Explore the Best Insurance Coverage Options for Your Needs

Mia Anderson

Photo: Explore the Best Insurance Coverage Options for Your Needs

Navigating the world of insurance can be overwhelming, given the plethora of coverage options available. Whether you're looking for a policy to protect your health, home, or car, finding the right insurance can make a significant difference in your financial security. In this article, we will explore the best insurance coverage options tailored to various needs, emphasizing affordability, comprehensiveness, and optimal choices. We will also compare different plans and highlight key benefits to help you make an informed decision.

Understanding Insurance Coverage Options

What Are Insurance Coverage Options?

Insurance coverage options refer to the different types of policies available to protect against various risks. These include health insurance, auto insurance, homeowners insurance, and life insurance. Each type offers a range of plans designed to meet different needs and budgets. By understanding these options, you can choose the one that best suits your individual or family requirements.

Importance of Choosing the Right Coverage

Choosing the right insurance coverage is crucial because it ensures that you are adequately protected in the event of a loss or unexpected situation. For example, having comprehensive health insurance can help cover medical expenses, reducing the financial burden on you and your family. Similarly, choosing the right auto insurance policy can protect you from significant out-of-pocket expenses after an accident.

Best Insurance Plans for 2024

Health Insurance Plans

Health insurance is essential for managing medical costs and ensuring access to quality healthcare. For 2024, consider plans that offer extensive coverage while being affordable. Look for policies that cover preventive care, prescription drugs, and specialist visits. Major providers often offer tiered plans, allowing you to choose one that aligns with your health needs and budget.

Auto Insurance Options

Auto insurance is mandatory in most places and varies widely in terms of coverage and cost. In 2024, the best auto insurance plans include those offering comprehensive coverage, which protects against damages beyond collisions, such as theft and natural disasters. Additionally, look for policies with high customer satisfaction ratings and competitive rates.

Homeowners Insurance

Protecting your home and belongings is vital, and homeowners insurance provides peace of mind against various risks, including fire, theft, and natural disasters. For 2024, seek out policies that offer broad coverage and additional benefits such as liability protection and coverage for temporary housing if your home becomes uninhabitable.

Affordable Coverage Options

Finding Budget-Friendly Plans

Affording insurance is a common concern, but numerous options can fit within different budgets. To find affordable coverage, compare quotes from multiple insurers and consider higher deductibles to lower monthly premiums. Additionally, explore discounts for bundling multiple policies or maintaining a good claims history.

Government Assistance and Subsidies

In some cases, government programs can help make insurance more affordable. For example, health insurance marketplaces offer subsidies based on income levels, while certain states provide programs for low-income families. Investigate these options to potentially reduce your insurance costs.

Top Insurance Policies

Comprehensive Insurance Solutions

Comprehensive insurance policies offer extensive protection, covering a wide range of risks. These policies often include features such as coverage for natural disasters, personal liability, and additional living expenses. While these plans may have higher premiums, they provide robust protection against unexpected events.

Optimal Insurance Choices

Choosing an optimal insurance plan involves evaluating your specific needs and circumstances. Consider factors such as the level of coverage required, potential out-of-pocket costs, and any additional benefits offered. Opt for policies that balance cost with comprehensive coverage to ensure adequate protection without overspending.

Insurance Coverage Comparison

Evaluating Different Plans

When comparing insurance coverage options, focus on key factors such as coverage limits, exclusions, and premiums. Use online comparison tools to view side-by-side comparisons of various plans. Additionally, read customer reviews and ratings to gauge the reliability and satisfaction levels of different insurers.

Real-Life Example

Consider the case of Jane, who recently compared health insurance plans for her family. By using comparison tools and reading reviews, she identified a plan that offered extensive coverage at a lower cost than her previous policy. This not only saved her money but also ensured her family received comprehensive medical care.

Benefits of Comprehensive Insurance Coverage

Financial Security

One of the primary benefits of having comprehensive insurance coverage is financial security. With the right policy, you can avoid significant out-of-pocket expenses in the event of a claim. This financial cushion can be crucial in times of crisis, providing peace of mind and stability.

Peace of Mind

Having adequate insurance coverage also provides peace of mind. Knowing that you are protected against various risks allows you to focus on other aspects of your life without constant worry about potential financial burdens.

Finding the Best Insurance Coverage for Your Needs

Steps to Choose the Right Coverage

To find the best insurance coverage for your needs, follow these steps:

- Assess Your Needs: Determine what types of coverage you require based on your personal situation, such as health, auto, or home insurance.

- Research Options: Explore different insurance providers and their offerings. Look for plans that align with your needs and budget.

- Compare Plans: Use comparison tools to evaluate coverage options and premiums. Consider both the cost and the level of protection offered.

- Read Reviews: Check customer reviews and ratings to ensure the insurer has a good reputation for service and reliability.

- Consult an Expert: If needed, consult an insurance broker or advisor to help you navigate complex options and find the best fit.

Final Thoughts

Selecting the right insurance coverage is a critical decision that impacts your financial well-being and peace of mind. By exploring various options, comparing plans, and understanding the benefits of comprehensive coverage, you can make an informed choice that best meets your needs.

Conclusion

In summary, exploring the best insurance coverage options involves evaluating different types of policies, understanding the benefits of comprehensive coverage, and finding affordable yet effective solutions. By following the steps outlined and considering the provided examples, you can make a well-informed decision and ensure you are adequately protected.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the top movies to watch in 2024. Explore our curated list of must-see films and stay updated on the year's hottest cinematic releases.

Mia Anderson

Discover how influencers' place in the media is changing. Discover how influencers are revolutionizing the marketing landscape and why it is impossible to ignore their impact on consumers. Find out the keys to their worth and success!

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the best premium TV shows streaming right now. Get exclusive recommendations and top picks to enhance your viewing experience. Click to explore!

Mia Anderson

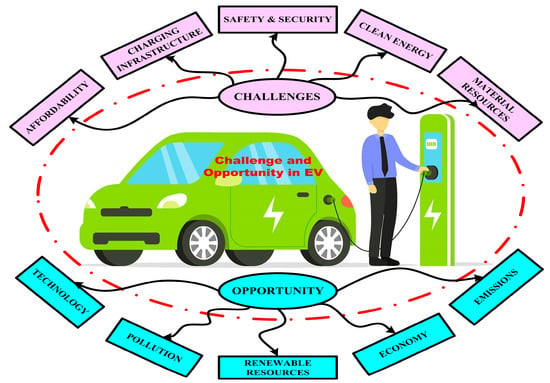

Automotive

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreCompare the total cost of ownership (TCO) between EVs and internal combustion engine vehicles. Which is more affordable?

Read MoreDiscover how AI applications are transforming EV technology, from autonomous driving to predictive maintenance.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

September 17, 2024

Top Software Development Life Cycle Trends to Watch in 2024

Explore the latest 2024 trends in the Software Development Life Cycle. Learn how AI, MLOps, and cloud innovations are shaping the future. Read now for insights!

August 12, 2024

Small Business, Big Leap: Call Center Software that Scales with You

Elevate your small business with call center software. Discover the top 5 platforms with advanced features like AI bots and omnichannel support to transform your customer experience.

Tips & Trick