The Ultimate Guide to Saving Money with Financial Apps

Mia Anderson

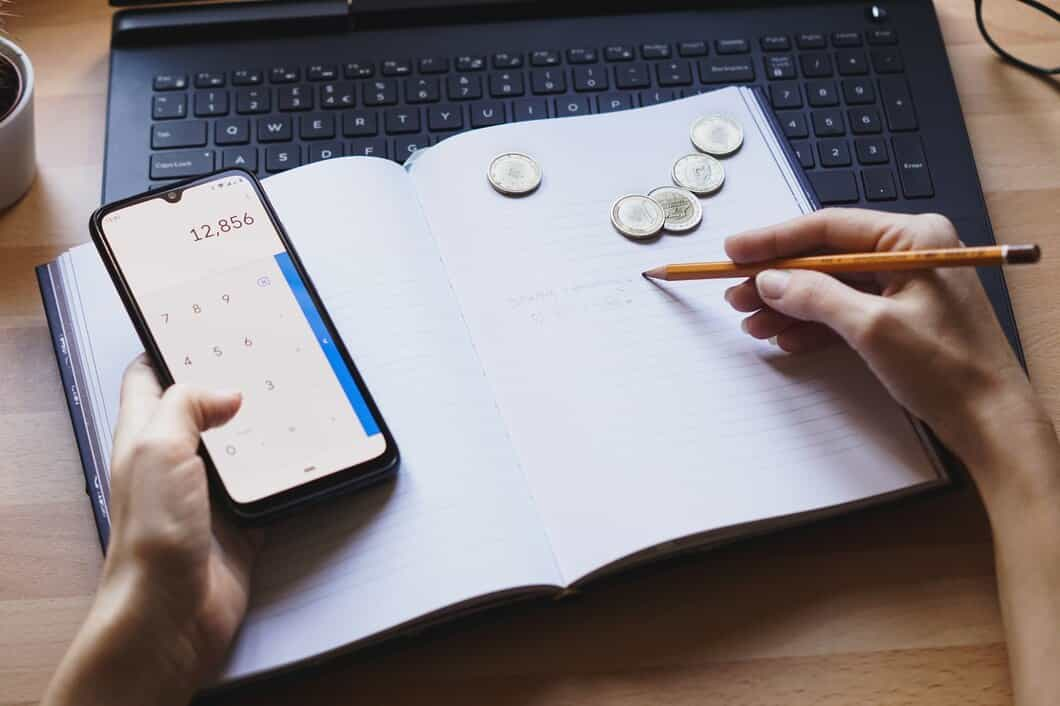

Photo: The Ultimate Guide to Saving Money with Financial Apps

managing personal finances has become easier and more efficient than ever before. With the rise of financial technology, or fintech, your smartphone can be a powerful tool to help you save money and achieve your financial goals. This article aims to provide an ultimate guide to saving money with financial apps, offering practical insights and tips to make your financial journey smoother and more rewarding. Get ready to discover the world of money-saving apps and take control of your finances!

The Rise of Financial Apps

Financial apps, also known as fintech apps, have gained immense popularity in recent years, and for good reason. These innovative tools have revolutionized the way we manage our money, offering convenience, accessibility, and a host of features to enhance our financial well-being. Let's explore why financial apps are becoming a go-to solution for savvy savers.

Convenience at Your Fingertips

Imagine having a personal financial assistant in your pocket! Financial apps provide a convenient way to track expenses, create budgets, and manage your money on the go. With just a few taps on your smartphone, you can access your financial information, making it easier to stay on top of your finances without the hassle of traditional paper-based methods.

For instance, let's say you're out for a coffee and want to quickly check your budget. With a financial app, you can instantly view your spending limits and make informed decisions. This real-time access to financial data empowers users to make smarter choices and avoid overspending.

Personalized Money Management

One of the most appealing aspects of financial apps is their ability to offer personalized money management. These apps utilize advanced algorithms and machine learning to analyze your spending patterns and provide tailored insights. By understanding your financial behavior, these apps can offer customized tips and recommendations to help you save more effectively.

For example, a financial app might notice that you frequently spend on takeout meals. It could then suggest setting a weekly dining-out budget and provide alternative, cost-saving options like meal prep ideas or discounted grocery shopping apps. This personalized approach helps users make conscious financial decisions and develop healthier money habits.

