies.

Throughout this guide, we have explored the ins and outs of invoice factoring, highlighting its benefits and providing a step-by-step understanding of the process. With this knowledge, staffing agency owners and decision-makers can make informed choices to secure their agency's financial health and future.

Remember, timely invoice payments are the lifeblood of your business, and invoice factoring ensures that late payments no longer hinder your success. Embrace the power of invoice factoring, and unlock the door to a thriving, prosperous staffing agency.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

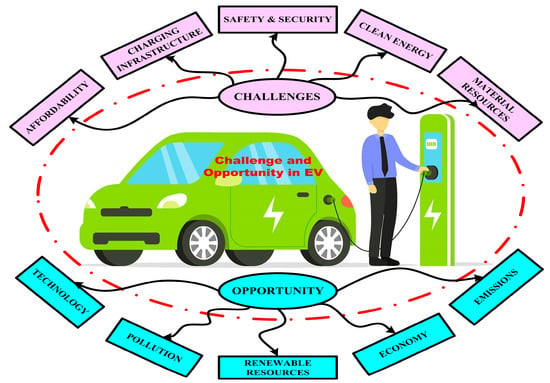

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick