Unlock the Best High-Yield Savings Accounts for Maximum Earnings

Mia Anderson

Photo: Unlock the Best High-Yield Savings Accounts for Maximum Earnings

In today's financial landscape, finding the best high-yield savings accounts can significantly impact your savings growth. High-yield savings accounts offer much better interest rates compared to traditional savings accounts, making them a popular choice for those looking to maximize their earnings. This article will guide you through the top options for 2024, help you understand what makes an account stand out, and provide practical advice to ensure you choose the right one for your needs.

Understanding High-Yield Savings Accounts

High-yield savings accounts are designed to offer higher interest rates than standard savings accounts. These accounts are typically offered by online banks, credit unions, and sometimes traditional banks that want to compete with online institutions. The key advantage is the higher annual percentage yield (APY), which means your money grows faster.

Benefits of High-Yield Savings Accounts

Increased Earnings: The primary benefit of high-yield savings accounts is the ability to earn more interest. For instance, while a traditional savings account might offer an interest rate of around 0.01% to 0.05%, a high-yield savings account can offer rates up to 4.00% or more. This difference can have a substantial impact over time.

Low Risk: High-yield savings accounts are a safe place to store your money. They are typically insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), providing peace of mind that your funds are protected.

Accessibility: Unlike other investment options, high-yield savings accounts provide easy access to your funds. You can withdraw money when needed, though some accounts may limit the number of withdrawals you can make per month.

Top High-Yield Savings Accounts for 2024

Best Savings Account Rates

When choosing a high-yield savings account, comparing rates is crucial. Some of the top options for 2024 include:

1. Bank of America’s High-Yield Savings Account

- APY: 4.25%

- Features: No monthly fees, minimum deposit required, and easy online access.

2. Ally Bank High-Yield Savings

- APY: 4.20%

- Features: No minimum balance, no fees, and a user-friendly mobile app.

3. Marcus by Goldman Sachs High-Yield Savings

- APY: 4.10%

- Features: No fees, no minimum balance, and competitive interest rates.

Highest Interest Savings Accounts

For those seeking the highest interest rates, consider the following:

1. CIT Bank Savings Builder

- APY: 4.25%

- Features: Requires a $100 minimum deposit and a $100 monthly contribution to earn the top rate.

2. Discover Online Savings Account

- APY: 4.00%

- Features: No fees, no minimum balance, and easy online management.

Best Online Savings Accounts

Online savings accounts often provide the best rates due to lower overhead costs. Some of the top picks include:

1. Synchrony Bank High-Yield Savings

- APY: 4.05%

- Features: No fees, no minimum balance, and ATM access.

2. American Express National Bank High-Yield Savings

- APY: 4.00%

- Features: No fees, no minimum balance, and 24/7 customer service.

Comparing High-Yield Savings Accounts

Factors to Consider

Interest Rate: The APY is the most critical factor when comparing high-yield savings accounts. Higher APYs mean more interest earned.

Fees: Look for accounts with no monthly fees or hidden charges. Fees can significantly reduce your overall earnings.

Accessibility: Consider how easily you can access your funds. Some accounts offer ATM access or online transfers, while others might have withdrawal limitations.

Minimum Balance Requirements: Some high-yield savings accounts require a minimum balance to earn the highest rate. Ensure you can meet these requirements or choose an account with no minimum balance.

Real-Life Example

Imagine you have $10,000 to deposit. If you place this amount in a traditional savings account with a 0.05% APY, you would earn just $5 over a year. In contrast, if you deposit the same amount in a high-yield savings account with a 4.25% APY, you would earn $425 in interest. This example illustrates the substantial benefits of choosing a high-yield savings account.

Conclusion

Selecting the best high-yield savings account involves careful consideration of interest rates, fees, and accessibility. By comparing the top options for 2024 and understanding your needs, you can find an account that maximizes your earnings while providing the flexibility you require.

High-yield savings accounts offer a straightforward way to grow your money with minimal risk. Whether you're saving for a rainy day or building an emergency fund, these accounts can help you achieve your financial goals more effectively.

FAQs

What is a high-yield savings account?

A high-yield savings account is a type of savings account that offers a significantly higher interest rate compared to traditional savings accounts.

How do I choose the best high-yield savings account?

Compare interest rates, fees, minimum balance requirements, and accessibility features to find the account that best meets your needs.

Are high-yield savings accounts safe?

Yes, most high-yield savings accounts are insured by the FDIC or NCUA, making them a safe option for storing your money.

Marketing

View All

January 18, 2025

Top 10 Digital Marketing Trends for 2024Discover the must-know digital marketing trends for 2024. Stay ahead of the curve and elevate your strategies with these insights! Read more now!

Mia Anderson

January 20, 2025

5 Best Digital Marketing Tools for GrowthUncover the top 5 digital marketing tools every marketer needs. Boost efficiency, drive results, and streamline your campaigns now!

Mia Anderson

January 25, 2025

Email Marketing in the Digital AgeUnlock the power of email marketing with modern strategies tailored for the digital age. Connect with your audience like never before!

Mia Anderson

Entertainment

View AllExplore the intriguing past of streaming services and take a look at what's coming next. Discover how streaming transformed media, from the period of tape drives to the present on-demand entertainment era.

Mia Anderson

Explore the world of esports in 2024! Learn what esports is, why it’s booming, and how it’s changing the game. Click to dive into the future of gaming.