Exploring Money-Saving App Features

Financial apps come packed with a wide range of features designed to help users save money and improve their financial health. Let's delve into some of the most popular and beneficial features you can expect to find.

Budgeting Tools

Budgeting is a cornerstone of effective money management, and financial apps excel in this area. These apps allow users to create customized budgets tailored to their income and expenses. You can set spending limits for various categories like groceries, entertainment, or transportation, and receive alerts when you're approaching or exceeding your limits.

Many budgeting apps also offer forecasting features, helping you predict future financial trends based on your current spending habits. This enables you to make informed decisions and adjust your budget accordingly, ensuring you stay on track with your savings goals.

Expense Tracking

Keeping a close eye on your expenses is crucial for successful money management. Financial apps make expense tracking effortless by automatically categorizing and organizing your transactions. They can sync with your bank accounts and credit cards, providing a comprehensive overview of your spending.

Some apps even use AI-powered receipt scanning, allowing you to quickly capture and categorize expenses by simply snapping a photo of your receipt. This feature is especially useful for freelancers or small business owners who need to track expenses for tax purposes or reimbursement.

Discount Shopping and Cashback Rewards

Who doesn't love a good bargain? Financial apps often partner with retailers and brands to offer exclusive discounts and cashback rewards to their users. These apps provide a seamless shopping experience, allowing you to browse deals, compare prices, and make purchases all in one place.

For instance, you might find an app that offers cashback on everyday purchases like groceries or gas. By linking your payment methods, you can earn rewards on your regular spending, effectively saving money without changing your habits. These apps can be a great way to stretch your budget and make your money go further.

Choosing the Right Financial App

With countless financial apps available on the market, selecting the right one for your needs can be overwhelming. Here are some essential factors to consider when choosing a financial app to ensure it aligns with your financial goals.

Security and Data Protection

When entrusting your financial information to an app, security should be a top priority. Look for apps that prioritize data protection and have robust security measures in place. Features like two-factor authentication, encryption, and secure cloud storage are essential to safeguard your sensitive financial data.

Additionally, read user reviews and research the app's privacy policies to ensure they meet industry standards. A reputable financial app will be transparent about how they handle and protect your information.

User-Friendly Interface and Functionality

A financial app should make managing your money effortless and enjoyable. Opt for apps with a clean, intuitive interface that is easy to navigate. The app should provide a seamless user experience, allowing you to access essential features quickly and efficiently.

Consider your personal preferences as well. Do you prefer a minimalistic design or a more feature-rich interface? Do you want an app that offers a comprehensive suite of tools or one that focuses on a specific aspect of money management? Finding an app that aligns with your preferences will encourage you to use it regularly.

Integration with Existing Accounts

To get the most out of a financial app, it should seamlessly integrate with your existing financial accounts. Look for apps that support multiple bank and credit card connections, allowing you to view all your financial information in one place.

This integration enables you to track and manage your finances holistically, ensuring that you have a complete picture of your financial health. Some apps even offer the ability to make transfers and payments directly from the app, further simplifying your financial tasks.

Maximizing Your Savings with Financial Apps

Now that we've explored the world of financial apps and their features, let's dive into practical strategies to maximize your savings using these powerful tools.

Set Clear Financial Goals

Before diving into the world of financial apps, it's crucial to define your financial goals. Whether it's saving for a dream vacation, paying off debt, or building an emergency fund, having clear objectives will help you stay motivated and focused.

Financial apps often provide goal-setting features, allowing you to track your progress and adjust your savings plan accordingly. By setting realistic and measurable goals, you can leverage the app's functionality to achieve financial success.

Automate Your Savings

One of the most effective ways to save money is by automating the process. Financial apps make it easy to set up automatic transfers to your savings account, helping you save effortlessly. You can schedule regular transfers based on your income and expenses, ensuring that you consistently contribute to your savings.

For example, you could set up a rule to transfer a fixed amount to your savings account every time you receive your paycheck. This way, you're saving without even thinking about it, making it easier to reach your financial goals.

Utilize Personalized Insights

As mentioned earlier, financial apps offer personalized insights based on your spending behavior. Take advantage of these insights to identify areas where you can cut back or make adjustments. Many apps provide suggestions for reducing expenses or optimizing your budget, helping you make informed decisions.

For instance, if the app notices a recurring subscription you rarely use, it might suggest canceling it to save money. By following these personalized recommendations, you can make small changes that collectively lead to significant savings.

Stay Engaged and Review Regularly

Consistency is key when it comes to saving money with financial apps. Make it a habit to engage with the app regularly and review your financial progress. Set aside time each week to analyze your spending, update your budget, and track your savings goals.

Regular engagement ensures that you stay on top of your finances and quickly identify any areas that need attention. It also helps you develop a deeper understanding of your financial habits, allowing you to make better decisions and adapt your savings strategy as needed.

Real-Life Success Stories

Hearing about the experiences of others can be incredibly motivating and inspiring. Let's explore a few real-life success stories of individuals who have successfully used financial apps to transform their financial lives.

Sarah's Debt-Free Journey

Sarah, a 28-year-old marketing professional, found herself burdened with credit card debt after a series of unexpected expenses. Determined to become debt-free, she turned to a financial app that offered personalized debt repayment plans.

The app helped Sarah create a tailored strategy to pay off her debt efficiently. By setting up automatic payments and tracking her progress, she was able to stay focused and motivated. Within a year, Sarah successfully eliminated her credit card debt and gained valuable financial discipline.

John's Savings Success

John, a recent college graduate, wanted to save for a down payment on his first home. He downloaded a financial app that offered budgeting tools and savings challenges. The app's user-friendly interface and gamified approach made saving fun and engaging.

John set a savings goal and participated in the app's weekly challenges, which encouraged him to save more by offering rewards and friendly competition. Within two years, John had saved enough for his down payment and was well on his way to becoming a homeowner.

Conclusion

Financial apps have undoubtedly transformed the way we manage our money, offering convenience, personalization, and powerful tools to save effectively. By embracing these digital solutions, you can take control of your finances and work towards your financial goals with confidence.

Whether you're looking to budget better, track expenses, or discover money-saving opportunities, there's a financial app tailored to your needs. With the right app and a commitment to financial discipline, you can unlock a world of savings and achieve financial freedom.

So, why wait? Start exploring the exciting world of financial apps today and embark on a journey towards a brighter financial future!

Marketing

View All

January 23, 2025

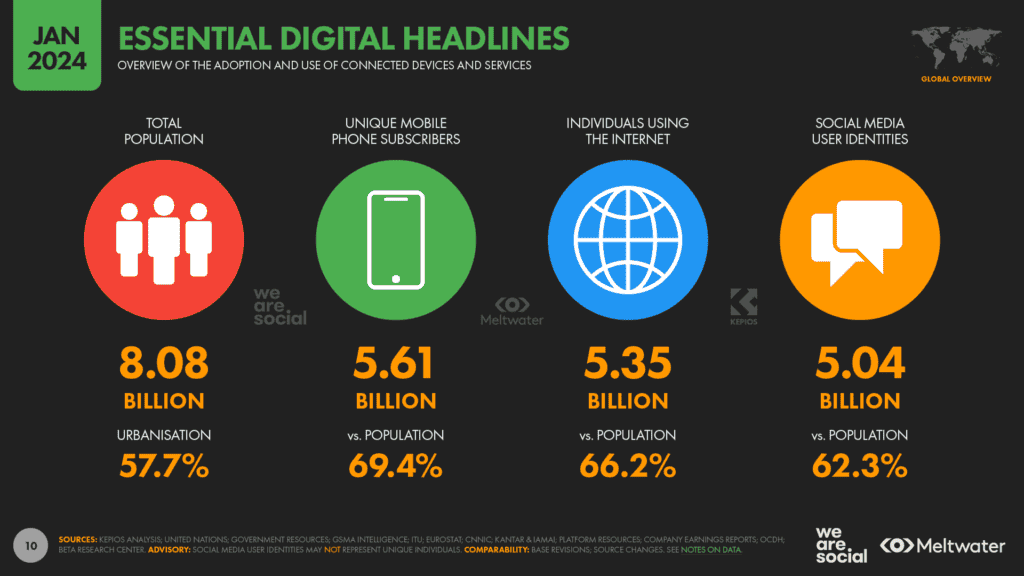

Social Media in Digital Marketing 2024Learn how social media is revolutionizing digital marketing in 2024. Boost your brand with actionable tips for viral campaigns!

