Credit Score Secrets: 8 Tips for Faster Loan Approvals

Mia Anderson

Photo: Credit Score Secrets: 8 Tips for Faster Loan Approvals

a good credit score is the key that unlocks numerous opportunities, especially when it comes to securing loans. Whether you're planning to buy a new home, start a business, or finance your education, understanding the secrets to improving and maintaining an excellent credit score can significantly increase your chances of loan approval. Let's delve into some valuable tips to help you navigate the path to faster and more successful loan applications.

Understanding the Basics: What is a Credit Score?

Before we dive into the secrets, let's clarify the concept of a credit score. A credit score is a numerical representation of your creditworthiness, calculated based on your credit history. It's a snapshot of your financial reliability and responsibility, as seen through the lens of lenders. The most widely used credit scoring model is FICO, which ranges from 300 to 850. A higher score indicates lower credit risk, making it easier to secure loans with favorable terms.

8 Tips for Boosting Your Credit Score and Loan Approval Chances

1. Check Your Credit Report Regularly

The first step in your credit score journey is to become intimately familiar with your credit report. Obtain a copy of your report from the major credit bureaus (Equifax, Experian, and TransUnion) annually or more frequently. Review it thoroughly for any errors or discrepancies. Mistakes on your credit report can negatively impact your score, so dispute any inaccuracies promptly. Remember, you're entitled to a free credit report each year, making it a valuable, cost-free resource.

2. Pay Your Bills on Time

Payment history is a critical factor in determining your credit score. Lenders want to see a consistent track record of on-time payments. Late or missed payments can significantly damage your score. Set up automatic payments or reminders to ensure you never miss a due date. If you've had late payments in the past, focus on building a positive payment history moving forward. Over time, this will demonstrate your commitment to financial responsibility.

3. Reduce Your Credit Utilization Ratio

The credit utilization ratio is the percentage of your available credit that you're currently using. It's recommended to keep this ratio below 30%, and the lower, the better. For example, if you have a credit card with a $10,000 limit, aim to keep your balance below $3,000. High credit utilization can signal to lenders that you're financially stretched, potentially leading to loan rejections. Consider spreading your spending across multiple cards or requesting a credit limit increase to improve this ratio.

4. Maintain a Mix of Credit Types

Lenders like to see a diverse credit portfolio. This means having a mix of credit accounts, such as credit cards, personal loans, mortgages, and auto loans. A varied credit mix demonstrates your ability to manage different types of credit responsibly. However, this doesn't mean you should open multiple new accounts at once, as this can negatively impact your score due to hard inquiries and a shorter average account age.

5. Avoid Closing Old Credit Accounts

Closing old credit accounts, especially those with a positive payment history, can hurt your credit score. These accounts contribute to your credit history length, which is a significant factor in credit scoring models. Instead of closing them, consider keeping these accounts active by using them occasionally and paying off the balances promptly.

6. Limit New Credit Applications

Each time you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your score. Multiple hard inquiries in a short period can be a red flag for lenders. Be strategic with your credit applications and only apply for new credit when necessary. If you're shopping for a loan, try to do so within a short time frame, as multiple inquiries for the same type of loan within a certain period are often treated as a single inquiry.

7. Consider a Secured Credit Card

If you're building or rebuilding your credit, a secured credit card can be a valuable tool. These cards require a security deposit, which typically becomes your credit limit. By using the card responsibly and making timely payments, you can demonstrate positive credit behavior, which will be reported to the credit bureaus. Over time, this can help improve your credit score and make you a more attractive candidate for loan approvals.

8. Negotiate with Lenders

When applying for a loan, don't be afraid to negotiate. Lenders may be willing to offer better terms if you have a strong credit score and a stable financial history. Discuss your credit score and its implications with the lender, and ask about any potential improvements they suggest. Sometimes, a simple conversation can lead to a more favorable loan offer.

Conclusion: Unlocking Loan Approvals with a Solid Credit Score

Improving your credit score is a journey that requires patience and discipline. By implementing these tips, you can gradually enhance your creditworthiness and increase your chances of loan approval. Remember, a good credit score not only opens doors to financing but also to better interest rates and loan terms. Start your credit score optimization journey today, and you'll be well on your way to achieving your financial goals.

Remember, building and maintaining a strong credit score is a long-term commitment, but the benefits are well worth the effort. With these secrets in your toolkit, you can confidently navigate the world of loans and credit, ensuring a brighter financial future.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the top movies to watch in 2024. Explore our curated list of must-see films and stay updated on the year's hottest cinematic releases.

Mia Anderson

Discover how influencers' place in the media is changing. Discover how influencers are revolutionizing the marketing landscape and why it is impossible to ignore their impact on consumers. Find out the keys to their worth and success!

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the best premium TV shows streaming right now. Get exclusive recommendations and top picks to enhance your viewing experience. Click to explore!

Mia Anderson

Automotive

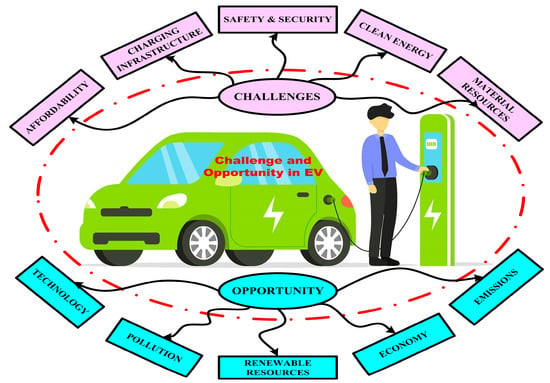

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreCompare the total cost of ownership (TCO) between EVs and internal combustion engine vehicles. Which is more affordable?

Read MoreDiscover how AI applications are transforming EV technology, from autonomous driving to predictive maintenance.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

September 17, 2024

Top Software Development Life Cycle Trends to Watch in 2024

Explore the latest 2024 trends in the Software Development Life Cycle. Learn how AI, MLOps, and cloud innovations are shaping the future. Read now for insights!

August 12, 2024

Small Business, Big Leap: Call Center Software that Scales with You

Elevate your small business with call center software. Discover the top 5 platforms with advanced features like AI bots and omnichannel support to transform your customer experience.

Tips & Trick