2024 Economic Recession Predictions: What to Expect Now

Mia Anderson

Photo: 2024 Economic Recession Predictions: What to Expect Now

ISEKUN - The world is always on the edge of economic uncertainty, and the question on everyone's mind is: will we face another recession in 2024? The possibility of an economic downturn has been a topic of discussion among economists, policymakers, and business leaders for months. While some predict a recession, others believe the economy will continue to grow, albeit at a slower pace. In this article, we will delve into the latest predictions, trends, and indicators that could shape the economic landscape in 2024.

Understanding Economic Recession

Before we dive into the predictions, it's essential to understand what an economic recession is. An economic recession is a period of significant decline in economic activity, typically defined as a decline in gross domestic product (GDP) for two or more consecutive quarters. Receptions can be triggered by various factors such as high interest rates, inflation, geopolitical tensions, and global economic shifts.

Economic Recession Predictions for 2024

- US Economic Downturn Predictions

- The United States is one of the world's largest economies, and its performance often sets the tone for global economic trends. According to recent forecasts, the US economy is expected to slow down in the second half of 2024. The Conference Board predicts that real GDP growth will decelerate from 2.8% in Q2 2024 to 0.6% in Q3 2024, primarily due to high prices and elevated interest rates sapping domestic demand.

- Global Recession Trends 2024

- The International Monetary Fund (IMF) forecasts that the global economy will continue growing at 3.2% in 2024 and 2025, albeit at a slower pace than in previous years. Advanced economies are expected to see a slight acceleration in growth, while emerging market and developing economies will experience a modest slowdown.

- Market Analysis Recession 2024

- Deloitte Insights suggest that despite the optimism in consumer spending and business investments, the economy faces several risks. These include higher-for-longer interest rates, worsening geopolitical conflicts, and strains on real-estate markets. These factors could lead to lower GDP growth, particularly over the next two years.

Indicators of Economic Slowdown

- Consumer Spending Trends

- Consumer spending has been a key driver of economic growth in recent years. However, with high interest rates and inflation persisting above 3%, consumers are dialing back on services spending. This trend is expected to continue, leading to a slowdown in overall economic activity.

- Labor Market Trends

- The labor market has been strong, but it is showing signs of slowing down. Job gains are expected to remain elevated in the first half of 2024 but will slow down in the latter half. This slowdown could lead to a rise in the unemployment rate above 4% by 2026.

- Inflation Rates

- Inflation remains a significant concern. The IMF forecasts that global inflation will decline steadily from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025. However, core inflation is expected to decline more gradually, indicating that underlying price pressures may persist.

Risk Factors for Recession

- Interest Rates

- Higher interest rates have been a major factor in the economic slowdown. The Federal Reserve's actions to hike rates twice in the near term have contributed to the elevated borrowing costs. These higher rates can reduce consumer spending and business investments, leading to a recession.

- Geopolitical Tensions

- Geopolitical conflicts and their spillovers can significantly impact the economy. The ongoing tensions between major economies can lead to trade wars, sanctions, and other disruptions that can slow down economic activity.

- Real-Estate Market Strains

- The real-estate market is another area of concern. Strains on office real estate and other sectors can lead to a decrease in investment and consumer spending, further exacerbating the economic slowdown.

Financial Outlook for 2024 Recession

Given the various indicators and risk factors, the financial outlook for 2024 is complex. While some predictions suggest a recession, others indicate a gradual expansion. The key will be how effectively policymakers can manage the risks and stimulate growth.

- Policy Responses

- Policymakers will need to balance the need to control inflation with the need to support economic growth. This might involve targeted fiscal policies, monetary interventions, and regulatory measures to mitigate the impact of high interest rates and geopolitical tensions.

- Investment Strategies

- Businesses and investors will need to adapt their strategies to the changing economic landscape. This might involve diversifying investments, reducing debt, and focusing on sectors that are less vulnerable to economic downturns.

- Consumer Behavior

- Consumers will also need to adjust their spending habits. This could mean prioritizing essential expenses, saving more, and being cautious about taking on debt.

Impact of Recession on Various Sectors

A recession can have far-reaching impacts on various sectors of the economy.

- Labor Market Impact

- A recession could lead to job losses, particularly in sectors that are heavily reliant on consumer spending or business investments. This could result in higher unemployment rates and reduced labor force participation.

- Business Impact

- Businesses may face reduced revenue, lower profits, and increased financial stress. This could lead to bankruptcies, layoffs, and reduced investment in new projects.

- Consumer Impact

- Consumers may see reduced disposable income, higher debt levels, and reduced access to credit. This could lead to reduced consumer spending, which is a critical driver of economic growth.

Conclusion

The economic landscape in 2024 is uncertain, with various predictions and indicators pointing to both a recession and a gradual expansion. The key will be how effectively policymakers can manage the risks and stimulate growth. By understanding the latest trends, indicators, and risk factors, we can better prepare for the challenges ahead and make informed decisions about our investments and spending habits.

Additional Insights

- Global Economic Trends: The global economy is expected to continue growing at 3.2% in 2024 and 2025, albeit at a slower pace than in previous years. Advanced economies are expected to see a slight acceleration in growth, while emerging market and developing economies will experience a modest slowdown.

- US Economic Performance: The US economy is expected to slow down in the second half of 2024, with real GDP growth decelerating from 2.8% in Q2 2024 to 0.6% in Q3 2024. This slowdown is primarily due to high prices and elevated interest rates sapping domestic demand.

- Market Analysis: Deloitte Insights suggest that despite the optimism in consumer spending and business investments, the economy faces several risks. These include higher-for-longer interest rates, worsening geopolitical conflicts, and strains on real-estate markets. These factors could lead to lower GDP growth, particularly over the next two years.

- Consumer Spending Trends: Consumer spending has been a key driver of economic growth in recent years. However, with high interest rates and inflation persisting above 3%, consumers are dialing back on services spending. This trend is expected to continue, leading to a slowdown in overall economic activity.

- Labor Market Trends: The labor market has been strong, but it is showing signs of slowing down. Job gains are expected to remain elevated in the first half of 2024 but will slow down in the latter half. This slowdown could lead to a rise in the unemployment rate above 4% by 2026.

By understanding these trends and indicators, we can better navigate the complexities of the economic landscape in 2024 and make informed decisions about our investments and spending habits.

References

- Statista: U.S. monthly projected recession probability 2020-2025. Retrieved from Statista.

- Deloitte Insights: US Economic Forecast Q2 2024. Retrieved from Deloitte Insights.

- The Conference Board: Economic Forecast for the US Economy. Retrieved from The Conference Board.

- IMF World Economic Outlook: April 2024. Retrieved from IMF.

- European Commission Economic Forecast: Spring 2024. Retrieved from European Commission.

Marketing

View All

January 22, 2025

The Future of Digital Marketing RevealedExplore where digital marketing is headed in the next decade. From AI to VR, see what’s shaping the future of online marketing. Don’t get left behind!

Mia Anderson

January 23, 2025

10 Content Strategies for Digital SuccessCreate winning content with these 10 proven digital marketing strategies. Enhance engagement and conversions starting today!

Mia Anderson

January 19, 2025

How to Master Digital Marketing BasicsLearn the essentials of digital marketing in this beginner-friendly guide. Kickstart your journey with step-by-step strategies. Start mastering today!

Mia Anderson

Entertainment

View AllDiscover the top movies to watch in 2024. Explore our curated list of must-see films and stay updated on the year's hottest cinematic releases.

Mia Anderson

Discover how influencers' place in the media is changing. Discover how influencers are revolutionizing the marketing landscape and why it is impossible to ignore their impact on consumers. Find out the keys to their worth and success!

Mia Anderson

Discover the latest strategies for creating a successful podcast in 2024. Learn key tips and techniques to launch and grow your show effectively. Read now!

Mia Anderson

Discover the best premium TV shows streaming right now. Get exclusive recommendations and top picks to enhance your viewing experience. Click to explore!

Mia Anderson

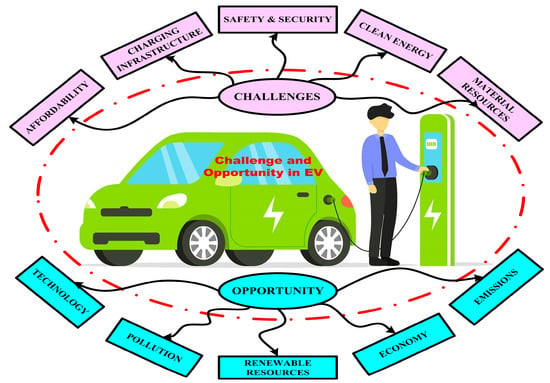

Automotive

View AllExplore how the rise of electric vehicle (EV) infrastructure is driving changes in land use and urban planning worldwide.

Read MoreCompare the total cost of ownership (TCO) between EVs and internal combustion engine vehicles. Which is more affordable?

Read MoreDiscover how AI applications are transforming EV technology, from autonomous driving to predictive maintenance.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

November 3, 2024

10 Tech Gadgets You Didn't Know You Needed in 2024

Discover the top 10 tech gadgets that will change your life in 2024. Uncover hidden must-haves read now!

September 17, 2024

Top Software Development Life Cycle Trends to Watch in 2024

Explore the latest 2024 trends in the Software Development Life Cycle. Learn how AI, MLOps, and cloud innovations are shaping the future. Read now for insights!

August 12, 2024

Small Business, Big Leap: Call Center Software that Scales with You

Elevate your small business with call center software. Discover the top 5 platforms with advanced features like AI bots and omnichannel support to transform your customer experience.

Tips & Trick