Mia Anderson

Learn how influencer marketing is used by the entertainment sector to generate buzz and increase engagement. Discover the keys to campaign success, as well as how to choose the proper influencers and produce interesting content.

Mia Anderson

Discover the top 10 entertainment trends of 2024 that will captivate you. Stay ahead with our expert insights and click to explore now!

Mia Anderson

Automotive

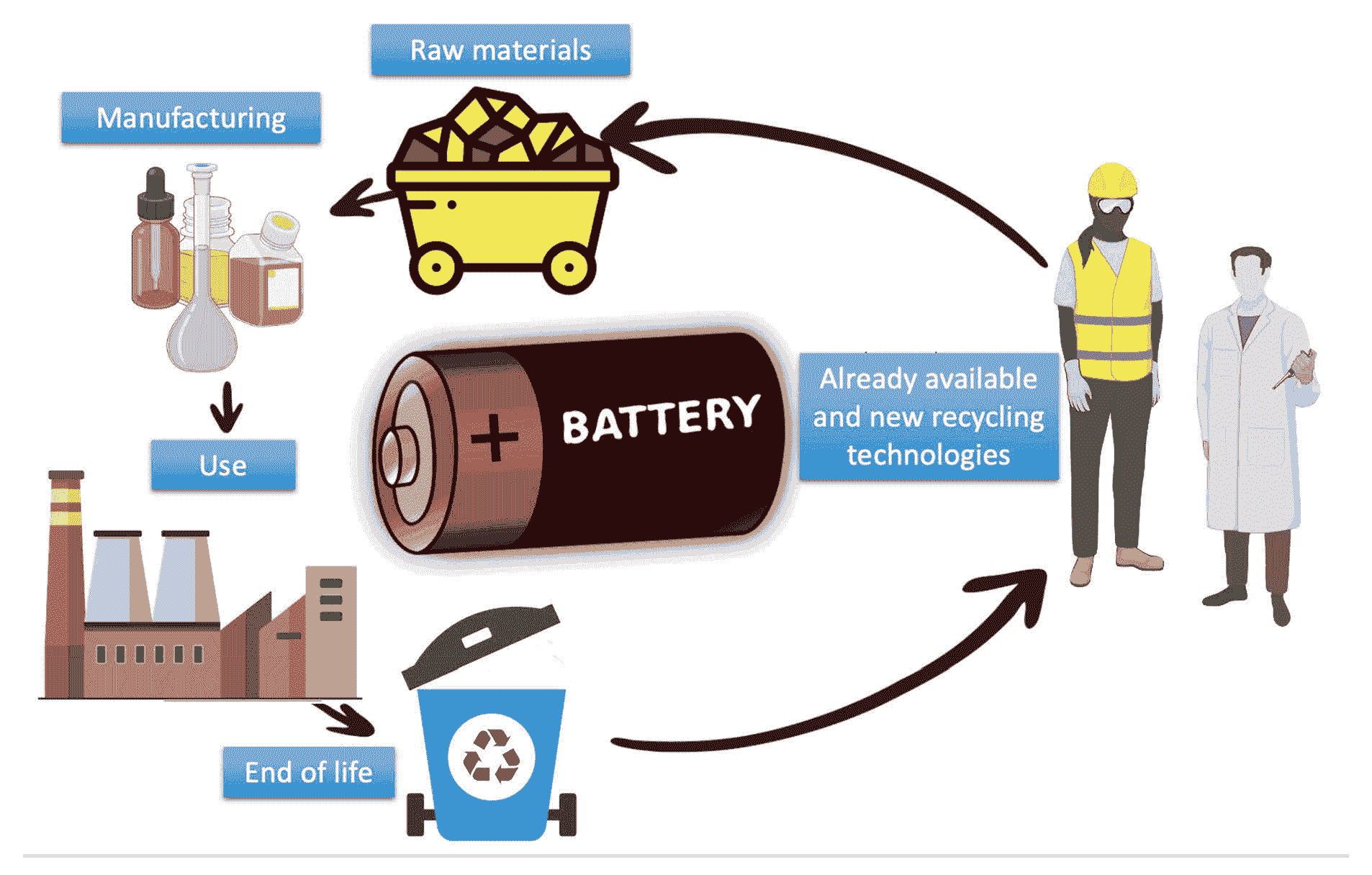

View AllUncover the environmental concerns surrounding EV battery recycling. What are the solutions to ensure sustainable practices?

Read MoreCompare the total cost of ownership (TCO) between EVs and internal combustion engine vehicles. Which is more affordable?

Read MoreForecast the EV market of 2030. Learn about expected growth rates, market penetration, and the rise of EV ownership globally.

Read MorePolular🔥

View All

1

2

3

4

5

6

7

8

9

10

Technology

View All

August 9, 2024

The Evolution of Mobile Apps: A Revolutionary Journey

Learn about the amazing development of mobile applications and how they have affected our lives. See how apps took over the globe and molded our future, from the App Store's early days to the newest developments.

December 17, 2024

10 Gadgets You Should Buy Right Now to Improve Your Tech Setup

Transform your tech setup with these 10 gadgets! Click to discover the latest must-haves and take your tech game to the next level.

January 21, 2025

Future Trends in Data Science: What’s Next?

Explore future trends in data science, from quantum computing to neuromorphic AI. Stay ahead of the curve with emerging technologies!

Tips & Trick