The Ultimate Guide to Financial Independence in 2024

Mia Anderson

Photo: The Ultimate Guide to Financial Independence in 2024

Are you ready to take control of your financial destiny and embark on a journey towards financial independence? In this comprehensive guide, we'll explore the concept of achieving financial freedom earlier than traditional retirement plans, a goal that has captivated many individuals seeking a life of autonomy and security. Get ready to discover strategies, real-life examples, and practical tips to set you on the path to financial independence in 2024 and beyond.

Understanding Financial Independence, Retire Early (FIRE)

Financial Independence, Retire Early, or FIRE, is a movement that encourages individuals to adopt a lifestyle of frugality, extreme savings, and strategic investments to achieve financial independence at a much earlier age than conventional retirement plans. The concept gained popularity through the 1992 book "Your Money or Your Life" by Vicki Robin and Joe Dominguez, which inspired countless individuals to rethink their financial strategies.

At its core, FIRE is about accumulating enough wealth to cover your expenses for the rest of your life, allowing you to retire and pursue your passions without being tied to a traditional job. This may sound like a challenging endeavor, but with the right mindset and approach, it is an achievable goal for many.

The FIRE Lifestyle: Strategies for Success

Spend Less, Save More

One of the fundamental principles of the FIRE movement is living below your means and saving aggressively. This doesn't mean sacrificing all life's pleasures; it's about making conscious choices. For instance, Chrissy and Ryan, a FIRE-inspired couple, shared their journey with Business Insider. They reduced dining out, bought in bulk, planned their vacations, and limited alcohol consumption. These small changes added up, allowing them to save a significant portion of their $250,000 combined income in 2023.

Invest Wisely

Investing is a crucial aspect of the FIRE strategy. The goal is to make your money work for you by generating passive income through various investment vehicles. Chrissy and Ryan, for example, manage investment properties that provide a steady income stream. They also invest in their 401(k) plans and low-cost index funds, ensuring their money grows over time.

Diversify Your Income Streams

Diversification is key to financial independence. Relying solely on a 9-to-5 job may not provide the financial security needed for early retirement. Consider exploring passive income ideas to create multiple income streams. This could include:

- Renting Out Property: Real estate investments, like Chrissy and Ryan's, can provide a consistent passive income.

- Digital Content Creation: Leveraging social media platforms like YouTube or selling stock photos online can generate income from ads, sponsorships, or affiliate marketing.

- Explore AI-Driven Ventures: With the rise of artificial intelligence, there are opportunities to create products or services that provide recurring income with minimal ongoing involvement.

Maximizing Passive Income Opportunities

Passive income is a powerful tool in the pursuit of financial independence. It allows you to earn money with reduced time and effort, freeing up your schedule for other pursuits. Here are some strategies to maximize your passive income potential:

Research and Experiment

Explore various passive income ideas and find what resonates with your interests and skills. For instance, if you're passionate about travel, creating a travel-themed YouTube channel or selling your travel photos online could be a viable option. Remember, the key is to align your passions with income-generating activities.

Start Small and Build Up

You don't need to dive into multiple ventures at once. Start with one or two ideas and see what works best for you. As you gain experience and confidence, you can expand your passive income streams.

Embrace Technology

Technology can be a powerful ally in generating passive income. From automation to AI-driven solutions, there are numerous tools and platforms that can help you create and manage income-generating assets with minimal ongoing involvement.

The Long-Term Perspective

Financial independence is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. While the FIRE movement emphasizes early retirement, it's essential to tailor your goals to your unique circumstances. Consulting a financial planner can help you create a personalized roadmap, ensuring your journey is sustainable and aligned with your aspirations.

Conclusion

Financial independence is not just a dream; it's an achievable reality for those willing to embrace a disciplined approach to savings and investment. By adopting the principles of the FIRE movement and exploring passive income opportunities, you can take control of your financial future. Remember, the path to financial freedom is a personal journey, and what works for others may not work for you. Stay informed, adapt your strategies, and never stop learning. Your financial independence awaits!

Marketing

View All

January 21, 2025

Why Digital Marketing is Vital for SMBsDiscover why small businesses must adopt digital marketing in 2024. Learn tips and tactics to compete in the digital age. Take your business online today!

Mia Anderson

January 25, 2025

SEO’s Role in Digital Marketing StrategyDive into the importance of SEO in crafting a digital marketing strategy that works. Rank higher and drive organic traffic today!

Mia Anderson

January 27, 2025

PPC vs SEO: Digital Marketing ShowdownDiscover the differences between PPC and SEO in digital marketing. Find out which strategy is right for your goals and budget. Make an informed choice today!

Mia Anderson

Entertainment

View AllDiscover the amazing history of animated films and how they came to rule the world. Discover how animation has captured the attention of viewers all across the world, from the first attempts to the greatest works of today!

Mia Anderson

Discover the best tips for acing your acting auditions in 2024. Boost your chances with expert advice and stand out in the competitive industry!

Mia Anderson

Learn how to edit videos like a pro without breaking the bank. Explore the latest tools, techniques, and trends in 2024 video editing. Start creating today!

Mia Anderson

Explore the ultimate guide to 2024 film festivals. Discover top events, trends, and tips for filmmakers and attendees. Click to learn more now!

Mia Anderson

Automotive

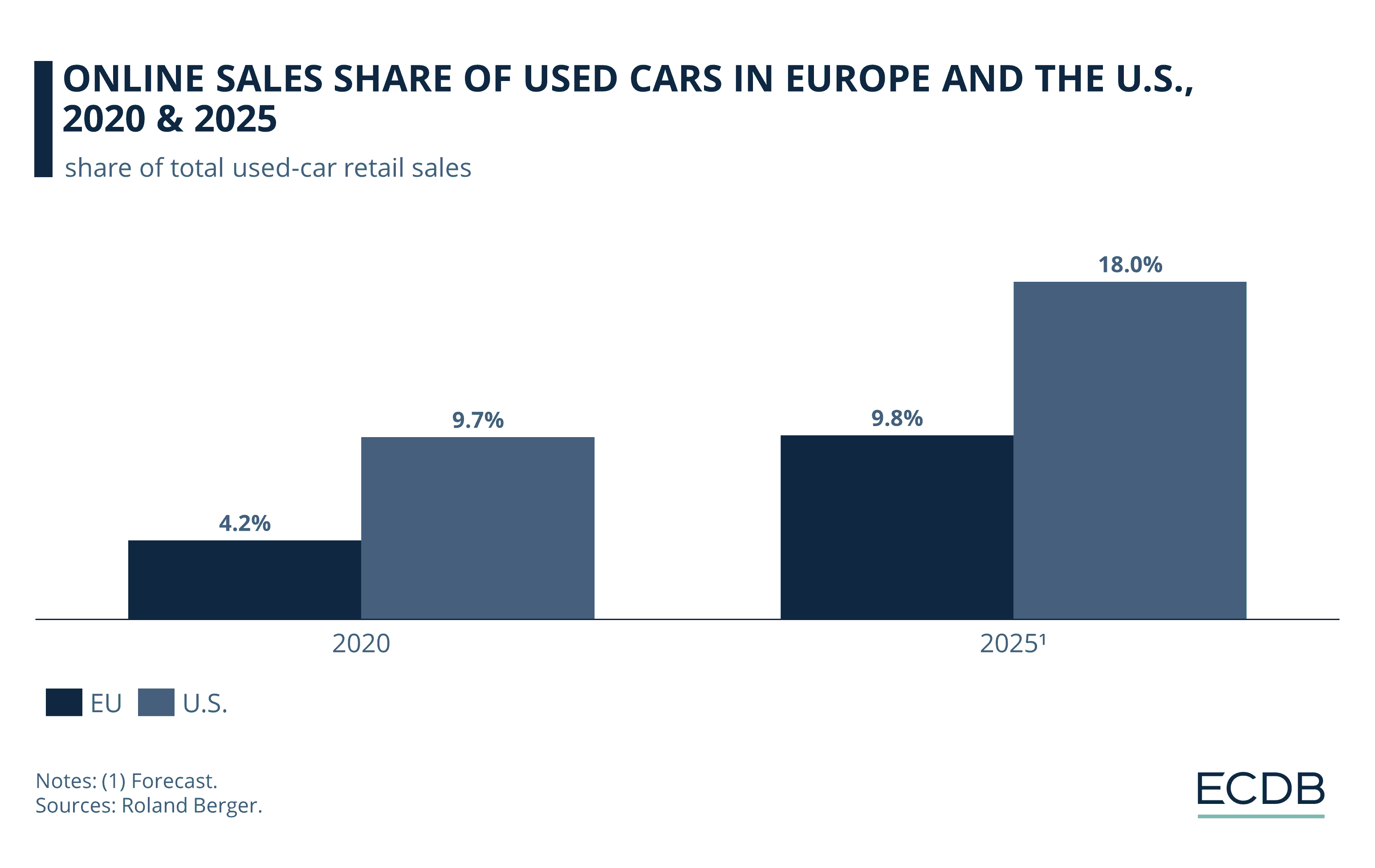

View AllExplore the pros and cons of selling your car online vs. locally. Find out which suits you best!

Read MoreExplore the importance of EV test drives in boosting consumer confidence and accelerating adoption rates.

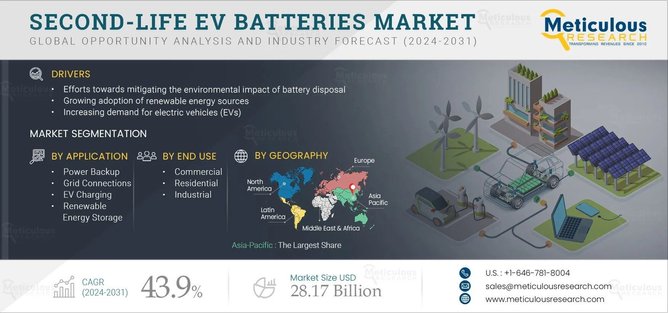

Read MoreLearn how second-life EV batteries are helping reduce environmental impact by providing sustainable energy solutions.

Read MorePolular🔥

View All

1

2

3

5

6

7

8

9

10

Technology

View All

August 27, 2024

Maximize Your Business Potential with Top Enterprise Software Solutions

Discover the best enterprise software solutions to transform your business operations. Explore top picks, benefits, and how they can boost your efficiency. Click to learn more!

August 10, 2024

The Top Productivity Apps to Boost Your Efficiency in 2024

Boost your productivity to the most with the top 2024 applications! Learn how to better focus, manage projects, and arrange chores using these tools. Increase your productivity with these best practices.

November 7, 2024

Best Virtual Reality Headsets for Immersive Gaming in 2024

Ready for next-level gaming? Explore the best VR headsets for immersive experiences in 2024. Dive into the world of virtual reality now!

Tips & Trick