2024 Mergers and Acquisitions Trends: What You Need to Know

Mia Anderson

Photo: 2024 Mergers and Acquisitions Trends: What You Need to Know

ISEKUN - Mergers and acquisitions (M&A) have been a cornerstone of business strategy for decades, allowing companies to expand their reach, enhance their capabilities, and drive growth. As we enter 2024, the global M&A market is poised for a rebound, driven by various trends and factors. In this article, we will delve into the latest M&A trends, exploring what you need to know to navigate the complex world of corporate mergers and acquisitions.

The State of M&A in 2023

Before diving into the trends of 2024, it's essential to understand the landscape of M&A in 2023. The past year saw a significant decline in global M&A activity, with deal value dropping 16% to $3.1 trillion compared to 2022[2]. This downturn was attributed to macroeconomic challenges, geopolitical tensions, and regulatory scrutiny. Despite these headwinds, many dealmakers remain optimistic about the future, recognizing that M&A is a vital tool for strategic growth and transformation.

Key Trends in 2024

1. Supply Chain Security and Geopolitics

One of the primary drivers of M&A activity in 2024 is the quest for supply chain security. As companies seek to mitigate risks and ensure continuity, they are increasingly turning to strategic acquisitions. This trend is evident across various industries, from automotive to retail and e-commerce, and healthcare[1]. The geopolitical landscape also plays a significant role, with companies looking to diversify their operations and reduce reliance on specific regions. This shift is likely to fuel an uptick in cross-border M&A activity.

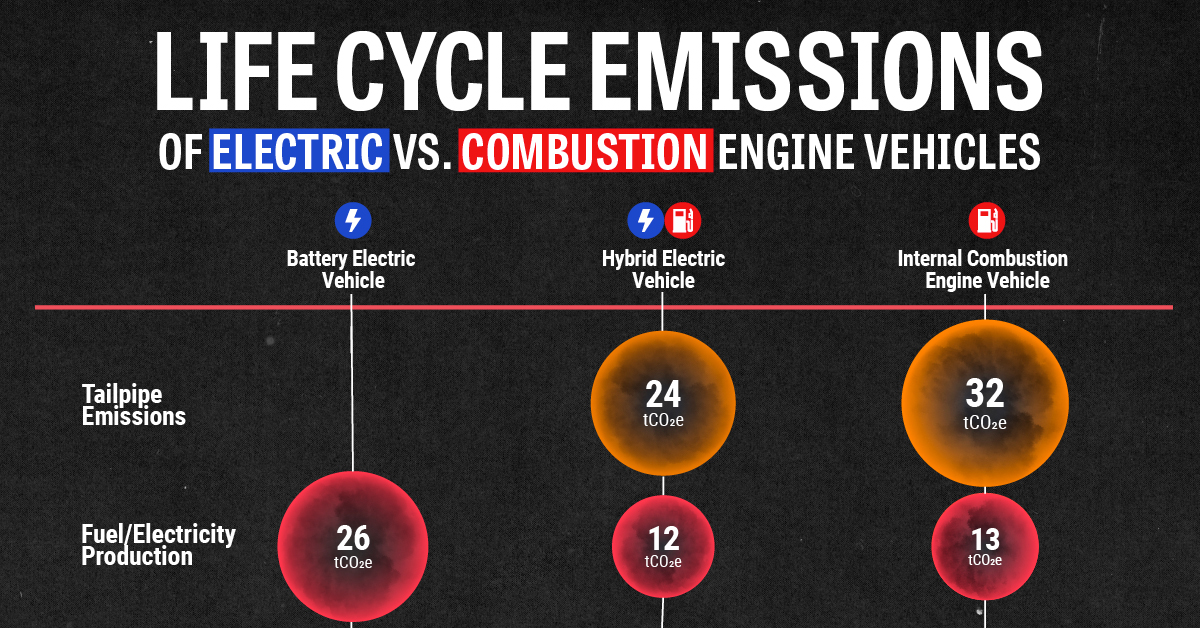

2. Energy Transition and Decarbonization

The energy sector is another area where M&A activity is expected to surge. Government policies and tax incentives are stimulating investment in clean energy and decarbonization projects. The Inflation Reduction Act (IRA) and the Infrastructure, Investment and Jobs Act (IIJA) in the US have expanded the capital pool for clean energy, driving foreign investment into the country[1]. This trend is expected to continue, with companies seeking to capitalize on supportive government policies and emerging technologies.

3. AI and Technology

Technology is expected to see significant growth in inbound cross-border M&A in 2024, with 71% of respondents citing it as one of their top-three sectors[3]. The emergence of AI-specific regulation will shape the future of tech M&A, leading to a fragmented regulatory landscape. Companies are adopting targeted M&A strategies to navigate these regulations, focusing on deals aligned with the regulations in different markets[1].

4. Private Equity Deals

Private equity (PE) deals are also expected to increase in 2024. Financial sponsors are under pressure to invest their large amounts of dry powder, leading to higher private equity deal activity. However, early- and later-stage funding for startups is approximately 50% lower than in 2021, despite the strong enthusiasm for AI startups[5]. This disparity highlights the need for companies to diversify their investment strategies and focus on strategic acquisitions.

5. Strategic Acquisitions and Business Divestitures

Companies are shifting their M&A strategies to mitigate increased geopolitical risks. This includes emphasizing localization over geographic expansion, targeting sectors with stronger market outlooks, investing in vertical integration, and strengthening supply chain resiliency[2]. Additionally, businesses are increasingly focusing on transformative deals to future-proof their business models and address capital scarcity. Divestitures are also becoming more prominent as companies re-evaluate their portfolios and seek to streamline operations.

Case Studies and Real-Life Examples

- Synopsys Inc. and ANSYS Inc.

- In January 2024, Synopsys Inc. announced a $35 billion cash-and-stock deal for ANSYS Inc., one of the largest M&A deals of the year. This acquisition highlights the strategic importance of technological capabilities and solutions in driving M&A activity[4].

- Hewlett Packard Enterprise and Juniper Networks

- Hewlett Packard Enterprise's $14 billion all-cash acquisition of Juniper Networks demonstrates the ongoing pursuit of digital transformation and the strategic need for M&A in the tech sector[4].

- Disney and Epic Games

- Disney's $1.5 billion deal to acquire a stake in Epic Games, the developer of Fortnite, showcases the growing interest in AI and gaming technologies. This deal underscores the potential for strategic acquisitions to enhance a company's market presence and technological capabilities[4].

M&A Advisory Services and Growth Strategies

As companies navigate the complex landscape of M&A, they often require specialized advisory services. These services help companies evaluate potential targets, structure deals, and manage the integration process. The use of alternative deal structures, such as joint ventures and alliances, is also becoming more prevalent as companies seek to offset the reduced availability of debt financing[2][5].

To prepare for the potential wave of transactions in 2024, companies can take several steps:

- Re-evaluate M&A Themes and Update Strategy

- Companies should reassess their M&A strategies to align with current market conditions and emerging trends.

- Invest in Capabilities and Assets

- Investing in capabilities and assets that will effectively evolve the portfolio is crucial for long-term success.

- Consider Divestitures

- Actively considering divestitures as part of the M&A strategy can help streamline operations and focus on core business areas.

- Mitigate Geopolitical Risks

- Emphasizing localization, targeting sectors with stronger market outlooks, and investing in vertical integration can help mitigate geopolitical risks.

- Establish a Higher Bar for Value Creation

- Companies should set a higher bar for value creation to offset higher costs of capital and think broadly about different kinds of synergies.

- Pursue Partnerships and Alternative Deal Structures

- Using partnerships and alternative deal structures, such as joint ventures and public market buyouts, can help offset the reduced availability of debt financing and reduce transaction risks.

Conclusion

The M&A landscape in 2024 is characterized by a mix of optimism and caution. While the global M&A market has shown signs of recovery, dealmakers remain cautious due to ongoing economic uncertainty, regulatory challenges, and geopolitical tensions. However, the trends outlined above suggest that strategic acquisitions, driven by the need for supply chain security, technological advancements, and energy transition, will continue to shape the M&A landscape.

As companies navigate these trends, it is essential to remain adaptable and proactive. By leveraging specialized advisory services, diversifying investment strategies, and focusing on transformative deals, businesses can capitalize on the opportunities presented by the evolving M&A market.

In conclusion, understanding the latest M&A trends is crucial for any business looking to drive growth and transformation in 2024. By staying informed and strategic, companies can navigate the complex world of mergers and acquisitions with confidence.

Marketing

View All

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

Entertainment

View AllThe definitive manual on how internet streaming services have evolved. Learn how to keep ahead of the curve by exploring the theories, tactics, and inventions influencing the future of streaming.

Mia Anderson

Discover the latest trends in cinematic universes for 2024. Explore how interconnected storytelling is evolving and its impact on modern media. Learn more now!

Mia Anderson

Discover the hottest entertainment news and updates! Stay ahead with the latest trends and exclusive stories. Click now for breaking news.

Mia Anderson

Unlock access to live concerts from home. Discover top platforms, tips, and exclusive offers to elevate your streaming experience. Click now for the ultimate guide!

Mia Anderson

Automotive

View AllExplore the positive impact of EV adoption on urban air quality. See how EVs are cleaning the air in cities worldwide.

Read MoreA complete guide to selling your car like a pro! From pricing to paperwork, we cover it all.

Read MoreForecast the EV market of 2030. Learn about expected growth rates, market penetration, and the rise of EV ownership globally.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

News

View AllOctober 14, 2024

2024 Vaccination Updates: What You Need to Know for Flu & COVID-19 Protection

Read MoreTechnology

View All

January 21, 2025

Future Trends in Data Science: What’s Next?

Explore future trends in data science, from quantum computing to neuromorphic AI. Stay ahead of the curve with emerging technologies!

August 26, 2024

How Blockchain Technology Is Transforming Our World

Discover how blockchain technology is revolutionizing industries. Learn how it can benefit you today click to explore the future of innovation!

August 29, 2024

Top SaaS Trends Shaping Business Success in 2024

Discover the latest SaaS trends revolutionizing businesses in 2024. Learn how these innovations can boost efficiency and drive growth. Read now!

Tips & Trick