Top 10 Financial Tools You Need to Succeed in 2024

Mia Anderson

Photo: Top 10 Financial Tools You Need to Succeed in 2024

As we step into 2024, the financial landscape is evolving rapidly, and staying on top of your finances has never been more crucial. Whether you're a seasoned investor, a small business owner, or someone looking to gain control over personal finances, having the right tools can make all the difference. In this article, we'll explore the top 10 financial tools that will empower you to manage, grow, and protect your finances in the coming year. Get ready to transform your financial journey and embrace a brighter financial future!

Introduction: Navigating the Financial Landscape in 2024

The financial world is brimming with opportunities and challenges, and the right tools can be your compass through this ever-changing terrain. With the rise of digital technologies, the way we manage our finances has shifted dramatically. From budgeting to investing, there's a wealth of resources available to help you make informed decisions and achieve your financial goals. Let's dive into the essential tools that will shape your financial journey in 2024.

1. Budgeting Apps: Taking Control of Your Spending

The foundation of financial success often starts with budgeting. These days, budgeting apps have revolutionized the way we track and manage our expenses. Here are some top picks to consider:

Mint: The All-in-One Budgeting Companion

Mint is a popular and trusted budgeting app that offers a comprehensive suite of features. It allows you to link your bank accounts, credit cards, and loans to track your spending in real-time. Mint provides personalized insights, budget categories, and goal-setting tools to help you stay on top of your finances. Its user-friendly interface and intuitive budgeting features make it a favorite among beginners and experienced budgeters alike.

YNAB (You Need a Budget): The Zero-Based Budgeting Guru

YNAB takes a unique approach to budgeting by focusing on the zero-based budgeting method. This app encourages users to give every dollar a job, ensuring that your expenses align with your income. YNAB provides powerful tools to track spending, create budgets, and adjust your financial strategy as needed. It's an excellent choice for those who want a structured and intentional approach to budgeting.

PocketGuard: The Overspending Guard

PocketGuard is designed to help you avoid overspending and stay within your budget. It connects to your bank accounts and categorizes your transactions, providing a clear picture of your spending habits. PocketGuard also offers bill negotiation services, helping you save money on recurring expenses like internet and phone bills. It's a great tool for those who want to keep a tight grip on their spending.

2. Investment Tracking Tools: Monitoring Your Portfolio's Performance

Investing is a key component of long-term financial growth, and keeping an eye on your investments is crucial. These investment tracking tools will help you stay informed and make strategic decisions:

Personal Capital: Comprehensive Investment Management

Personal Capital is a powerful financial tool that offers investment tracking, retirement planning, and wealth management services. It provides a holistic view of your investment portfolio, including stocks, bonds, mutual funds, and more. Personal Capital's advanced analytics and performance tracking features enable you as an investor to make informed decisions and optimize your investment strategy.

Morningstar: In-Depth Investment Research

Morningstar is a renowned investment research platform that provides extensive data and analysis on stocks, funds, and ETFs. It offers a wealth of information, including analyst reports, fund ratings, and portfolio tracking tools. Morningstar is an excellent resource for investors who want to conduct thorough research before making investment decisions.

SigFig: Automated Investment Tracking

SigFig is a user-friendly investment tracking app that connects to your investment accounts and provides a consolidated view of your portfolio. It offers automated performance tracking, personalized investment insights, and portfolio rebalancing suggestions. SigFig is ideal for investors who want a simple yet effective way to monitor their investments.

3. Financial Planning Software: Mapping Out Your Financial Future

Financial planning is about more than just budgeting and investing; it's about setting and achieving long-term financial goals. These financial planning software options will help you create a roadmap for your financial success:

eMoney Advisor: Comprehensive Financial Planning

eMoney Advisor is a robust financial planning software that offers a wide range of tools for professionals and individuals. It provides a holistic view of your financial situation, including net worth, cash flow, and debt management. eMoney Advisor allows you to create personalized financial plans, set goals, and track your progress over time. It's a powerful tool for those seeking a comprehensive financial planning experience.

Quicken: Personal Finance Management

Quicken is a long-standing and trusted personal finance software that offers budgeting, investment tracking, and debt management features. It allows you to connect your bank accounts, credit cards, and loans to track your finances in one place. Quicken provides customizable reports and budgeting tools to help you make informed financial decisions and plan for the future.

MoneyGuidePro: Goal-Oriented Financial Planning

MoneyGuidePro is a goal-focused financial planning software that helps you align your finances with your life goals. It offers a personalized financial planning experience, taking into account your values, priorities, and aspirations. MoneyGuidePro provides a clear roadmap to achieving your financial objectives, making it an excellent choice for those who want a purpose-driven financial plan.

4. Tax Preparation Software: Navigating the Tax Season with Ease

Tax season can be a stressful time, but the right tools can simplify the process. These tax preparation software options will make filing your taxes a breeze:

TurboTax: User-Friendly Tax Filing

TurboTax is one of the most popular tax preparation software, known for its user-friendly interface and step-by-step guidance. It offers various versions tailored to different tax situations, ensuring that you can file your taxes accurately. TurboTax provides helpful tips and explanations along the way, making it a great choice for those who want a seamless tax filing experience.

H&R Block: Expert Tax Guidance

H&R Block offers both online tax filing software and in-person tax services. Their software provides a comprehensive tax filing experience, with guidance and support for various tax situations. H&R Block's expertise and resources make it an excellent option for those who want professional assistance with their tax preparation.

Credit Karma Tax: Free Tax Filing

Credit Karma Tax offers free tax filing for both federal and state returns, making it an attractive option for those on a budget. It provides a straightforward filing process and supports various tax forms. Credit Karma Tax is a great choice for simple tax situations, ensuring you can file your taxes without incurring additional costs.

