Inflation Eases in 2024: What It Means for Your Finances

Mia Anderson

Photo: Inflation Eases in 2024: What It Means for Your Finances

ISEKUN - the rate at which prices for goods and services are rising, has been a significant concern for many individuals and businesses in recent years. However, as we enter 2024, there is a glimmer of hope: inflation is easing. This shift in economic trends brings about a mix of relief and uncertainty. In this article, we will delve into the latest inflation news, explore the trends and forecasts for 2024, and discuss how these changes might impact your finances.

Understanding Inflation

To grasp the significance of easing inflation, it's essential to understand what inflation is and how it affects the economy. Inflation is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. It's often measured using the Consumer Price Index (CPI), which tracks the prices of a basket of goods and services commonly purchased by households.

In the United States, the Federal Reserve closely monitors inflation rates to ensure they remain within a healthy range. The Federal Reserve's dual mandate includes maintaining maximum employment and keeping prices stable. When inflation rises too high, it can erode the purchasing power of consumers, reduce savings, and potentially lead to higher interest rates to combat it.

Inflation News 2024: Trends and Forecasts

As we navigate the economic landscape of 2024, several key trends and forecasts are emerging:

1. US Inflation Rate

The latest data from the Bureau of Labor Statistics (BLS) indicates that the US inflation rate has been trending downward. In July 2024, the annual inflation rate stood at 2.5%, down from its peak of 7.1% in January 2023. This decline is largely attributed to a decrease in energy prices and stabilizing food costs.

2. Consumer Price Index (CPI)

The CPI, a widely used indicator of inflation, has also shown a downward trajectory. The CPI measures the weighted average of prices of a basket of goods and services. In 2024, the CPI has been influenced by lower prices for housing, transportation, and healthcare services.

3. Federal Reserve Inflation Update

The Federal Reserve has been closely monitoring these trends and has adjusted its monetary policy accordingly. In response to easing inflation, the Fed has hinted at potential interest rate cuts in the coming months. This move aims to stimulate economic growth while maintaining price stability.

Impact on Savings and Investments

Easing inflation can have both positive and negative impacts on savings and investments:

1. Impact on Savings

For savers, lower inflation means that their money will retain more purchasing power over time. This is particularly beneficial for those relying on fixed-income investments like certificates of deposit (CDs) or savings accounts.

2. Impact on Investments

On the other hand, investors need to consider how lower inflation might affect their portfolios. For instance, bonds typically offer lower returns in a low-inflation environment because their value is tied to interest rates. Conversely, stocks and real estate might perform better as lower inflation can lead to increased consumer spending and economic growth.

Inflation Protection Strategies

While easing inflation is a welcome development, it's crucial to remain vigilant about protecting your finances from potential future price increases. Here are some strategies to consider:

1. Diversification

Spread your investments across various asset classes to mitigate the impact of any future inflation spikes. A diversified portfolio can help you ride out economic fluctuations.

2. Inflation-Linked Investments

Invest in assets that are directly linked to inflation, such as Treasury Inflation-Protected Securities (TIPS) or inflation-indexed annuities. These investments offer returns that are adjusted for inflation, ensuring your purchasing power remains intact.

3. Real Estate

Real estate can be a solid hedge against inflation. As prices rise, the value of your property increases, providing a potential source of wealth.

Economic Forecasts 2024

Economic forecasts for 2024 suggest a continued easing of inflationary pressures. However, it's essential to remain cautious and monitor developments closely. Here are some key forecasts:

1. GDP Growth

The US GDP is expected to grow at a moderate pace in 2024, driven by consumer spending and business investment. This growth should help sustain economic recovery while keeping inflation in check.

2. Interest Rates

As mentioned earlier, interest rates might see a downward trend in response to easing inflation. Lower interest rates can stimulate borrowing and spending, further supporting economic growth.

Conclusion

The easing of inflation in 2024 brings both relief and opportunities. While it's essential to celebrate this development, it's equally important to remain proactive in managing your finances. By understanding the latest trends and forecasts, diversifying your investments, and employing inflation protection strategies, you can navigate the ever-changing economic landscape with confidence.

In conclusion, the easing of inflation is a positive sign for the economy, but it's crucial to stay informed and adaptable. By doing so, you can make the most of this trend and ensure your financial well-being in the years to come.

Additional Tips for Readers

- Stay Informed: Regularly check economic news and updates from reliable sources like the Federal Reserve or the Bureau of Labor Statistics.

- Diversify: Spread your investments across different asset classes to minimize risk.

- Review Budget: Adjust your budget according to the current economic conditions to maximize savings.

- Consider Long-Term Goals: Think about long-term financial goals and plan accordingly, taking into account potential future economic scenarios.

By following these tips and staying informed about inflation news, you can better navigate the complexities of the economy and make informed decisions about your finances.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

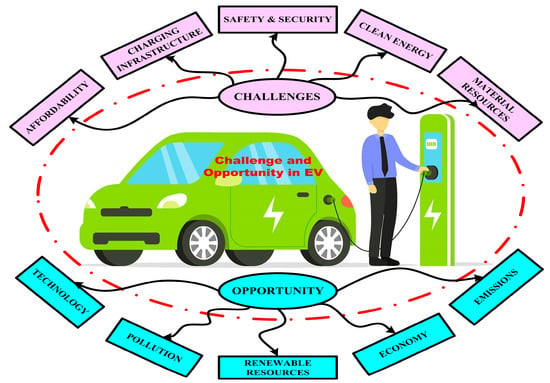

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick