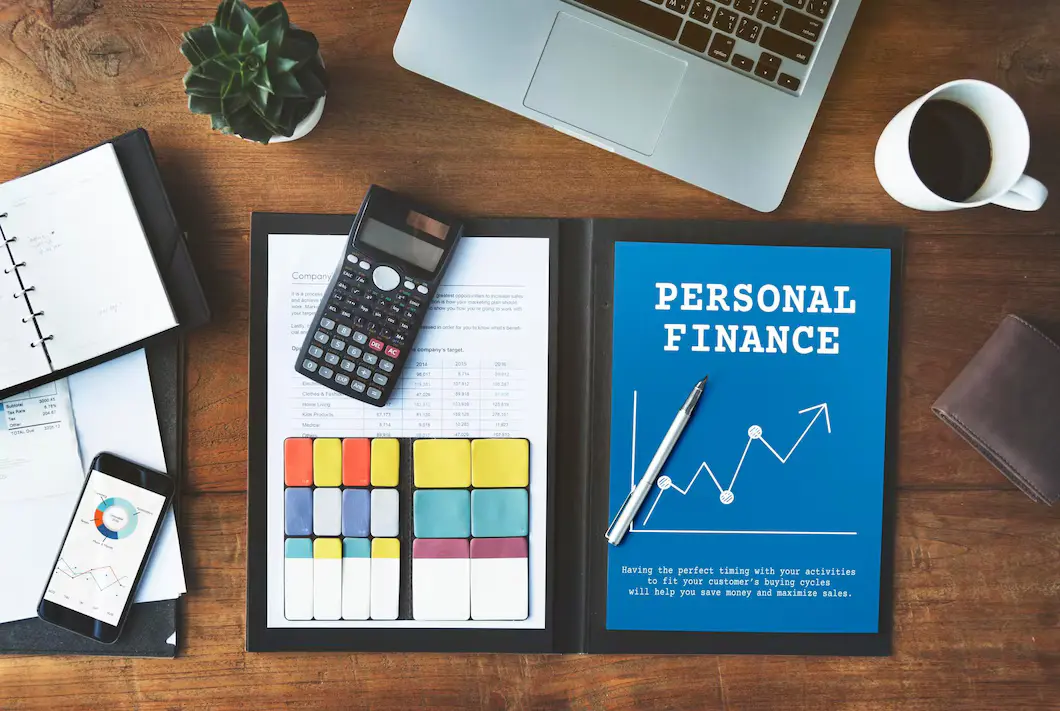

Top 5 Financial Mistakes to Avoid in Your 30s and 40s

Mia Anderson

Photo: Top 5 Financial Mistakes to Avoid in Your 30s and 40s

As you navigate through the exciting journey of adulthood, your 30s and 40s are crucial years for building a solid financial foundation. This period is often associated with increased responsibilities, career growth, and family commitments, making financial planning even more essential. However, it's easy to stumble upon financial pitfalls that can hinder your progress. This article aims to shed light on the top 5 financial mistakes to avoid during this pivotal stage of your life, empowering you to make informed decisions and secure your financial future.

1. Neglecting a Solid Budgeting Plan

Creating and sticking to a budget is a cornerstone of financial planning, yet it is often overlooked. Many individuals in their 30s and 40s find themselves caught in the whirlwind of life, leading to impulsive spending and a lack of financial control.

The Pitfall: Without a structured budget, you might overspend on discretionary items, struggle to save consistently, or even fall into the trap of excessive debt. This financial mistake can lead to a stressful financial situation, impacting your overall well-being.

The Solution: Start by tracking your income and expenses to gain a clear understanding of your financial flow. Create a realistic budget that allocates funds for essentials, savings, and leisure. Utilize budgeting apps or spreadsheets to simplify the process and ensure you stay on track. By embracing a disciplined approach to budgeting, you'll gain control over your finances and work towards your long-term goals.

2. Ignoring the Power of Investing

Investing is a powerful tool to grow your wealth, but it's often misunderstood or overlooked by those in their mid-life years. Many individuals mistakenly believe that investing is only for the wealthy or those with extensive financial knowledge.

The Mistake: Avoiding investments due to fear or lack of understanding can significantly hinder your financial growth. Missing out on the potential returns from the stock market, real estate, or other investment avenues can limit your wealth accumulation.

Empowering Your Finances: Educate yourself about various investment options and seek professional advice if needed. Start small and diversify your portfolio to minimize risks. Consider investing in retirement accounts, such as a 401(k) or IRA, to take advantage of tax benefits and employer contributions. By embracing investing as a long-term strategy, you can watch your wealth grow and secure a more comfortable future.