5. Credit Monitoring Services: Protecting Your Financial Identity

In today's digital age, protecting your financial identity is crucial. Credit monitoring services can help you stay vigilant and safeguard your credit health:

Experian: Comprehensive Credit Monitoring

Experian, one of the major credit bureaus, offers a range of credit monitoring services. Their platform provides access to your credit score and credit report, allowing you to track changes and identify potential fraud. Experian's credit monitoring tools help you stay informed and take proactive steps to protect your financial identity.

Credit Karma: Free Credit Monitoring

Credit Karma offers free credit monitoring services, providing access to your credit score and report. It alerts you to changes in your credit profile and offers educational resources to improve your credit health. Credit Karma is an excellent option for those who want a free and user-friendly way to monitor their credit.

Identity Guard: Advanced Identity Protection

Identity Guard takes credit monitoring a step further by offering comprehensive identity protection services. It monitors your credit, personal information, and even dark web activity for potential threats. Identity Guard provides alerts and resources to help you protect your financial identity and recover from potential identity theft.

Conclusion: Empowering Your Financial Journey in 2024

In 2024, the financial tools at your disposal are more powerful and accessible than ever before. From budgeting apps that help you manage your daily expenses to investment tracking tools that monitor your portfolio's performance, you have the resources to take control of your financial destiny.

Financial planning software enables you to create a comprehensive roadmap for your financial future, ensuring that your goals are within reach. Tax preparation software simplifies the often-daunting task of filing taxes, while credit monitoring services safeguard your financial identity.

By leveraging these top financial tools, you can make informed decisions, optimize your finances, and achieve your financial aspirations. Remember, financial success is a journey, and these tools are your trusted companions along the way. Embrace the power of technology to unlock your financial potential and make 2024 your most financially successful year yet!

As you navigate the financial landscape, stay informed, adapt to new trends, and utilize these tools to create a secure and prosperous future. Happy financial planning!

Marketing

View All

January 23, 2025

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllReady to launch your band? Discover the essential tips and tricks for starting a successful band in 2024. Click now to get started on your musical journey!

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover the latest exclusive movie releases that everyone’s talking about. Don’t miss out click to stay ahead of the curve!

Mia Anderson

Discover the best streaming services for 2024 and find your next favorite show. Read now for expert recommendations and start streaming today!

Mia Anderson

Automotive

View AllUncover how vehicle-to-grid (V2G) technology is reshaping the energy ecosystem by integrating EVs into power grids.

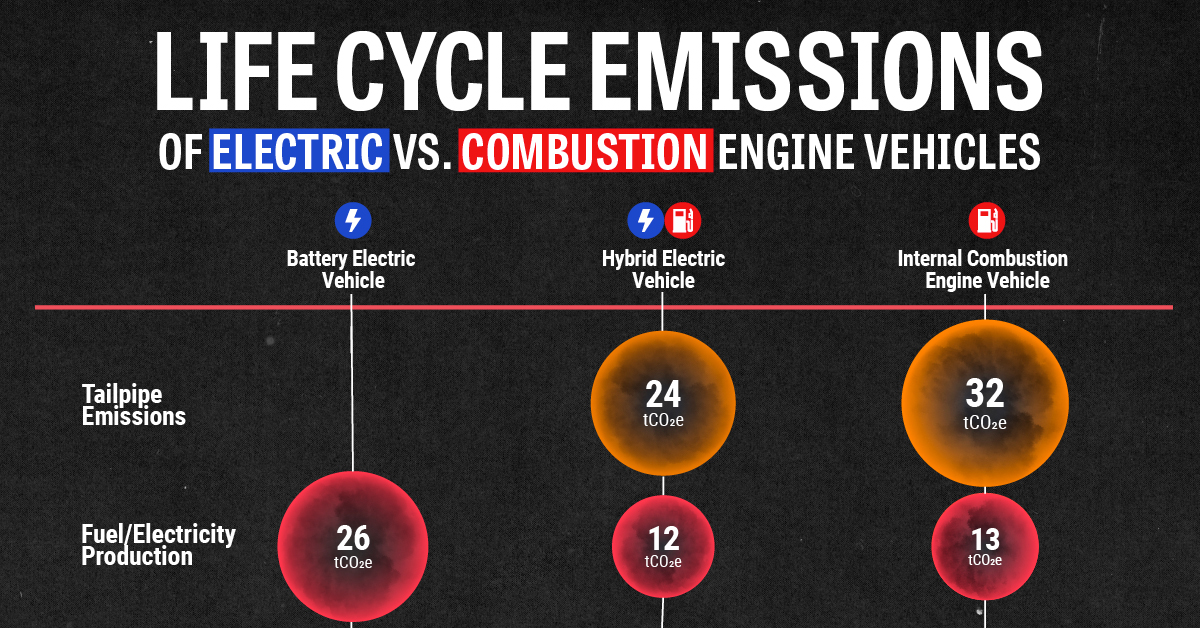

Read MoreCompare the lifecycle emissions of electric vehicles (EVs) and internal combustion engines (ICE). Which is better for the planet?

Read MoreExplore how different age groups are embracing EVs. Learn what drives adoption among millennials, Gen Z, and baby boomers.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

September 12, 2024

Best CRM Software for Small Businesses

Uncover the top CRM software perfect for small businesses. Discover key features, affordability, and how to choose the right one for your business with our ultimate guide to CRM solutions.

August 29, 2024

Discover How Digital Transformation Services Can Revolutionize Your Business

Discover how digital transformation services can revolutionize your business. Explore top solutions to drive growth and efficiency. Read more now!

September 15, 2024

Tips for Securing Your IoT Devices in 2024

Discover the latest strategies for securing IoT devices in 2024. Learn practical tips to protect your smart tech and enhance your digital safety.

Tips & Trick

View All