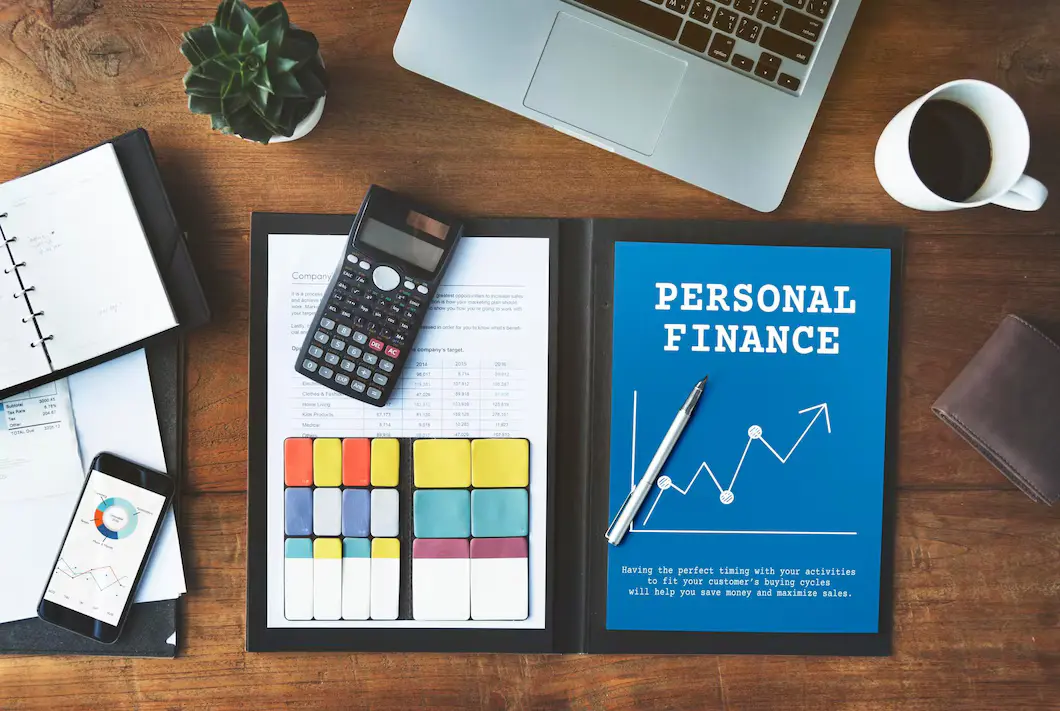

Financial Mistakes That Are Costing You Thousands Every Year

Mia Anderson

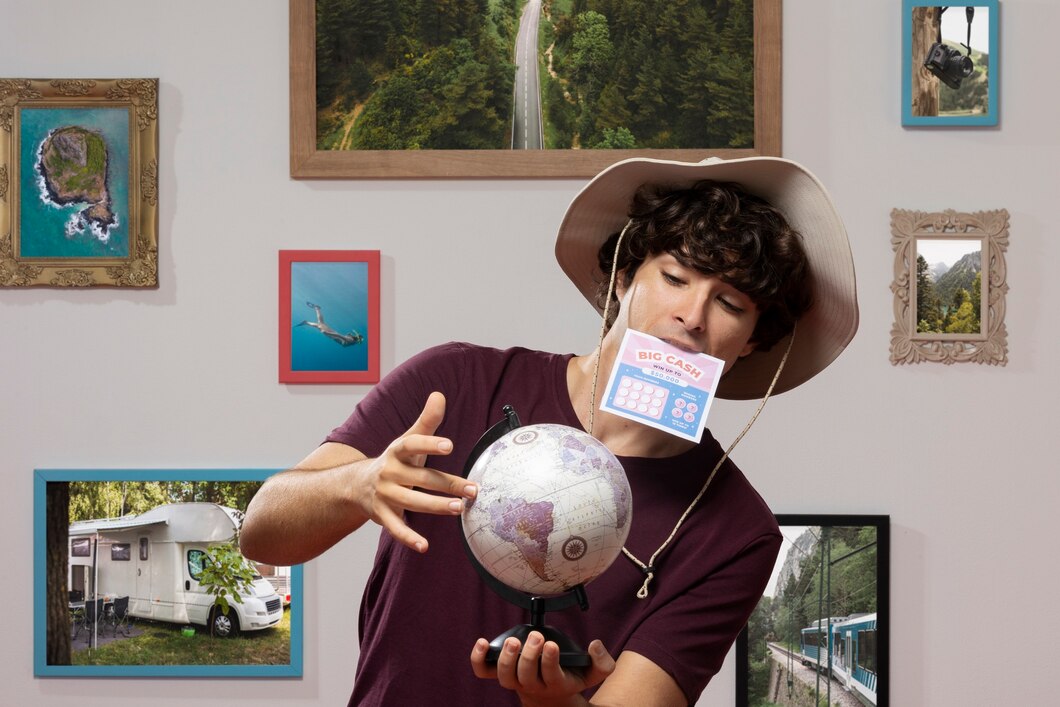

Photo: Financial Mistakes That Are Costing You Thousands Every Year

Are you unknowingly making financial mistakes that could be draining your bank account? In today's fast-paced world, it's easy to fall into common money management traps that can cost you thousands of dollars each year. This article aims to shed light on some of these financial pitfalls and provide you with valuable insights to help you navigate the complex world of personal finance. By the end, you'll be equipped with the knowledge to make informed decisions and take control of your financial future.

Common Financial Mistakes: A Costly Affair

Financial mistakes can be a silent enemy, slowly eroding your wealth and financial stability. From impulsive spending to neglecting long-term planning, these errors can have a significant impact on your overall financial health. Let's explore some of the most prevalent financial mistakes that people often make.

