How to Build an Emergency Fund on Any Income

Mia Anderson

Photo: How to Build an Emergency Fund on Any Income

Life is full of unexpected twists and turns, and having a financial safety net can make all the difference when emergencies arise. Building an emergency fund is a crucial step towards achieving financial stability and peace of mind. No matter the size of your paycheck, having a dedicated fund for unforeseen expenses is essential. In this article, we'll explore practical strategies on how anyone, regardless of their income level, can start and grow their emergency fund, ensuring they're prepared for whatever life throws their way.

Understanding the Importance of an Emergency Fund

An emergency fund is a personal financial safety net, a reservoir of money set aside to cover unforeseen expenses and unexpected financial challenges. These emergencies could range from sudden medical bills, car repairs, home maintenance issues, or even temporary job loss. Without an emergency fund, these situations can quickly spiral into a financial crisis, leading to debt and long-term financial strain.

For instance, imagine your car breaks down unexpectedly, and the repair costs amount to a significant sum. If you don't have an emergency fund, you might resort to high-interest credit cards or loans to cover the expense, adding financial stress and potential long-term debt. However, with a well-prepared emergency fund, you can handle such situations with confidence, knowing you have the resources to manage these unforeseen events.

Strategies to Build an Emergency Fund on Any Income

1. Set Realistic Goals

The first step to building an emergency fund is setting a realistic savings goal. A common rule of thumb is to aim for three to six months' worth of living expenses. However, this can seem daunting, especially for those with lower incomes. Start small and set an initial goal of saving $500 or one month's rent, for example. As you achieve these smaller milestones, you'll gain momentum and confidence to increase your savings target.

2. Create a Budget and Track Expenses

Understanding your financial situation is key to building an emergency fund. Create a detailed budget that outlines your income, fixed expenses (rent, utilities, insurance), variable expenses (groceries, entertainment), and discretionary spending. Tracking your expenses for a month will reveal areas where you can cut back and redirect funds towards savings.

For instance, you might realize that dining out less frequently or reducing subscription services can free up a significant amount each month for your emergency fund. Personal finance apps can be a great tool to help you track expenses and identify areas for improvement.

3. Automate Your Savings

One of the most effective ways to save is to make it automatic. Set up a regular transfer from your checking account to a dedicated savings account for your emergency fund. Many banks offer the option to automate this process, ensuring that a portion of your income is consistently saved without any effort on your part.

Consider setting up the transfer to occur right after your paycheck is deposited. This way, you'll save first and adjust your spending accordingly, making it easier to stick to your budget.

4. Increase Your Income

Boosting your income can significantly accelerate your emergency fund savings. Consider ways to earn extra money, such as taking on a side hustle, freelancing, or selling unwanted items online. These additional income streams can provide a substantial boost to your savings, especially if you allocate a portion of this extra income directly to your emergency fund.

For example, if you're skilled in graphic design, offering your services online can bring in extra cash. Or, if you have a spare room, renting it out on a short-term basis can provide a steady income stream.

5. Minimize Unnecessary Expenses

Review your budget and identify areas where you can cut back. Small adjustments can add up over time. For instance, reducing your daily coffee shop visits or packing your lunch instead of eating out can save a considerable amount each month. Consider negotiating your bills, such as insurance premiums or cable subscriptions, to get a better deal.

A personal story: I realized I was spending a significant amount on gym memberships I rarely used. By canceling these memberships and working out at home or outdoors, I saved over $500 annually, which went straight into my emergency fund.

6. Save Windfalls and Bonuses

Unexpected financial gains, such as tax refunds, work bonuses, or gifts, can provide a significant boost to your emergency fund. Instead of viewing these windfalls as extra spending money, consider allocating a portion or even the entire amount to your savings. This strategy can help you reach your savings goals faster and build a robust emergency fund.

Conclusion

Building an emergency fund is a journey that requires discipline, planning, and a commitment to financial security. By setting realistic goals, creating a budget, automating savings, and exploring ways to increase your income, you can steadily grow your emergency fund. Remember, the key is consistency and making saving a habit.

Start small, and as your fund grows, you'll gain financial confidence and resilience. An emergency fund is not just about saving money it's about securing your financial future and ensuring you're prepared for life's unexpected turns. Take control of your finances today and build a safety net that will provide peace of mind for tomorrow.

With these strategies, anyone can begin their emergency fund journey, no matter their income level, and take a significant step towards financial stability.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

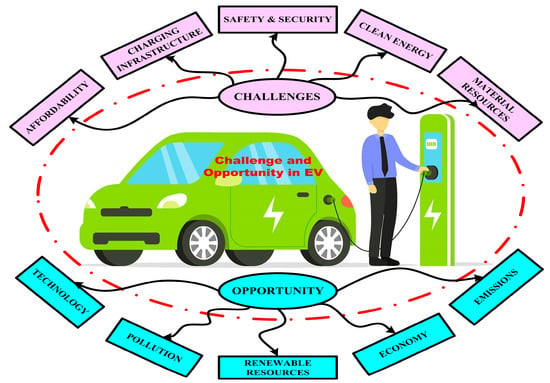

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

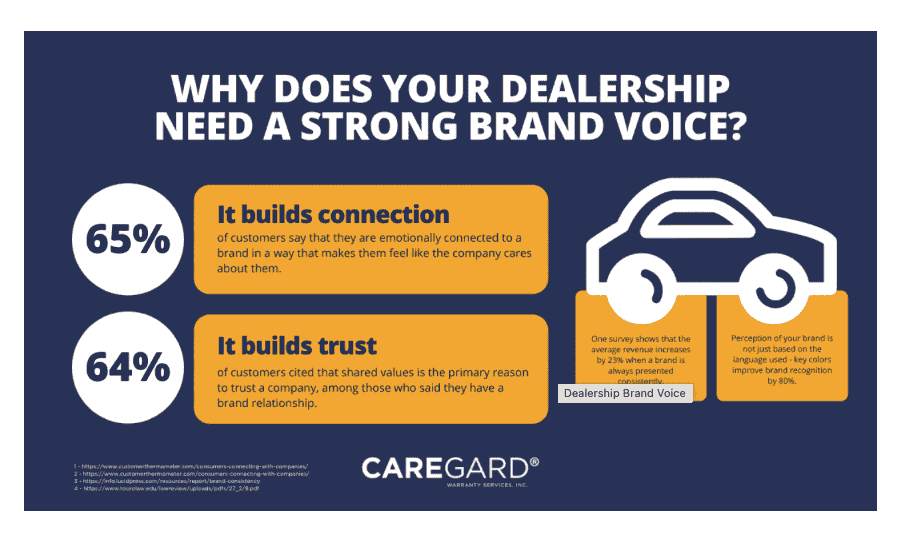

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick