The Ultimate Guide to Invoice Factoring in California: Supercharge Your Cash Flow

Mia Anderson

Photo: The Ultimate Guide to Invoice Factoring in California: Supercharge Your Cash Flow

Invoice factoring is a powerful tool for California businesses to enhance their cash flow and unlock new growth opportunities. It's a strategy that has helped countless enterprises navigate the challenges of inconsistent cash flow and limited access to capital. By the end of this guide, you'll understand the ins and outs of invoice factoring and be empowered to make informed decisions about utilizing this financial strategy.

What is Invoice Factoring?

Invoice factoring is a financial practice where a business sells its accounts receivable (invoices) to a third-party company (known as a factor) at a discount. This process provides immediate cash flow to the business, bypassing the often tedious waiting game for customer payments.

Here's a simple example to illustrate the process:

Imagine you own a small business in Los Angeles, and you have just completed a large project for a client. Instead of waiting 30, 60, or even 90 days for the client to pay your invoice, you can sell it to a factoring company. They will give you a significant percentage of the invoice's value (typically 70-98%) within 24 hours. The factoring company then takes on the responsibility of collecting payment from your client.

Benefits of Invoice Factoring for California Businesses

Improved Cash Flow

Cash flow is the lifeblood of any business, and invoice factoring ensures a consistent flow of funds. It provides liquidity to cover expenses, invest in growth opportunities, and navigate unpredictable financial landscapes. Invoice factoring is tailored to your business needs, offering a scalable funding solution that adapts to fluctuations in sales without compromising financial stability.

Accelerated Business Growth

Unlike traditional loans, invoice factoring enables your business to grow without accumulating debt. It provides a sustainable financial model, promoting long-term expansion without the burden of long-term financial obligations. With invoice factoring, you can access the capital needed to invest in new equipment, hire talent, or expand your operations.

Reduced Risk of Bad Debts

Late payments and non-payments can significantly impact a business's financial health. Invoice factoring mitigates this risk by promptly providing a substantial percentage of the invoice value. This proactive approach safeguards cash flow, maintains profitability, and protects the integrity of your accounts receivable.

Flexible Financing

Invoice factoring offers a flexible financing option that can be adapted to your business's unique needs. It provides precision in managing working capital, enabling you to align financial resources with strategic goals. Whether you're facing seasonal fluctuations or unexpected expenses, invoice factoring ensures you have the funds to navigate these challenges.

Factoring Companies in California

Several reputable factoring companies serve the state of California, each offering unique services and benefits. Here's a look at some of the top players in the industry:

- AeroFund Financial, Inc.: Specializes in accounts receivable financing and factoring for small to medium-sized businesses nationwide, providing direct commercial lending.

- PMFBancorp: With over 30 years of experience, PMFBancorp offers quick credit decisions and invoice factoring services, converting invoices into immediate cash for growing businesses.

- Advance Capital Solutions (ACS Factors): Provides working capital to small businesses in the form of non-recourse factoring, ensuring funding without the risk of debt accumulation.

- Round Table Financial: A nationwide business funding service, offering invoice factoring as their core service to small and medium-sized businesses.

- San Diego Business Financing: Tailored to local San Diego companies, this company provides alternative financing options for startups and small businesses, ensuring they have the capital needed to thrive.

Choosing the Right Factoring Company

When selecting a factoring company, it's essential to consider your unique business needs and goals. Research the company's reputation, customer service, and fees involved. Some factors to specialize in certain industries, while others offer more flexible terms. Understanding the fine print and potential hidden costs is crucial to making an informed decision.

Conclusion

Invoice factoring is a valuable tool for California businesses seeking improved cash flow and sustainable growth. It offers a debt-free financing option, providing immediate funds to seize opportunities. By utilizing the services of reputable factoring companies, businesses can navigate the challenges of inconsistent cash flow and focus on their core operations.

Remember, while invoice factoring has numerous benefits, it's essential to weigh it against other funding options and consult financial experts to make the right choice for your unique business needs.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

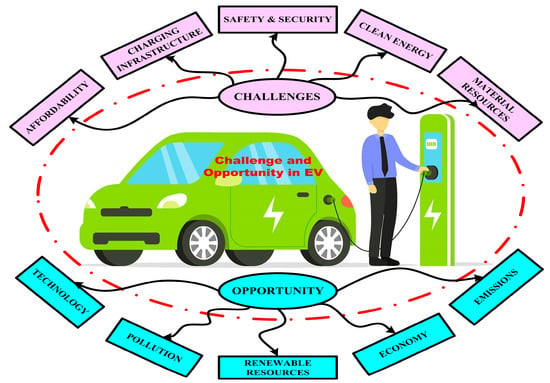

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

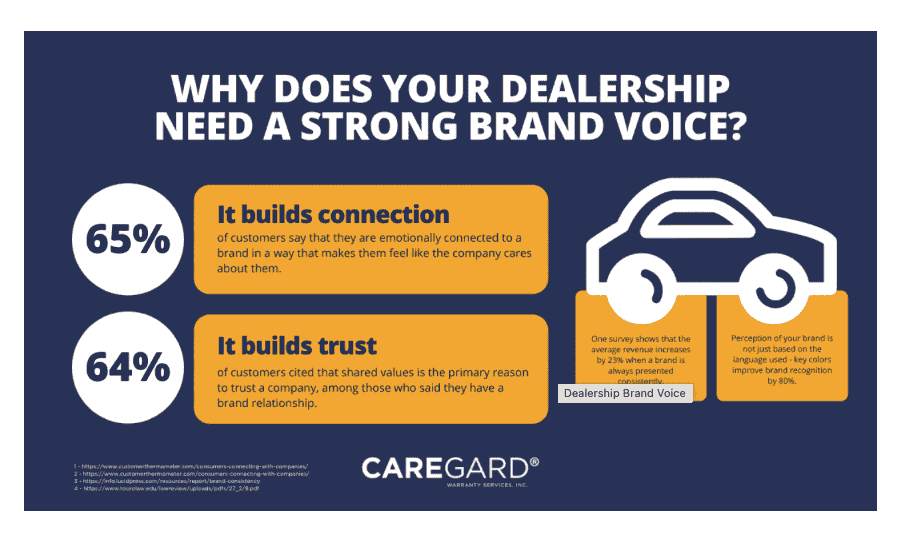

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick