Understanding Compound Interest: How It Can Make You Rich

Mia Anderson

Photo: Understanding Compound Interest: How It Can Make You Rich

Have you ever wondered how some people seem to effortlessly grow their wealth over time? The secret lies in understanding and harnessing the power of compound interest. In this article, we'll delve into the fascinating world of compound interest, exploring how it works, its impact on wealth accumulation, and why it's a crucial concept for anyone seeking financial prosperity. Get ready to unlock the potential of your hard-earned money and discover strategies that can set you on the path to financial success.

Understanding Compound Interest: A Key to Wealth Building

What is Compound Interest?

Compound interest is a financial concept that can be likened to a snowball effect, where your money grows exponentially over time. Simply put, it is the interest you earn on both the initial amount you invest (the principal) and the interest that accumulates over time. This means that your savings or investments not only generate returns, but those returns also generate their own returns, leading to a remarkable growth trajectory.

How Does it Work?

Imagine you have a savings account with an annual compound interest rate of 5%. If you deposit $1,000, after the first year, you'll have $1,050. Now, in the second year, the interest is calculated on the new balance of $1,050, resulting in a slightly higher amount of interest earned. This process repeats year after year, and the power of compound interest becomes evident as your savings grow at an accelerating rate.

The Magic of Time and Consistency

Time is Money

The true magic of compound interest lies in the element of time. The longer your money remains invested, the more significant the impact of compounding. For instance, if you invest $10,000 at a 7% annual interest rate, you'll have over $23,670 after ten years. But if you leave that investment untouched for another ten years, it will grow to a staggering $75,950! This demonstrates how time allows your money to work harder for you, making it a valuable ally in wealth accumulation.

The Power of Regular Contributions

Compound interest isn't just about letting your money sit and grow; it's also about consistently adding to it. Regular contributions, no matter how small, can significantly boost your wealth over time. Consider this: if you invest $200 every month for 30 years at an annual interest rate of 6%, you'll end up with over $200,000. This strategy, often referred to as dollar-cost averaging, is a powerful way to build wealth gradually and is a cornerstone of many successful wealth accumulation strategies.

Real-Life Examples of Compound Interest in Action

The Early Bird Catches the Worm

Let's take a look at the story of Sarah, a young professional who started investing early. At the age of 25, Sarah began contributing $300 per month to her retirement account, which offered a modest 5% annual compound interest rate. By the time she turned 65, Sarah had accumulated a substantial nest egg of over $500,000. This example highlights the incredible power of starting early and letting compound interest work its magic over several decades.

The Late Bloomer's Journey

Not everyone starts their financial journey early, but compound interest can still be a powerful tool. Meet John, who began investing at 40 years old. He invested $500 monthly in a balanced portfolio with an average annual return of 8%. Despite starting later, John's dedication and the power of compound interest resulted in a retirement fund of over $800,000 by the time he turned 65. This proves that it's never too late to start, and consistent contributions can make up for a late start.

Strategies to Maximize Compound Interest

Diversify Your Investments

Diversification is a key strategy to maximize compound interest. By spreading your investments across various asset classes like stocks, bonds, and real estate, you reduce risk and create a balanced portfolio. For instance, investing in a mix of growth-oriented stocks and stable government bonds can provide a steady stream of compound interest while minimizing volatility.

Automate Your Savings

Automating your savings is a simple yet effective way to ensure consistent contributions. Set up automatic transfers from your paycheck or bank account to your investment or savings accounts. This removes the temptation to spend the money and makes saving a seamless part of your financial routine.

Consider Tax-Advantaged Accounts

Take advantage of tax-efficient savings and investment accounts, such as 401(k)s or Individual Retirement Accounts (IRAs). These accounts offer tax benefits that can further boost your compound interest. For example, contributions to a 401(k) are often made with pre-tax dollars, allowing your money to grow tax-free until withdrawal.

Conclusion: Unlocking Your Financial Potential

Compound interest is a powerful tool that can transform your financial future. By understanding its mechanics and implementing strategic wealth accumulation strategies, you can make your money work harder and smarter. Whether you're an early bird like Sarah or a late bloomer like John, starting today and staying consistent will put you on the path to financial freedom. Remember, time is a valuable asset, and compound interest is the key to unlocking its full potential.

So, take control of your financial destiny, embrace the power of compound interest, and watch your wealth grow exponentially. Happy investing!

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

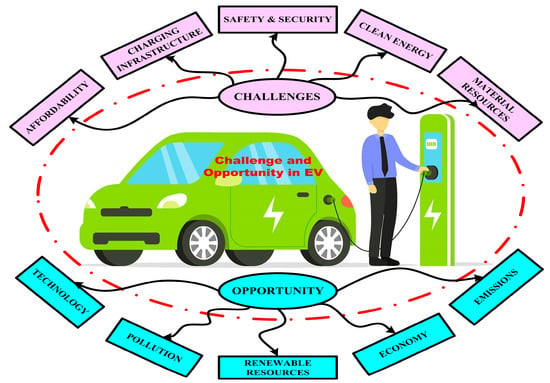

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick