Essential Wealth Management Tips to Grow Your Fortune Safely

Mia Anderson

Photo: Essential Wealth Management Tips to Grow Your Fortune Safely

In today’s complex financial landscape, effective wealth management is crucial for anyone looking to build and preserve their wealth. Whether you’re a high-net-worth individual, a business owner, or simply someone aiming for financial security, implementing the right strategies can significantly impact your financial future. This article explores essential wealth management advice, focusing on practical tips and strategies to grow your fortune safely.

Understanding Wealth Management

Wealth management is more than just financial planning; it encompasses a broad range of strategies designed to protect and grow your assets. It involves a comprehensive approach, addressing everything from investment advice to estate planning. By employing effective wealth management strategies, you can ensure your financial well-being and achieve long-term success.

Wealth Management Strategies

Diversification: A Key to Stability

One of the cornerstone principles of wealth management is diversification. Spreading your investments across various asset classes—such as stocks, bonds, real estate, and commodities—helps mitigate risk. For example, a diversified portfolio can cushion against market volatility, ensuring that a downturn in one sector does not disproportionately affect your overall wealth.

Risk Management and Asset Allocation

Risk management is essential for preserving wealth. Effective asset allocation involves dividing your investments among different asset classes based on your risk tolerance, investment goals, and time horizon. For instance, younger investors might allocate more towards equities for higher growth potential, while those nearing retirement may prefer bonds for stability.

Financial Planning for High-Net-Worth Individuals

High-net-worth individuals face unique financial challenges and opportunities. Personalized financial planning is crucial to addressing these needs effectively. This may include managing large portfolios, navigating complex tax regulations, and planning for significant life events.

Personalized Investment Strategies

For high-net-worth individuals, tailored investment strategies are essential. This might involve alternative investments, such as private equity or hedge funds, which can offer higher returns but come with increased risk. Working with a financial advisor to design a strategy that aligns with your specific goals and risk tolerance is key to optimizing your portfolio.

Tax-Efficient Wealth Management

Tax efficiency is critical in preserving wealth. Implementing strategies such as tax-loss harvesting, utilizing tax-deferred accounts, and making use of tax-advantaged investments can help minimize your tax liability. For example, investing in municipal bonds may offer tax-free income, which can be advantageous for those in higher tax brackets.

Investment Advice for Wealth Growth

Investing wisely is fundamental to growing your wealth. Here are some strategies to consider:

Long-Term Investing

Investing with a long-term perspective allows you to ride out market fluctuations and benefit from compounding returns. Historical data shows that long-term investments, such as a diversified stock portfolio, often outperform short-term trading strategies.

Regular Portfolio Review

Regularly reviewing and adjusting your investment portfolio ensures it remains aligned with your financial goals and risk tolerance. For instance, rebalancing your portfolio periodically can help maintain your desired asset allocation and address any imbalances that may arise.

Wealth Preservation Techniques

Preserving your wealth involves protecting it from various risks, including market downturns, inflation, and unforeseen life events.

Estate Planning for Wealth Protection

Estate planning is crucial for ensuring your wealth is distributed according to your wishes. This involves creating wills, trusts, and powers of attorney to manage your assets and provide for your heirs. For example, setting up a trust can help reduce estate taxes and avoid probate, ensuring a smooth transition of your wealth.

Insurance and Risk Management

Insurance plays a vital role in wealth preservation by protecting against potential losses. Life insurance, disability insurance, and property insurance are some of the types that can safeguard your assets and income. Adequate insurance coverage helps mitigate financial risks and ensures that your wealth is protected against unexpected events.

Retirement Planning for the Wealthy

Planning for retirement involves more than just saving; it requires strategic planning to ensure that your wealth lasts throughout your retirement years.

Creating a Retirement Income Strategy

Developing a retirement income strategy involves calculating how much you’ll need to maintain your desired lifestyle and determining the best way to generate that income. This may include a combination of Social Security benefits, pension plans, retirement accounts, and investment income.

Managing Retirement Withdrawals

Strategically managing withdrawals from your retirement accounts can help maximize your income and minimize taxes. For example, drawing from taxable accounts first and allowing tax-deferred accounts to grow can be a tax-efficient strategy.

Wealth Management Tips for Business Owners

Business owners often face additional complexities in managing their wealth. Here are some tips tailored to their unique situation:

Separating Personal and Business Finances

Maintaining separate personal and business finances is crucial for effective wealth management. This separation helps in accurately assessing your personal financial situation and ensures that your business liabilities do not impact your personal wealth.

Planning for Business Succession

Business succession planning involves preparing for the future transfer of your business. This includes identifying potential successors, creating a succession plan, and ensuring that your business remains viable and continues to grow after your departure.

Private Wealth Management Services

Private wealth management services offer personalized financial advice and management tailored to individual needs. These services often include comprehensive financial planning, investment management, and estate planning. Working with a private wealth manager can provide valuable insights and strategies to help you achieve your financial goals.

Benefits of Working with a Private Wealth Manager

Private wealth managers provide a high level of expertise and personalized service. They can help you navigate complex financial situations, optimize your investment portfolio, and develop a comprehensive wealth management plan tailored to your unique needs.

High-Net-Worth Investment Opportunities

Exploring investment opportunities designed for high-net-worth individuals can enhance your wealth growth. These opportunities often include:

Alternative Investments

Alternative investments, such as venture capital, private equity, and real estate, can offer high returns and diversification benefits. However, they may also come with higher risks and lower liquidity compared to traditional investments.

Customized Investment Solutions

Customized investment solutions are designed to meet the specific needs and goals of high-net-worth individuals. These may include bespoke portfolio management, tax-efficient strategies, and access to exclusive investment opportunities.

Conclusion

Effective wealth management is essential for growing and preserving your fortune. By employing strategic wealth management advice, including diversification, risk management, and personalized financial planning, you can enhance your financial stability and achieve long-term success. Whether you’re a high-net-worth individual, a business owner, or someone planning for retirement, implementing these strategies will help secure your financial future.

By staying informed and working with financial professionals, you can navigate the complexities of wealth management and make informed decisions that align with your goals. Start implementing these tips today to take control of your financial destiny and grow your wealth safely.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

Entertainment

View AllDiscover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the top indie movies of all time that will captivate and inspire you. Dive in to see which films made the list click to explore cinematic gems!

Mia Anderson

Discover how streaming is revolutionizing the movie industry. Explore its impact and future trends. Click to stay ahead in the entertainment world!

Mia Anderson

Unlock the secrets to creating captivating animation videos in 2024. Discover expert tips and techniques to bring your ideas to life. Start now!

Mia Anderson

Automotive

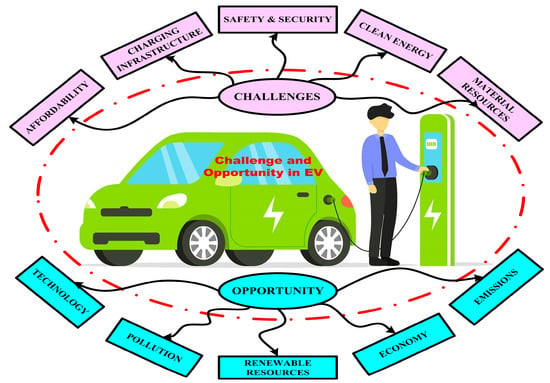

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreNeed cash fast? Discover how to sell your car for cash with quick and reliable methods!

Read MoreDominate the auto market with these Dealer Daily tips. Learn strategies to increase efficiency and outshine competitors!

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllAugust 6, 2024

2024 Election News: Breaking Updates, Polls, and Predictions - Get the Latest Insights Now!

Read MoreTechnology

View All

August 12, 2024

The Ultimate Guide to Investment Banking Services: Unlocking Wealth Secrets

Discover the secrets to building wealth with investment banking services. Our guide unlocks the exclusive world of investment banking and how it can work for you.

January 18, 2025

Data-Driven Decisions: Strategies for Success

Discover how data-driven decision-making improves business outcomes. Learn strategies and tools to make smarter, data-backed choices!

August 12, 2024

The Best Help Desk Software for Small Businesses: Top Picks

Elevate your small business with the best help desk software! Discover our top picks for simple, efficient, and cost-effective solutions to streamline your customer support and boost growth.

Tips & Trick