Mia Anderson

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

Entertainment

View AllReady to launch your band? Discover the essential tips and tricks for starting a successful band in 2024. Click now to get started on your musical journey!

Mia Anderson

Explore the latest trends in virtual reality gaming for 2024. Our in-depth guide covers new technology and gameplay innovations. Discover more now!

Mia Anderson

Discover the latest exclusive movie releases that everyone’s talking about. Don’t miss out click to stay ahead of the curve!

Mia Anderson

Discover the best streaming services for 2024 and find your next favorite show. Read now for expert recommendations and start streaming today!

Mia Anderson

Automotive

View AllUncover how vehicle-to-grid (V2G) technology is reshaping the energy ecosystem by integrating EVs into power grids.

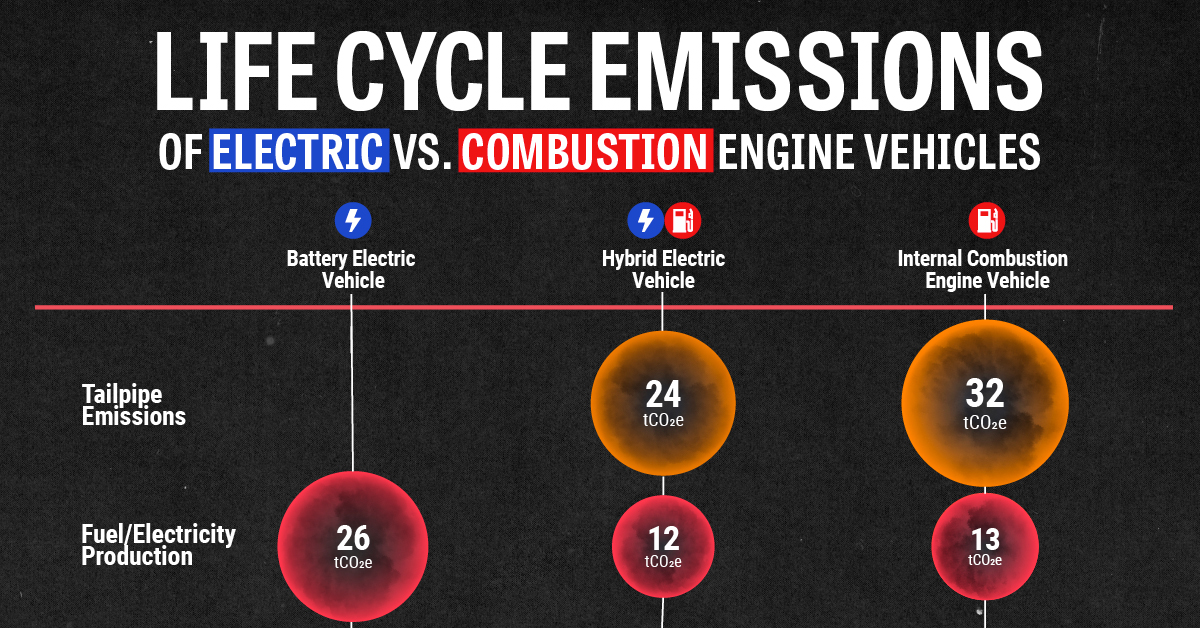

Read MoreCompare the lifecycle emissions of electric vehicles (EVs) and internal combustion engines (ICE). Which is better for the planet?

Read MoreExplore how different age groups are embracing EVs. Learn what drives adoption among millennials, Gen Z, and baby boomers.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

September 12, 2024

Best CRM Software for Small Businesses

Uncover the top CRM software perfect for small businesses. Discover key features, affordability, and how to choose the right one for your business with our ultimate guide to CRM solutions.

August 29, 2024

Discover How Digital Transformation Services Can Revolutionize Your Business

Discover how digital transformation services can revolutionize your business. Explore top solutions to drive growth and efficiency. Read more now!

September 15, 2024

Tips for Securing Your IoT Devices in 2024

Discover the latest strategies for securing IoT devices in 2024. Learn practical tips to protect your smart tech and enhance your digital safety.

Tips & Trick

View All