1. Falling for the "New Year, New Spending" Trap

The start of a new year often brings a sense of renewal and the urge to make a fresh start. However, this can lead to a common financial mistake—the "New Year, New Spending" trap. Many individuals fall into the mindset that the turn of the calendar year justifies a shopping spree or unnecessary purchases. Roksolana Ponomarenko, a CFA and Business Advisor, warns against this mindset, emphasizing that life is continuous, and a change in the year does not reset financial responsibilities or past expenditures.

For instance, imagine a scenario where an individual, excited about the new year, decides to splurge on the latest tech gadgets, trendy fashion items, or extravagant vacations. While these purchases might provide temporary satisfaction, they can quickly lead to financial strain if not aligned with a budget or long-term financial goals. This impulsive spending can result in credit card debt, high-interest loans, or a depleted savings account.

2. Failing to Diversify Investments

Diversification is a cornerstone of successful investing, yet many individuals make the financial mistake of putting all their eggs in one basket. Relying on a single investment or asset class can be a risky endeavor. Financial educator Yanely Espinal highlights the importance of diversification, stating that it reduces risk and provides a safety net against market volatility.

Consider a person who invests their entire savings in a single company's stock, believing in its potential for rapid growth. While this might seem like a promising opportunity, it exposes their finances to significant risk. If the company encounters unforeseen challenges or market downturns, their entire investment could be at stake. Diversifying investments across different asset classes, such as stocks, bonds, real estate, or mutual funds, helps mitigate this risk and ensures a more stable financial portfolio.

3. Ignoring Tax Planning

Taxes are an inevitable part of life, but many people make the financial mistake of neglecting tax planning. Efficient tax planning can save you a substantial amount of money and ensure you're not paying more than necessary. Seeking professional advice from tax specialists can help you navigate the complex world of tax laws and optimize your tax liabilities.

Imagine a small business owner who, in their first year of operation, neglects to keep detailed financial records or fails to understand the tax implications of their business structure. As the tax season approaches, they realize they may have missed out on deductions, overpaid taxes, or even faced penalties due to non-compliance with tax regulations. This scenario underscores the importance of proactive tax planning and the potential financial benefits it can bring.

4. Neglecting Regular Financial Reviews

Financial planning is not a one-time event; it requires ongoing attention and adjustments. One of the critical financial mistakes people make is neglecting regular financial reviews. As your life circumstances, goals, and market conditions change, so should your financial plan.

For example, a young professional who creates a financial plan early in their career might set specific goals for savings, investments, and debt repayment. However, as they progress in their career, get married, start a family, or face unexpected life events, their financial priorities and goals may shift. Regularly reviewing and updating their financial plan ensures that it remains relevant and aligned with their evolving needs and aspirations.

5. Chasing Headlines Instead of Sticking to the Plan

In today's information-rich world, it's easy to get caught up in the hype or hysteria surrounding financial news and trends. Financial expert Jerome Knyszewski points out that humans often fixate on near-term dynamics, which can lead to emotional decisions that derail long-term financial goals.

Suppose an investor, influenced by sensational headlines about a particular stock market sector, decides to abruptly shift their entire investment portfolio. This impulsive decision, driven by short-term market fluctuations, could potentially undermine their carefully crafted long-term investment strategy. By recognizing this tendency to chase headlines, investors can make more rational decisions and stay committed to their financial plans.

Conclusion

Avoiding these financial mistakes is crucial for anyone seeking to secure their financial future. By being mindful of spending, diversifying investments, planning for taxes, regularly reviewing financial goals, and staying focused on long-term strategies, you can significantly improve your financial well-being. Remember, financial success is not just about making money; it's also about making informed decisions and avoiding costly mistakes.

In the world of personal finance, knowledge is power. Stay informed, seek professional advice when needed, and continuously educate yourself to navigate the financial pitfalls that could be costing you thousands. Your financial journey is unique, and with the right approach, you can achieve financial prosperity and security.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the top movies to watch in 2024. Explore our curated list of must-see films and stay updated on the year's hottest cinematic releases.

Mia Anderson

Discover how influencers' place in the media is changing. Discover how influencers are revolutionizing the marketing landscape and why it is impossible to ignore their impact on consumers. Find out the keys to their worth and success!

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the best premium TV shows streaming right now. Get exclusive recommendations and top picks to enhance your viewing experience. Click to explore!

Mia Anderson

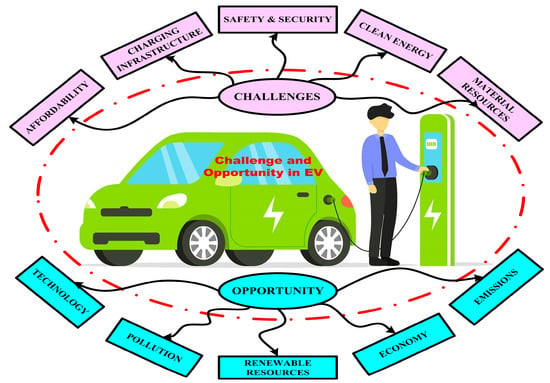

Automotive

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreCompare the total cost of ownership (TCO) between EVs and internal combustion engine vehicles. Which is more affordable?

Read MoreDiscover how AI applications are transforming EV technology, from autonomous driving to predictive maintenance.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

September 17, 2024

Top Software Development Life Cycle Trends to Watch in 2024

Explore the latest 2024 trends in the Software Development Life Cycle. Learn how AI, MLOps, and cloud innovations are shaping the future. Read now for insights!

August 12, 2024

Small Business, Big Leap: Call Center Software that Scales with You

Elevate your small business with call center software. Discover the top 5 platforms with advanced features like AI bots and omnichannel support to transform your customer experience.

Tips & Trick