3. Falling into the Debt Trap

Debt is a common financial challenge for many individuals in their 30s and 40s. Whether it's student loans, credit card debt, or mortgages, managing debt effectively is crucial to financial stability.

The Pitfall: Accumulating excessive debt can lead to high-interest payments, negatively impacting your financial health. It can limit your ability to save, invest, or achieve other financial milestones.

Breaking Free: Prioritize paying off high-interest debt, such as credit cards, to reduce the overall burden. Consider debt consolidation or refinancing options to manage payments more efficiently. Create a debt repayment plan and stick to it. By tackling debt head-on, you'll regain control over your finances and reduce financial stress.

4. Neglecting Emergency Funds

Life is full of unexpected twists and turns, and having an emergency fund is a crucial safety net. However, many individuals in their mid-life years underestimate the importance of this financial buffer.

The Mistake: Failing to set aside funds for emergencies can leave you vulnerable to financial setbacks. Unexpected expenses, such as medical bills or car repairs, can disrupt your financial stability and push you towards debt.

Building Resilience: Aim to build an emergency fund that covers at least three to six months' worth of living expenses. Automate your savings by setting up regular transfers to a dedicated savings account. By having this financial cushion, you'll be prepared for life's surprises and avoid the need to rely on high-interest loans or credit cards.

5. Forgetting to Plan for Retirement

Retirement planning is often associated with later stages of life, but starting early is crucial for a comfortable retirement. Many individuals in their 30s and 40s underestimate the importance of early retirement planning.

The Financial Pitfall: Delaying retirement savings can result in a significant gap between your desired retirement lifestyle and reality. It may lead to working longer than planned or facing financial constraints during retirement.

Securing Your Future: Take advantage of employer-sponsored retirement plans, such as a 401(k), and contribute regularly. Consider setting up automatic contributions to make saving effortless. Explore other retirement savings options like IRAs and consult with a financial advisor to create a comprehensive retirement plan. By starting early, you'll benefit from compound interest and ensure a more secure and enjoyable retirement.

Conclusion

Your 30s and 40s are pivotal years for financial growth and stability. By avoiding these top 5 financial mistakes, you can take control of your financial future and build a solid foundation. Remember, financial planning is a journey, and it's never too late to start. Embrace budgeting, investing, debt management, emergency funds, and retirement planning to unlock your financial freedom and achieve your long-term goals.

By taking proactive steps today, you'll be rewarded with financial security and peace of mind tomorrow. So, embark on this financial journey with confidence, and watch your financial dreams become a reality!

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the top movies to watch in 2024. Explore our curated list of must-see films and stay updated on the year's hottest cinematic releases.

Mia Anderson

Discover how influencers' place in the media is changing. Discover how influencers are revolutionizing the marketing landscape and why it is impossible to ignore their impact on consumers. Find out the keys to their worth and success!

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the best premium TV shows streaming right now. Get exclusive recommendations and top picks to enhance your viewing experience. Click to explore!

Mia Anderson

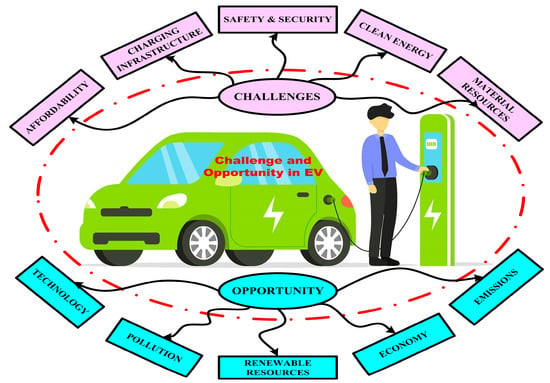

Automotive

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreCompare the total cost of ownership (TCO) between EVs and internal combustion engine vehicles. Which is more affordable?

Read MoreDiscover how AI applications are transforming EV technology, from autonomous driving to predictive maintenance.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

September 17, 2024

Top Software Development Life Cycle Trends to Watch in 2024

Explore the latest 2024 trends in the Software Development Life Cycle. Learn how AI, MLOps, and cloud innovations are shaping the future. Read now for insights!

August 12, 2024

Small Business, Big Leap: Call Center Software that Scales with You

Elevate your small business with call center software. Discover the top 5 platforms with advanced features like AI bots and omnichannel support to transform your customer experience.

Tips & Trick